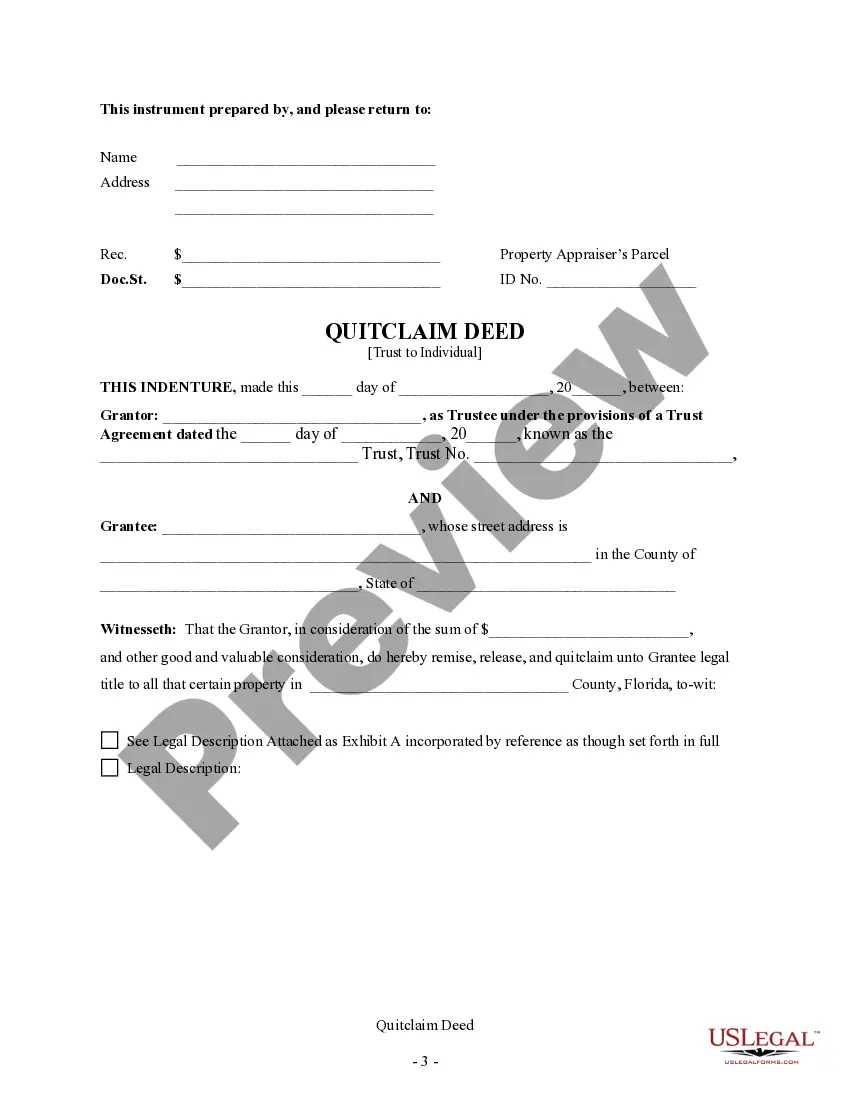

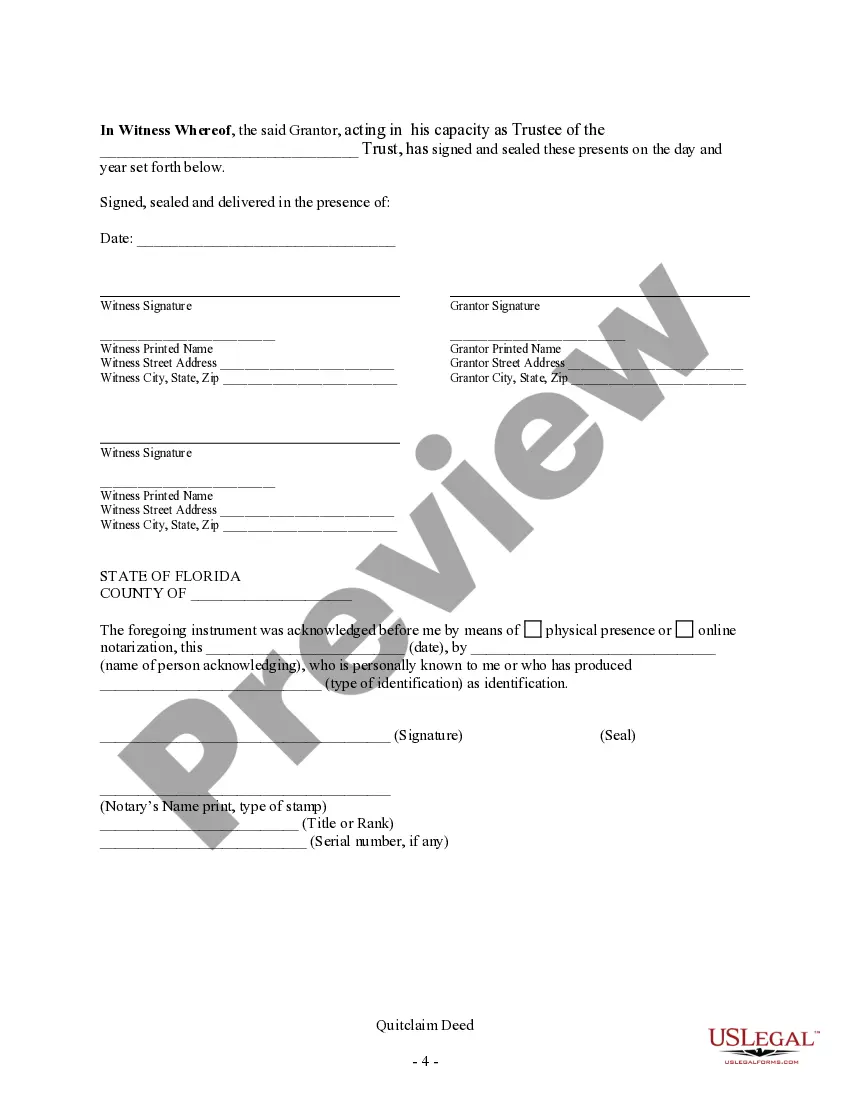

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is an Individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Coral Springs Florida Quitclaim Deed is a legal document that transfers ownership of a property from a trust to an individual. This type of deed is commonly used to transfer property between family members, as well as for estate planning purposes. The Coral Springs Florida Quitclaim Deed from a Trust to an Individual is used specifically when the property is held within a trust and the trustee wishes to transfer the property to an individual beneficiary. This deed is typically used to convey property without guaranteeing that the title is free from any existing liens or encumbrances. It is important to note that this type of deed may not provide the same level of protection for the grantee as other types of deeds. There may be variations or additional types of Coral Springs Florida Quitclaim Deeds depending on specific circumstances. Some examples of these variations may include: 1. Coral Springs Florida Quitclaim Deed with Reservation of Life Estate: This type of deed allows the granter (typically the trust) to transfer ownership of a property to an individual while reserving the right to live on and use the property until their death. 2. Coral Springs Florida Joint Tenancy Quitclaim Deed: This deed is used when two or more individuals wish to establish joint tenancy ownership of a property. It allows for the transfer of a co-owner's interest to the other joint tenants upon their death, ensuring the property passes smoothly without going through probate. 3. Coral Springs Florida Quitclaim Deed from a Trustee to Trustee: This deed is used when there is a change in trusteeship and the property needs to be transferred from one trustee to another, while keeping ownership within the trust intact. When executing a Coral Springs Florida Quitclaim Deed, it is essential to consult with a qualified real estate attorney or title company to ensure compliance with all legal requirements and to protect the interests of both the granter and the grantee.