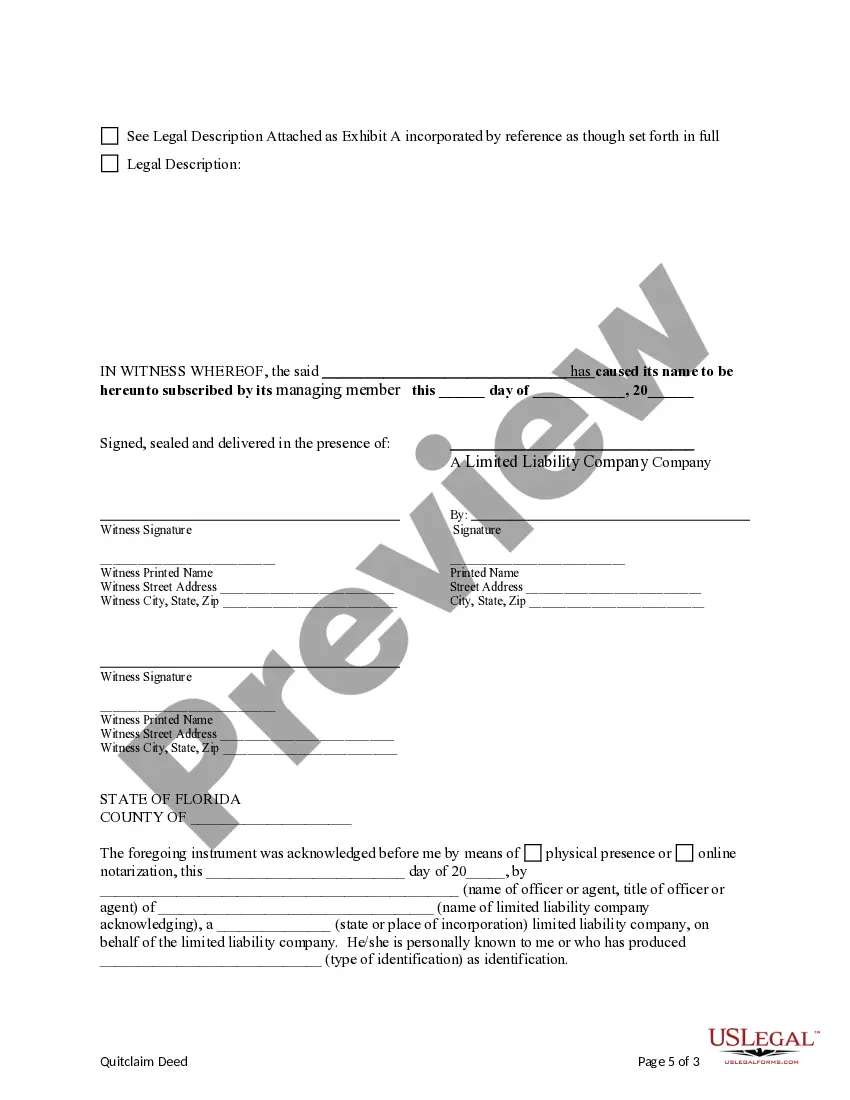

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantees are three individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

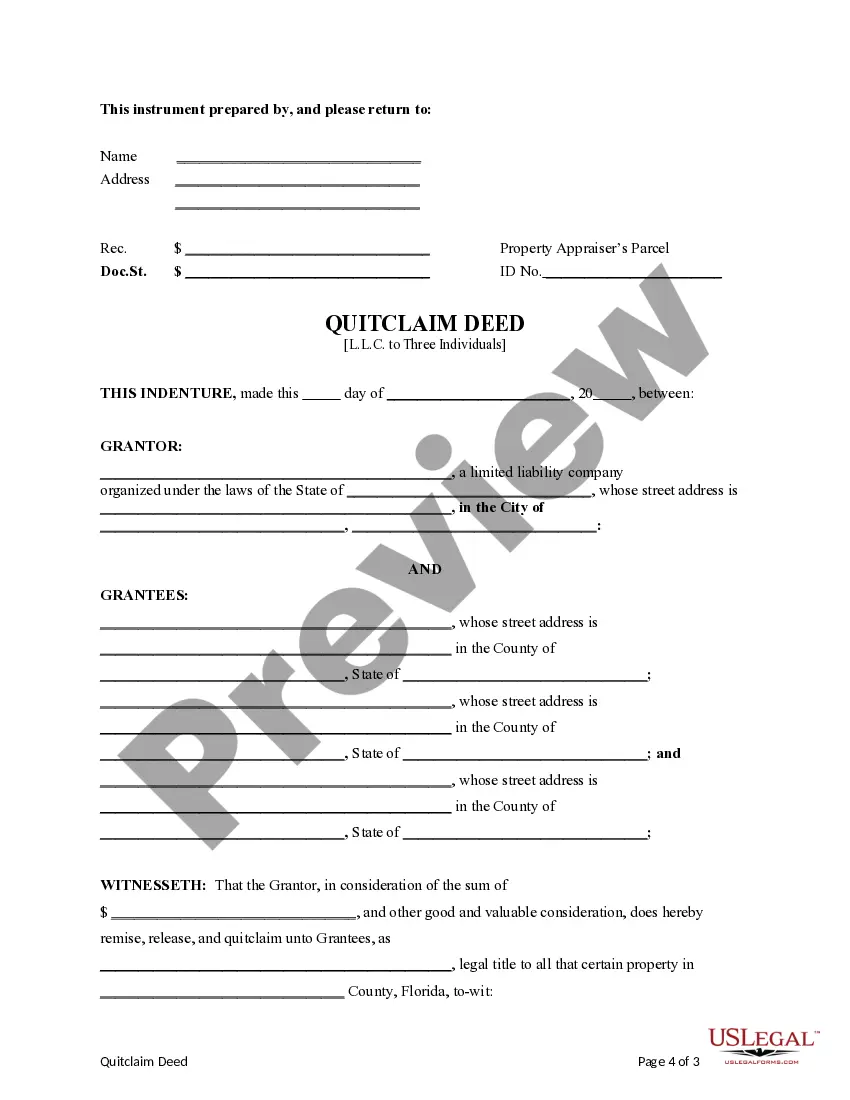

Title: Understanding the Tallahassee Florida Quitclaim Deed from a Limited Liability Company to Three Individuals Introduction: In Tallahassee, Florida, a quitclaim deed is a legal document that allows a Limited Liability Company (LLC) to transfer property rights to three individuals. This article will provide a detailed description of the Tallahassee Florida quitclaim deed from an LLC to three individuals, including its purpose, key components, and potential variations. 1. Purpose: The Tallahassee Florida quitclaim deed from a limited liability company to three individuals serves as a means for the LLC to transfer ownership of a property to three specific individuals. It relinquishes any interest or claim the LLC holds over the property, providing a clear title to the new owners. 2. Key Components: i. Parties Involved: The quitclaim deed will identify the LLC as the granter and the three individuals as the grantees. ii. Property Description: The deed will provide an accurate and detailed description of the property being transferred. iii. Consideration: The quitclaim deed may mention the consideration or compensation exchanged between the parties, although in many cases, this may be nominal or non-existent. iv. Legal Language: The document will contain specific legal language to ensure the transfer is binding and complies with Florida state laws. v. Signatures and Notarization: The deed must be signed by authorized representatives of the LLC, the three individuals, and often requires notarization for validity. 3. Types of Tallahassee Florida Quitclaim Deed from an LLC to Three Individuals: While the essence of a Tallahassee Florida quitclaim deed remains consistent, there may be certain variations depending on specific circumstances, such as: i. Individual or Multiple Properties: The quitclaim deed may involve the transfer of a single property or multiple properties from the LLC to the three individuals. ii. Ownership Percentage: The LLC may distribute property ownership unevenly among the three individuals, mentioning their respective ownership percentages. iii. Consideration Clause: In certain cases, the deed may explicitly state the consideration exchanged, such as the purchase price or the LLC's liabilities assumed by the three individuals. iv. Contingencies: The deed may include additional clauses or contingencies, such as provisions regarding easements, restrictions, or any existing liens. Conclusion: The Tallahassee Florida quitclaim deed from a Limited Liability Company to three individuals serves as a valuable legal document for property transfers. It allows LCS to transfer ownership to specific individuals, providing transparency and clarity in property ownership. Understanding the purpose and key components of this deed is essential for both the LLC and the individuals involved in the transfer. Remember, consulting a legal professional is highly recommended ensuring compliance with Tallahassee and Florida state laws.