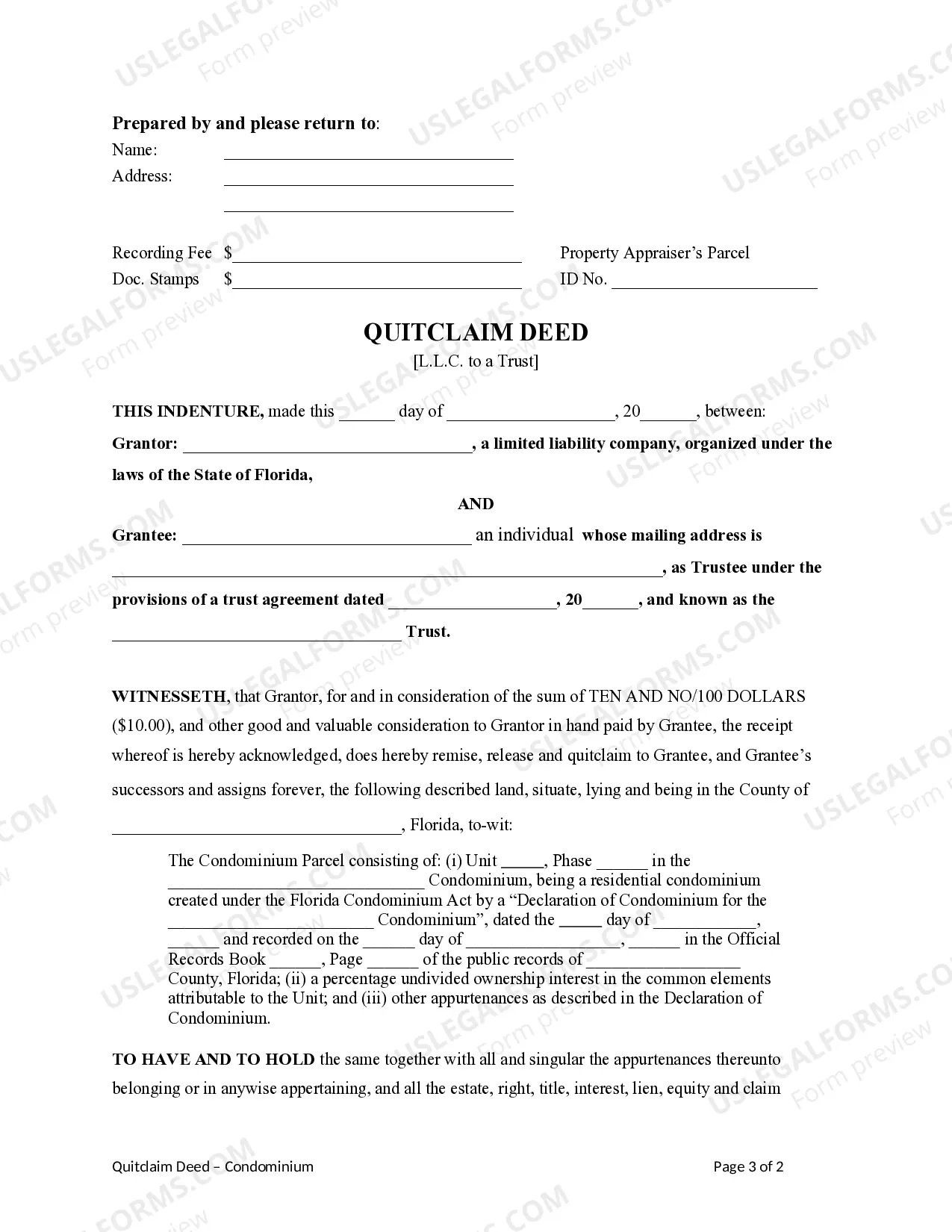

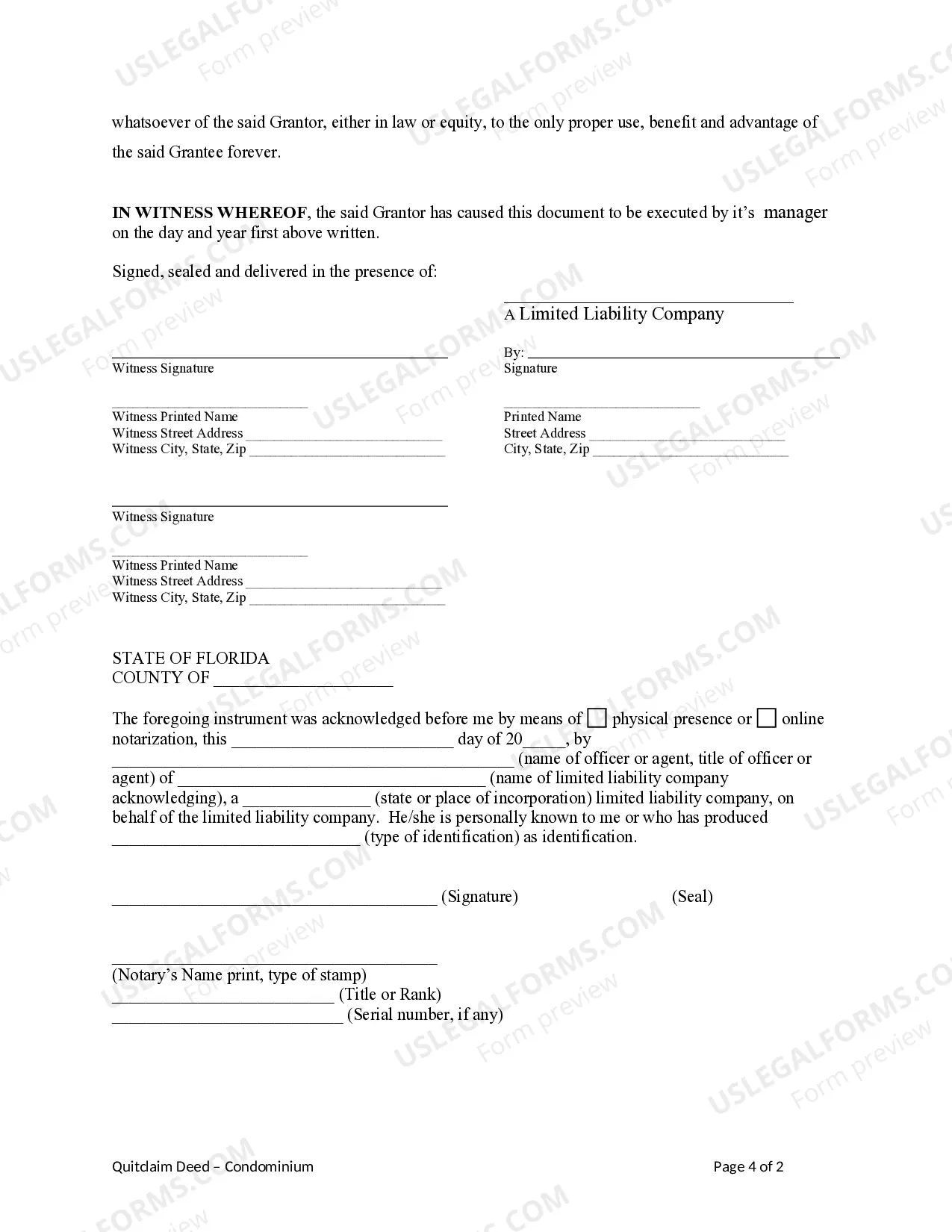

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

In Fort Lauderdale, Florida, a quitclaim deed is a legal document used to transfer ownership of a condominium from a limited liability company (LLC) to a trust. This type of transaction is essential for individuals or entities who wish to transfer ownership without any guarantees or warranties regarding the property's title. A quitclaim deed serves as a means of conveying the LLC's interest in the condominium to the trust, effectively relinquishing any claims or rights to the property. This transfer can occur for various reasons, such as estate planning, asset protection, or reorganization of ownership structure. Fort Lauderdale offers a few different types of quitclaim deeds for transferring condominium ownership from an LLC to a trust: 1. Individual Trust Transfer: This quitclaim deed allows for the transfer of ownership from an individual's LLC to a trust created by that individual. It may be utilized for estate planning purposes or to hold the property within a revocable or irrevocable trust structure. 2. Family Trust Transfer: This variant of the quitclaim deed facilitates the transfer from a family's LLC to a trust established for the benefit of multiple family members. It allows for efficient management and distribution of the property among family members, often used for long-term generational planning. 3. Charitable Trust Transfer: In some cases, individuals or entities may transfer a condominium owned by their LLC to a charitable trust. This specialized quitclaim deed enables the LLC to donate the property to a selected charitable organization, ensuring the establishment of a philanthropic legacy or acquiring potential tax benefits. 4. Business Trust Transfer: For LCS with strictly business purposes, this quitclaim deed can transfer ownership of a condominium to a business trust. Such transfers may be useful for separating real estate assets from the LLC's operations while maintaining control or division of property ownership. Regardless of the specific type of quitclaim deed used, it is crucial to consult with legal professionals experienced in Florida real estate law, specifically those familiar with the Fort Lauderdale area. Addressing any complex legal aspects and ensuring proper documentation is essential for a smooth and legally enforceable transfer of condo ownership from an LLC to a trust. Overall, Fort Lauderdale's quitclaim deed options for transferring condominium ownership from an LLC to a trust provide flexible solutions for individuals, families, businesses, and charities seeking to transfer property interests while safeguarding assets and achieving their respective goals.In Fort Lauderdale, Florida, a quitclaim deed is a legal document used to transfer ownership of a condominium from a limited liability company (LLC) to a trust. This type of transaction is essential for individuals or entities who wish to transfer ownership without any guarantees or warranties regarding the property's title. A quitclaim deed serves as a means of conveying the LLC's interest in the condominium to the trust, effectively relinquishing any claims or rights to the property. This transfer can occur for various reasons, such as estate planning, asset protection, or reorganization of ownership structure. Fort Lauderdale offers a few different types of quitclaim deeds for transferring condominium ownership from an LLC to a trust: 1. Individual Trust Transfer: This quitclaim deed allows for the transfer of ownership from an individual's LLC to a trust created by that individual. It may be utilized for estate planning purposes or to hold the property within a revocable or irrevocable trust structure. 2. Family Trust Transfer: This variant of the quitclaim deed facilitates the transfer from a family's LLC to a trust established for the benefit of multiple family members. It allows for efficient management and distribution of the property among family members, often used for long-term generational planning. 3. Charitable Trust Transfer: In some cases, individuals or entities may transfer a condominium owned by their LLC to a charitable trust. This specialized quitclaim deed enables the LLC to donate the property to a selected charitable organization, ensuring the establishment of a philanthropic legacy or acquiring potential tax benefits. 4. Business Trust Transfer: For LCS with strictly business purposes, this quitclaim deed can transfer ownership of a condominium to a business trust. Such transfers may be useful for separating real estate assets from the LLC's operations while maintaining control or division of property ownership. Regardless of the specific type of quitclaim deed used, it is crucial to consult with legal professionals experienced in Florida real estate law, specifically those familiar with the Fort Lauderdale area. Addressing any complex legal aspects and ensuring proper documentation is essential for a smooth and legally enforceable transfer of condo ownership from an LLC to a trust. Overall, Fort Lauderdale's quitclaim deed options for transferring condominium ownership from an LLC to a trust provide flexible solutions for individuals, families, businesses, and charities seeking to transfer property interests while safeguarding assets and achieving their respective goals.