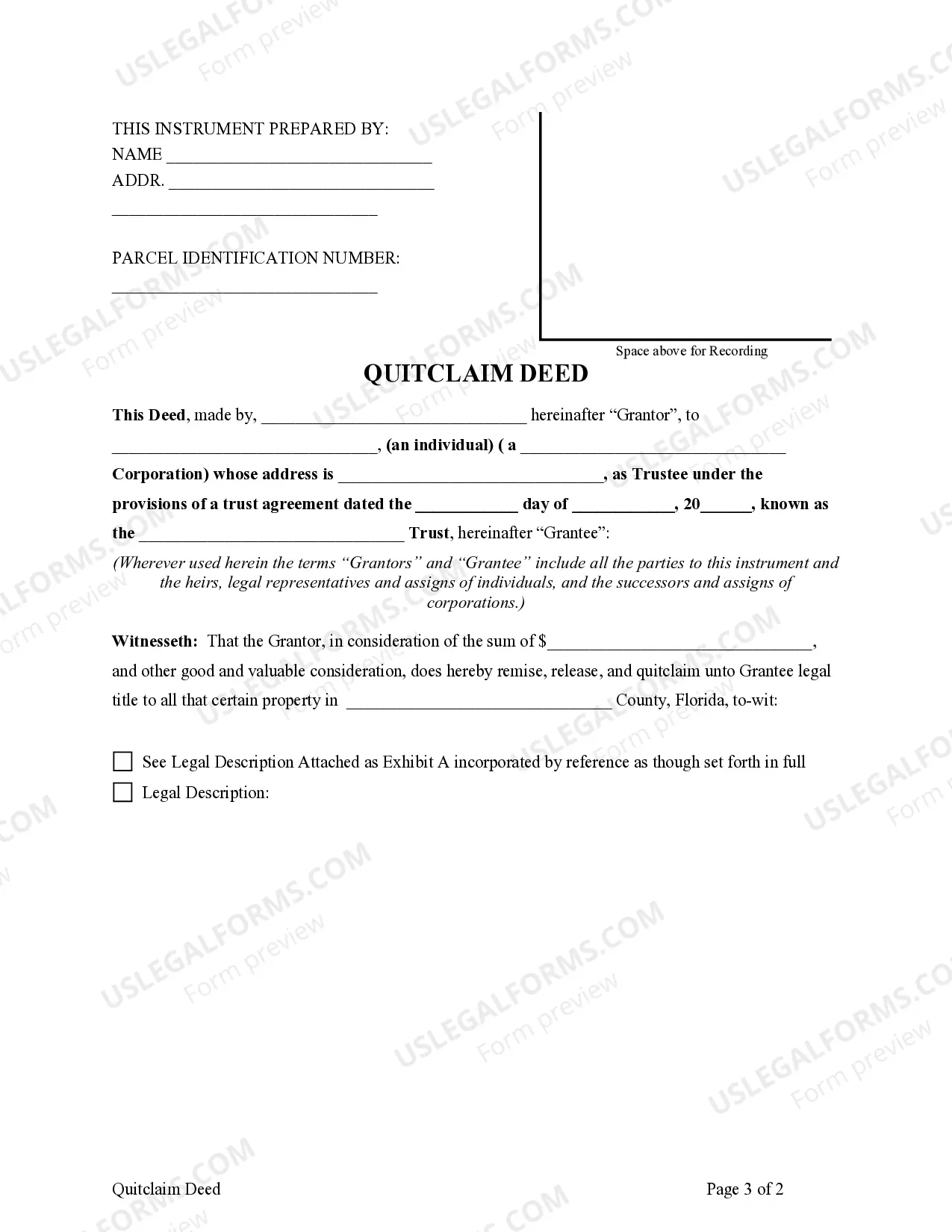

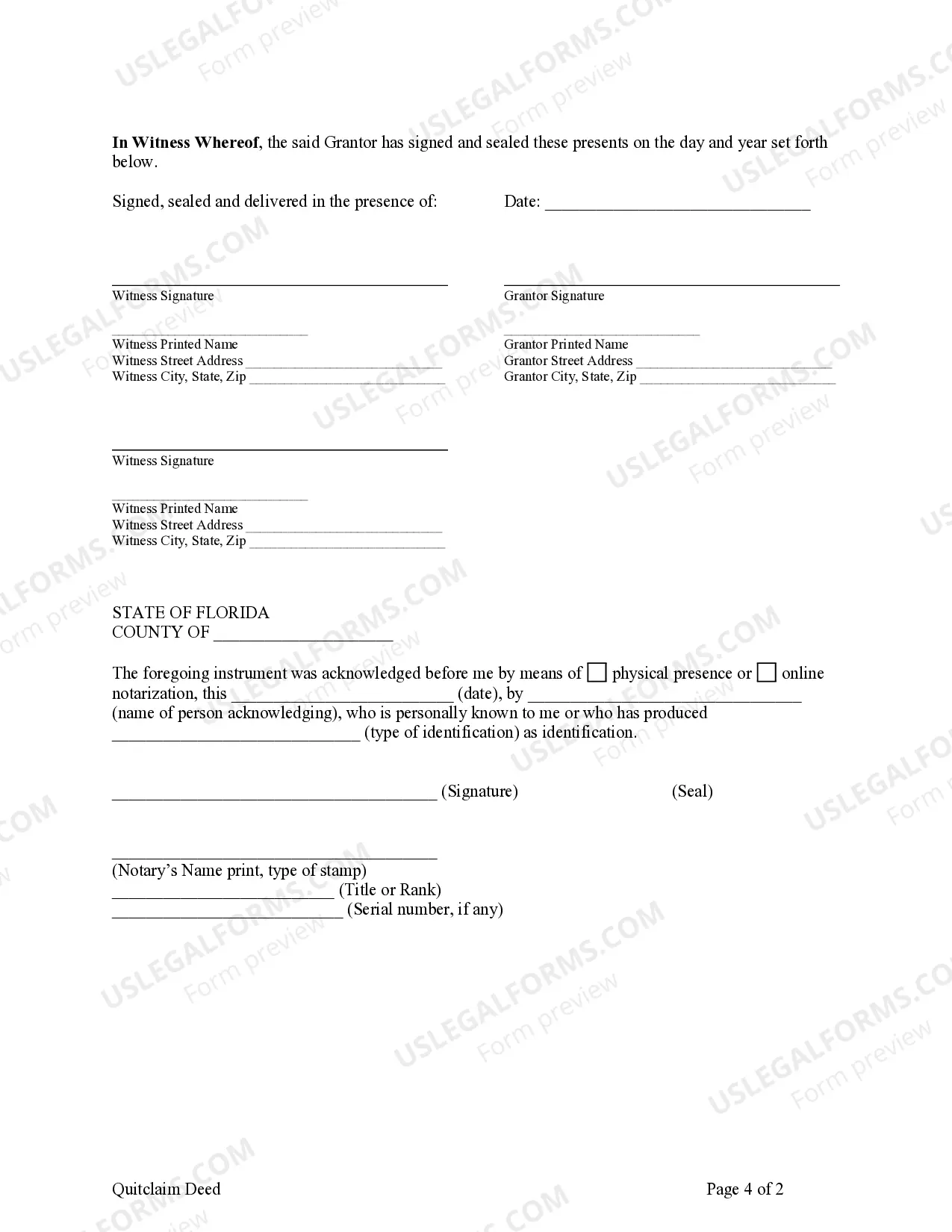

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Port St. Lucie Florida quitclaim deed, specifically an Individual to a Trust, is a legal document used to transfer ownership of property from an individual to a trust in Port St. Lucie, Florida. This type of deed is commonly used in estate planning and asset protection purposes. By transferring property to a trust, individuals can protect their assets, ensure their wishes are met, and facilitate smoother estate distribution. There are several types of Port St. Lucie Florida quitclaim deeds that can be used to transfer ownership from an individual to a trust. Some of these include: 1. Individual to Revocable Living Trust: This type of quitclaim deed is commonly used when an individual wants to transfer ownership of their property to a revocable living trust, which they maintain control over during their lifetime. The individual can revoke or change the terms of the trust as desired and can also serve as the trustee. 2. Individual to Irrevocable Trust: An irrevocable trust is one in which the individual transferring the property relinquishes control and ownership permanently. Once the property is transferred to an irrevocable trust, it cannot be revoked or changed by the individual. This type of transfer can be helpful for tax planning or asset protection purposes. 3. Individual to Family Trust: A family trust is established by an individual or couple to benefit their family members. It can be used to hold various types of assets, including real estate. By transferring property to a family trust, individuals can ensure that their heirs receive the intended benefits and protection while avoiding probate. 4. Individual to Charitable Trust: Sometimes individuals may choose to donate property to a charitable trust. This type of quitclaim deed enables the transfer to a trust that is specifically established for charitable purposes, allowing the donor to support a cause they are passionate about while potentially receiving tax benefits. 5. Individual to Special Needs Trust: A special needs trust is created to provide for the financial needs of an individual with special needs or disabilities. Transferring property through a quitclaim deed to a special needs trust is a way to ensure ongoing support and protection for the beneficiary. It is crucial to consult with a qualified attorney when considering a quitclaim deed transfer to a trust in Port St. Lucie, Florida. A legal professional can guide individuals through the process, explain the various trust options available, and help ensure that the transfer aligns with their specific goals and objectives.A Port St. Lucie Florida quitclaim deed, specifically an Individual to a Trust, is a legal document used to transfer ownership of property from an individual to a trust in Port St. Lucie, Florida. This type of deed is commonly used in estate planning and asset protection purposes. By transferring property to a trust, individuals can protect their assets, ensure their wishes are met, and facilitate smoother estate distribution. There are several types of Port St. Lucie Florida quitclaim deeds that can be used to transfer ownership from an individual to a trust. Some of these include: 1. Individual to Revocable Living Trust: This type of quitclaim deed is commonly used when an individual wants to transfer ownership of their property to a revocable living trust, which they maintain control over during their lifetime. The individual can revoke or change the terms of the trust as desired and can also serve as the trustee. 2. Individual to Irrevocable Trust: An irrevocable trust is one in which the individual transferring the property relinquishes control and ownership permanently. Once the property is transferred to an irrevocable trust, it cannot be revoked or changed by the individual. This type of transfer can be helpful for tax planning or asset protection purposes. 3. Individual to Family Trust: A family trust is established by an individual or couple to benefit their family members. It can be used to hold various types of assets, including real estate. By transferring property to a family trust, individuals can ensure that their heirs receive the intended benefits and protection while avoiding probate. 4. Individual to Charitable Trust: Sometimes individuals may choose to donate property to a charitable trust. This type of quitclaim deed enables the transfer to a trust that is specifically established for charitable purposes, allowing the donor to support a cause they are passionate about while potentially receiving tax benefits. 5. Individual to Special Needs Trust: A special needs trust is created to provide for the financial needs of an individual with special needs or disabilities. Transferring property through a quitclaim deed to a special needs trust is a way to ensure ongoing support and protection for the beneficiary. It is crucial to consult with a qualified attorney when considering a quitclaim deed transfer to a trust in Port St. Lucie, Florida. A legal professional can guide individuals through the process, explain the various trust options available, and help ensure that the transfer aligns with their specific goals and objectives.