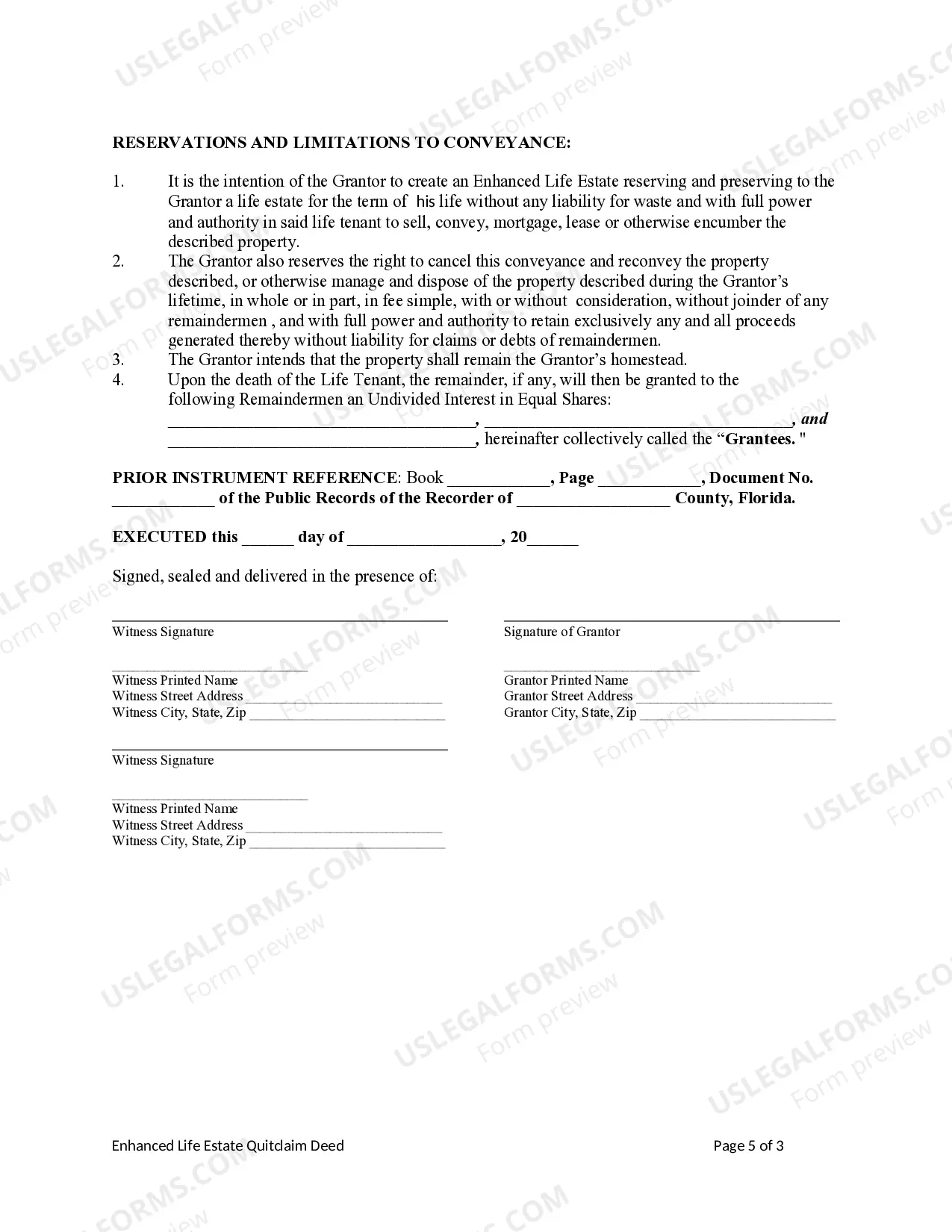

This form is an Enhanced Life Estate Deed where the Grantor is an individual and the Grantees are three individuals. Grantor conveys the property to Grantees subject to a retained enhanced life estate. Further, the Grantor retains for life the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

A Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Individual to Three Individuals is a specific type of real estate transfer deed that allows an individual ("Granter") to transfer ownership of their property to three named individuals ("Grantees") while reserving the right to live in or use the property for the duration of their lifetime. This type of deed offers certain advantages, including the ability to avoid probate, retain control over the property during the Granter's lifetime, and ensure the seamless transfer of ownership upon the Granter's passing. The Lady Bird Deed, also known as an "Enhanced Life Estate Deed," is a specific variation of the Enhanced Life Estate Deed often used in Florida. It is a highly flexible and widely utilized estate planning tool that enables individuals to transfer their property while safeguarding their rights and avoiding unnecessary taxation or loss of governmental assistance. Some key features and benefits of the Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Individual to Three Individuals include: 1. Avoidance of Probate: With this type of deed, the property ownership is automatically transferred to the named Grantees upon the Granter's passing, effectively bypassing the probate process. This saves time, costs, and ensures a smoother transition of ownership. 2. Continued Use and Control: By retaining an enhanced life estate, the Granter maintains the right to live in or use the property, collect rent, make improvements, or even sell the property without seeking permission from the Grantees during their lifetime. 3. Medicaid and Government Assistance Protection: The Lady Bird Deed helps individuals protect their eligibility for Medicaid benefits and other governmental assistance programs. It allows the Granter to transfer their property while avoiding Medicaid estate recovery claims. 4. Tax Benefits: Since the property is not considered a completed gift until the Granter's passing, the transfer may have tax advantages, such as avoiding gift taxes or obtaining a step-up in the property's tax basis upon the Granter's death. Other types of Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Individual to Three Individuals may include variations specific to certain states or regions, each having their own unique legal requirements. However, the core concept of transferring property while reserving an enhanced life estate remains consistent. In summary, a Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Individual to Three Individuals is a legally binding property transfer deed that allows an individual to pass on their property to three named individuals while retaining the right to use or reside in the property during their lifetime. It provides numerous benefits, including probate avoidance, continued control over the property, protection of government assistance eligibility, and potential tax advantages.A Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Individual to Three Individuals is a specific type of real estate transfer deed that allows an individual ("Granter") to transfer ownership of their property to three named individuals ("Grantees") while reserving the right to live in or use the property for the duration of their lifetime. This type of deed offers certain advantages, including the ability to avoid probate, retain control over the property during the Granter's lifetime, and ensure the seamless transfer of ownership upon the Granter's passing. The Lady Bird Deed, also known as an "Enhanced Life Estate Deed," is a specific variation of the Enhanced Life Estate Deed often used in Florida. It is a highly flexible and widely utilized estate planning tool that enables individuals to transfer their property while safeguarding their rights and avoiding unnecessary taxation or loss of governmental assistance. Some key features and benefits of the Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Individual to Three Individuals include: 1. Avoidance of Probate: With this type of deed, the property ownership is automatically transferred to the named Grantees upon the Granter's passing, effectively bypassing the probate process. This saves time, costs, and ensures a smoother transition of ownership. 2. Continued Use and Control: By retaining an enhanced life estate, the Granter maintains the right to live in or use the property, collect rent, make improvements, or even sell the property without seeking permission from the Grantees during their lifetime. 3. Medicaid and Government Assistance Protection: The Lady Bird Deed helps individuals protect their eligibility for Medicaid benefits and other governmental assistance programs. It allows the Granter to transfer their property while avoiding Medicaid estate recovery claims. 4. Tax Benefits: Since the property is not considered a completed gift until the Granter's passing, the transfer may have tax advantages, such as avoiding gift taxes or obtaining a step-up in the property's tax basis upon the Granter's death. Other types of Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Individual to Three Individuals may include variations specific to certain states or regions, each having their own unique legal requirements. However, the core concept of transferring property while reserving an enhanced life estate remains consistent. In summary, a Tallahassee Florida Enhanced Life Estate or Lady Bird Deed Quitclaimai— - Individual to Three Individuals is a legally binding property transfer deed that allows an individual to pass on their property to three named individuals while retaining the right to use or reside in the property during their lifetime. It provides numerous benefits, including probate avoidance, continued control over the property, protection of government assistance eligibility, and potential tax advantages.