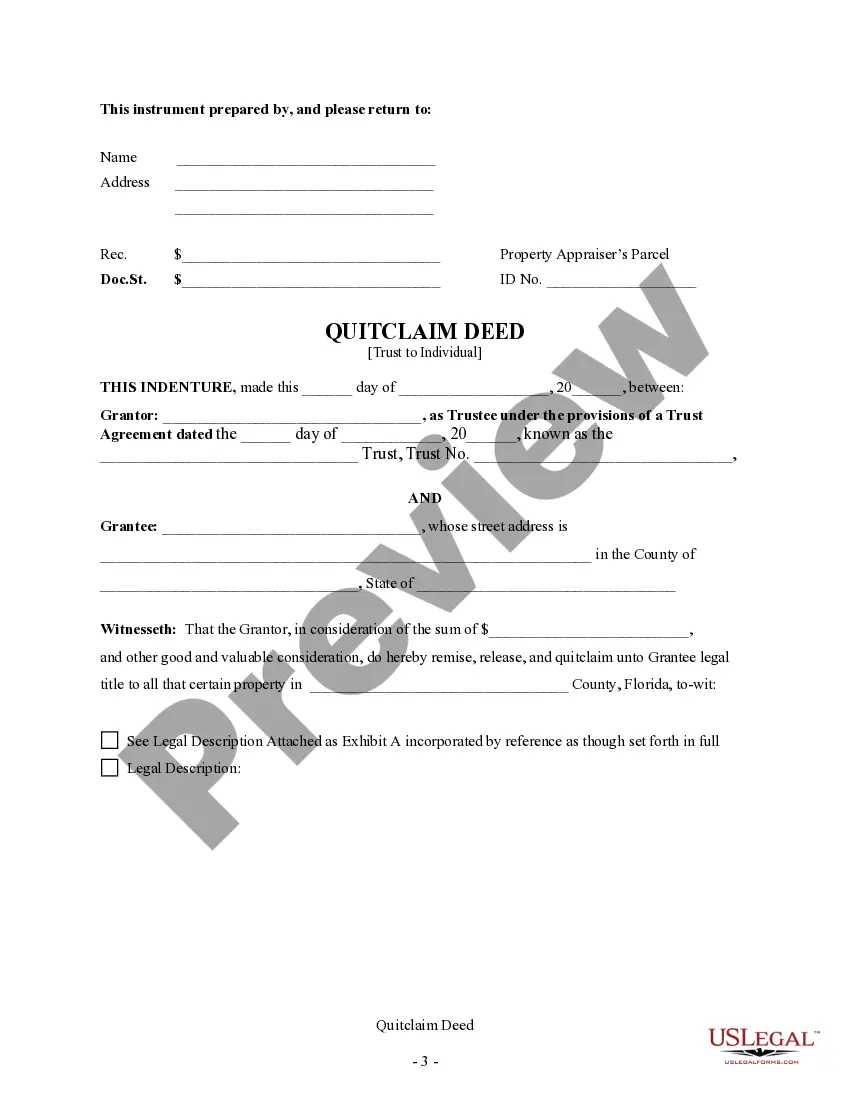

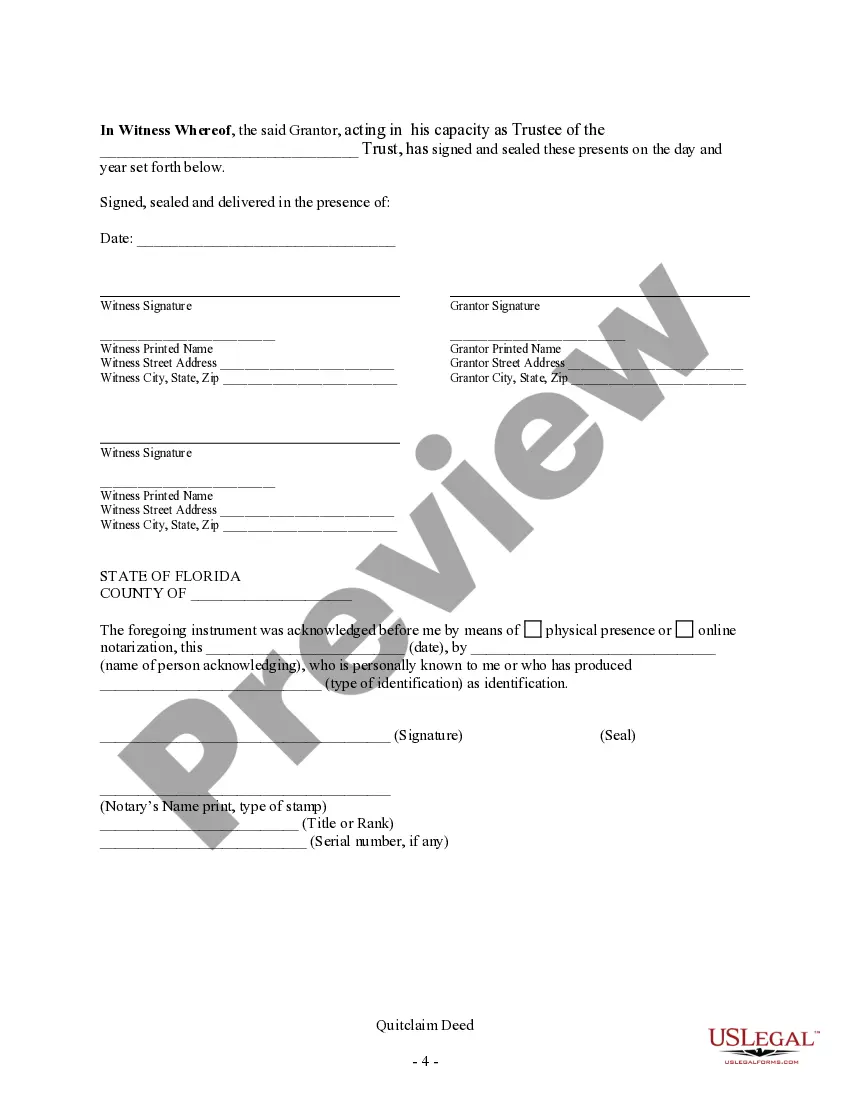

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is an Individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Jacksonville Florida Quitclaim Deed is a legal document that transfers ownership of a property from a trust to an individual. This type of deed is commonly used when there is a change in ownership or a transfer of property within a trust. A quitclaim deed is a type of deed that conveys any interest or claim that the granter (the trust in this case) may have in the property, without providing any guarantee of clear title. This means that the trust is not guaranteeing that it owns the property free and clear of any liens or encumbrances, nor is it guaranteeing that it has the legal authority to transfer the property. In Jacksonville, Florida, there may be different types of quitclaim deeds from a trust to an individual, depending on the specific circumstances of the transfer. For example, there could be a quitclaim deed when a trustee is transferring the property to a beneficiary of the trust, or when a trust is being dissolved, and the property is distributed to an individual. Some relevant keywords related to a Jacksonville Florida Quitclaim Deed from a Trust to an Individual may include: 1. Transfer of ownership: The quitclaim deed facilitates the transfer of ownership from the trust to the individual, clearly stating that the trust is relinquishing any interest it may have in the property. 2. Title: The deed does not guarantee clear title since it only conveys the granter's interest, which might include liens or encumbrances on the property. However, it is crucial for the granter to disclose any known issues to the grantee. 3. Trustee: The trustee is the legal entity holding the property in the trust. They have the authority to execute the quitclaim deed and transfer the ownership rights to the individual. 4. Beneficiary: The individual who will receive ownership of the property through the quitclaim deed. They will become the new owner and have all associated rights and responsibilities. 5. Dissolution: In some cases, a trust may be dissolved, and the quitclaim deed is used to transfer the property to the individual beneficiaries. 6. Liens and encumbrances: Any outstanding debts or claims against the property may still exist after the transfer. It is important for the individual receiving the property to conduct a thorough title search to identify any potential issues. Overall, a Jacksonville Florida Quitclaim Deed from a Trust to an Individual is a legal instrument used to transfer ownership of a property from a trust to an individual. It is essential for all parties involved to understand the nature of the transfer and the limitations of a quitclaim deed.A Jacksonville Florida Quitclaim Deed is a legal document that transfers ownership of a property from a trust to an individual. This type of deed is commonly used when there is a change in ownership or a transfer of property within a trust. A quitclaim deed is a type of deed that conveys any interest or claim that the granter (the trust in this case) may have in the property, without providing any guarantee of clear title. This means that the trust is not guaranteeing that it owns the property free and clear of any liens or encumbrances, nor is it guaranteeing that it has the legal authority to transfer the property. In Jacksonville, Florida, there may be different types of quitclaim deeds from a trust to an individual, depending on the specific circumstances of the transfer. For example, there could be a quitclaim deed when a trustee is transferring the property to a beneficiary of the trust, or when a trust is being dissolved, and the property is distributed to an individual. Some relevant keywords related to a Jacksonville Florida Quitclaim Deed from a Trust to an Individual may include: 1. Transfer of ownership: The quitclaim deed facilitates the transfer of ownership from the trust to the individual, clearly stating that the trust is relinquishing any interest it may have in the property. 2. Title: The deed does not guarantee clear title since it only conveys the granter's interest, which might include liens or encumbrances on the property. However, it is crucial for the granter to disclose any known issues to the grantee. 3. Trustee: The trustee is the legal entity holding the property in the trust. They have the authority to execute the quitclaim deed and transfer the ownership rights to the individual. 4. Beneficiary: The individual who will receive ownership of the property through the quitclaim deed. They will become the new owner and have all associated rights and responsibilities. 5. Dissolution: In some cases, a trust may be dissolved, and the quitclaim deed is used to transfer the property to the individual beneficiaries. 6. Liens and encumbrances: Any outstanding debts or claims against the property may still exist after the transfer. It is important for the individual receiving the property to conduct a thorough title search to identify any potential issues. Overall, a Jacksonville Florida Quitclaim Deed from a Trust to an Individual is a legal instrument used to transfer ownership of a property from a trust to an individual. It is essential for all parties involved to understand the nature of the transfer and the limitations of a quitclaim deed.