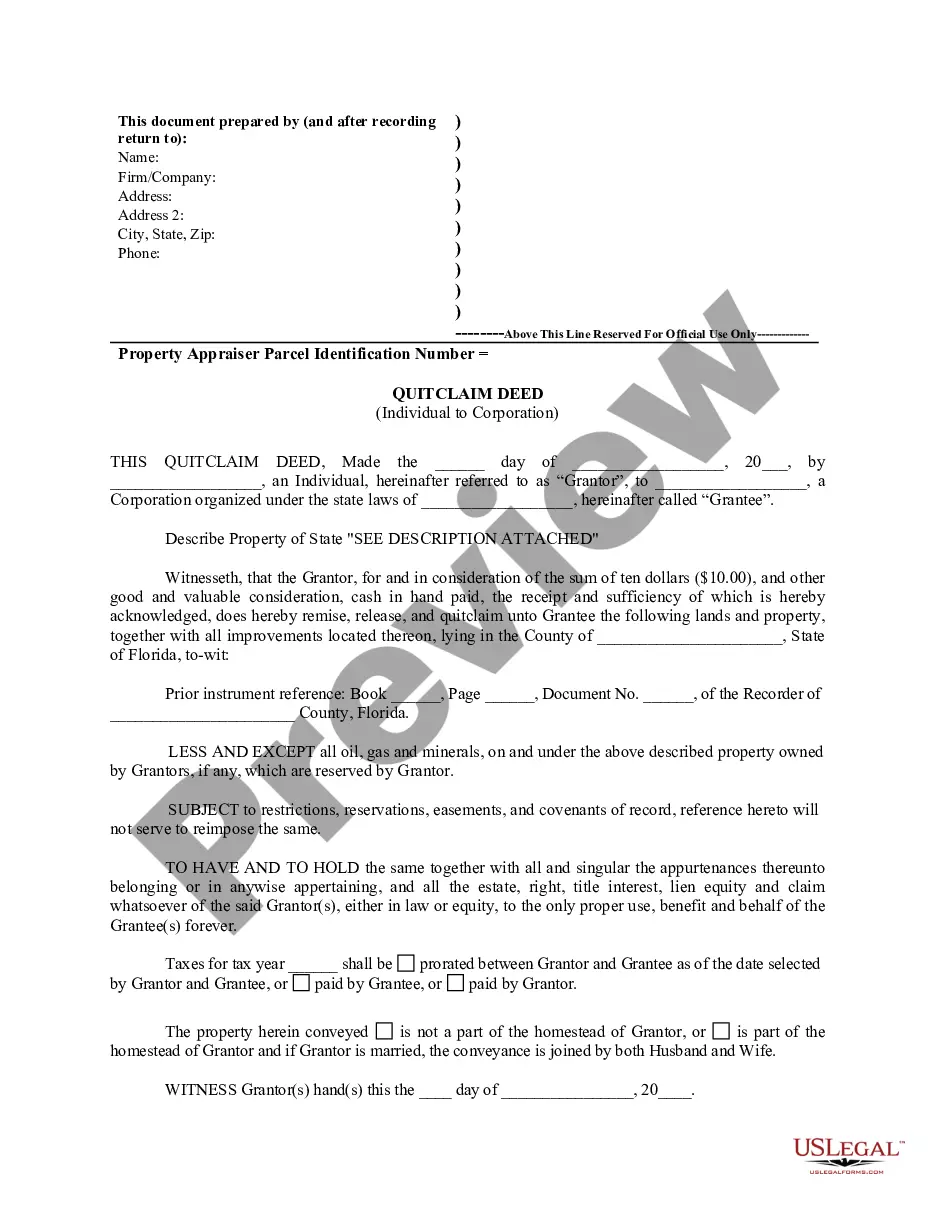

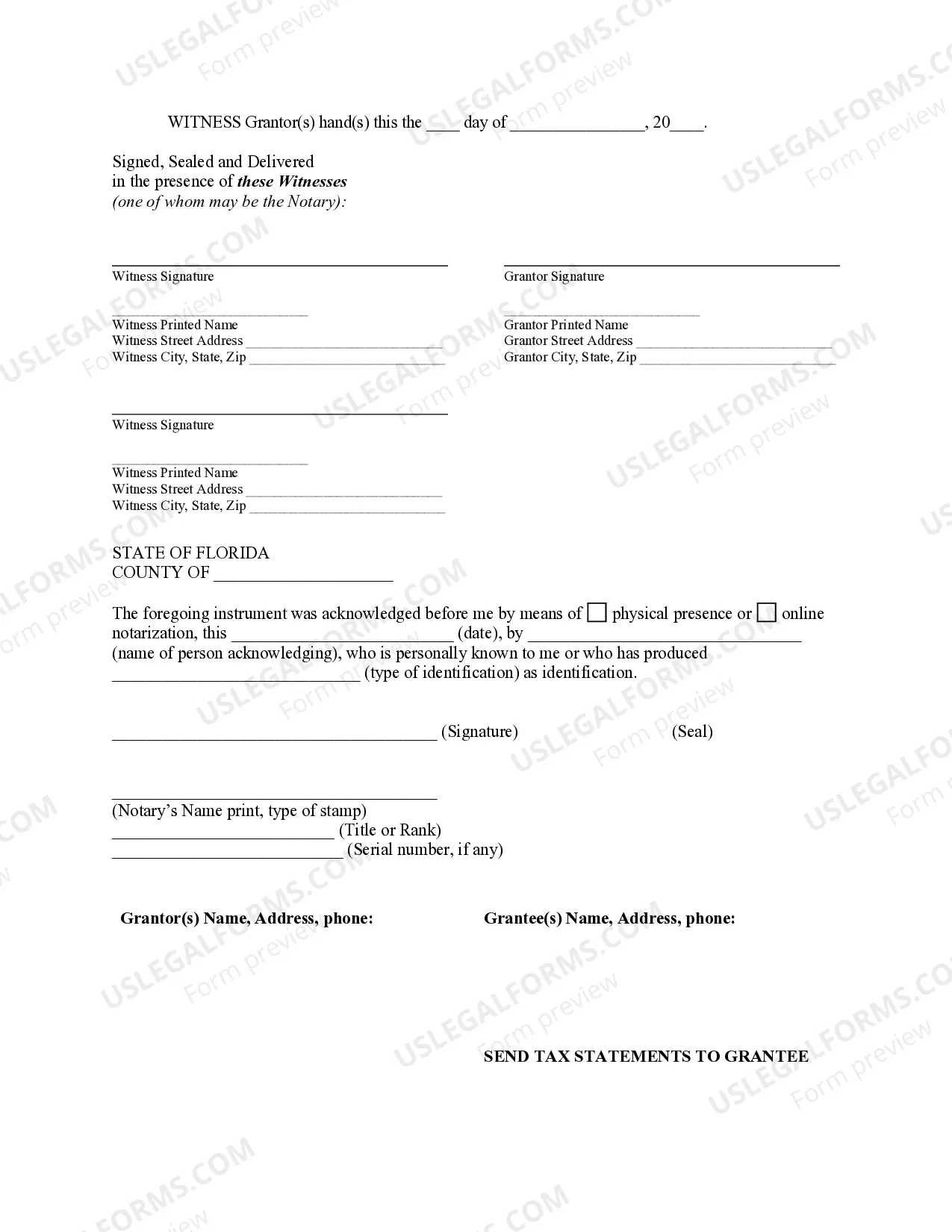

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Tampa Florida Quitclaim Deed from Individual to Corporation is a legal document used to transfer the ownership of a property from an individual to a corporation, using the quitclaim method. This type of deed is commonly used when a person wants to transfer their property to a corporation they are involved in or when restructuring property ownership for business purposes. The Quitclaim Deed is a form of conveyance that transfers any interest or claim the individual has on the property to the corporation. Unlike a warranty deed that guarantees the title's validity and the granter's ownership rights, a quitclaim deed only transfers the granter's interest/status in the property, without any warranties or guarantees. Therefore, it's essential for the corporation to conduct a thorough title search and examination before accepting the transfer. Whether you are a property owner looking to transfer your property to a corporation or a corporation seeking to acquire real estate, understanding the different types of Tampa Florida Quitclaim Deeds from Individuals to Corporations can help you navigate the process more effectively. Here are a few variations: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used to transfer ownership. It transfers the granter's entire interest in the property to the corporation. 2. Partial Quitclaim Deed: In some cases, a property owner may want to transfer only a portion of their interest in the property to the corporation. This type of deed specifies the portion being transferred and leaves the remaining interest with the individual granter. 3. Quitclaim Deed with Consideration: While quitclaim deeds typically don't involve a monetary exchange, there are instances where a corporation may offer compensation for the transfer. This type of deed includes the consideration amount or other assets involved in the transaction. 4. Quitclaim Deed with Restrictive Covenants: Sometimes, the individual granter may include certain restrictions or conditions in the deed, such as limitations on the property's use or future development plans for the corporation. These covenants become binding on the corporation upon accepting the transfer. 5. Corporate Resolution Quitclaim Deed: If the corporation's board of directors or other authorized decision-makers pass a resolution to acquire property, this type of deed specifies that the transfer is made pursuant to the corporate resolution. When executing a Tampa Florida Quitclaim Deed from Individual to Corporation, it's crucial to consult with a qualified real estate attorney to ensure proper preparation, execution, and recording of the deed. The deed should accurately describe the property, clearly identify the granter and grantee, provide the legal description of the property, and include any additional terms or conditions agreed upon by the parties involved. Remember, obtaining professional legal advice is crucial to protect the interests of both the individual granter and the acquiring corporation, ensuring that the transfer is done in compliance with Florida's real estate laws and regulations.