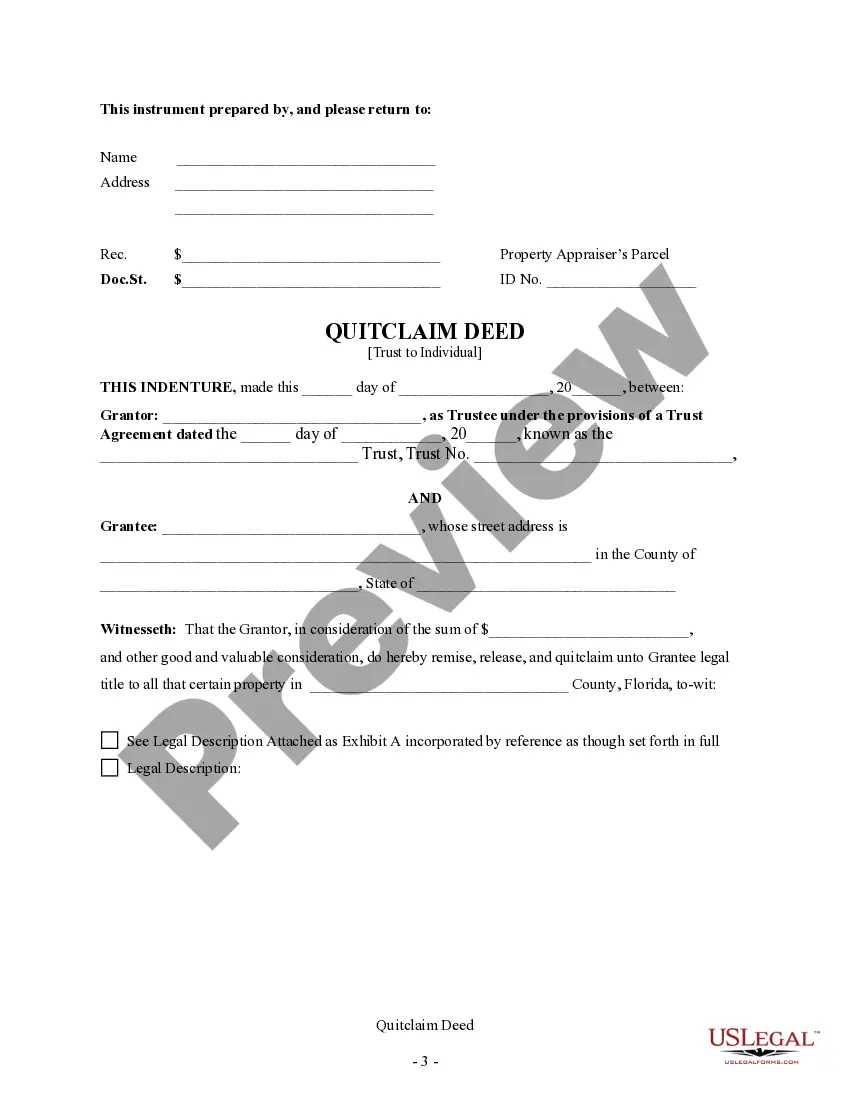

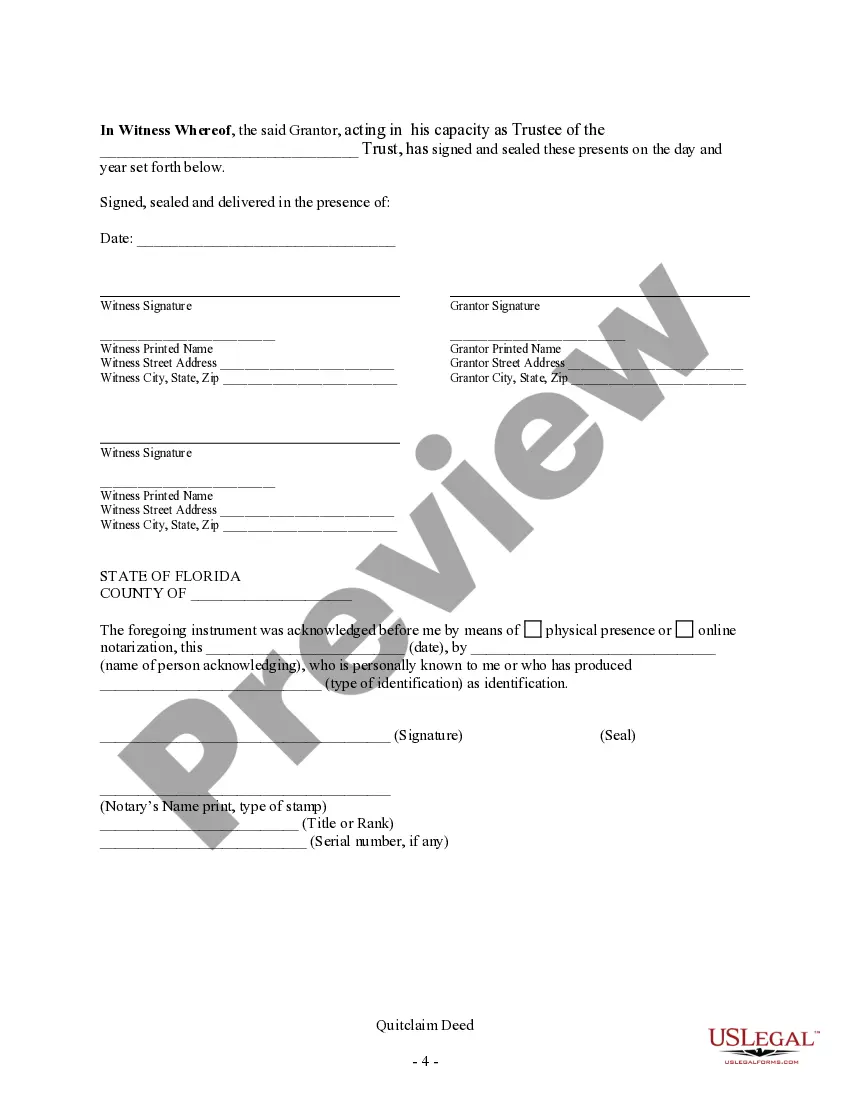

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is an Individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Port St. Lucie Florida Quitclaim Deed from a Trust to an Individual is a legal document used to transfer ownership of real estate property located in Port St. Lucie, Florida from a trust to an individual. This type of deed is commonly used when the trustee of a trust wants to transfer the property to a beneficiary or any other individual. It is important to note that a quitclaim deed only transfers the interest or ownership the granter holds in the property, without providing any warranties or guarantees about the property's title. Some different types of Port St. Lucie Florida Quitclaim Deeds from a Trust to an Individual may include: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed used to transfer real estate ownership from a trust to an individual. It simply conveys any interest or claim the trust holds in the property to the individual, without providing any guarantees about the property's title. 2. Joint Tenancy Quitclaim Deed: This type of quitclaim deed allows for ownership of the property to be held jointly by two or more individuals. It can be useful when the trust wants to transfer the property to multiple beneficiaries or family members. 3. Life Estate Quitclaim Deed: With this type of quitclaim deed, the trust transfers ownership of the property to an individual for the duration of their life. After the individual's passing, the property reverts to the trust or passes onto another designated beneficiary. 4. Trustee-to-Individual Quitclaim Deed: In some cases, the trustee of a trust might transfer the property to an individual without dissolving the trust entirely. This type of quitclaim deed allows for the transfer of ownership from the trust to the individual, while the trust itself remains intact. Whether you are a trustee or a beneficiary, it is important to consult with a qualified real estate attorney or legal professional to ensure that the quitclaim deed accurately reflects your intentions and protects your rights during the transfer process. Additionally, conducting a thorough title search and obtaining title insurance may be advisable in order to address any potential title issues or concerns.A Port St. Lucie Florida Quitclaim Deed from a Trust to an Individual is a legal document used to transfer ownership of real estate property located in Port St. Lucie, Florida from a trust to an individual. This type of deed is commonly used when the trustee of a trust wants to transfer the property to a beneficiary or any other individual. It is important to note that a quitclaim deed only transfers the interest or ownership the granter holds in the property, without providing any warranties or guarantees about the property's title. Some different types of Port St. Lucie Florida Quitclaim Deeds from a Trust to an Individual may include: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed used to transfer real estate ownership from a trust to an individual. It simply conveys any interest or claim the trust holds in the property to the individual, without providing any guarantees about the property's title. 2. Joint Tenancy Quitclaim Deed: This type of quitclaim deed allows for ownership of the property to be held jointly by two or more individuals. It can be useful when the trust wants to transfer the property to multiple beneficiaries or family members. 3. Life Estate Quitclaim Deed: With this type of quitclaim deed, the trust transfers ownership of the property to an individual for the duration of their life. After the individual's passing, the property reverts to the trust or passes onto another designated beneficiary. 4. Trustee-to-Individual Quitclaim Deed: In some cases, the trustee of a trust might transfer the property to an individual without dissolving the trust entirely. This type of quitclaim deed allows for the transfer of ownership from the trust to the individual, while the trust itself remains intact. Whether you are a trustee or a beneficiary, it is important to consult with a qualified real estate attorney or legal professional to ensure that the quitclaim deed accurately reflects your intentions and protects your rights during the transfer process. Additionally, conducting a thorough title search and obtaining title insurance may be advisable in order to address any potential title issues or concerns.