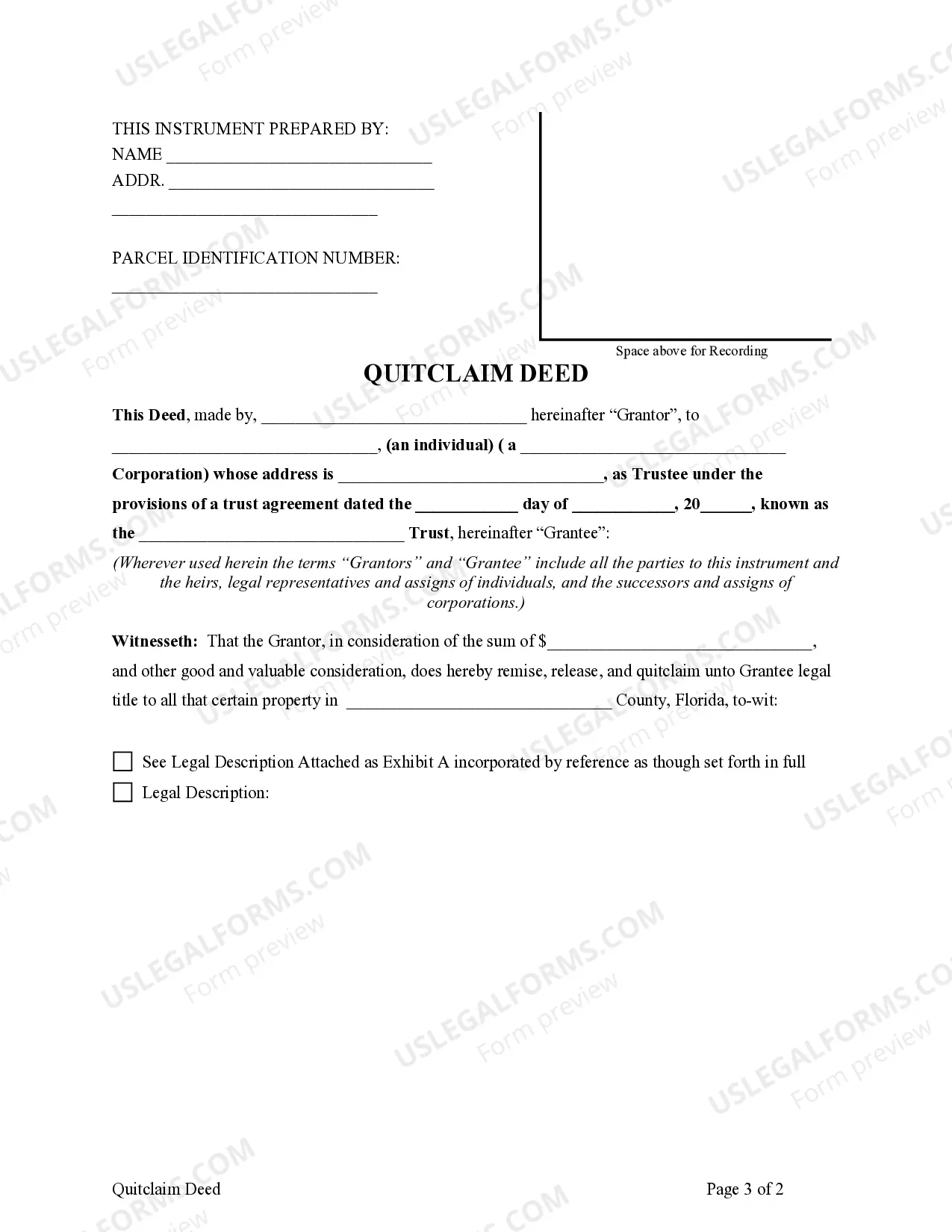

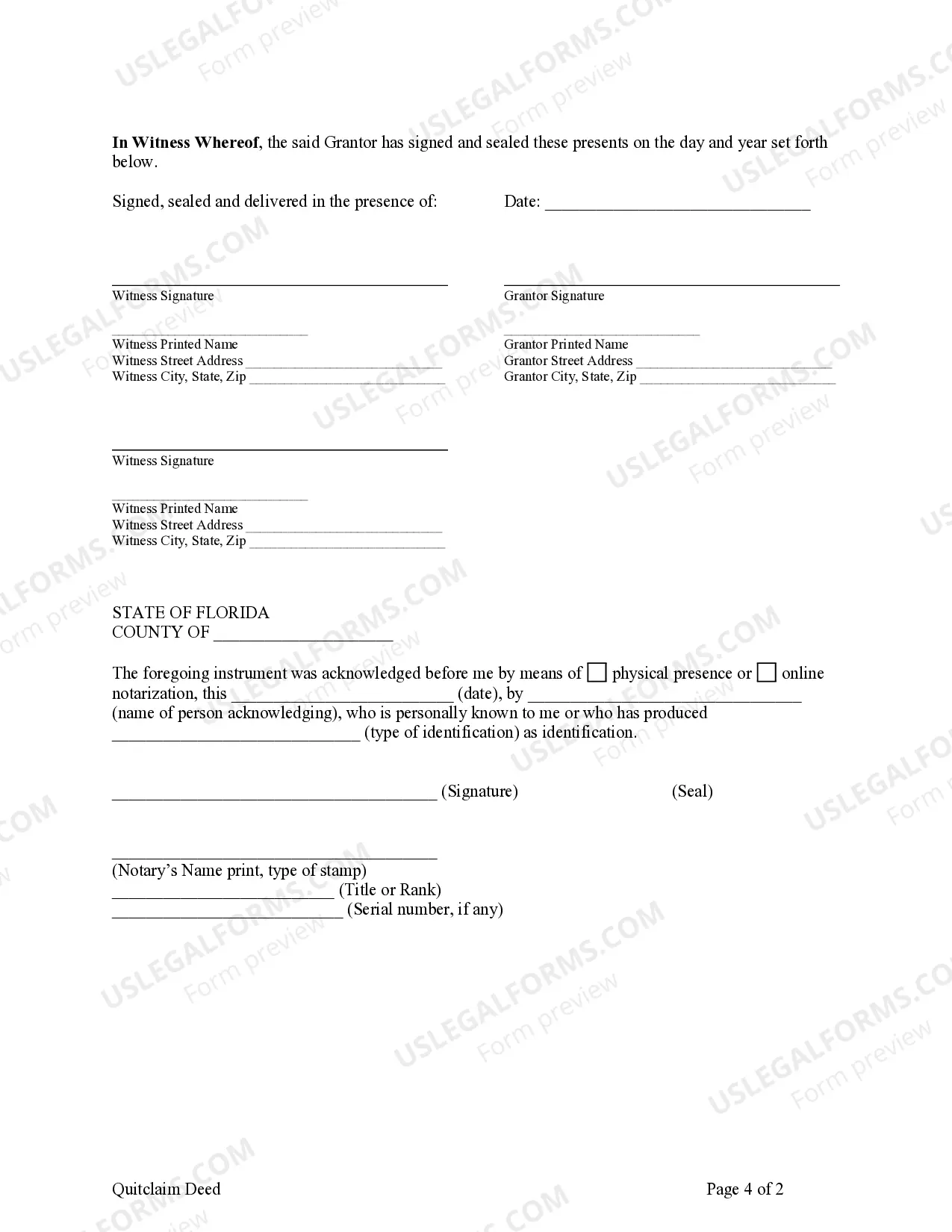

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

The Gainesville Florida Quitclaim Deed — Individual to a Trust is a legal document that allows an individual, known as the granter, to transfer ownership of real property to a trust. This deed is commonly used when the property owner wishes to place their property into a trust for various reasons, including estate planning, asset protection, or transferring property to beneficiaries. When executing a Gainesville Florida Quitclaim Deed — Individual to a Trust, it is crucial to understand the specific types of deeds that fall under this category. These may include: 1. Revocable Living Trust Quitclaim Deed: This type of deed is often used when an individual creates a revocable living trust and wishes to transfer their property to that trust. It allows the granter to maintain control over the property during their lifetime while securing its future distribution according to the terms of the trust. 2. Irrevocable Trust Quitclaim Deed: This deed is appropriate when the granter wants to establish an irrevocable trust, which means the terms and conditions cannot be changed or revoked. By transferring the property into this type of trust, the granter relinquishes all rights to the property, potentially offering tax benefits and asset protection. 3. Special Needs Trust Quitclaim Deed: This variation of the Quitclaim Deed is employed when creating a trust specifically designed to provide financial support and assistance to individuals with special needs. By transferring the property into this trust, the granter ensures that the beneficiary receives the necessary care and support while preserving their eligibility for government benefits. 4. Charitable Remainder Trust Quitclaim Deed: Individuals who wish to make a charitable donation through real estate can utilize this deed. By transferring the property into a charitable remainder trust, the granter can receive an income stream during their lifetime, while ensuring that the property's ownership eventually passes to the chosen charity. Executing a Gainesville Florida Quitclaim Deed — Individual to a Trust involves several essential steps. Firstly, identify the property and accurately describe it in the deed. Secondly, provide the names of the granter (individual transferring the property) and the trustee (individual overseeing the trust). Additionally, consult with a legal professional to ensure compliance with Gainesville's specific regulations concerning deed transfers and trust establishment. In conclusion, the Gainesville Florida Quitclaim Deed — Individual to a Trust is a vital legal document used to transfer real property into a trust structure. Understanding the different types of this deed, such as the revocable living trust, irrevocable trust, special needs trust, and charitable remainder trust, is crucial for property owners looking to benefit from estate planning, asset protection, and charitable giving. Seek professional advice and ensure compliance with local regulations when executing this important legal process.The Gainesville Florida Quitclaim Deed — Individual to a Trust is a legal document that allows an individual, known as the granter, to transfer ownership of real property to a trust. This deed is commonly used when the property owner wishes to place their property into a trust for various reasons, including estate planning, asset protection, or transferring property to beneficiaries. When executing a Gainesville Florida Quitclaim Deed — Individual to a Trust, it is crucial to understand the specific types of deeds that fall under this category. These may include: 1. Revocable Living Trust Quitclaim Deed: This type of deed is often used when an individual creates a revocable living trust and wishes to transfer their property to that trust. It allows the granter to maintain control over the property during their lifetime while securing its future distribution according to the terms of the trust. 2. Irrevocable Trust Quitclaim Deed: This deed is appropriate when the granter wants to establish an irrevocable trust, which means the terms and conditions cannot be changed or revoked. By transferring the property into this type of trust, the granter relinquishes all rights to the property, potentially offering tax benefits and asset protection. 3. Special Needs Trust Quitclaim Deed: This variation of the Quitclaim Deed is employed when creating a trust specifically designed to provide financial support and assistance to individuals with special needs. By transferring the property into this trust, the granter ensures that the beneficiary receives the necessary care and support while preserving their eligibility for government benefits. 4. Charitable Remainder Trust Quitclaim Deed: Individuals who wish to make a charitable donation through real estate can utilize this deed. By transferring the property into a charitable remainder trust, the granter can receive an income stream during their lifetime, while ensuring that the property's ownership eventually passes to the chosen charity. Executing a Gainesville Florida Quitclaim Deed — Individual to a Trust involves several essential steps. Firstly, identify the property and accurately describe it in the deed. Secondly, provide the names of the granter (individual transferring the property) and the trustee (individual overseeing the trust). Additionally, consult with a legal professional to ensure compliance with Gainesville's specific regulations concerning deed transfers and trust establishment. In conclusion, the Gainesville Florida Quitclaim Deed — Individual to a Trust is a vital legal document used to transfer real property into a trust structure. Understanding the different types of this deed, such as the revocable living trust, irrevocable trust, special needs trust, and charitable remainder trust, is crucial for property owners looking to benefit from estate planning, asset protection, and charitable giving. Seek professional advice and ensure compliance with local regulations when executing this important legal process.