This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust

Description

How to fill out Florida Quitclaim Deed For A Condominium From A Limited Liability Company To A Trust?

If you are looking for a pertinent form template, it’s hard to find a more suitable location than the US Legal Forms site – likely the most exhaustive libraries available online.

Here you can obtain a vast array of document samples for corporate and personal use categorized by types and states, or keywords.

Utilizing our high-caliber search feature, acquiring the latest Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust is as simple as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and save it to your device.

- In addition, the significance of each individual document is verified by a team of professional lawyers who regularly evaluate the templates on our site and modify them in accordance with the most recent state and county laws.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the guidelines outlined below.

- Ensure you have located the sample you require. Review its description and utilize the Preview feature to examine its content. If it doesn’t satisfy your requirements, make use of the Search option at the top of the page to find the desired record.

- Confirm your selection. Click on the Buy now button. After that, choose your preferred pricing plan and provide the necessary credentials to register for an account.

Form popularity

FAQ

Several disadvantages exist when placing your LLC in a trust. For instance, you may face increased operational complexity, as the trust becomes the new owner and may require additional administrative tasks. Additionally, transferring assets, such as through a Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust, can involve legal intricacies that might necessitate professional guidance.

While it is not strictly necessary to have a lawyer for a quitclaim deed in Florida, consulting with one can provide valuable insight, especially for complex transactions like a Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust. A lawyer helps ensure that all legal requirements are met correctly, reducing the risk of future disputes. Using services like uslegalforms can also guide you through the process effectively.

To transfer ownership of your business to a trust, you start by creating a trust and drafting the necessary legal documents that specify the business interest is being placed into the trust. This includes executing a Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust, which appropriately covers the transaction. Lastly, update your business documentation to accurately reflect the new ownership under the trust.

Putting your LLC into a trust involves creating a trust document that clearly specifies that the trust holds the membership interest of your LLC. You will need to draft an assignment document and complete a Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust to ensure all legal aspects are covered. After that, you must update your LLC's records to reflect this change in ownership.

To transfer ownership of your Limited Liability Company to a trust in Florida, first, ensure the trust is established and properly funded. Next, draft an assignment of membership interest document that outlines the transfer, which includes details about the Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust. Finally, update your LLC operating agreement to reflect the trust as the new owner and notify the Florida Department of State.

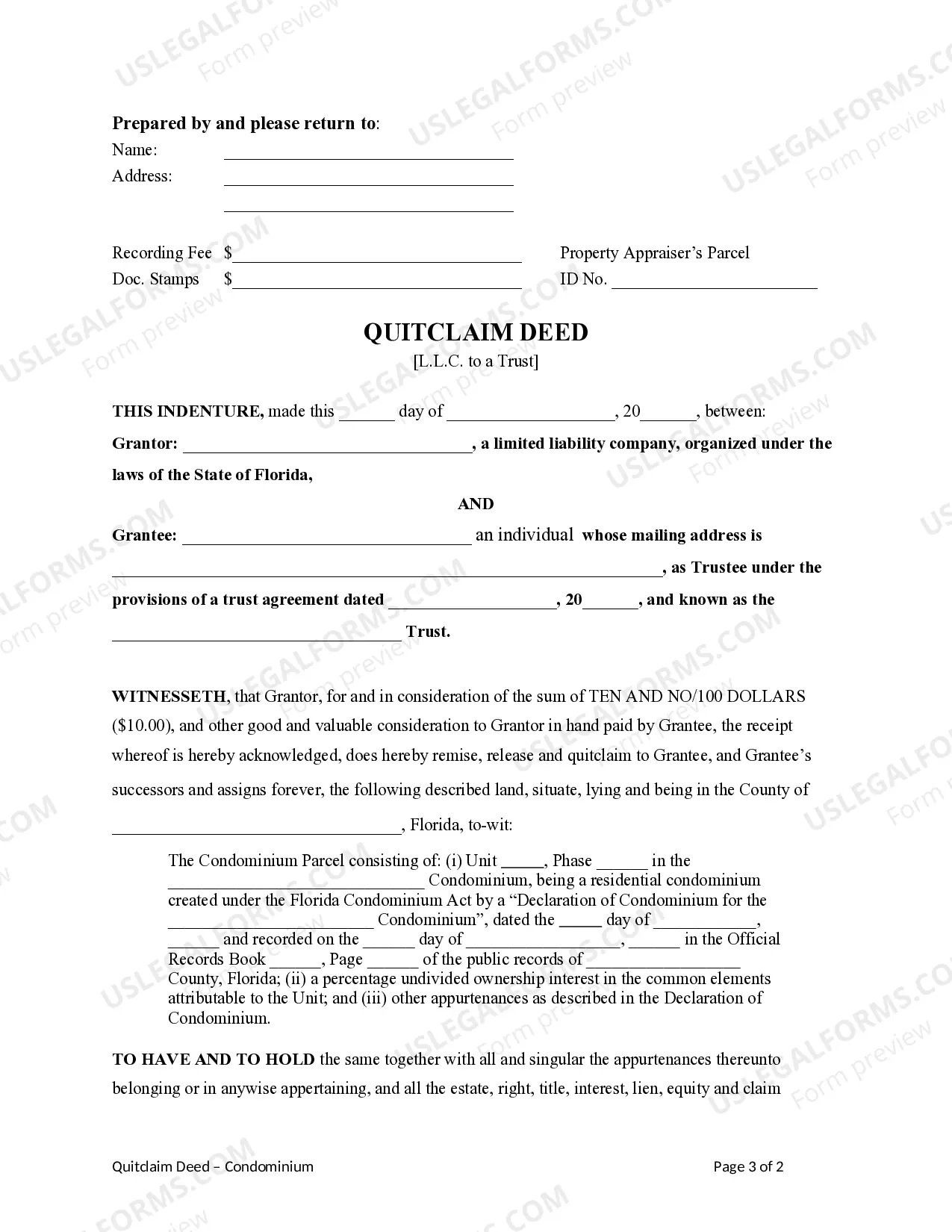

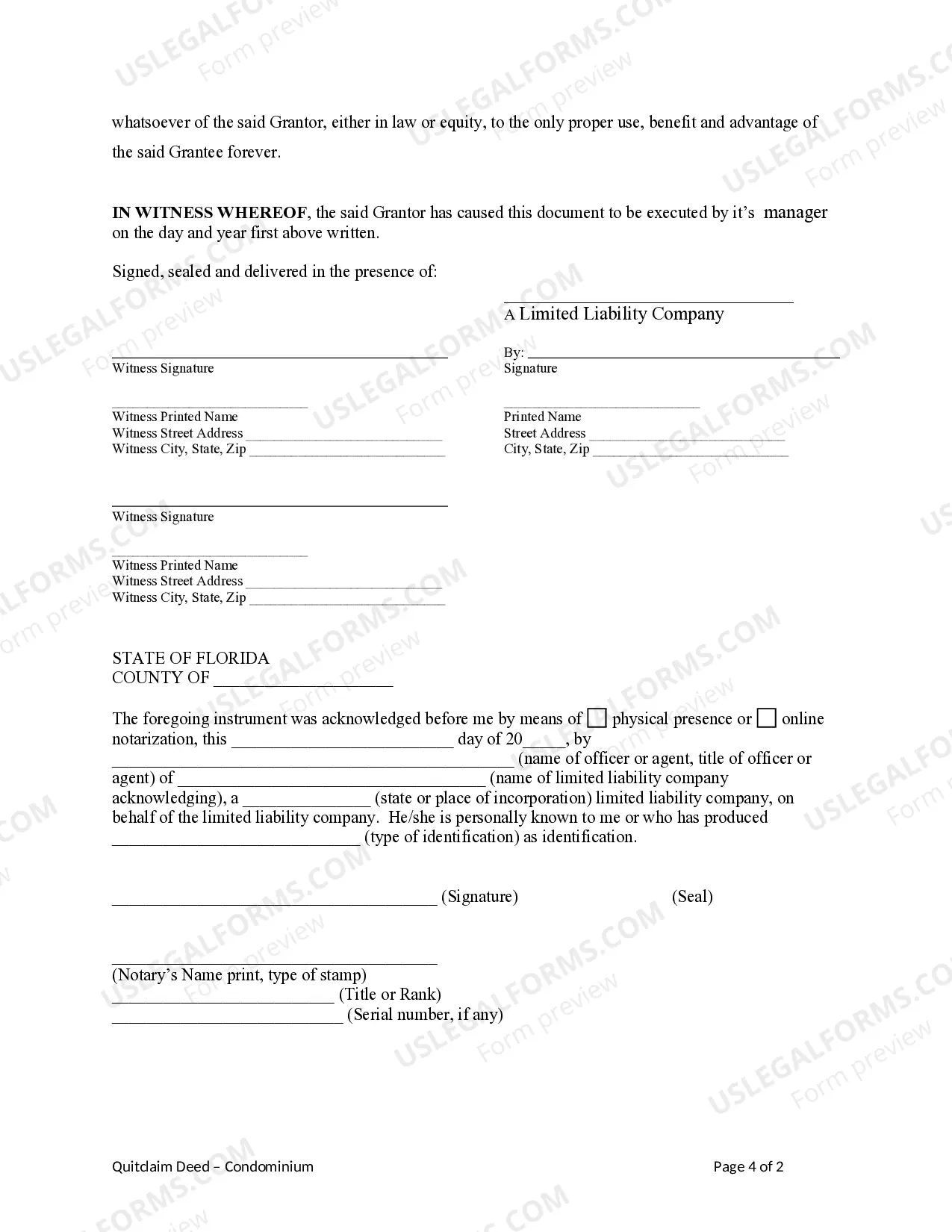

Filling out the quitclaim deed form involves several crucial steps. You'll want to include the grantor's and grantee's names, as well as a detailed description of the property involved, such as in a Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust. Make sure to sign the document in front of a notary public for it to be valid. USLegalForms offers various templates to assist you in this process, ensuring all necessary information is included.

While it is not legally required to have a lawyer to file a quitclaim deed in Florida, having legal guidance can be beneficial. Especially when dealing with a Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust, a lawyer can help ensure all documents are correctly filled out and filed. Utilizing resources from platforms like USLegalForms may also provide the support you need.

To fill out a quit claim deed in Florida, gather the necessary information about the property and the parties involved. Be sure to specify the nature of the ownership transfer, like a Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust. It is important to format the deed correctly and have it signed before a notary public. Using resources such as USLegalForms can ease this process and ensure compliance.

Filling out a Florida quit claim deed requires clear identification of the parties involved and the property. Start by entering the name of the grantor, followed by the name of the grantee, which could be a trust in the Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust. Ensure accurate legal descriptions of the property are included. Platforms like USLegalForms provide helpful templates and resources to guide you through the process.

Yes, a quit claim deed can transfer property from a trust. In the case of a Gainesville Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust, the trust must be identified as the grantee on the deed. This process allows for a smooth transition of ownership, ensuring the property's title accurately reflects the trust as the new owner. Always consider consulting an expert to ensure a proper transfer.