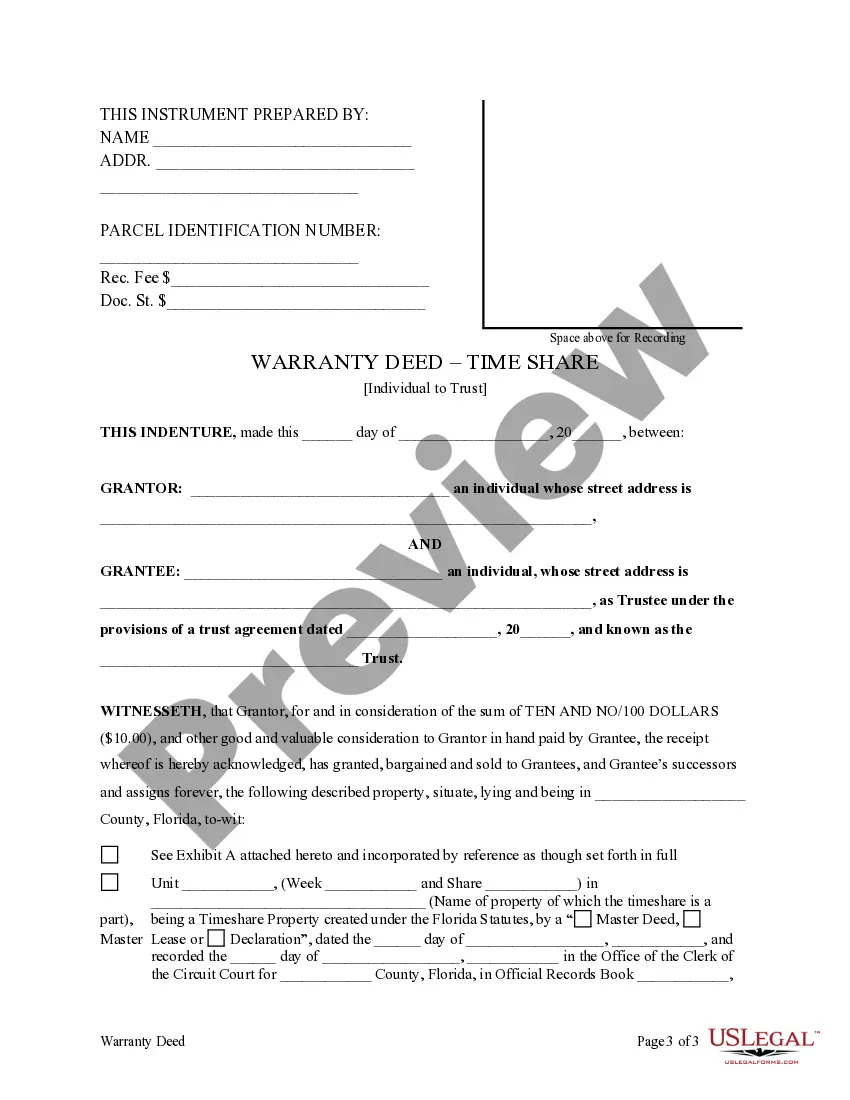

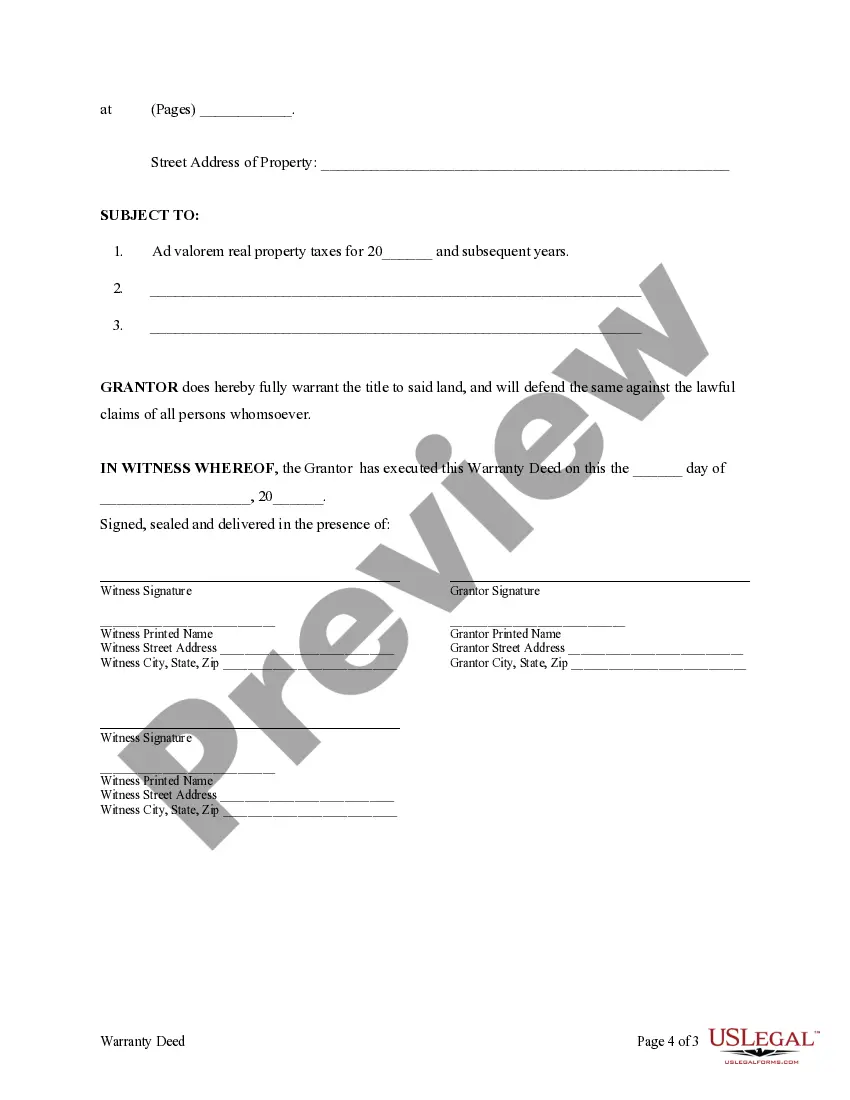

This form is a Warranty Deed where the Grantor is an Individual and the Grantee is a Trust. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

A Palm Beach Florida Warranty Deed for a Time Share from an Individual to a Trust is a legal document that signifies the transfer of ownership rights of a time-share property from an individual owner to a trust. This type of deed ensures that the time-share property is transferred with certain guarantees and warranties regarding the owner's legal ownership and the property's title. In Palm Beach, Florida, there are several types of warranty deeds that can be used for transferring a time-share from an individual to a trust. These include: 1. General Warranty Deed: This type of warranty deed provides the highest level of protection for the grantee (the trust). It assures that the granter (individual owner) holds clear and marketable title to the time-share property and guarantees protection against any potential claims or encumbrances. 2. Special Warranty Deed: Similar to the general warranty deed, a special warranty deed also guarantees that the granter has the right to transfer the property, but only provides protection against any claims or encumbrances that may have occurred during the granter's ownership tenure. 3. Quitclaim Deed: Unlike warranty deeds, a quitclaim deed does not offer any warranties or guarantees as to the validity of the granter's title. It simply transfers the granter's interest in the time-share property to the trust, without any guarantees regarding the ownership history. When drafting a Palm Beach Florida Warranty Deed for a Time Share from an Individual to a Trust, it is crucial to include specific details such as the legal description of the property, the names and addresses of both the granter and the grantee, and any applicable terms or conditions of the transfer. Additionally, the deed should be properly executed, signed, and notarized to ensure its validity. Transferring ownership of a time-share property from an individual to a trust can have various legal and financial implications. It is always recommended consulting with a qualified real estate attorney or professional experienced in time-share transactions to navigate the specific requirements and nuances of Palm Beach, Florida laws.