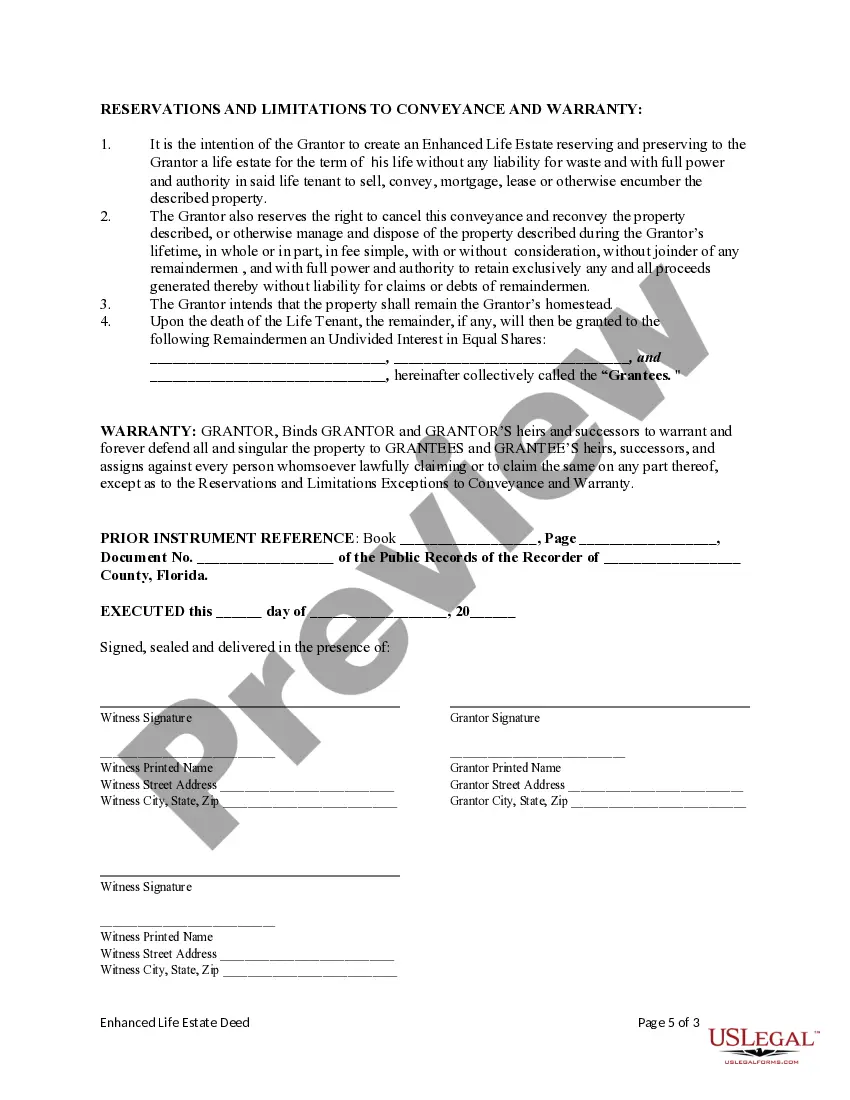

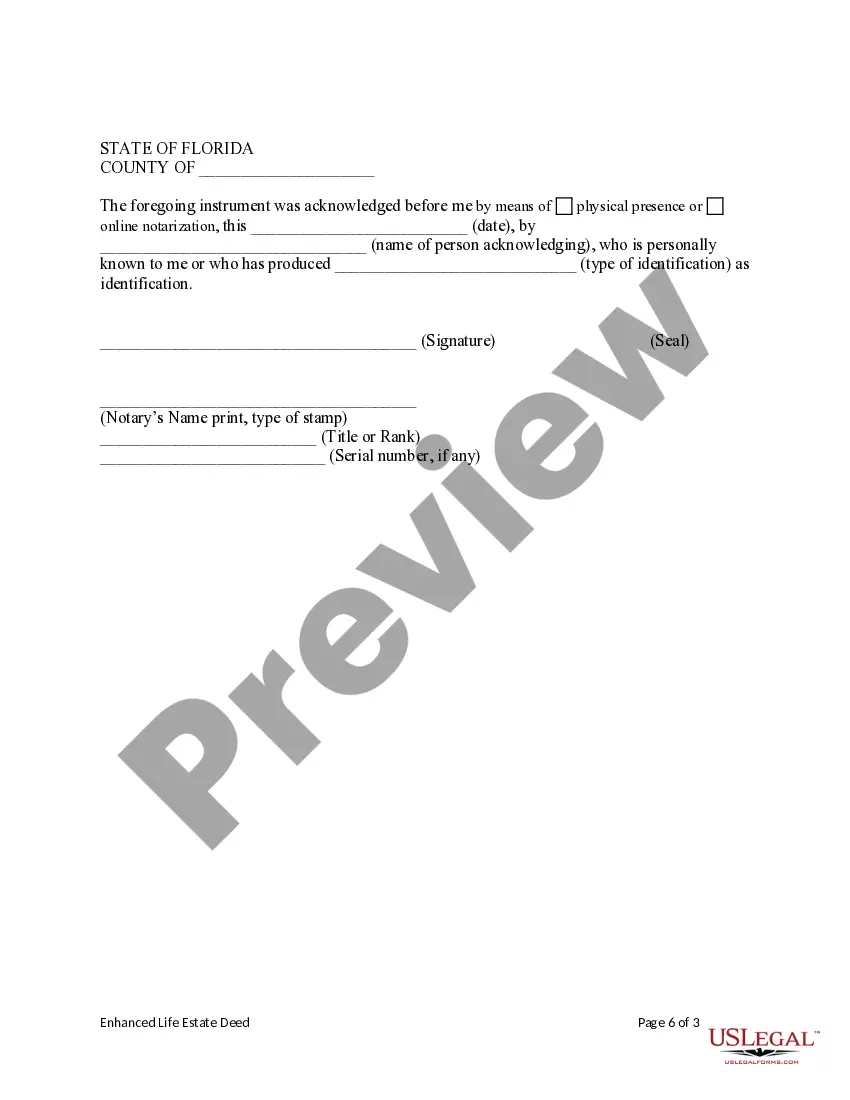

This form is an Enhanced Life Estate Deed where the Grantor is an individual and the Grantees are three individuals. Grantor conveys the property to Grantees subject to a retained enhanced life estate. Further, the Grantor retains for life the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Hialeah Florida Enhanced Life Estate or Lady Bird Deed — An Individual to Three Individuals is a legal instrument that allows property owners in Hialeah, Florida, to transfer ownership of their property to three individuals while retaining enhanced life estate rights. This legal tool can provide several advantages for property owners, such as avoiding probate, protecting the property from Medicaid estate recovery, and maintaining control and use of the property during their lifetime. The Hialeah Florida Enhanced Life Estate or Lady Bird Deed distinguishes itself by offering unique features compared to a traditional life estate deed. The granter (property owner) in this deed maintains the right to live in the property, sell it, modify it, or even revoke the deed entirely without requiring permission from the grantees (three individuals). This level of control sets it apart from standard life estate deeds, making it a flexible estate planning option. By using the Hialeah Florida Enhanced Life Estate or Lady Bird Deed, property owners can still benefit from homestead exemptions and property tax advantages available in Florida. Through this instrument, the granter can transfer their property to three individuals, who become the ultimate owners once the granter passes away. The grantees do not have any present rights to the property. However, upon the granter's death, they automatically gain full ownership, bypassing the probate process. There are different variations of this deed available in Hialeah, Florida, each with specific features and purposes. Some common types include: 1. Traditional Lady Bird Deed: This type of deed allows the granter to transfer the property to the three individuals, while retaining the right to sell, mortgage, or revoke the deed during their lifetime. It provides enhanced protection against Medicaid estate recovery. 2. Irrevocable Lady Bird Deed: This version of the Lady Bird Deed is unalterable once executed, meaning the granter cannot revoke or modify it without obtaining permission from all grantees. It offers increased asset protection and can be useful for Medicaid planning purposes. 3. Transfer-on-Death (TOD) Lady Bird Deed: This deed variation allows the granter to specify the grantees who will succeed them as property owners upon their death. It offers a seamless transfer of ownership, bypassing probate and ensuring a smoother succession process. In conclusion, the Hialeah Florida Enhanced Life Estate or Lady Bird Deed — An Individual to Three Individuals is a powerful estate planning tool that provides property owners in Hialeah, Florida, with the ability to transfer their property while retaining control and use during their lifetime. With different types available, individuals can choose the specific deed variation that aligns with their goals, preferences, and estate planning needs.Hialeah Florida Enhanced Life Estate or Lady Bird Deed — An Individual to Three Individuals is a legal instrument that allows property owners in Hialeah, Florida, to transfer ownership of their property to three individuals while retaining enhanced life estate rights. This legal tool can provide several advantages for property owners, such as avoiding probate, protecting the property from Medicaid estate recovery, and maintaining control and use of the property during their lifetime. The Hialeah Florida Enhanced Life Estate or Lady Bird Deed distinguishes itself by offering unique features compared to a traditional life estate deed. The granter (property owner) in this deed maintains the right to live in the property, sell it, modify it, or even revoke the deed entirely without requiring permission from the grantees (three individuals). This level of control sets it apart from standard life estate deeds, making it a flexible estate planning option. By using the Hialeah Florida Enhanced Life Estate or Lady Bird Deed, property owners can still benefit from homestead exemptions and property tax advantages available in Florida. Through this instrument, the granter can transfer their property to three individuals, who become the ultimate owners once the granter passes away. The grantees do not have any present rights to the property. However, upon the granter's death, they automatically gain full ownership, bypassing the probate process. There are different variations of this deed available in Hialeah, Florida, each with specific features and purposes. Some common types include: 1. Traditional Lady Bird Deed: This type of deed allows the granter to transfer the property to the three individuals, while retaining the right to sell, mortgage, or revoke the deed during their lifetime. It provides enhanced protection against Medicaid estate recovery. 2. Irrevocable Lady Bird Deed: This version of the Lady Bird Deed is unalterable once executed, meaning the granter cannot revoke or modify it without obtaining permission from all grantees. It offers increased asset protection and can be useful for Medicaid planning purposes. 3. Transfer-on-Death (TOD) Lady Bird Deed: This deed variation allows the granter to specify the grantees who will succeed them as property owners upon their death. It offers a seamless transfer of ownership, bypassing probate and ensuring a smoother succession process. In conclusion, the Hialeah Florida Enhanced Life Estate or Lady Bird Deed — An Individual to Three Individuals is a powerful estate planning tool that provides property owners in Hialeah, Florida, with the ability to transfer their property while retaining control and use during their lifetime. With different types available, individuals can choose the specific deed variation that aligns with their goals, preferences, and estate planning needs.