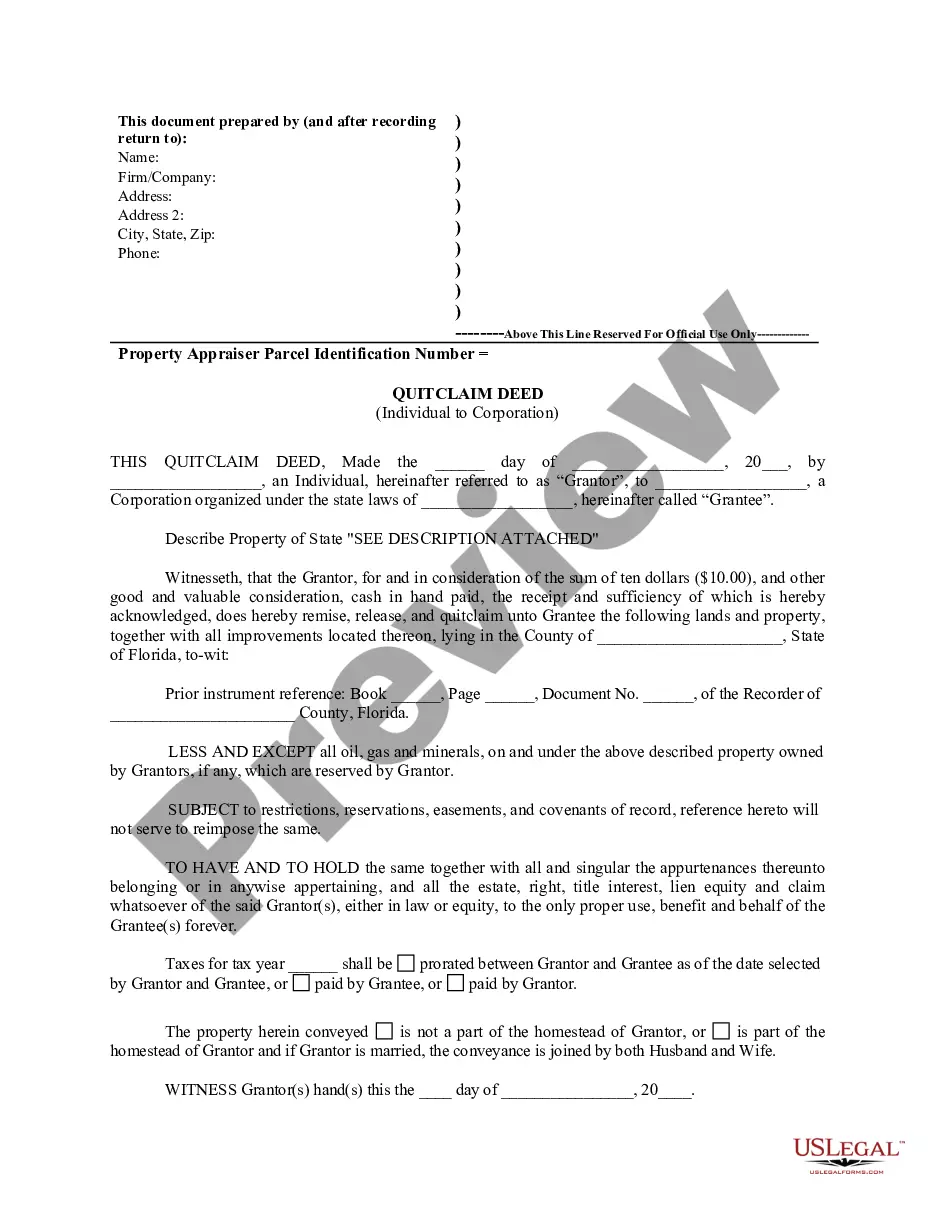

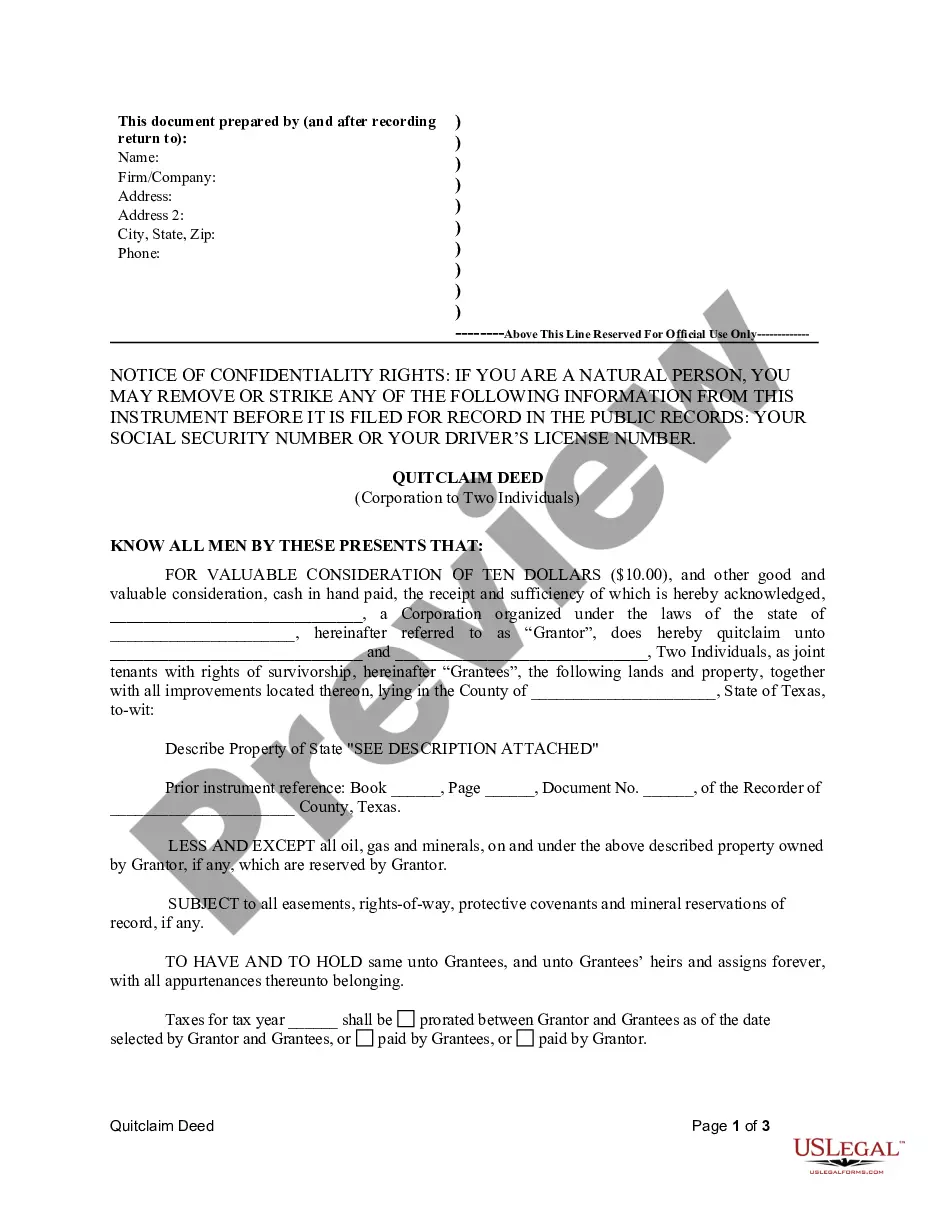

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

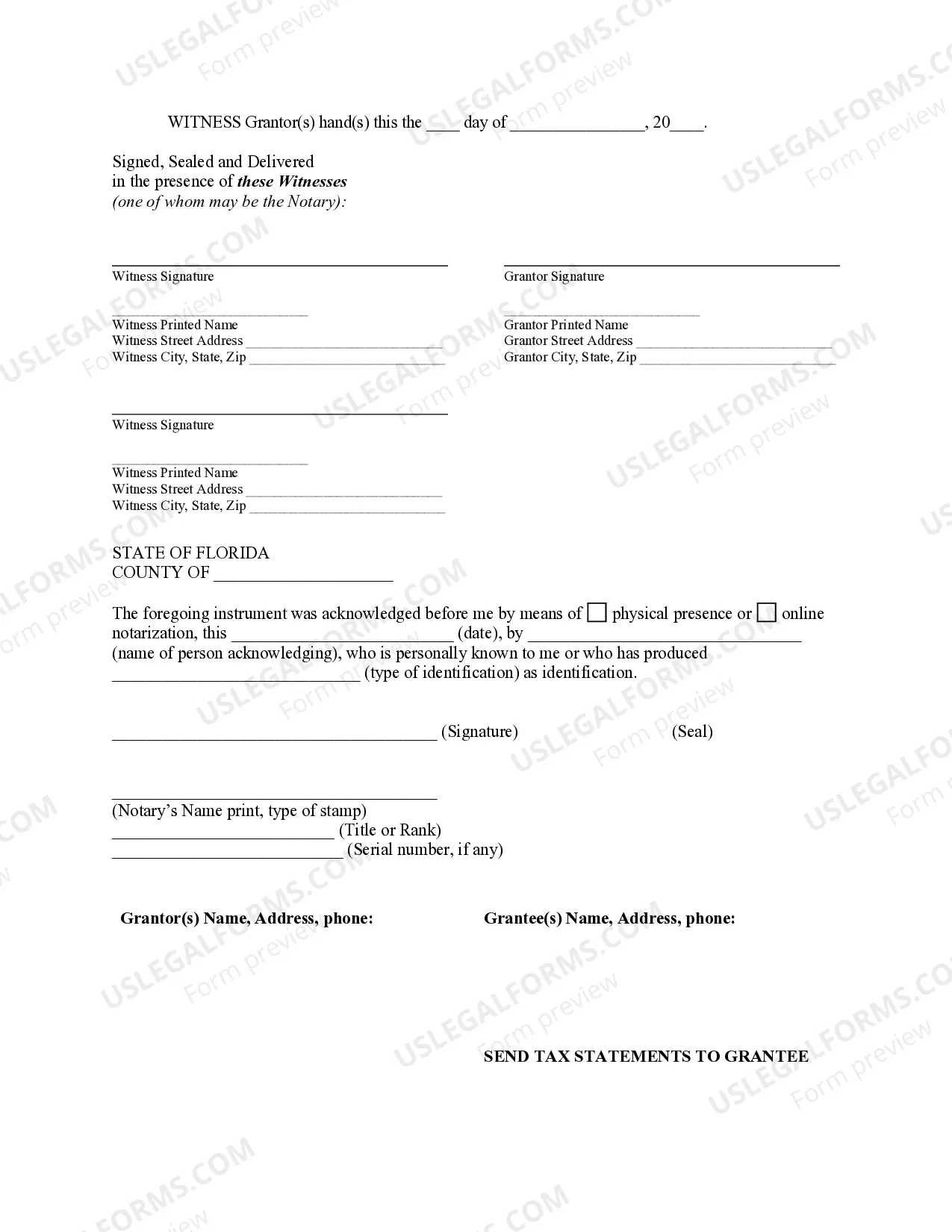

A Jacksonville Florida Quitclaim Deed from Individual to Corporation is a legal document used to transfer ownership of a property from an individual to a corporation. This type of deed is commonly used in real estate transactions where an individual property owner wants to transfer their property to a corporation, typically for business or tax purposes. The Jacksonville Florida Quitclaim Deed from Individual to Corporation includes relevant keywords such as quitclaim deed, individual, corporation, real estate, property, and Jacksonville Florida. The term "Quitclaim Deed" refers to a legal document used to transfer an individual's interest in a property to another party. "Individual" refers to the current property owner who wishes to transfer ownership. "Corporation" refers to the legal entity that will become the new owner of the property. "Real estate" and "property" are terms that describe the physical land or buildings involved in the transaction. "Jacksonville Florida" specifies the location where the deed is being executed and has jurisdiction. It is important to note that there may be different types or variations of a Jacksonville Florida Quitclaim Deed from Individual to Corporation. These may include variations based on the specific terms and conditions agreed upon by the individual and the corporation, or specific requirements set forth by the state of Florida. Some common types or variations may include: 1. Standard Quitclaim Deed from Individual to Corporation: This is the most common type of deed used to transfer ownership from an individual to a corporation. It typically includes basic information about the parties involved, a legal description of the property, and any relevant terms and conditions. 2. Special Warranty Quitclaim Deed from Individual to Corporation: This type of deed provides some limited warranty of title to the corporation by the individual. It guarantees that the individual has not done anything to impair the title of the property, but does not provide a full warranty against any defects. 3. Enhanced Life Estate Deed from Individual to Corporation: This type of deed allows an individual to transfer ownership to a corporation but retain a life estate in the property. This means that the individual can still live on or use the property during their lifetime, but ownership will ultimately transfer to the corporation upon their death. It is essential for individuals and corporations involved in a Jacksonville Florida Quitclaim Deed from Individual to Corporation to seek legal advice and ensure compliance with all relevant laws and regulations to protect their rights and interests in the property.