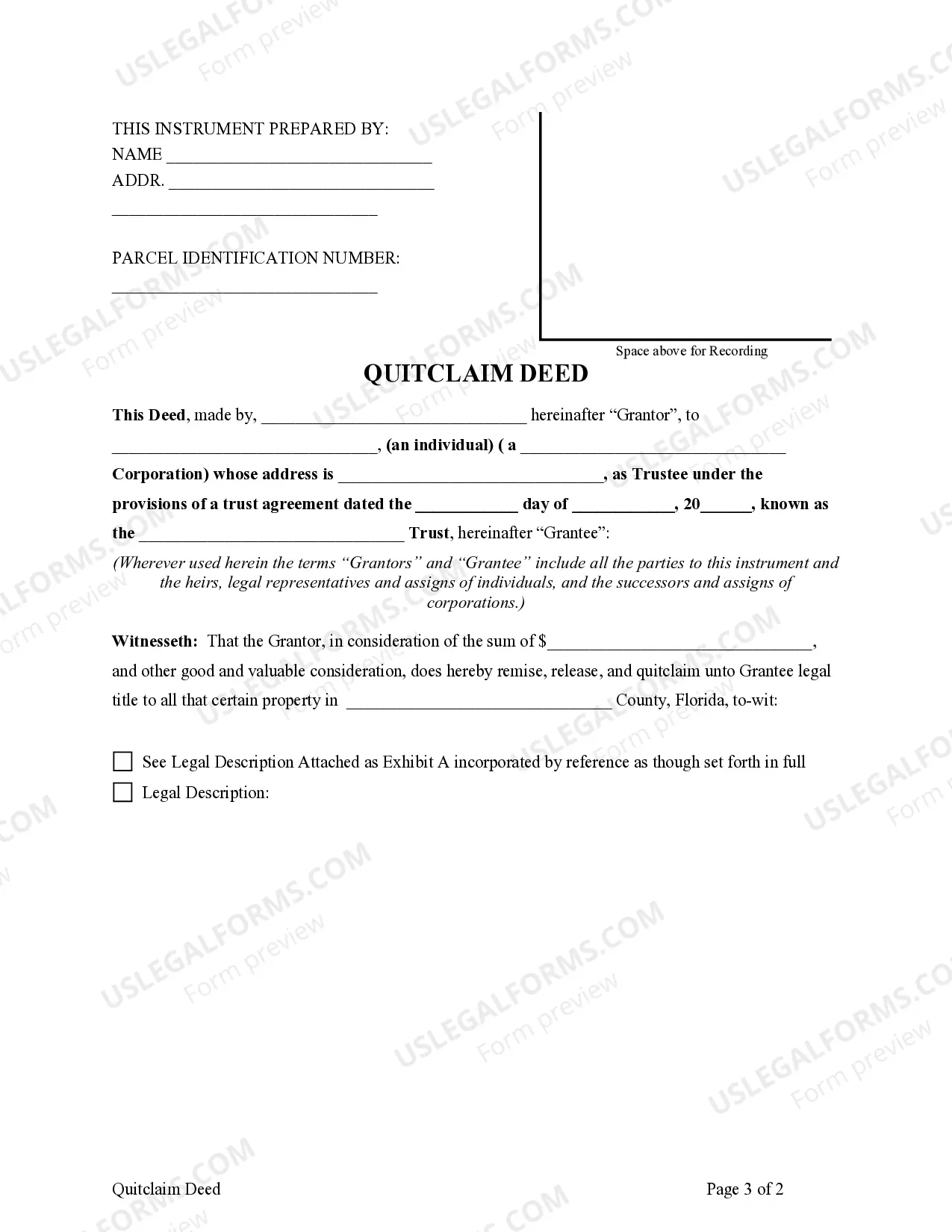

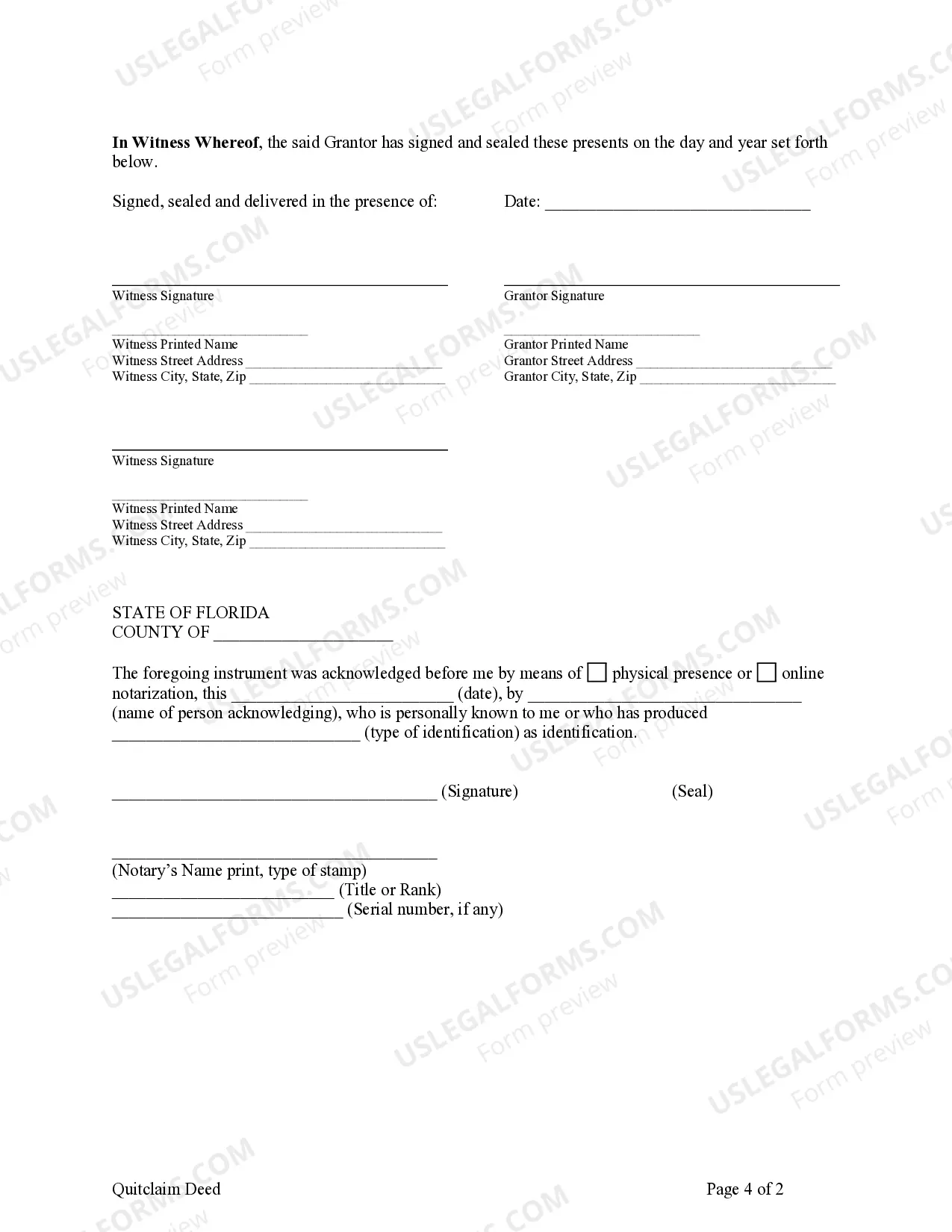

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Quitclaim Deed is a legal document used to transfer property ownership from one individual to another, effectively transferring their interest or title in the property. In the context of Palm Beach, Florida, a Quitclaim Deed can also be used to transfer property from an individual to a trust. This process allows the individual to place their property into a trust, which can have various benefits such as estate planning, asset protection, and efficient transfer of property upon the individual's passing. One type of Palm Beach, Florida Quitclaim Deed — Individual to a Trust is the "Revocable Living Trust Quitclaim Deed." This type of transfer allows the property owner to place their property into a revocable living trust while still maintaining control and ownership during their lifetime. The revocable living trust can be altered, modified, or revoked by the individual, providing flexibility and the ability to manage assets within the trust. This type of transfer is often used for estate planning purposes as it allows for a smooth transition of property ownership to the trust beneficiaries upon the individual's passing, avoiding probate and potential disputes. Another type of Palm Beach, Florida Quitclaim Deed — Individual to a Trust is the "Irrevocable Trust Quitclaim Deed." This transfer involves the individual relinquishing all ownership and control over the property, transferring it to an irrevocable trust. Unlike the revocable living trust, an irrevocable trust cannot be modified or revoked without the consent of the trust beneficiaries. This type of transfer is often used for advanced estate planning strategies, asset protection, and minimizing estate taxes. By placing the property into an irrevocable trust, the individual can protect it from potential creditors, preserve its value for future generations, and potentially reduce estate tax liabilities. When drafting a Palm Beach, Florida Quitclaim Deed — Individual to a Trust, it is essential to include the legal names of both the individual transferring the property and the trust. The deed should accurately describe the property being transferred, including the physical address, legal description, and any relevant parcel or lot numbers. Additionally, the deed should clearly state that the transfer is being made from the individual to the trust, citing the type of trust involved (e.g., revocable living trust or irrevocable trust). In conclusion, a Palm Beach, Florida Quitclaim Deed — Individual to a Trust refers to the process of transferring property ownership from an individual to a trust. The two main types of transfers are the Revocable Living Trust Quitclaim Deed, which allows for flexibility and control during the individual's lifetime, and the Irrevocable Trust Quitclaim Deed, which provides asset protection and advanced estate planning benefits. By utilizing a Quitclaim Deed, individuals in Palm Beach, Florida can effectively transfer their property to a trust while ensuring a seamless transition of ownership and potential benefits for their estate.