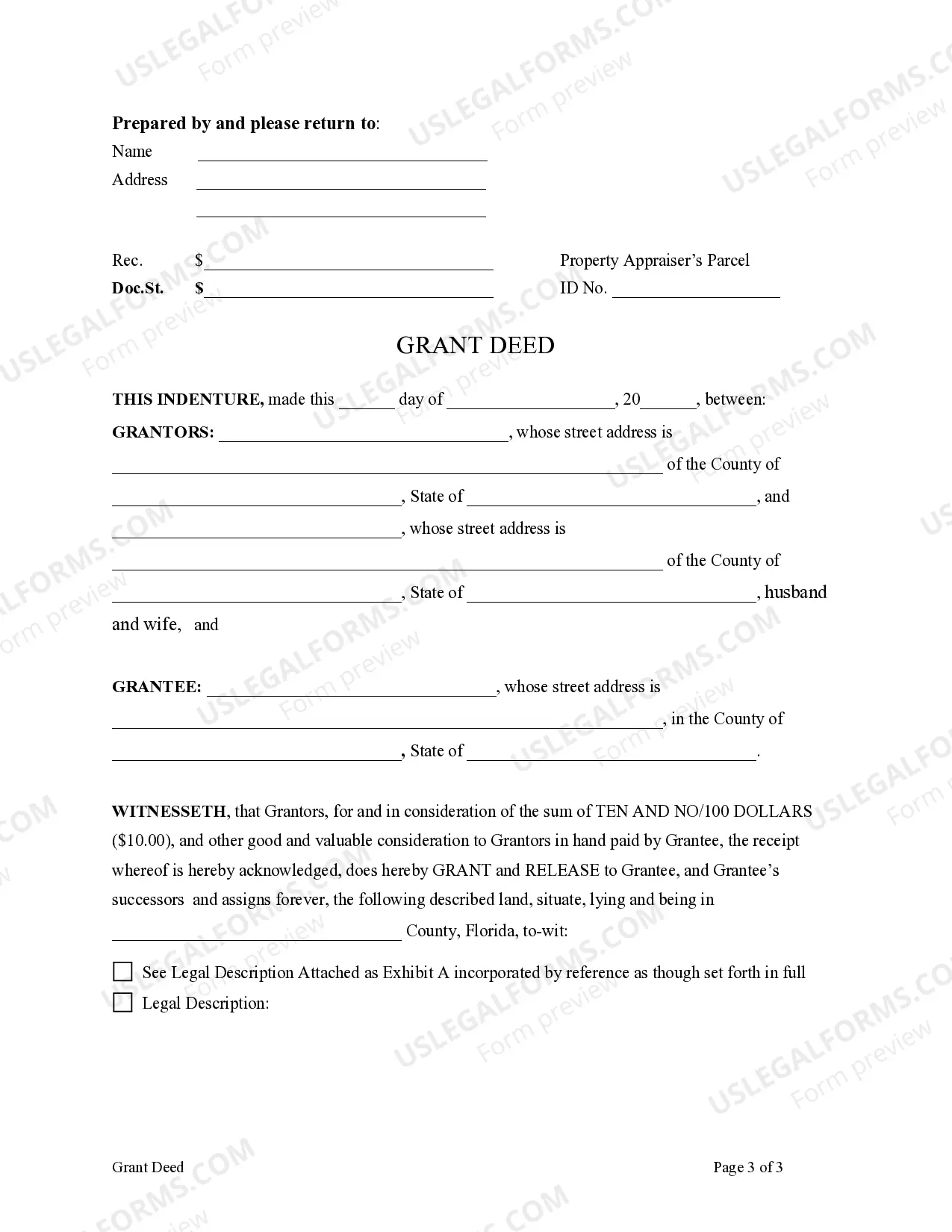

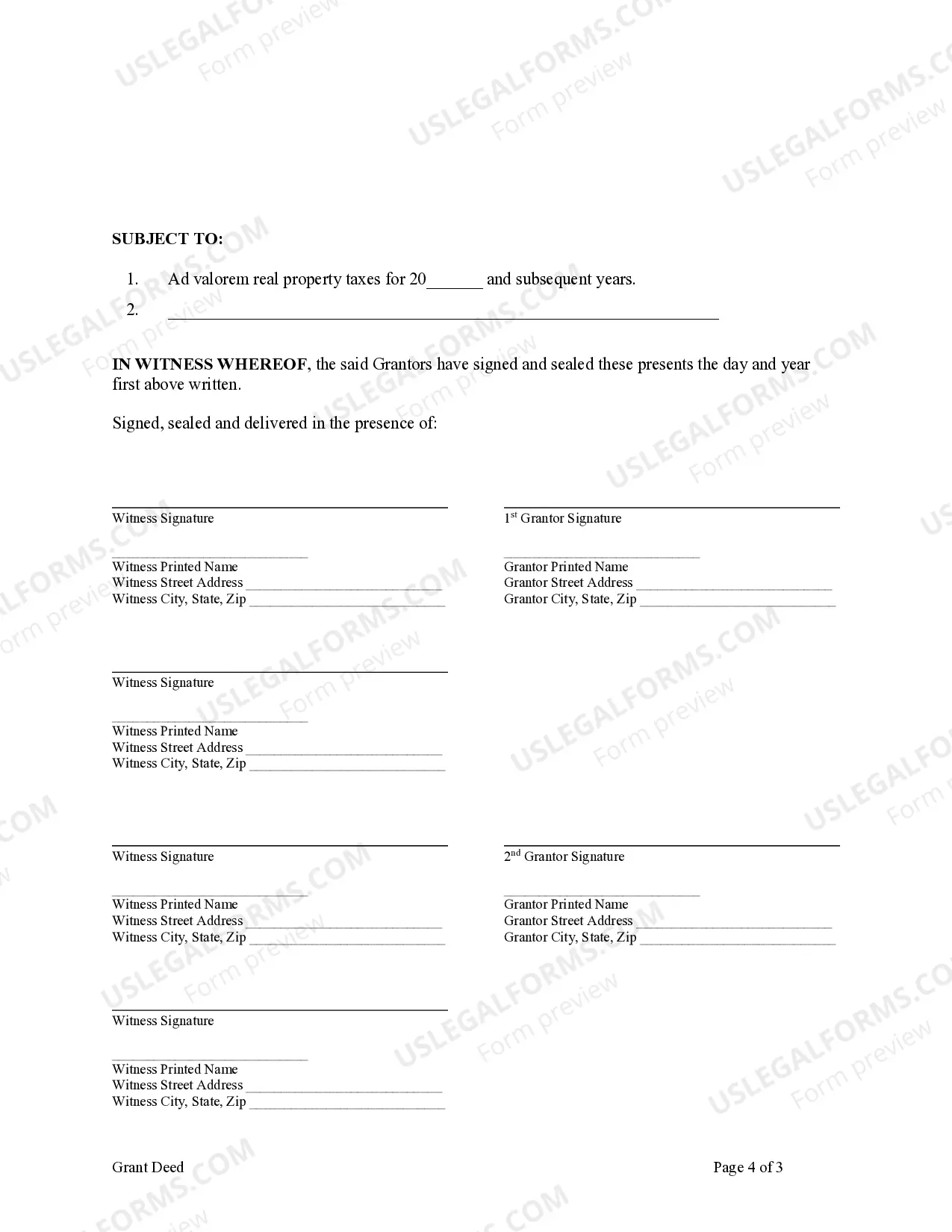

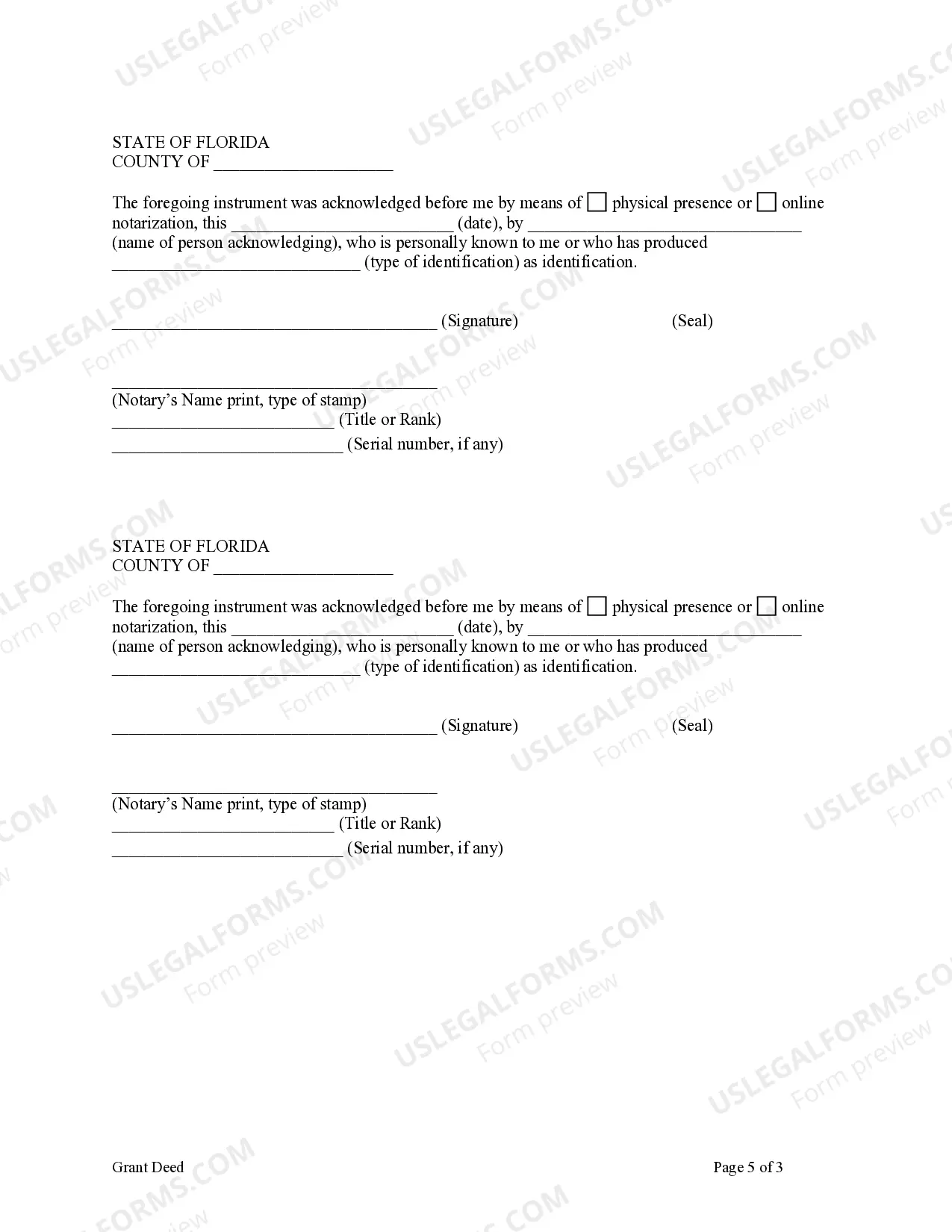

This form is a Grant Deed where the Grantors are two individuals, or husband and wife, and the Grantee is an individual. Grantors convey and grant the described property to the Grantee. This deed complies with all state statutory laws.

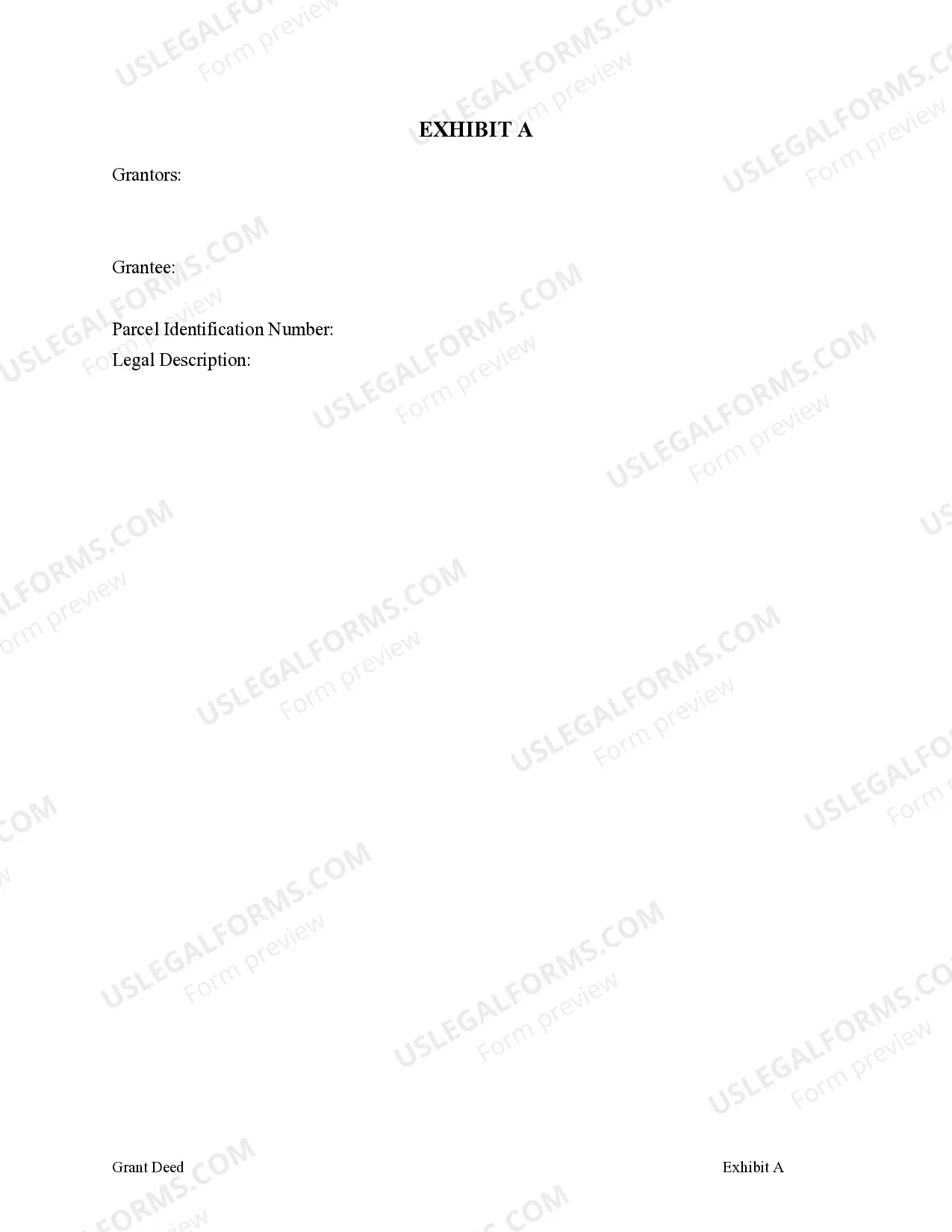

A Jacksonville Florida Grant Deed — Husband and Wife, or Two Individuals, to an Individual is a legally binding document used for transferring ownership of real estate property from a married couple or two individuals to a single individual. This type of grant deed ensures that the property is being transferred to a specific person and provides proof of the transfer. The grant deed includes the names of the granters (the husband and wife or two individuals) who are transferring the property, as well as the name of the grantee (the individual receiving the property). It also specifies the legal description of the property being conveyed, including the property address, lot number, and any other relevant details required to accurately identify the land. When using a Jacksonville Florida Grant Deed — Husband and Wife, or Two Individuals, to an Individual, there may be different variations depending on the specific circumstances or intentions of the parties involved. Some common types include: 1. Tenancy by the Entirety: This type of grant deed is typically used when the granters are a married couple. It establishes joint ownership of the property, where both spouses have equal rights and ownership interests. In the event of one spouse's death, the surviving spouse automatically inherits the deceased spouse's share without the need for probate. 2. Joint Tenancy with Right of Survivorship: This grant deed is often used when two individuals (whether married or not) wish to own the property together with rights of survivorship. It means that if one owner passes away, their ownership interest automatically transfers to the surviving owner(s) without the need for probate. 3. Tenants in Common: This type of grant deed is used when two individuals, whether married or not, want to own the property with separate and distinct ownership interests. Each owner has a specific percentage of ownership, and their shares can be transferred or inherited separately. In case of death, the deceased owner's share will be distributed according to their will or state laws. It is important to consult with a knowledgeable attorney or real estate professional in Jacksonville, Florida, to understand the specific requirements and legal implications associated with each type of grant deed. This will help ensure a smooth and legally valid property transfer process.