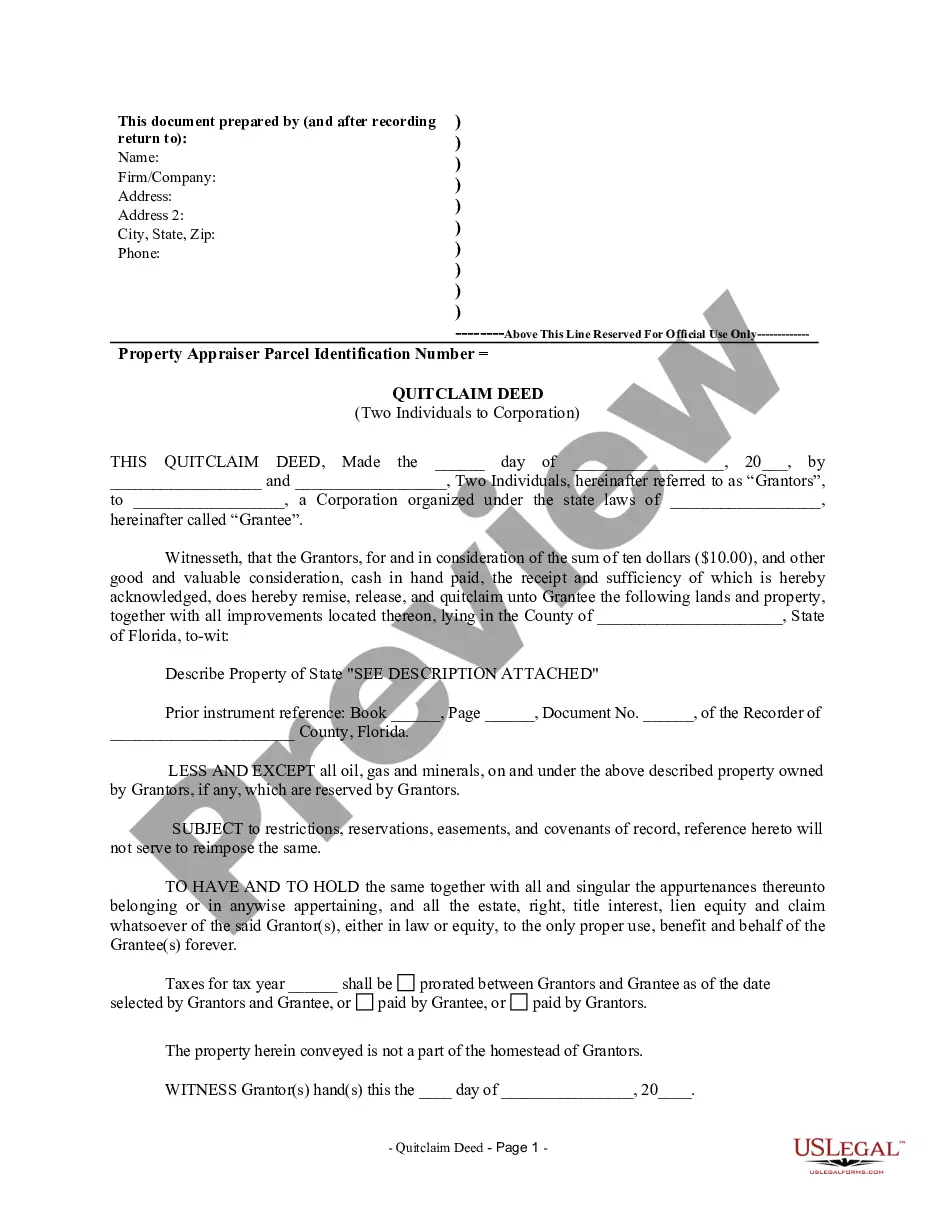

This Quitclaim Deed by Two Individuals to Corporation form is a Quitclaim Deed where the Grantors are two individuals and the Grantee is a corporation. Grantors convey quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Broward Florida Quitclaim Deed by Two Individuals to Corporation

Description

How to fill out Florida Quitclaim Deed By Two Individuals To Corporation?

Do you require a reliable and affordable provider of legal documents to obtain the Broward Florida Quitclaim Deed from Two Persons to a Corporation? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a collection of documents to process your divorce through the judicial system, we have you supported. Our site offers over 85,000 current legal document templates for individual and business purposes. All the templates we provide are not generic and are tailored to meet the requirements of distinct states and counties.

To retrieve the document, you must Log In to your account, find the necessary document, and click the Download button alongside it. Please remember that you can retrieve your previously acquired document templates at any time in the My documents section.

Are you unfamiliar with our site? No problem. You can establish an account with ease, but prior to that, ensure to do the following.

Now you can establish your account. Next, select the subscription plan and proceed with the payment. Once the payment is finalized, download the Broward Florida Quitclaim Deed from Two Persons to a Corporation in any of the available file formats. You can revisit the site whenever needed and redownload the form without incurring any additional fees.

Locating current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your valuable time understanding legal paperwork online once and for all.

- Verify whether the Broward Florida Quitclaim Deed from Two Persons to a Corporation complies with the regulations of your state and locality.

- Examine the form’s specifics (if available) to discern who and what the form is suitable for.

- Restart the search if the form does not fit your particular circumstances.

Form popularity

FAQ

In Florida, the rules for a quit claim deed mandate that the document must be in writing and signed by the grantors. For the Broward Florida Quitclaim Deed by Two Individuals to Corporation, it is essential that both individuals accurately identify themselves and the corporation receiving the property. Additionally, the deed must be notarized and filed with the county clerk for it to be effective. It's advisable to consult legal resources or platforms like US Legal Forms to ensure compliance with all requirements.

While this question pertains to Missouri, similar principles apply for a Broward Florida Quitclaim Deed by Two Individuals to Corporation. Generally, a quit claim deed in Missouri needs to include the names of the grantor and grantee, a legal description of the property, and must be signed in front of a notary. Furthermore, there may be state-specific requirements regarding recording the deed at the appropriate county office. Always consult local laws or platforms like USLegalForms for precise guidance.

To add a co-owner to a deed, you typically need to create a quit claim deed that specifies the new ownership structure. For a Broward Florida Quitclaim Deed by Two Individuals to Corporation, both current owners must sign the new deed designating the co-owner. Ensure that you include the property description and necessary signatures. Afterward, file the deed with the local recorder's office for it to be legally recognized.

The simplest way to add someone to a deed is by executing a new quit claim deed. This is particularly effective for a Broward Florida Quitclaim Deed by Two Individuals to Corporation, as it allows for clear documentation of ownership transfer. Both current owners must agree to the addition, and the new deed should be filed with the county clerk's office. It's important to include all relevant details for clarity.

A quit claim deed can be voided under certain conditions, such as when it was not properly executed or notarized. Additionally, if it was signed under duress or due to fraud, it may also become invalid. In the context of a Broward Florida Quitclaim Deed by Two Individuals to Corporation, challenges may arise if there are discrepancies in ownership or if the property description is unclear. Ensure that all paperwork is accurate to avoid complications.

Filling out a Florida quit claim deed involves several key steps. Start by obtaining the correct form for the Broward Florida Quitclaim Deed by Two Individuals to Corporation, which you can find on platforms like USLegalForms. Next, clearly provide the names of the grantors and grantee, including the legal description of the property. Lastly, ensure both parties sign the deed in front of a notary public and file it with the appropriate county office.

One major issue with a quit claim deed is that it does not guarantee the title is clear. When using a Broward Florida Quitclaim Deed by Two Individuals to Corporation, if one of the individuals has outstanding liens or claims, the corporation may inherit those problems. Another concern is that quit claim deeds do not provide warranties, leaving the new owner vulnerable to disputes. It is advisable to conduct thorough due diligence before executing such a deed.

In Broward County, you file a quitclaim deed with the Clerk of the Court's office. This office is responsible for recording property transactions and maintaining public records. When completing a Broward Florida quitclaim deed by two individuals to a corporation, be sure to gather all required information and documentation to ensure a smooth filing process.

Yes, you can file a quitclaim deed yourself in Florida without the need for a licensed attorney. It involves completing the necessary forms accurately and submitting them to the appropriate local authority. However, if you're executing a Broward Florida quitclaim deed by two individuals to a corporation, using a platform like US Legal Forms can simplify the process, ensuring you adhere to state requirements effectively.

While hiring a lawyer for a quitclaim deed in Florida is not legally required, it may be beneficial. A legal expert can help ensure that the deed is completed correctly and complies with all relevant laws. For those engaging in a Broward Florida quitclaim deed by two individuals to a corporation, consulting a lawyer can help avoid potential pitfalls and clarify the process.