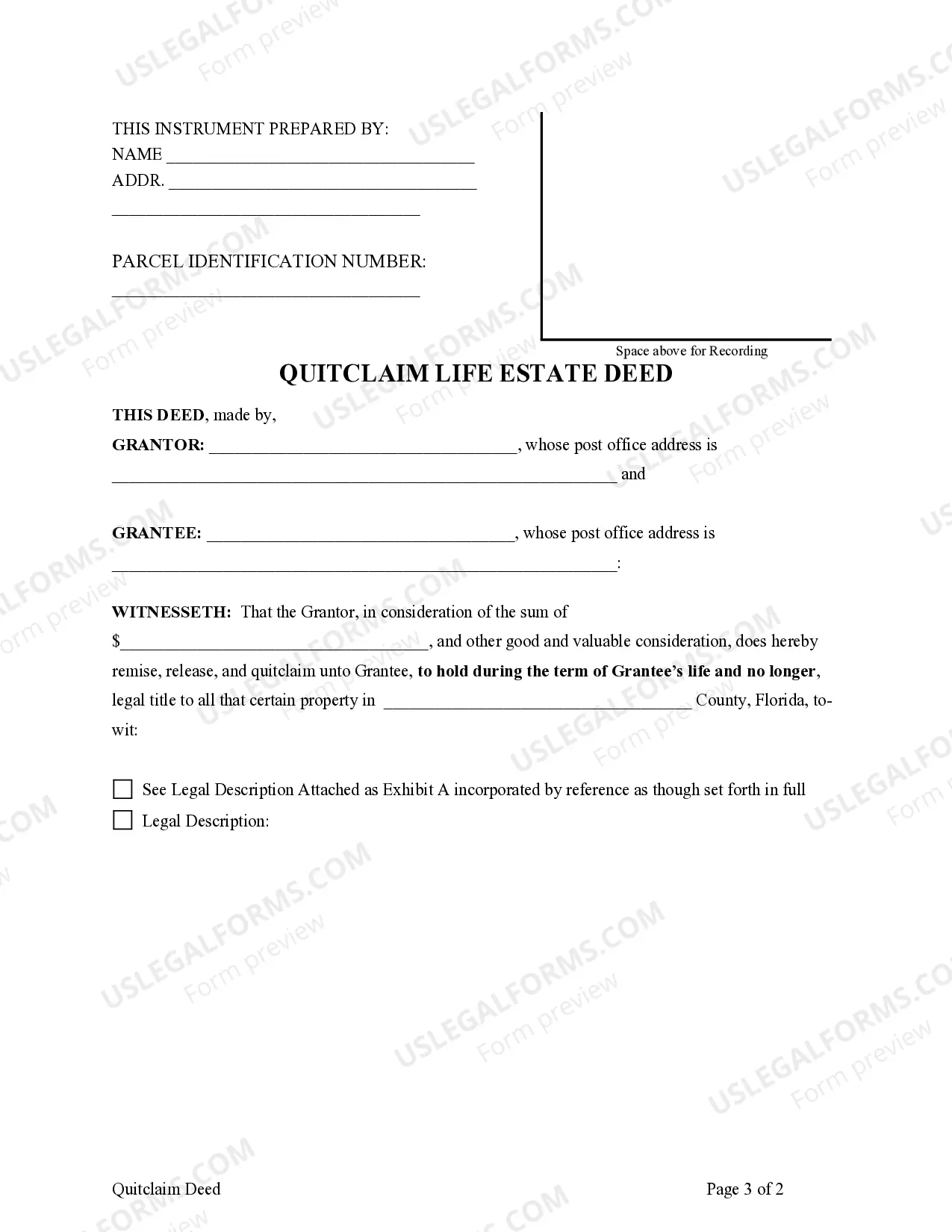

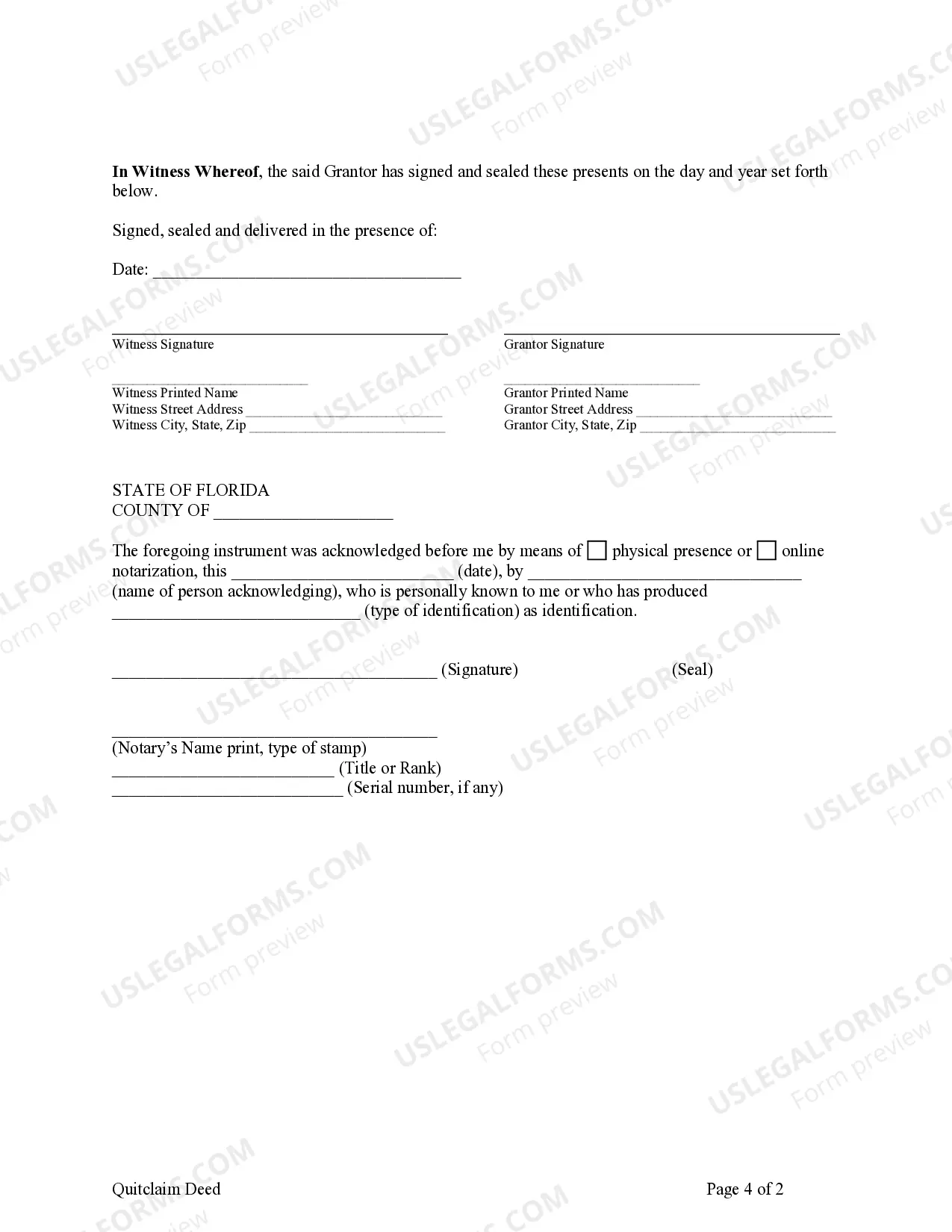

This form is a Quitclaim Deed where the Grantor is an individual and the

Grantee is an Individual. Grantor conveys and quitclaims a life estate interest in the described property to Grantee. This deed complies with all state statutory laws.

The Miami-Dade Florida Quitclaim Life Estate Deed — Individual to Individual is a legal document used to transfer ownership of real estate property from one individual to another while establishing a life estate. This type of deed provides the granter (the person transferring the property) with the right to live in the property for the duration of their lifetime, after which the property automatically transfers to the designated grantee (the person receiving the property). In Miami-Dade County, Florida, there are different variations of the Quitclaim Life Estate Deed that individuals can utilize based on their specific requirements. These variations may include: 1. Basic Quitclaim Life Estate Deed: This is the most common form of the deed, wherein the granter conveys the property to the grantee and retains the right to occupy and enjoy the property for the remainder of their life. Upon the granter's death, the property is automatically transferred to the grantee. 2. Enhanced Life Estate Deed: Also known as a Lady Bird Deed or an Enhanced Quitclaim Deed, this variation allows the granter to retain control over the property during their lifetime, including the ability to sell, mortgage, or even revoke the deed. However, upon the granter's death, the property passes directly to the grantee without going through probate. 3. Annuity Life Estate Deed: This type of deed grants the granter a regular income stream during their lifetime, generated from the property being transferred. The granter typically receives fixed payments over a specified period, after which the property is transferred to the grantee. 4. Remainder Interest Life Estate Deed: In this variation, the granter holds a life estate in the property while designating a remainder man — a specified individual or entity – who will receive full ownership rights to the property upon the granter's death. 5. Joint Life Estate Deed: This deed is commonly used by married couples or individuals in a long-term relationship. Both partners hold a joint life estate in the property, meaning that upon the death of either partner, the surviving partner retains full ownership rights to the property. It is crucial to consult with a legal professional or an experienced estate planning attorney when considering the use of any type of Miami-Dade Florida Quitclaim Life Estate Deed — Individual to Individual. They can provide guidance on which variation best suits the specific circumstances and ensure the deed is properly executed to protect the rights and interests of all parties involved.