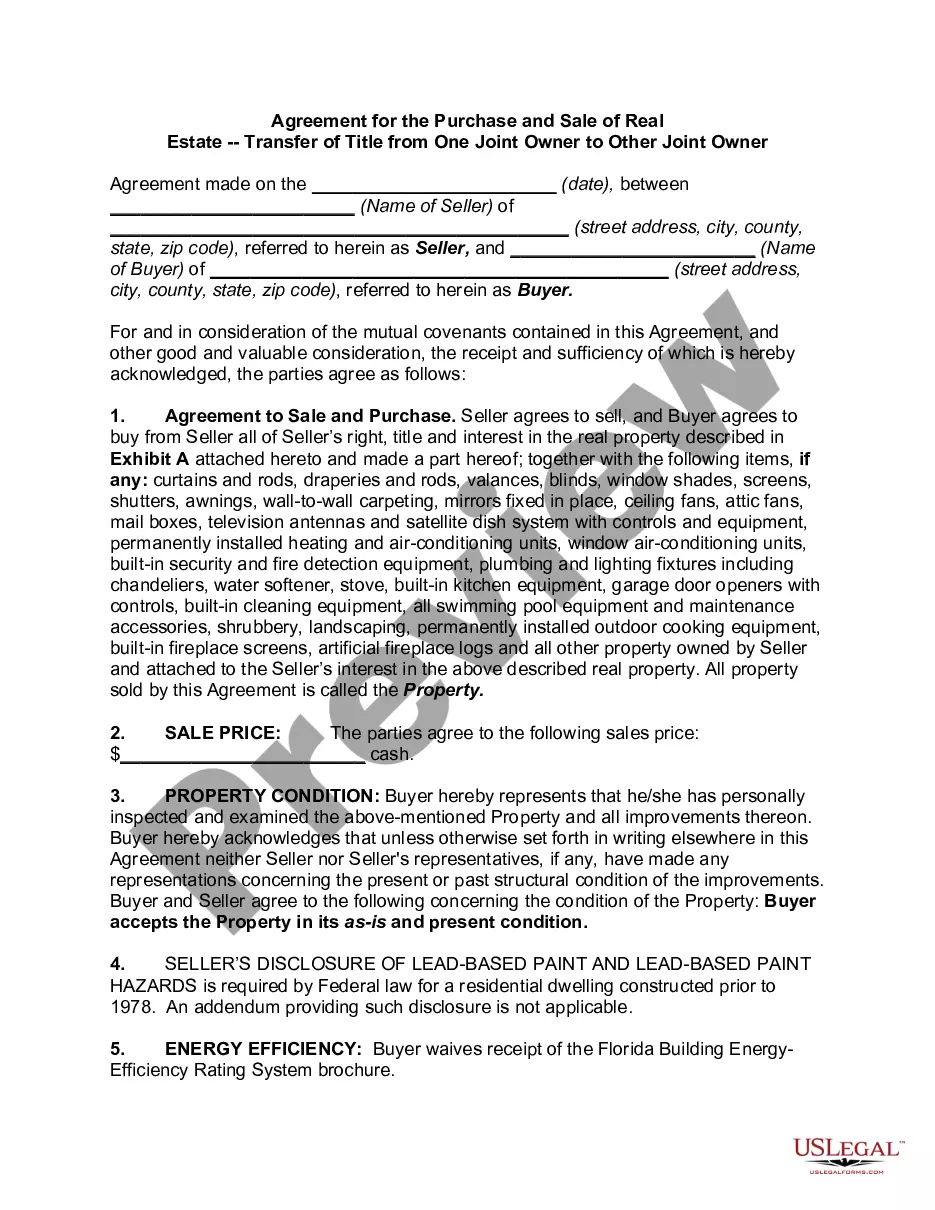

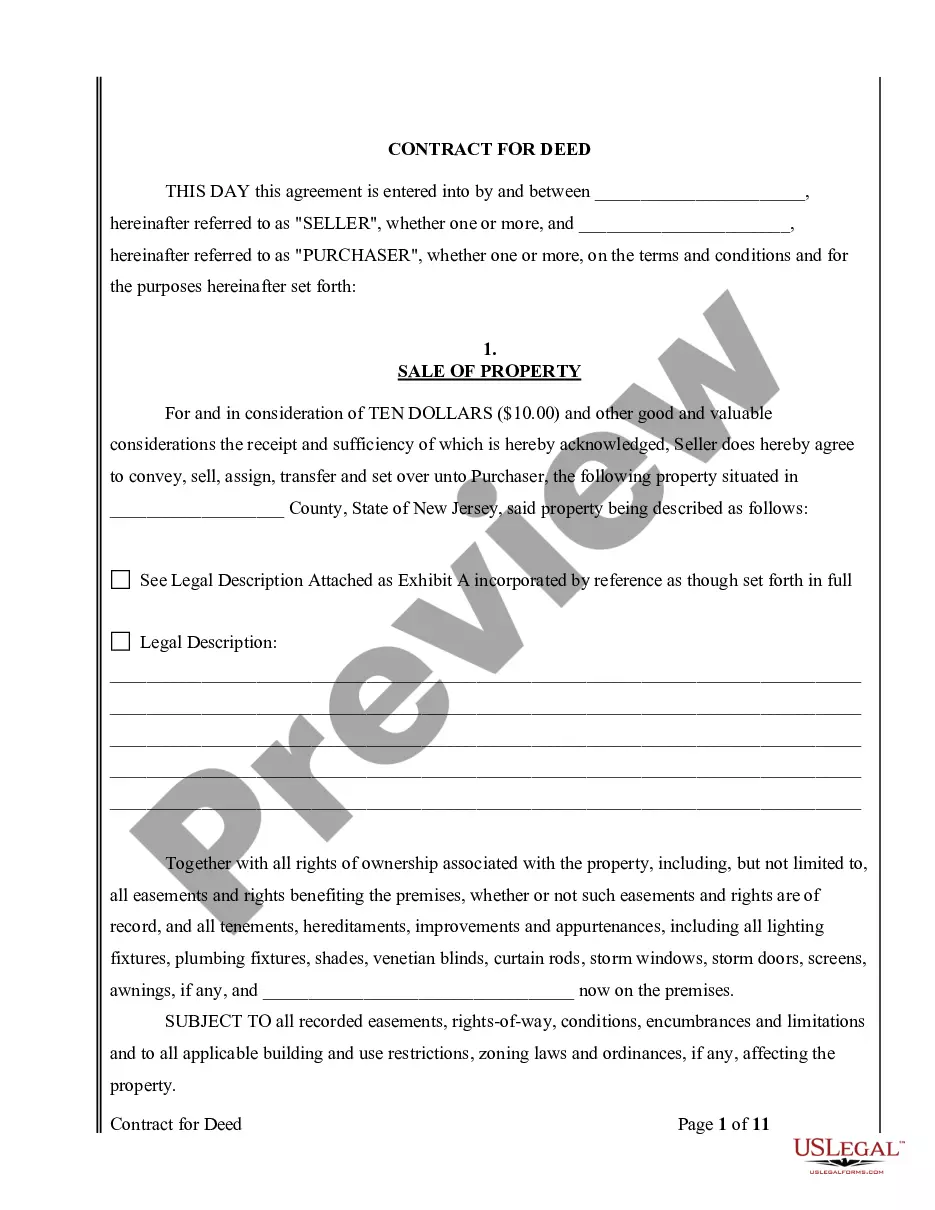

The Gainesville Florida Agreement for the Purchase and Sale of Real Estate Transfer of Title from One Joint Owner to Other Joint Owner is a legal document that outlines the terms and conditions for transferring ownership of a property from one joint owner to another. This agreement is commonly used in real estate transactions where co-owners wish to transfer their ownership interest to their fellow co-owner. The primary purpose of this agreement is to facilitate the smooth transfer of title and ensure that both parties involved are protected legally. It establishes the obligations, rights, and responsibilities of both the transferring joint owner (the "Transferor") and the receiving joint owner (the "Transferee"). Key terms and clauses included in this agreement typically cover: 1. Identification of Parties: The agreement identifies the Transferor and Transferee by their respective names, addresses, and ownership interest in the property. 2. Property Description: Clear and accurate description of the property being transferred, including its legal address, lot or parcel number, and any relevant land surveys. 3. Transfer Terms: The agreement specifies the terms under which the transfer will take place, including the agreed-upon purchase price or considerations for the transfer, any financing arrangements, and the method of payment. 4. Closing and Delivery of Title: The agreement outlines the closing date by which the Transferor will deliver the necessary documents to effect the transfer of title, such as a warranty deed or quitclaim deed. It also includes provisions for the delivery of keys, access to the property, and any existing leases or contracts associated with the property. 5. Representations and Warranties: Both parties typically provide certain representations and warranties regarding their ownership interest, the legality of the transfer, and the absence of any undisclosed liens or encumbrances. 6. Indemnification and Liability: The agreement includes provisions for indemnification, protecting both parties against any potential claims, liabilities, or disputes arising from the transfer. 7. Closing Costs: The agreement may address who will bear the costs associated with the transfer, such as recording fees, title insurance, and legal fees. It is worth noting that there may be different variations or types of agreements for the transfer of title from one joint owner to another, depending on specific circumstances or local legal requirements in Gainesville, Florida. Some potential variations include agreements for transfers involving residential properties, commercial properties, vacant land, or even agreements specific to certain types of joint ownership (e.g., joint tenancy or tenancy in common). These variations may have specific clauses or considerations unique to the particular type of property or joint ownership arrangement. In any real estate transaction, it is essential for both parties to consult legal professionals experienced in Gainesville, Florida real estate law to ensure compliance with local regulations and to protect their rights and interests.

Gainesville Florida Agreement for the Purchase and Sale of Real Estate Transfer of Title from One Joint Owner to Other Joint Owner

Description

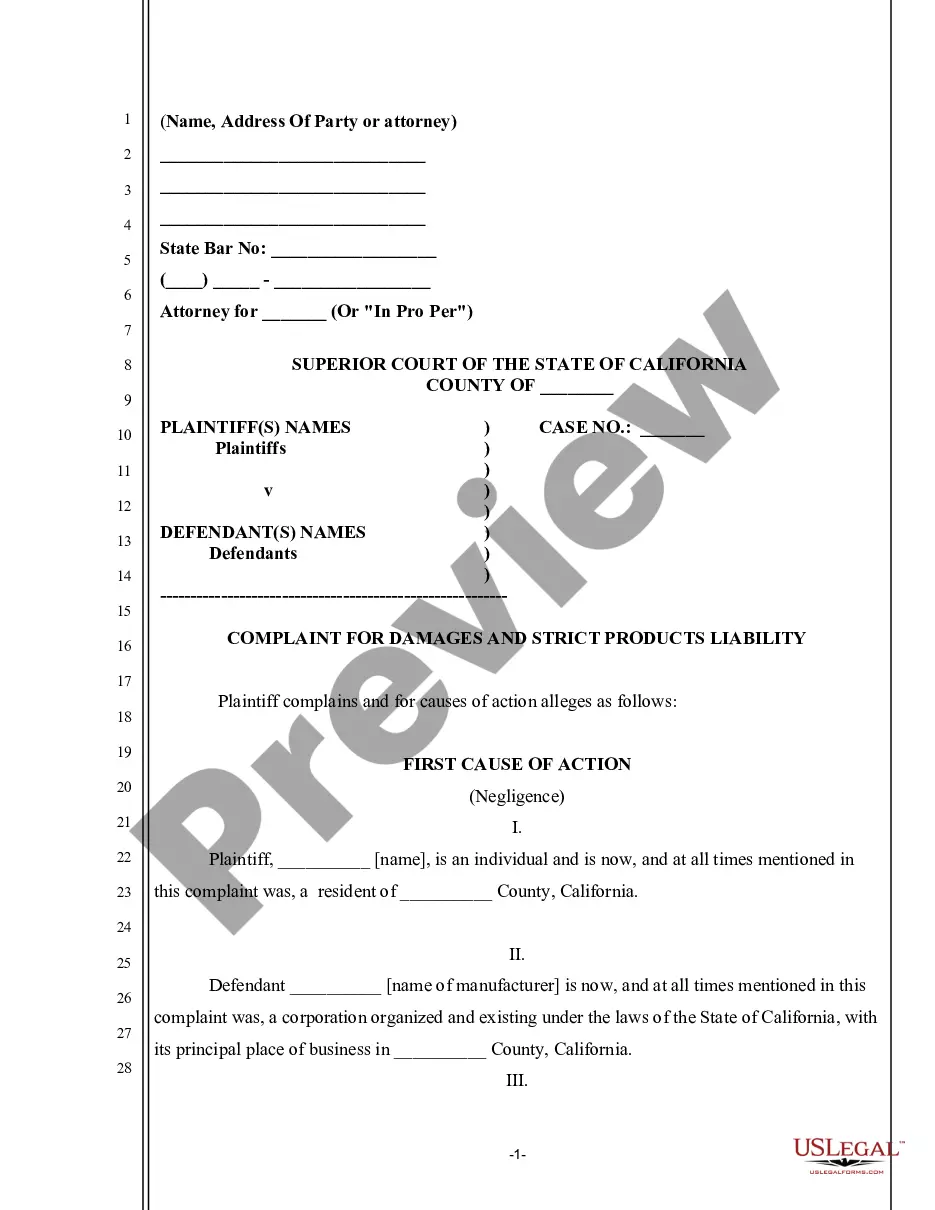

How to fill out Gainesville Florida Agreement For The Purchase And Sale Of Real Estate Transfer Of Title From One Joint Owner To Other Joint Owner?

If you’ve previously utilized our service, Log In to your account and save the Gainesville Florida Agreement for the Purchase and Sale of Real Estate Transfer of Title from One Joint Owner to Another Joint Owner on your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your file.

You have continuous access to every document you have acquired: you can find it in your profile under the My documents menu whenever you need to use it again. Make use of the US Legal Forms service to quickly find and save any template for your personal or professional requirements!

- Confirm you’ve found the correct document. Review the description and utilize the Preview feature, if available, to verify if it satisfies your needs. If it’s not suitable, utilize the Search tab above to locate the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Gainesville Florida Agreement for the Purchase and Sale of Real Estate Transfer of Title from One Joint Owner to Another Joint Owner. Choose the file format for your document and save it to your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A person filing a deed for transfer of Florida real estate ownership must do so through the county comptroller's office where the property is located. There is a small fee for filing and a document stamp tax, which is an excise tax on legal documents delivered, executed or recorded in the state.

70 per $100 (or portion thereof) on documents that transfer interest in Florida real property, such as warranty deeds and quit claim deeds. This tax is based on the sale, consideration or transfer amount and is usually paid to the Clerk of Court when the document is recorded.

A new deed must be filed with the local clerk of court's office in order to change the name on a Florida deed, no matter the circumstances leading to the change. Marriages and divorces are some of the most common reasons to alter a deed in Florida. A death in the family may also necessitate a name change to a deed.

A partition action is commenced to force the sale of jointly-owned property, often real estate. Under Florida law, a co-owner of real property may file a lawsuit against the other co-owners of the property when they cannot agree on how to continue their joint ownership of the property.

A person filing a deed for transfer of Florida real estate ownership must do so through the county comptroller's office where the property is located. There is a small fee for filing and a document stamp tax, which is an excise tax on legal documents delivered, executed or recorded in the state.

Yes! In most cases, ANY co-owner (even a minority owner) can force a sale of the property regardless of whether the other owners want to sell or not.

Involve a judge. If you can't find a workaround that suits both parties, you do have the option to turn to a judge to compel a sale of the home. Once a judge orders a home to sell, you will need to bring in a real estate agent to sell the home, even if one party isn't happy about it.

A person can file a quitclaim deed by (1) entering the relevant information on a quitclaim deed form, (2) signing the deed with two witnesses and a notary, and (3) recording the deed at the county comptroller's office. In Florida, quitclaim deeds must have the name and address of both the grantor and the grantee.

Unless you and your spouse agree to deal with the home in another way, they can apply to Court for an order for sale. Such an order would not ordinarily be made until a final hearing.