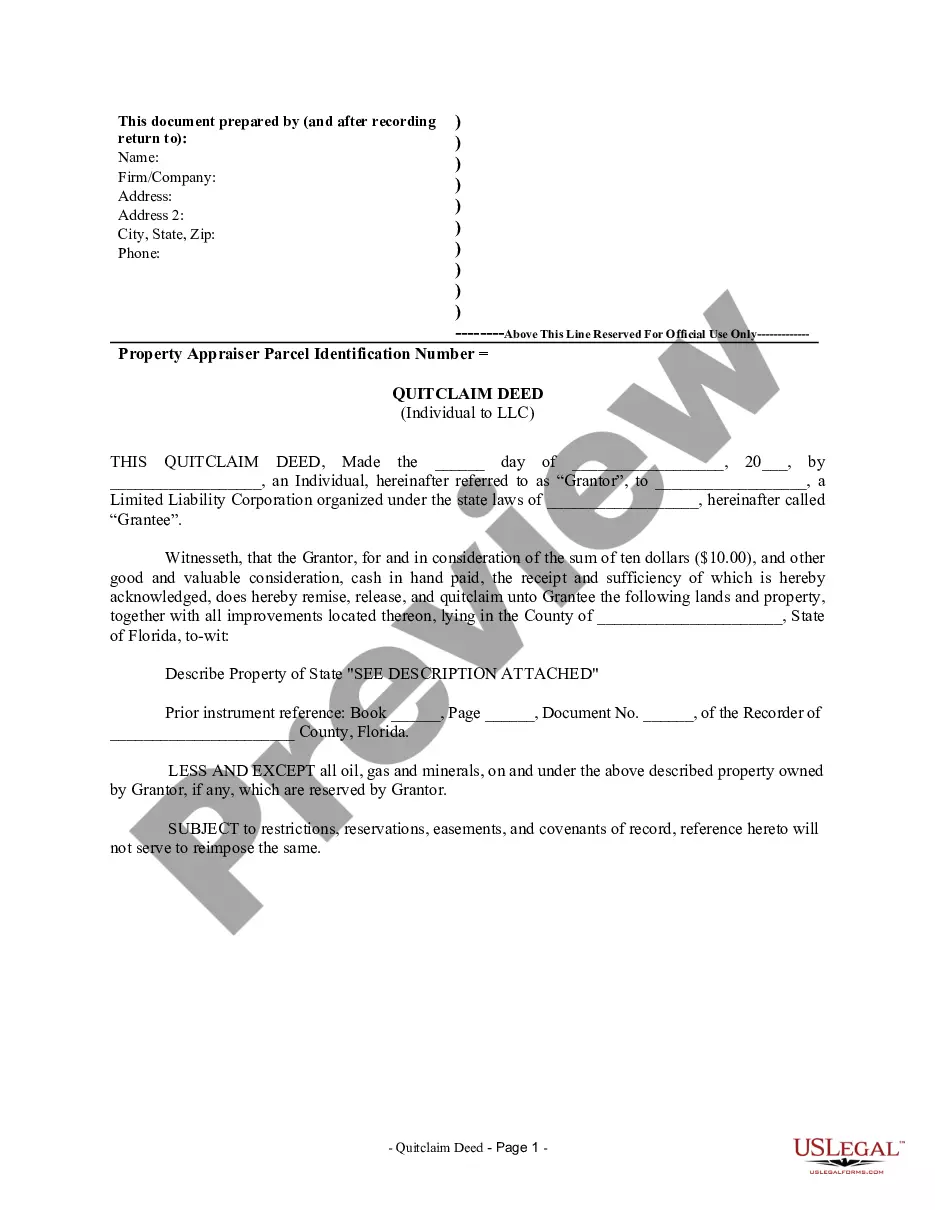

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Fort Lauderdale Florida Quitclaim Deed from Individual to LLC

Description

How to fill out Florida Quitclaim Deed From Individual To LLC?

If you have previously utilized our service, sign in to your account and fetch the Fort Lauderdale Florida Quitclaim Deed from Individual to LLC onto your device by pressing the Download button. Ensure your subscription is active. If it is not, renew it based on your payment plan.

If this is your first interaction with our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have acquired: you can find it in your profile within the My documents section whenever you need to reuse it. Take advantage of the US Legal Forms service to quickly discover and save any template for your personal or professional requirements!

- Ensure you’ve located the correct document. Read the details and utilize the Preview feature, if available, to verify if it aligns with your needs. If it doesn’t suit you, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Input your credit card information or choose the PayPal option to finalize the transaction.

- Obtain your Fort Lauderdale Florida Quitclaim Deed from Individual to LLC. Select the file format for your document and store it on your device.

- Complete your document. Print it out or utilize online editors for professional assistance to fill it out and sign it digitally.

Form popularity

FAQ

No, an attorney does not have to prepare a deed in Florida, but their guidance can be valuable. While you can prepare a Fort Lauderdale Florida Quitclaim Deed from Individual to LLC on your own or use other services, an attorney can help navigate complex situations or avoid mistakes. For easy preparation, consider using uslegalforms to ensure you meet all requirements.

Yes, a title company can prepare a deed in Florida. Their expertise in handling real estate transactions makes them a great resource for drafting documents like a Fort Lauderdale Florida Quitclaim Deed from Individual to LLC. Engaging a title company can also provide additional assurance in the accuracy and legality of the paperwork.

Typically, individuals or entities looking to quickly transfer property interest benefit the most from a quitclaim deed. It is especially useful in situations like estate planning or transferring property from a personal name to an LLC, as with a Fort Lauderdale Florida Quitclaim Deed from Individual to LLC. This method ensures simplicity and speed in the transfer process.

A quitclaim deed in Florida can be prepared by anyone, though it's often completed by a real estate attorney or a certified document preparer. If you are transferring property through a Fort Lauderdale Florida Quitclaim Deed from Individual to LLC, obtaining professional help can save you from potential legal issues. Alternatively, you can use uslegalforms to create a compliant deed quickly and easily.

Yes, you can file a quitclaim deed yourself in Florida. However, it's important to understand the process and requirements involved. When completing a Fort Lauderdale Florida Quitclaim Deed from Individual to LLC, ensure you follow the state's guidelines for drafting and filing. If you are unsure, consider using a platform like uslegalforms for assistance.

The processing time for a quitclaim deed in Florida typically depends on the county and can take anywhere from a few days to a couple of weeks. Once filed, the county clerk will record the deed, returning a copy for your records. Timely filing and proper documentation are crucial for faster processing. For simplified procedures in creating your Fort Lauderdale Florida Quitclaim Deed from Individual to LLC, consider using uslegalforms for valuable assistance.

Completing a quitclaim deed in Florida can often be done in a single day, depending on document preparation. You will need to gather necessary information about the property and the parties involved. Once prepared, you simply need to sign and notarize the document. To streamline your experience and ensure accuracy, consider using uslegalforms to guide you through creating your Fort Lauderdale Florida Quitclaim Deed from Individual to LLC.

The recording time for a quitclaim deed can vary by county in Florida, but it generally takes a few days to process. Once you submit the deed to the county clerk’s office, it will enter the official public record. To ensure quick recording, check that all information is complete and accurate. Utilizing platforms like uslegalforms can help you prepare your Fort Lauderdale Florida Quitclaim Deed from Individual to LLC correctly, speeding up the process.

You do not need a lawyer to complete a quitclaim deed in Florida. However, seeking legal advice can help ensure the process goes smoothly and that you comprehend all legal implications. A qualified attorney can guide you through the required steps to execute a Fort Lauderdale Florida Quitclaim Deed from Individual to LLC. If you're unsure about the process, consider using resources like uslegalforms for in-depth support.

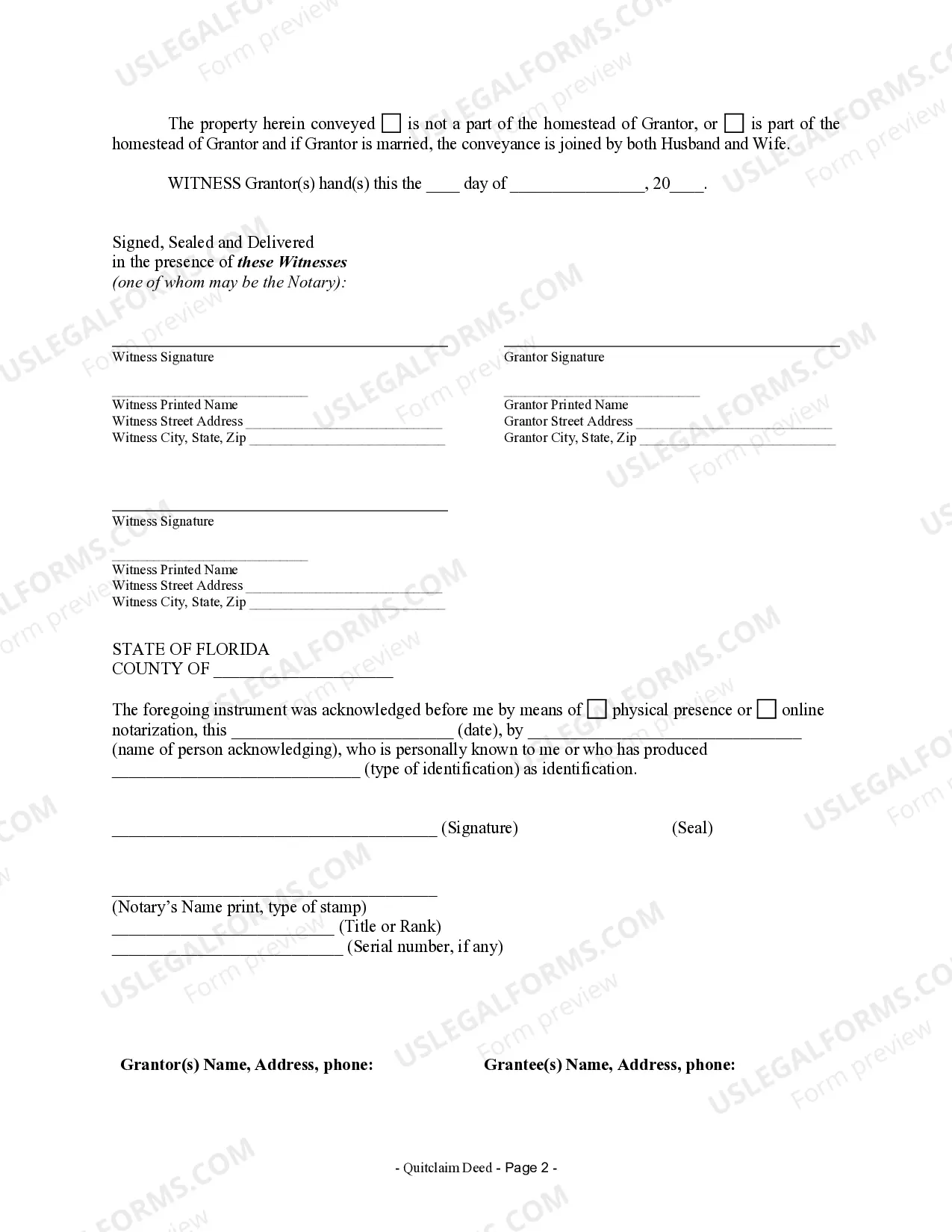

Yes, a quitclaim deed in Florida must be notarized to be legally effective. Notarization ensures the authenticity of the signatures and protects against fraud. For transferring property in Fort Lauderdale, Florida, using US Legal Forms can provide you with the correct notarial instructions and forms to meet these requirements.