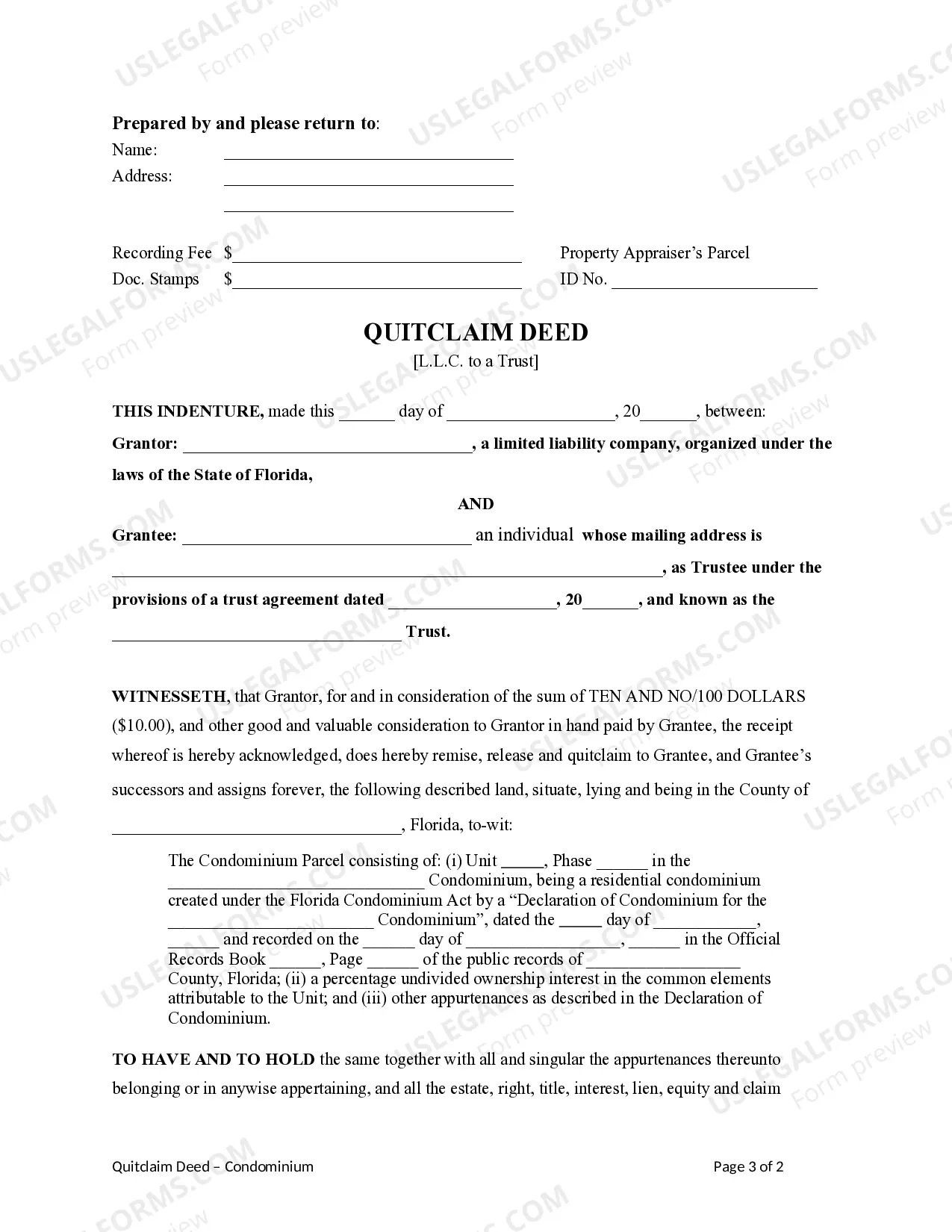

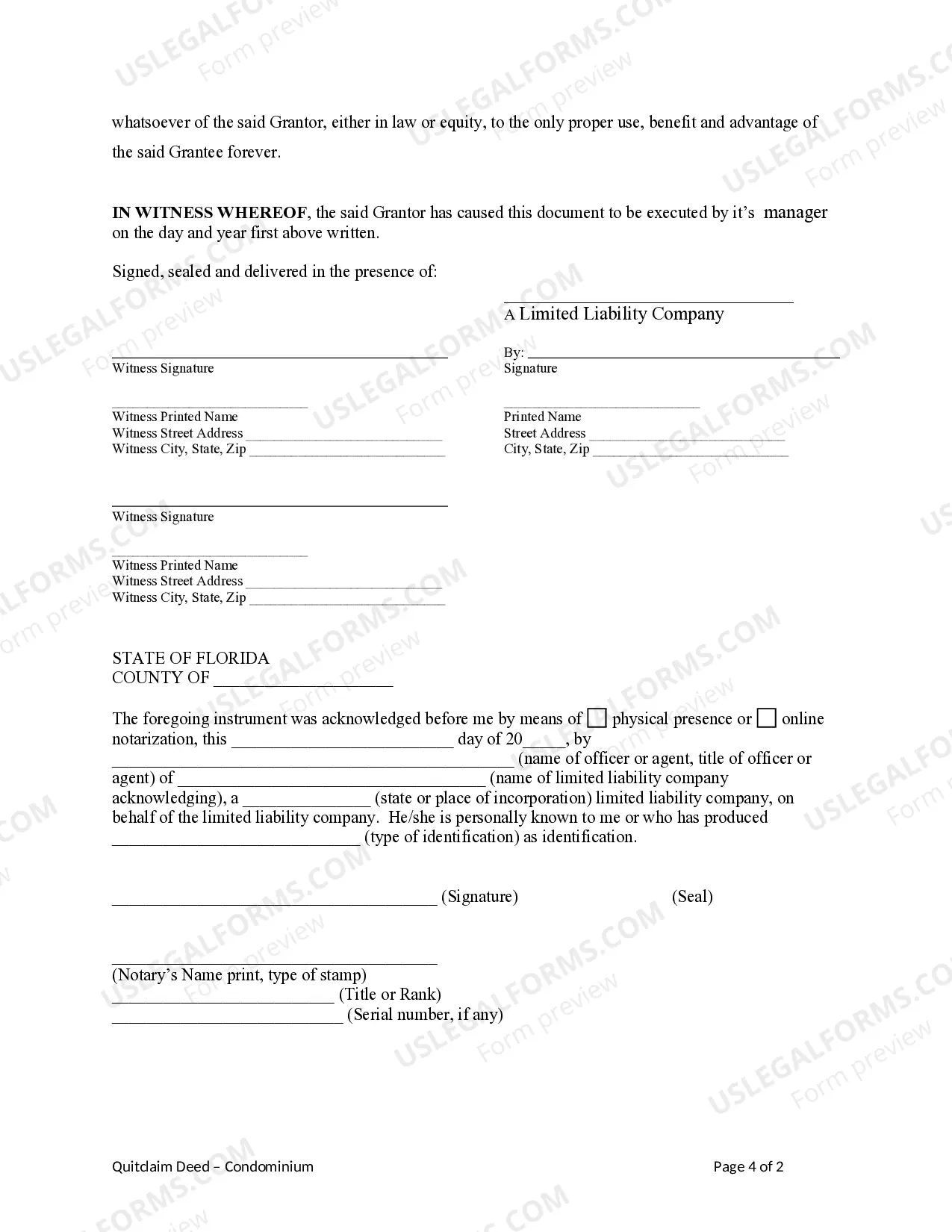

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Miami-Dade Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust is a legal document that transfers ownership of a condominium unit from a limited liability company (LLC) to a trust. This deed is commonly used in real estate transactions, allowing the LLC to transfer the property to a trust, typically for estate planning or asset protection purposes. Key terms: 1. Miami-Dade County: The specific county in Florida where the condominium is located. 2. Quitclaim Deed: A legal instrument used to transfer ownership interest in a property from one party (the LLC) to another (the trust) without any warranties or guarantees of title. 3. Condominium: A type of real estate property where individual units are privately owned, while the common areas are collectively owned by all unit owners in the building or complex. 4. Limited Liability Company (LLC): A business structure that combines the limited liability protection of a corporation with the flexibility and tax advantages of a partnership. 5. Trust: A legal arrangement where a trustee holds and manages assets on behalf of beneficiaries. 6. Real Estate: Land, buildings, and other permanent structures attached to the land. 7. Property Ownership Transfer: The legal process of changing ownership of a property from one party to another. 8. Estate Planning: The process of arranging and distributing one's assets and wealth during and after their lifetime. 9. Asset Protection: Legal strategies and tools used to safeguard one's assets from potential threats, such as lawsuits or creditors. Different types of Miami-Dade Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust may include variations based on the specific trust type or purpose. For instance: 1. Revocable Living Trust Deed: This type of deed allows the LLC to transfer ownership of the condominium unit to a revocable living trust, typically used for estate planning purposes to avoid probate. 2. Irrevocable Trust Deed: With this deed, the LLC transfers ownership to an irrevocable trust, providing greater asset protection and potential tax benefits. 3. Special Needs Trust Deed: In the case where the trust is intended to provide for the special needs of a beneficiary, this type of deed would be used to transfer ownership accordingly. Regardless of the specific type, a Miami-Dade Florida Quitclaim Deed for a Condominium from a Limited Liability Company to a Trust is a vital legal document that facilitates the transfer of ownership smoothly and efficiently while maintaining the LLC's liability protection and fulfilling the trust's specific purposes.