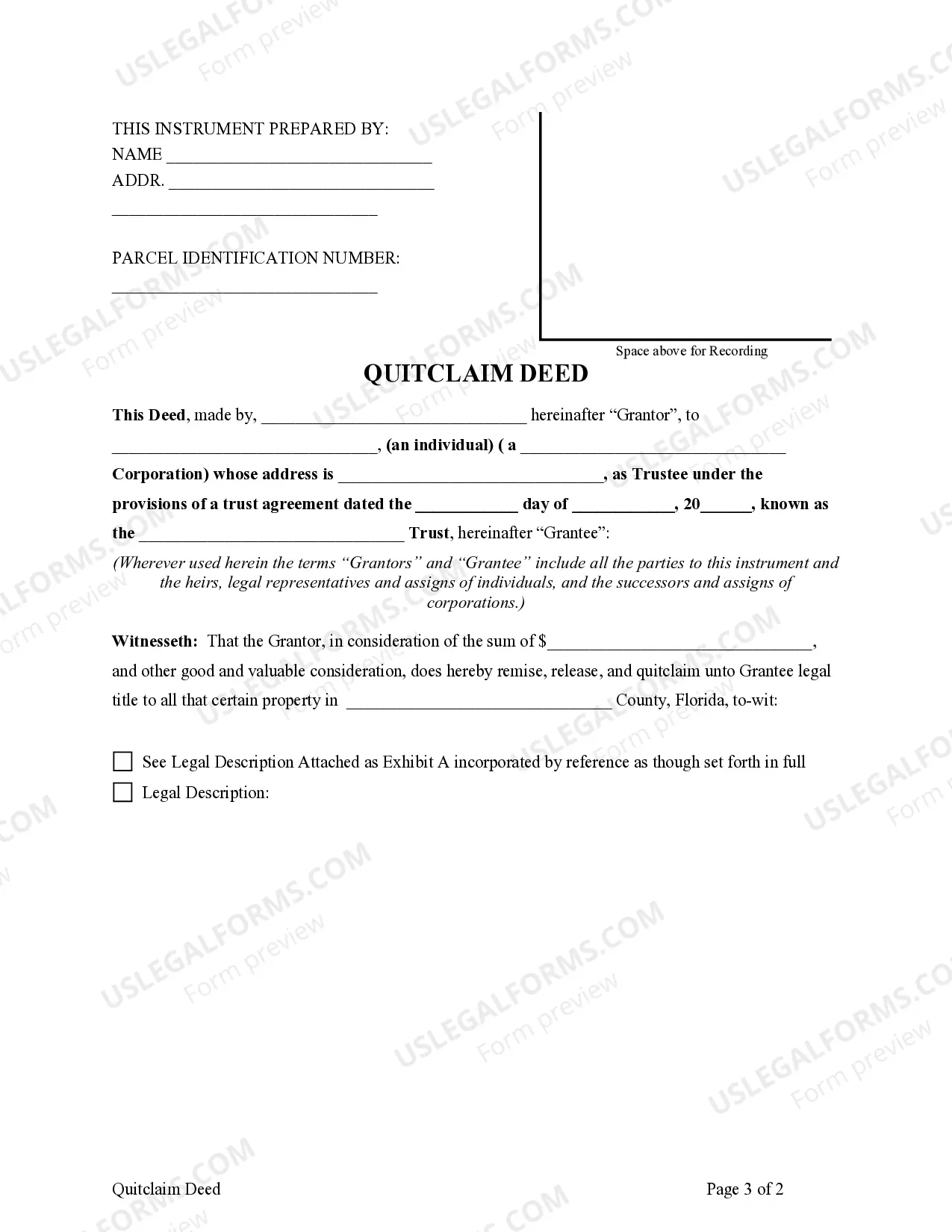

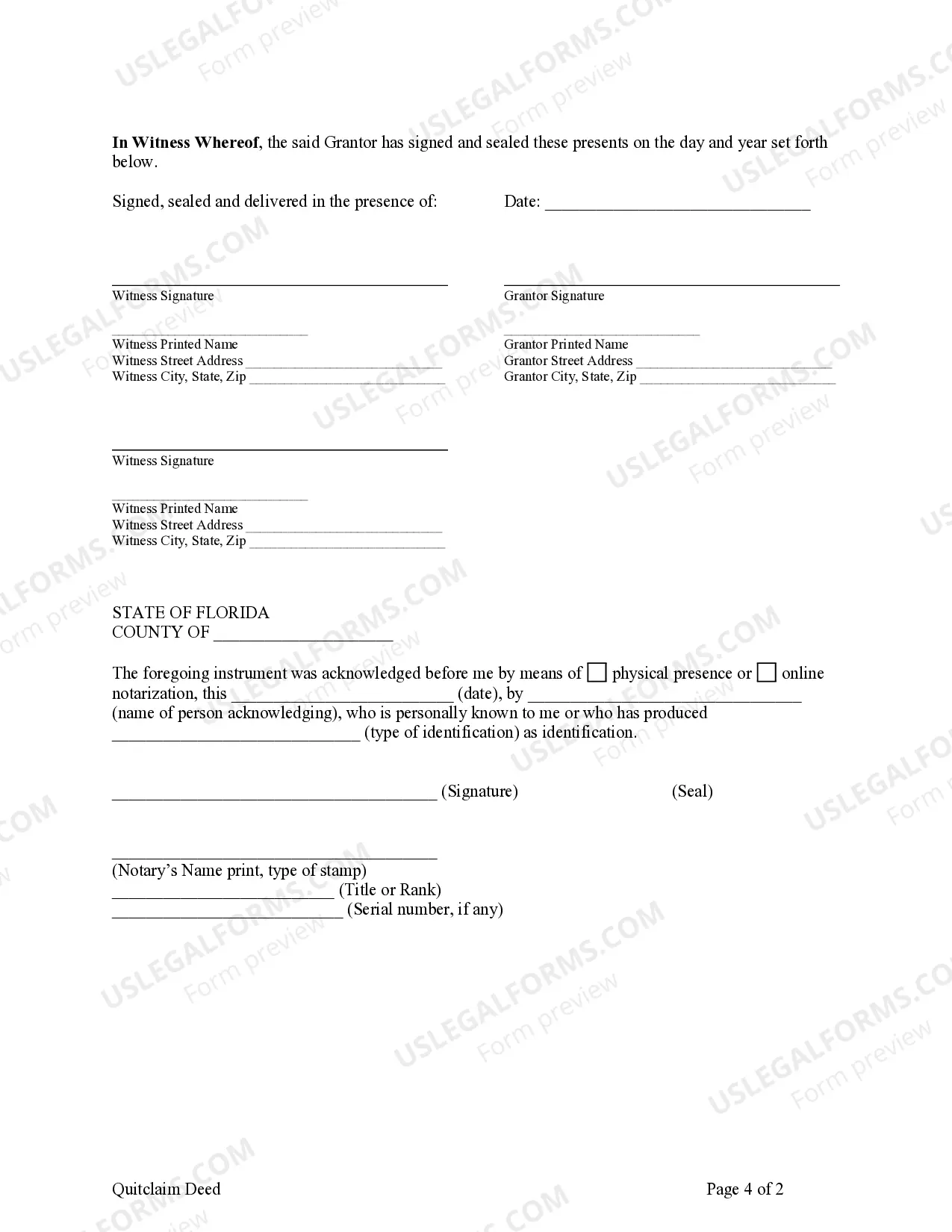

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

An Orange Florida Quitclaim Deed — Individual to a Trust is a legal document that transfers ownership of a property from an individual to a trust. This type of deed is commonly used when an individual wants to transfer their property into a trust to protect their assets and ensure the smooth transfer of ownership upon their passing. In Orange County, Florida, there are various types of Orange Florida Quitclaim Deeds — Individual to a Trust, tailored to different circumstances and intentions. Some key types of these deeds include: 1. Orange Florida Quitclaim Deed — Individual to Revocable Living Trust: This type of deed is used when an individual places their property into a revocable living trust, which allows them to have control over the property during their lifetime while ensuring it is smoothly transitioned to the beneficiaries named in the trust upon their death. 2. Orange Florida Quitclaim Deed — Individual to Irrevocable Trust: When an individual intends to transfer their property to an irrevocable trust, using this type of deed is necessary. Unlike a revocable living trust, an irrevocable trust cannot be changed or revoked once established, offering greater asset protection but limited control for the individual. 3. Orange Florida Quitclaim Deed — Individual to Special Needs Trust: This type of deed is used specifically when an individual wants to transfer their property to a special needs trust, which is designed to provide for the needs of a physically or mentally disabled person while keeping their eligibility for government assistance intact. 4. Orange Florida Quitclaim Deed — Individual to Land Trust: When an individual wishes to place their property in a land trust for investment or privacy purposes, this type of deed is suitable. It allows for the property to be managed by a trustee while keeping the owner's identity private. Regardless of the type of Orange Florida Quitclaim Deed — Individual to a Trust, it is crucial to consult with a qualified attorney or real estate professional to ensure the deed is drafted accurately, legally binding, and aligns with your specific needs and objectives.