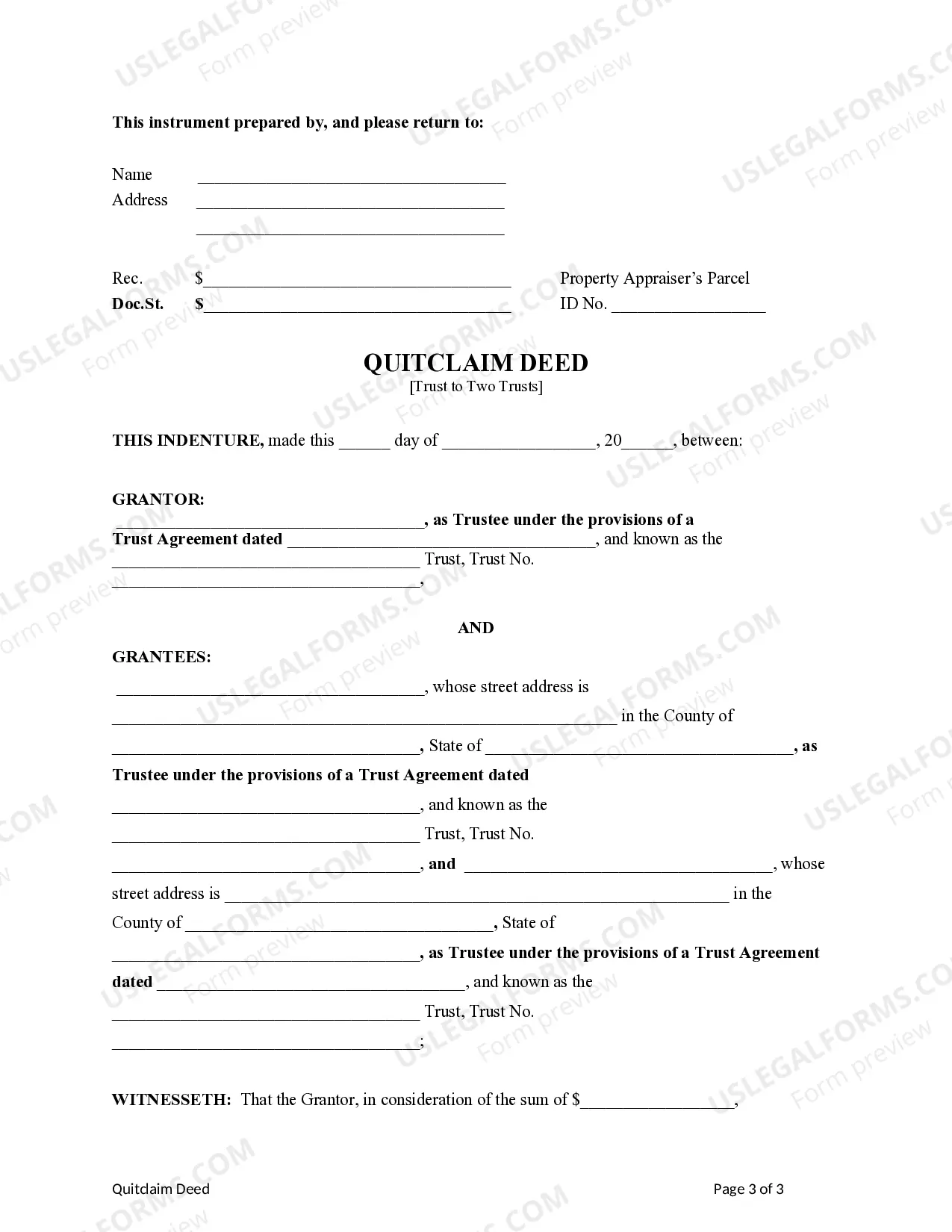

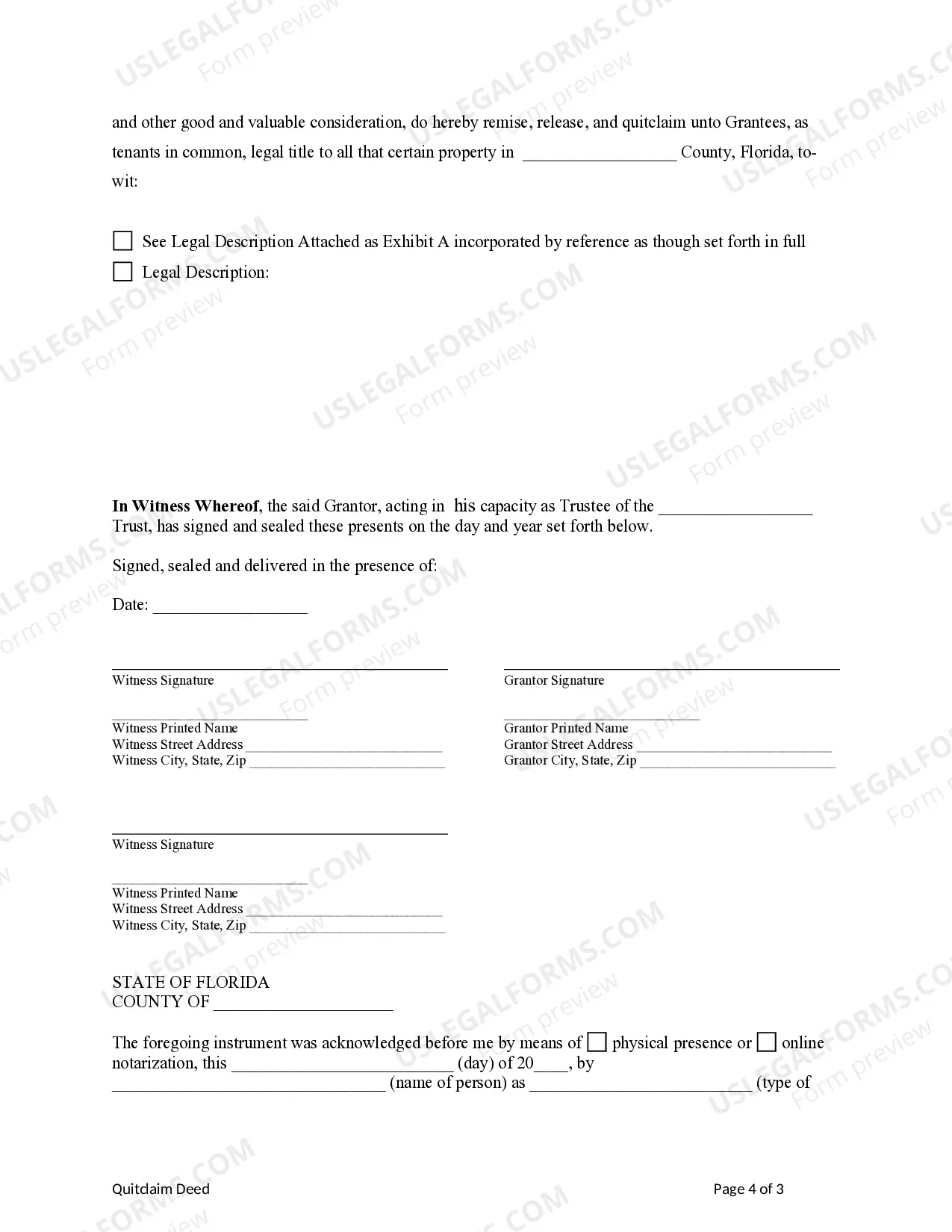

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are two Trusts. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

A Tallahassee Florida Quitclaim Deed is a legal document used to transfer ownership of real estate property within the city of Tallahassee. This deed allows the current owner, known as the granter, to relinquish their legal rights and interests in the property to the recipient, known as the grantee, without making any guarantees or warranties about the property's title history. When executing a Tallahassee Florida Quitclaim Deed, it is crucial to understand that this type of deed offers no guarantee that the title is free from any liens, encumbrances, or defects. Essentially, the granter is transferring whatever ownership interest they hold in the property at the time of the deed's execution, whether it is fee simple absolute or a lesser interest. Different types of Tallahassee Florida Quitclaim Deeds may include: 1. Individual-to-Individual Quitclaim Deed: This is the most common type of quitclaim deed used in Tallahassee, where an individual property owner transfers their interest in the property to another individual, such as a family member, friend, or buyer. 2. Company-to-Individual Quitclaim Deed: This type of quitclaim deed is used when a company or corporation transfers ownership of a property to an individual. It might occur during a real estate transaction or as part of a corporate restructuring process. 3. Individual-to-Trust Quitclaim Deed: This quitclaim deed is employed when an individual owner transfers their interest in the property to a trust. The property becomes an asset of the trust, managed according to its terms, and ultimately benefiting the trust's beneficiaries. 4. Individual-to-LLC Quitclaim Deed: This type of quitclaim deed is used when an individual owner transfers their interest in the property to a Limited Liability Company (LLC) that they control or are a part of. This can provide liability protection and allow for easier management of the property. It is crucial for both the granter and grantee to fully understand the implications of executing a Tallahassee Florida Quitclaim Deed, including potential title issues or any unresolved disputes regarding the property. Consulting with a qualified real estate attorney is highly recommended ensuring a smooth transfer of ownership and to navigate any potential legal complexities.