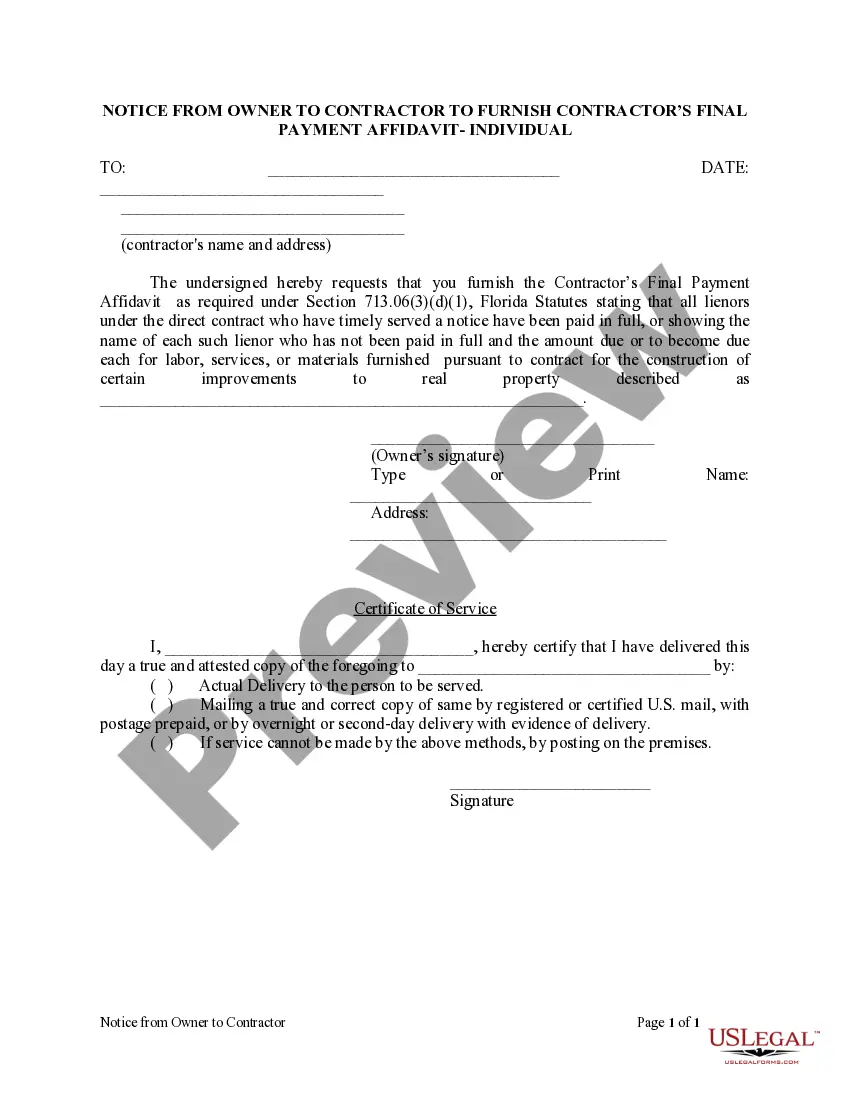

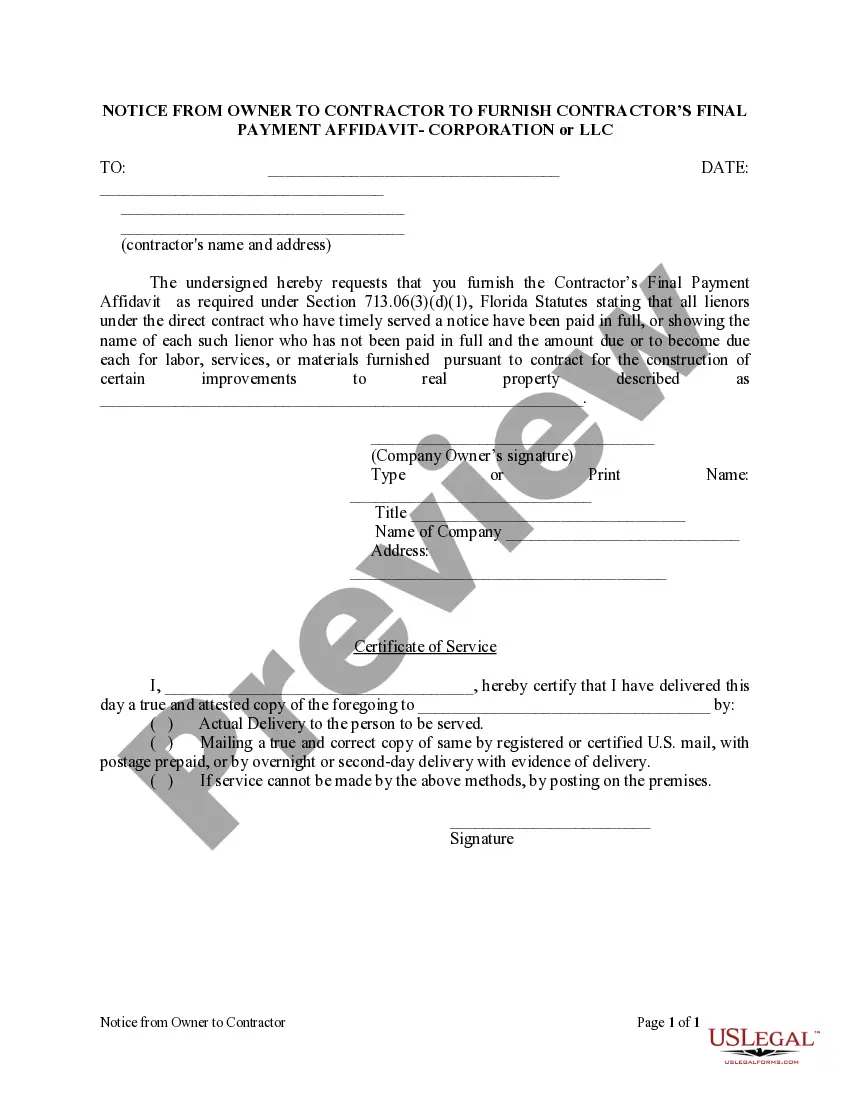

This form is a Quitclaim Deed where the Grantor is an individual and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantees. The Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals

Description

How to fill out Florida Quitclaim Deed For Condominium - Individual To Two Individuals?

If you are seeking an applicable form template, it’s hard to find a more user-friendly service than the US Legal Forms site – likely the most comprehensive libraries available online.

Here, you can discover a multitude of templates for business and personal uses categorized by type and state, or through keywords. Utilizing our top-notch search feature, acquiring the latest Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals is as simple as 1-2-3.

Additionally, the validity of each document is verified by a team of experienced attorneys who continuously review the templates on our platform and refresh them according to the most current state and county requirements.

Obtain the document. Select the file format and save it to your device.

Make modifications. Complete, alter, print, and sign the acquired Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals. Each form you add to your account does not expire and is yours eternally. You always have the option to access them via the My documents section, so if you require another copy for editing or producing a hard copy, you can return and download it again whenever you wish.

- If you already know about our service and possess an account, all you need to obtain the Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have located the template you need. Review its details and utilize the Preview feature to examine its content. If it doesn’t meet your requirements, use the Search bar near the top of the page to find the suitable document.

- Confirm your selection. Click the Buy now button. Then, select your desired subscription plan and enter your information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Yes, you can file a quitclaim deed yourself in Florida, including the Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals. Ensure that you understand the steps involved, from completing the deed to filing it at the county office. While filing independently is an option, you may want to use a platform like US Legal Forms for guidance and a streamlined experience. Their resources can help ensure that your deed is in compliance with local laws.

To transfer ownership of a condo in Florida, you typically use a quitclaim deed. Specifically, the Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals is an effective method for this transaction. You’ll need to gather necessary documentation, including the original deed and identification. It’s prudent to consult with a professional to guarantee that you follow all legal requirements.

A quitclaim deed can have multiple parties listed as grantors and grantees. In the context of the Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals, you can easily add one individual alongside another to share ownership. However, always confirm with legal counsel or local regulations to ensure compliance. Understanding your ownership structure is key to making informed decisions.

Filing a quitclaim deed in Palm Beach County, Florida, requires you to complete the appropriate form, which includes details about the property and both parties involved. After filling out the Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals, you need to sign it in front of a notary. Then, submit the completed deed to the Palm Beach County Clerk’s office. Ensuring that this deed is filed correctly is crucial for legal recognition of the property transfer.

You do not necessarily need a lawyer to complete a Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals. Many people successfully handle this process on their own, as it involves straightforward steps like filling out the form and having it notarized. However, consulting with a lawyer can provide peace of mind and ensure that all legal aspects are properly addressed. If you prefer a guided experience, platforms like US Legal Forms can assist you in navigating this process efficiently.

While you are not required to hire a lawyer to file a Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals, it can be beneficial. Legal expertise helps ensure the deed meets all state requirements and protects your interests. If you face complexities or have questions, consulting a professional can provide clarity. Uslegalforms offers an easy-to-use platform to guide you through the process, making it simpler for you.

People typically use a quitclaim deed to transfer property ownership without guaranteeing the title's validity. This method is often favored for transactions between family members or acquaintances because it is quick and straightforward. If you are considering a Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals, be aware of the implications of transferring properties in this way.

In Missouri, a quit claim deed must include the names of the grantor and grantee, a legal description of the property, and signatures of the parties involved. It's important to properly notarize the deed to ensure its validity. If you're moving to Florida, keep in mind that your Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals will need to satisfy the specific Florida requirements.

Yes, you can complete a quit claim deed yourself in Florida, but doing so requires careful attention to detail. You must ensure that all required information is accurate and that the document complies with state laws. For added convenience and assurance, consider using services like uslegalforms to accurately complete your Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals.

While it is not strictly necessary for both parties to be present during the execution of a quit claim deed, it is often beneficial. Having both individuals present simplifies the signing process and helps clarify any questions that may arise. For those utilizing a Palm Beach Florida Quitclaim Deed for Condominium - Individual to Two Individuals, mutual understanding can prevent future disputes.