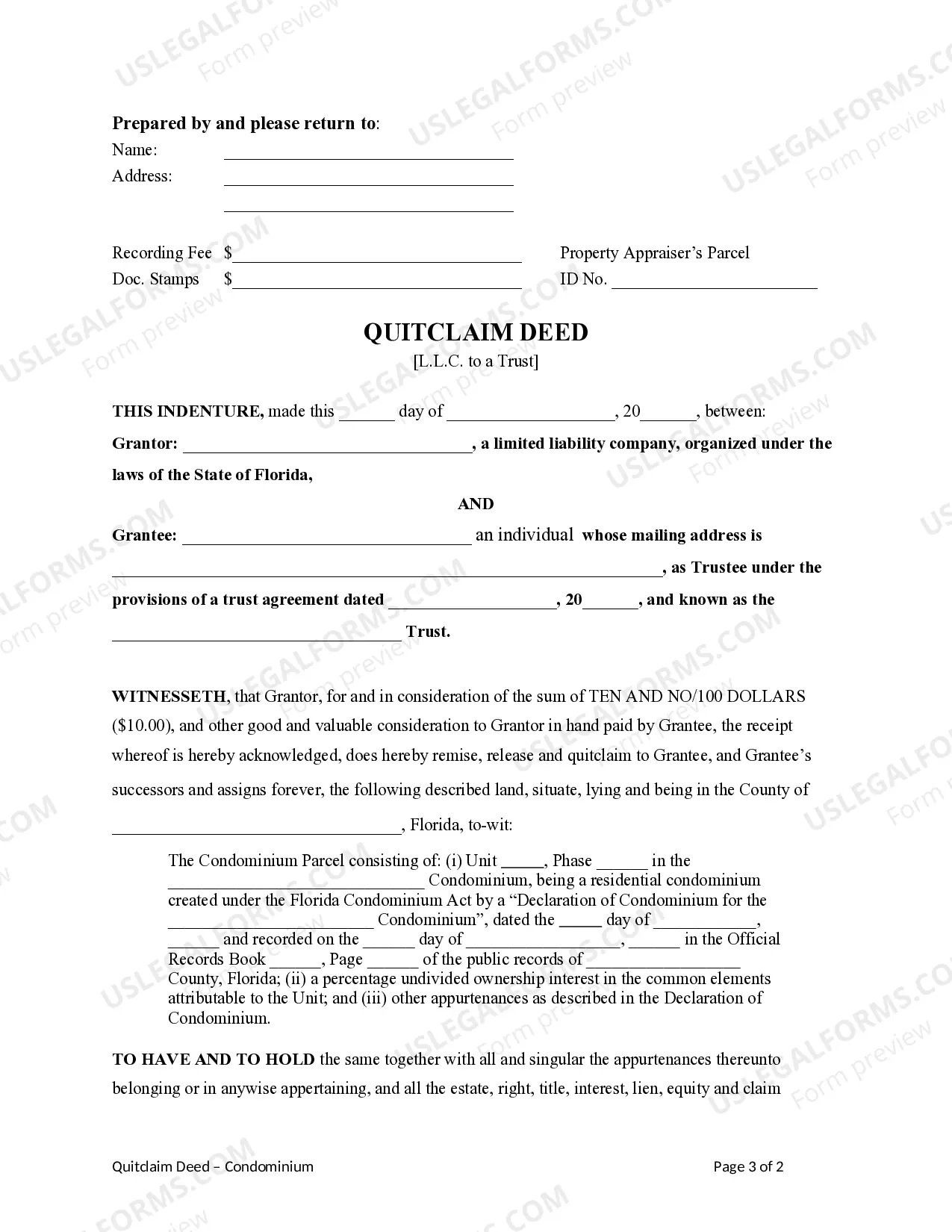

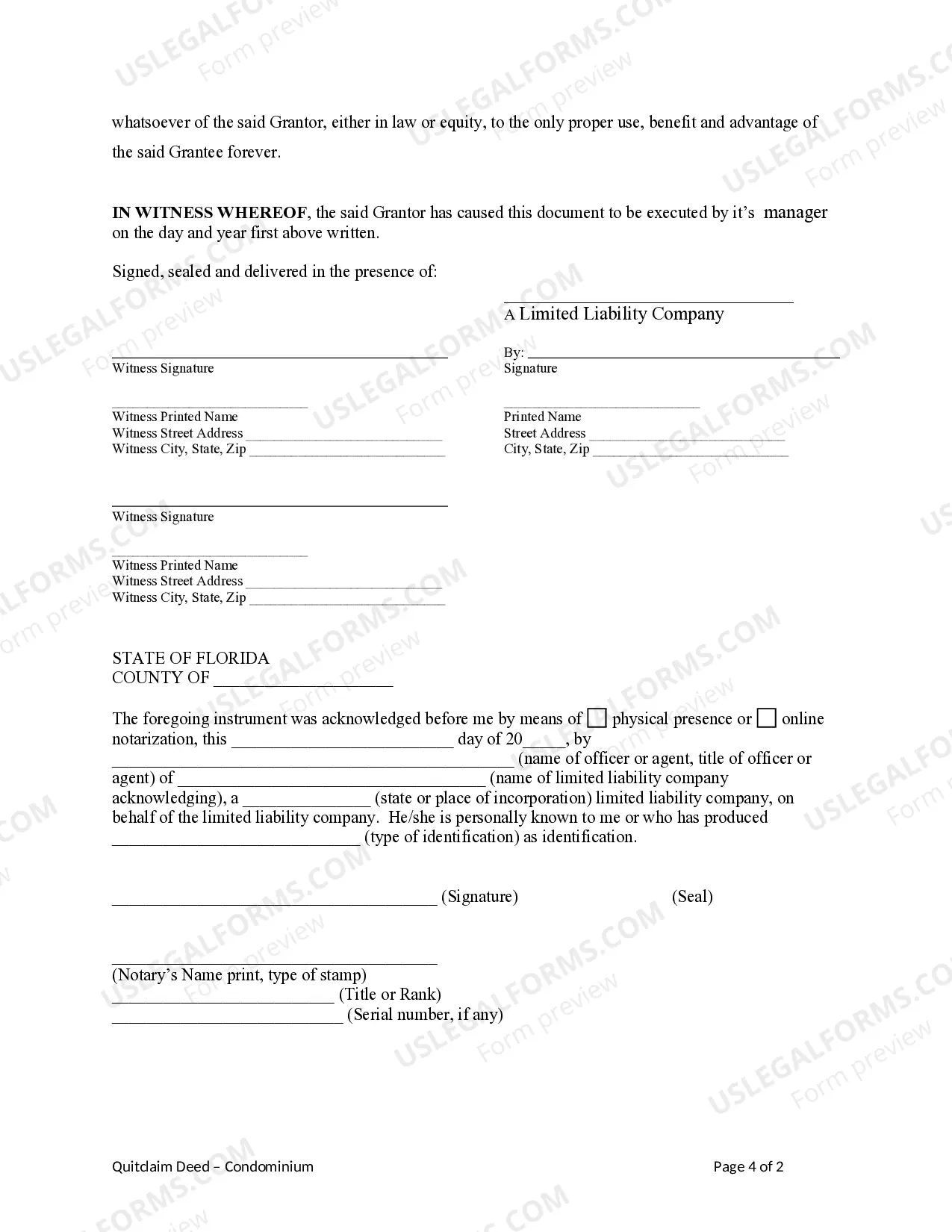

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A quitclaim deed is a legal document that conveys ownership of real property from one party to another. In the context of a Lakeland, Florida condominium, a quitclaim deed may be used to transfer ownership of the property from a limited liability company (LLC) to a trust. This type of transfer is commonly employed for estate planning purposes, asset protection, or to facilitate the seamless transfer of property within a family. A Lakeland, Florida quitclaim deed for a condominium from an LLC to a trust is a straightforward process that involves certain important considerations. For instance, the deed must include the accurate and complete legal description of the condominium, ensuring that the property boundaries are precisely defined. Additionally, the deed should clearly state the names of both the LLC as the granter (the party transferring ownership) and the trust as the grantee (the recipient of ownership). There are various types of Lakeland, Florida quitclaim deeds for a condominium transfer from an LLC to a trust, depending on the specific circumstances. Some possible variations include: 1. Individual-to-Trust Quitclaim Deed: This type of quitclaim deed might be used when an individual owner of a condominium decides to transfer ownership to a trust they have established for estate planning purposes. This type of transfer allows for the smooth transition of the property's ownership upon the individual's passing. 2. LLC-to-Revocable Living Trust Quitclaim Deed: In this case, an LLC that holds ownership of a Lakeland, Florida condominium transfers the property to a revocable living trust. This transfer may provide estate planning benefits, allowing for the efficient transfer of the condominium's ownership while avoiding the probate process. 3. LLC-to-Irrevocable Trust Quitclaim Deed: An LLC could also use a quitclaim deed to transfer a condominium to an irrevocable trust. This type of trust is typically utilized for asset protection purposes, shielding the property from potential creditors or minimizing taxation. Regardless of the specific type, all Lakeland, Florida quitclaim deeds for a condominium transfer from an LLC to a trust require proper documentation and must adhere to the Florida laws governing real estate transactions. It is advisable to consult with an experienced real estate attorney to ensure compliance with legal requirements and to effectively complete the transfer process.A quitclaim deed is a legal document that conveys ownership of real property from one party to another. In the context of a Lakeland, Florida condominium, a quitclaim deed may be used to transfer ownership of the property from a limited liability company (LLC) to a trust. This type of transfer is commonly employed for estate planning purposes, asset protection, or to facilitate the seamless transfer of property within a family. A Lakeland, Florida quitclaim deed for a condominium from an LLC to a trust is a straightforward process that involves certain important considerations. For instance, the deed must include the accurate and complete legal description of the condominium, ensuring that the property boundaries are precisely defined. Additionally, the deed should clearly state the names of both the LLC as the granter (the party transferring ownership) and the trust as the grantee (the recipient of ownership). There are various types of Lakeland, Florida quitclaim deeds for a condominium transfer from an LLC to a trust, depending on the specific circumstances. Some possible variations include: 1. Individual-to-Trust Quitclaim Deed: This type of quitclaim deed might be used when an individual owner of a condominium decides to transfer ownership to a trust they have established for estate planning purposes. This type of transfer allows for the smooth transition of the property's ownership upon the individual's passing. 2. LLC-to-Revocable Living Trust Quitclaim Deed: In this case, an LLC that holds ownership of a Lakeland, Florida condominium transfers the property to a revocable living trust. This transfer may provide estate planning benefits, allowing for the efficient transfer of the condominium's ownership while avoiding the probate process. 3. LLC-to-Irrevocable Trust Quitclaim Deed: An LLC could also use a quitclaim deed to transfer a condominium to an irrevocable trust. This type of trust is typically utilized for asset protection purposes, shielding the property from potential creditors or minimizing taxation. Regardless of the specific type, all Lakeland, Florida quitclaim deeds for a condominium transfer from an LLC to a trust require proper documentation and must adhere to the Florida laws governing real estate transactions. It is advisable to consult with an experienced real estate attorney to ensure compliance with legal requirements and to effectively complete the transfer process.