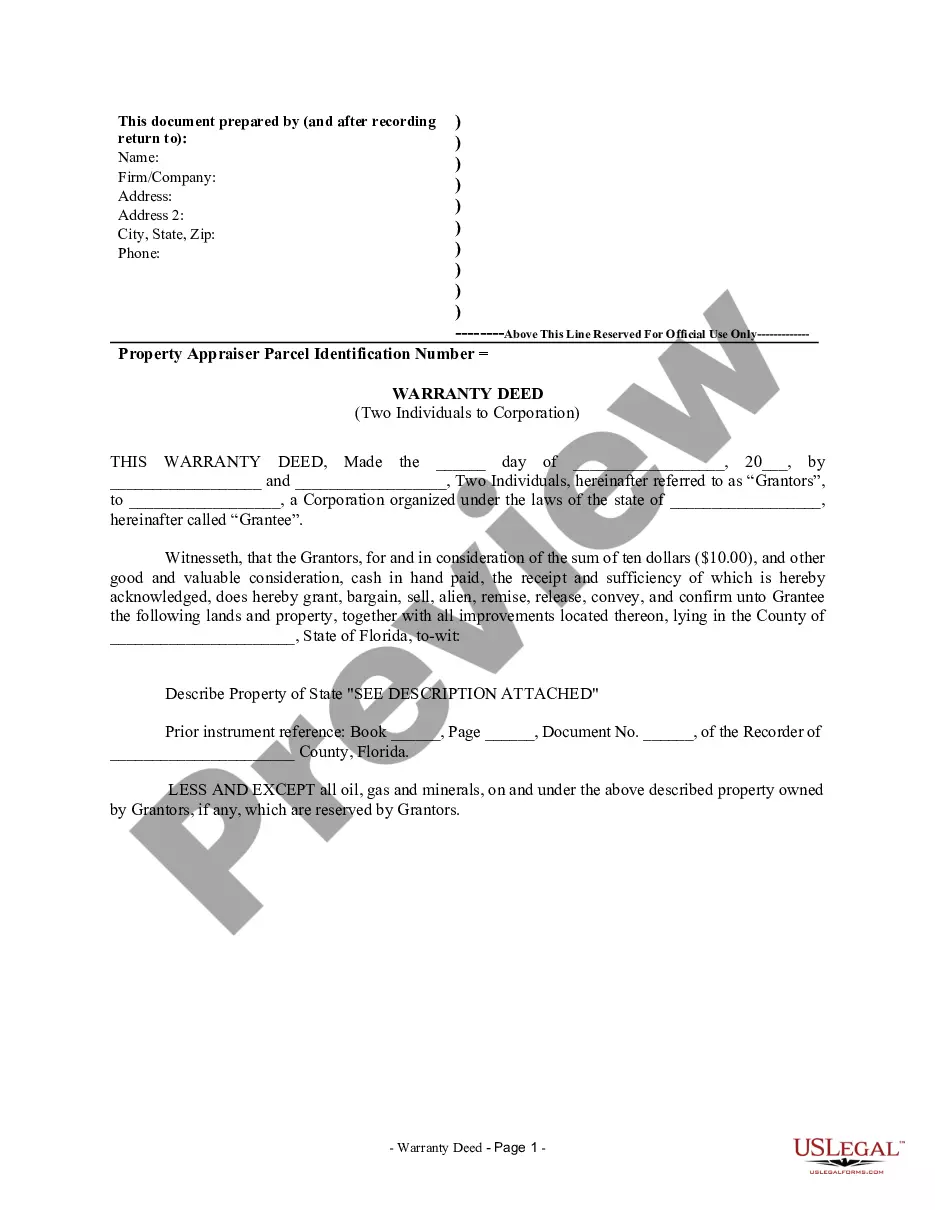

This Warranty Deed from two Individuals to Corporation form is a Warranty Deed where the Grantors are two individuals and the Grantee is a corporation. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A warranty deed is a legal document that transfers property ownership from two individuals to a corporation, offering a guarantee that the property is free from any outstanding liens, encumbrances, or legal issues. In West Palm Beach, Florida, there are various types of warranty deeds used in such transactions: 1. General Warranty Deed: This type of warranty deed provides the highest level of protection to the corporation purchasing the property. It ensures that the individuals transferring the property have clear legal ownership and that there are no undisclosed claims or encumbrances. 2. Special Warranty Deed: A special warranty deed guarantees that the individuals transferring the property have not incurred any encumbrances or claims during their ownership. However, it does not cover any prior issues, unlike a general warranty deed. 3. Limited Warranty Deed: With a limited warranty deed, the individuals transferring the property guarantee that they have not incurred any encumbrances or claims during their ownership. However, it is limited to the time they held the property and does not address any previous claims or issues. 4. Quitclaim Deed: A quitclaim deed is often used when there is a close relationship between the parties involved, such as family members or business associates. It transfers whatever ownership interest the individuals have in the property to the corporation. However, it does not guarantee that the individuals have clear ownership or that the property is free from liens or claims. When drafting a West Palm Beach Florida warranty deed from two individuals to a corporation, it is crucial to include the following information: 1. Names and addresses of the individuals transferring the property (granters) and the corporation (grantee). 2. A clear and detailed legal description of the property being transferred, including the street address, lot number, block, and subdivision name. 3. Statement of consideration (e.g., purchase price or exchange agreement). 4. Confirmation that the granters have clear legal ownership of the property and are authorized to transfer it to the corporation. 5. Warranty clause, specifying the warranty type (general, special, limited, or quitclaim) being provided. 6. Any specific conditions or special provisions agreed upon by both parties. 7. Notarization of the granters' signatures and acknowledgment of their voluntary intention to convey the property. 8. Recording information, including the county where the property is located and the book and page number where the deed will be recorded. 9. Execution date, which is when the deed is signed by the granters and delivered to the corporation. It is essential to consult a qualified real estate attorney or professional with experience in West Palm Beach, Florida real estate laws to ensure the warranty deed complies with all legal requirements and adequately protects the corporation's interests in the property.A warranty deed is a legal document that transfers property ownership from two individuals to a corporation, offering a guarantee that the property is free from any outstanding liens, encumbrances, or legal issues. In West Palm Beach, Florida, there are various types of warranty deeds used in such transactions: 1. General Warranty Deed: This type of warranty deed provides the highest level of protection to the corporation purchasing the property. It ensures that the individuals transferring the property have clear legal ownership and that there are no undisclosed claims or encumbrances. 2. Special Warranty Deed: A special warranty deed guarantees that the individuals transferring the property have not incurred any encumbrances or claims during their ownership. However, it does not cover any prior issues, unlike a general warranty deed. 3. Limited Warranty Deed: With a limited warranty deed, the individuals transferring the property guarantee that they have not incurred any encumbrances or claims during their ownership. However, it is limited to the time they held the property and does not address any previous claims or issues. 4. Quitclaim Deed: A quitclaim deed is often used when there is a close relationship between the parties involved, such as family members or business associates. It transfers whatever ownership interest the individuals have in the property to the corporation. However, it does not guarantee that the individuals have clear ownership or that the property is free from liens or claims. When drafting a West Palm Beach Florida warranty deed from two individuals to a corporation, it is crucial to include the following information: 1. Names and addresses of the individuals transferring the property (granters) and the corporation (grantee). 2. A clear and detailed legal description of the property being transferred, including the street address, lot number, block, and subdivision name. 3. Statement of consideration (e.g., purchase price or exchange agreement). 4. Confirmation that the granters have clear legal ownership of the property and are authorized to transfer it to the corporation. 5. Warranty clause, specifying the warranty type (general, special, limited, or quitclaim) being provided. 6. Any specific conditions or special provisions agreed upon by both parties. 7. Notarization of the granters' signatures and acknowledgment of their voluntary intention to convey the property. 8. Recording information, including the county where the property is located and the book and page number where the deed will be recorded. 9. Execution date, which is when the deed is signed by the granters and delivered to the corporation. It is essential to consult a qualified real estate attorney or professional with experience in West Palm Beach, Florida real estate laws to ensure the warranty deed complies with all legal requirements and adequately protects the corporation's interests in the property.