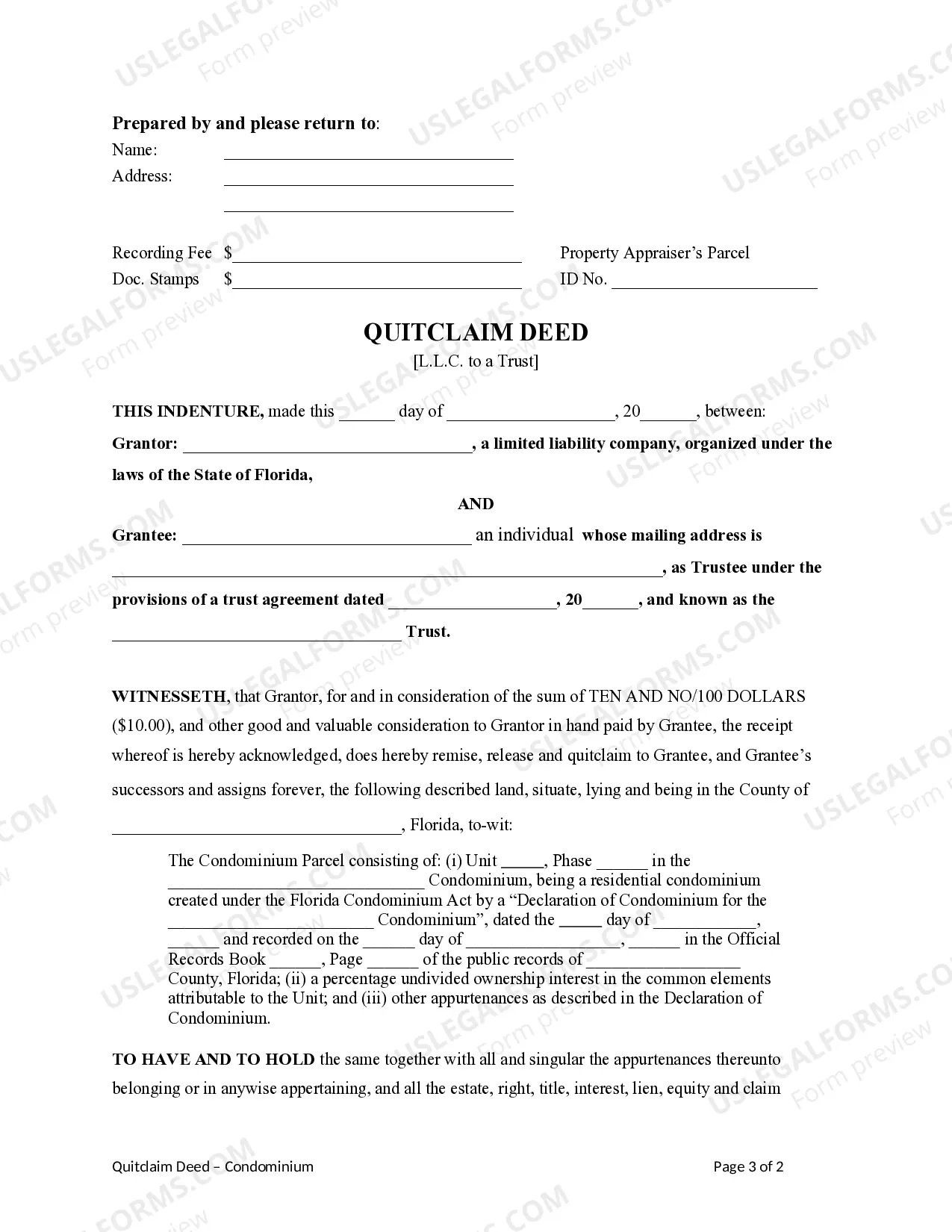

This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

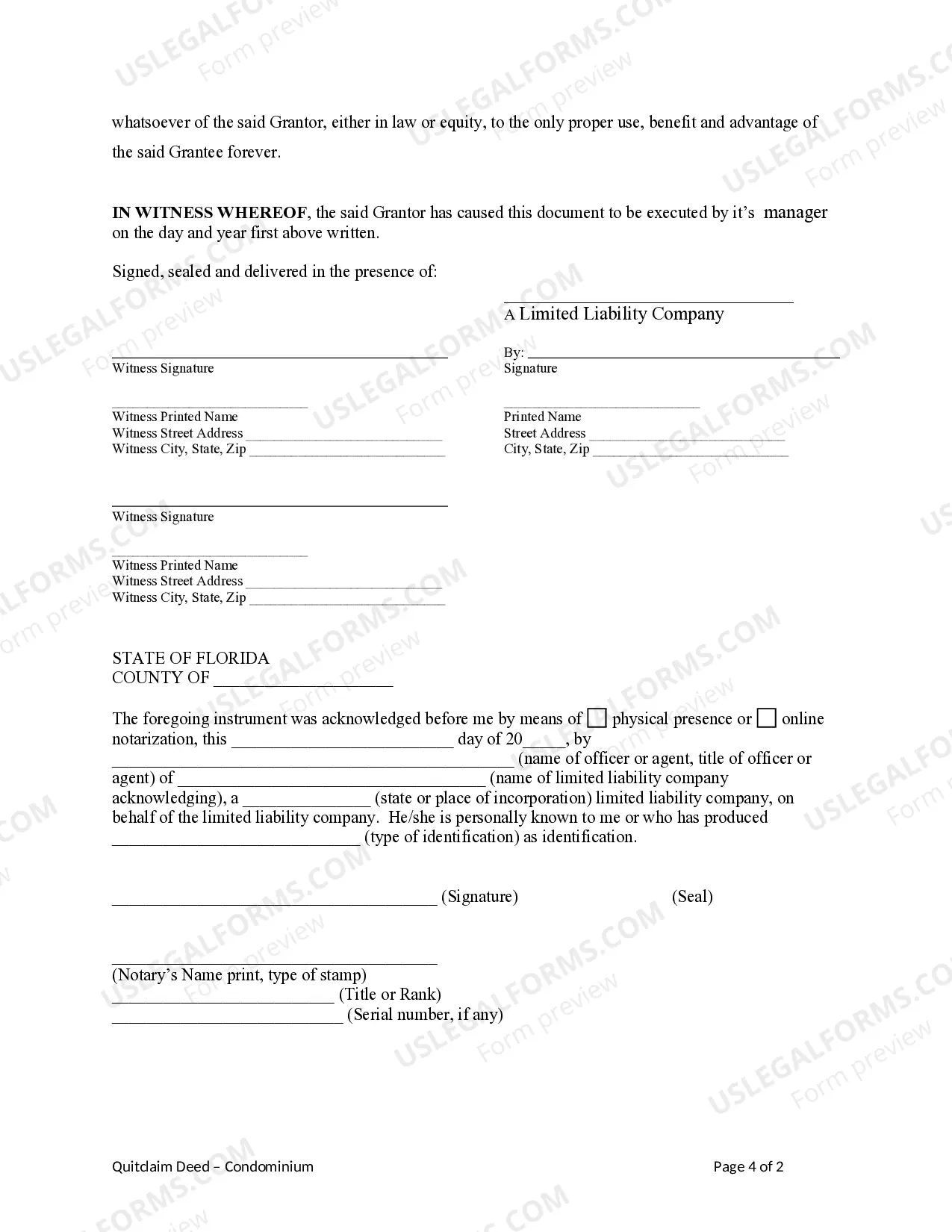

A quitclaim deed is a legal document used to transfer ownership of a property from one party to another. In the case of a Miami Gardens, Florida quitclaim deed for a condominium from a limited liability company (LLC) to a trust, it involves the transfer of ownership from an LLC to a trust entity. The Miami Gardens, Florida quitclaim deed for a condominium from an LLC to a trust is a common method of transferring ownership and protecting assets. This type of transfer is often used for estate planning purposes, asset protection, and to streamline ownership structures. There are different variations of Miami Gardens, Florida quitclaim deeds for a condominium from an LLC to a trust, including: 1. Individual Trust Quitclaim Deed: This type of quitclaim deed involves the transfer of ownership from the LLC to an individual trust. The individual trust is typically established for a specific individual or family and provides asset protection and estate planning benefits. 2. Revocable Living Trust Quitclaim Deed: With this type of quitclaim deed, ownership of the condominium is transferred from the LLC to a revocable living trust. A revocable living trust allows the granter to maintain control and flexibility over their assets during their lifetime while avoiding probate upon their death. 3. Irrevocable Trust Quitclaim Deed: In this scenario, the ownership of the condominium is transferred from the LLC to an irrevocable trust. Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked without the consent of the beneficiaries. This type of trust is often used for long-term asset protection and estate tax planning. The process of executing a Miami Gardens, Florida quitclaim deed for a condominium from an LLC to a trust involves several steps. First, the LLC must draft the quitclaim deed, ensuring all relevant information is included, such as the property description and legal names of the granter (LLC) and grantee (trust). Once the deed is prepared, it should be signed by the authorized representative of the LLC. The deed is then recorded at the Miami Gardens County Recorder's Office, officially transferring ownership to the trust. It is essential to consult with a qualified attorney familiar with Florida real estate law and estate planning when considering a Miami Gardens, Florida quitclaim deed for a condominium from an LLC to a trust. They can guide you through the process, ensuring all legal requirements are met, and addressing any specific concerns or goals you may have.A quitclaim deed is a legal document used to transfer ownership of a property from one party to another. In the case of a Miami Gardens, Florida quitclaim deed for a condominium from a limited liability company (LLC) to a trust, it involves the transfer of ownership from an LLC to a trust entity. The Miami Gardens, Florida quitclaim deed for a condominium from an LLC to a trust is a common method of transferring ownership and protecting assets. This type of transfer is often used for estate planning purposes, asset protection, and to streamline ownership structures. There are different variations of Miami Gardens, Florida quitclaim deeds for a condominium from an LLC to a trust, including: 1. Individual Trust Quitclaim Deed: This type of quitclaim deed involves the transfer of ownership from the LLC to an individual trust. The individual trust is typically established for a specific individual or family and provides asset protection and estate planning benefits. 2. Revocable Living Trust Quitclaim Deed: With this type of quitclaim deed, ownership of the condominium is transferred from the LLC to a revocable living trust. A revocable living trust allows the granter to maintain control and flexibility over their assets during their lifetime while avoiding probate upon their death. 3. Irrevocable Trust Quitclaim Deed: In this scenario, the ownership of the condominium is transferred from the LLC to an irrevocable trust. Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked without the consent of the beneficiaries. This type of trust is often used for long-term asset protection and estate tax planning. The process of executing a Miami Gardens, Florida quitclaim deed for a condominium from an LLC to a trust involves several steps. First, the LLC must draft the quitclaim deed, ensuring all relevant information is included, such as the property description and legal names of the granter (LLC) and grantee (trust). Once the deed is prepared, it should be signed by the authorized representative of the LLC. The deed is then recorded at the Miami Gardens County Recorder's Office, officially transferring ownership to the trust. It is essential to consult with a qualified attorney familiar with Florida real estate law and estate planning when considering a Miami Gardens, Florida quitclaim deed for a condominium from an LLC to a trust. They can guide you through the process, ensuring all legal requirements are met, and addressing any specific concerns or goals you may have.