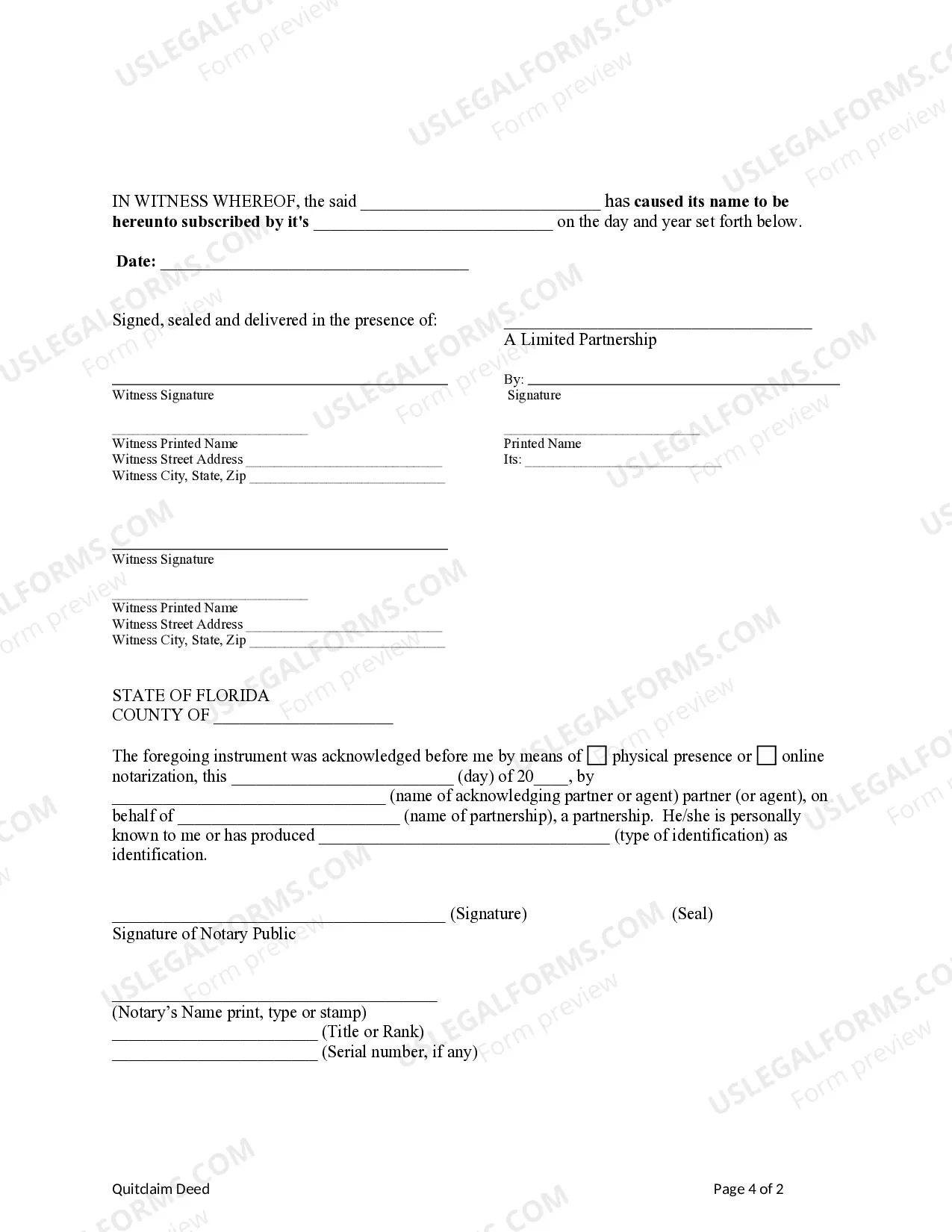

This form is a Quitclaim Deed where the Grantor is a limited partnership and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A quitclaim deed is a legal document used to transfer the ownership of a property from one party to another. In Pembroke Pines, Florida, a quitclaim deed from a limited partnership to a limited liability company is a specific type of transfer that can occur between these two entities. This type of deed is commonly used when there is a change in ownership or structure within a business. A quitclaim deed is a simple and straightforward way to transfer property ownership. It is important to note that a quitclaim deed does not guarantee ownership or establish the validity of the title. It simply transfers any interest or claim the limited partnership has on the property to the limited liability company. In Pembroke Pines, Florida, there may be different types of quitclaim deeds from a limited partnership to a limited liability company based on the specific circumstances of the transfer. Some of these variations may include: 1. Standard Pembroke Pines Florida Quitclaim Deed from Limited Partnership to Limited Liability Company: This is the most common type of quitclaim deed used in Pembroke Pines, Florida. It involves the transfer of ownership interest from a limited partnership to a limited liability company. 2. Partial Transfer Pembroke Pines Florida Quitclaim Deed from Limited Partnership to Limited Liability Company: This type of quitclaim deed is used when only a portion of the ownership interest is being transferred from the limited partnership to the limited liability company. 3. Appending Pembroke Pines Florida Quitclaim Deed from Limited Partnership to Limited Liability Company: In certain cases, a limited partnership may choose to append the quitclaim deed, meaning that the limited liability company becomes an additional owner alongside the limited partnership rather than replacing it entirely. 4. Dissolution Pembroke Pines Florida Quitclaim Deed from Limited Partnership to Limited Liability Company: Sometimes, a limited partnership may dissolve, leading to the transfer of its property ownership to a limited liability company through a quitclaim deed. This type of deed terminates the partnership and transfers the property exclusively to the limited liability company. It is crucial to consult with legal professionals or real estate experts to ensure the proper execution and filing of these quitclaim deeds. The specific requirements and regulations surrounding these transfers may vary based on the jurisdiction and the unique circumstances of the transfer. In conclusion, a Pembroke Pines Florida Quitclaim Deed from Limited Partnership to Limited Liability Company is a legal document used to transfer property ownership from a limited partnership to a limited liability company. Different variations of this deed may exist depending on the specific circumstances, such as partial transfers, appending the deed, or dissolving the partnership. It is advisable to seek expert guidance to navigate the legal complexities of these transactions.A quitclaim deed is a legal document used to transfer the ownership of a property from one party to another. In Pembroke Pines, Florida, a quitclaim deed from a limited partnership to a limited liability company is a specific type of transfer that can occur between these two entities. This type of deed is commonly used when there is a change in ownership or structure within a business. A quitclaim deed is a simple and straightforward way to transfer property ownership. It is important to note that a quitclaim deed does not guarantee ownership or establish the validity of the title. It simply transfers any interest or claim the limited partnership has on the property to the limited liability company. In Pembroke Pines, Florida, there may be different types of quitclaim deeds from a limited partnership to a limited liability company based on the specific circumstances of the transfer. Some of these variations may include: 1. Standard Pembroke Pines Florida Quitclaim Deed from Limited Partnership to Limited Liability Company: This is the most common type of quitclaim deed used in Pembroke Pines, Florida. It involves the transfer of ownership interest from a limited partnership to a limited liability company. 2. Partial Transfer Pembroke Pines Florida Quitclaim Deed from Limited Partnership to Limited Liability Company: This type of quitclaim deed is used when only a portion of the ownership interest is being transferred from the limited partnership to the limited liability company. 3. Appending Pembroke Pines Florida Quitclaim Deed from Limited Partnership to Limited Liability Company: In certain cases, a limited partnership may choose to append the quitclaim deed, meaning that the limited liability company becomes an additional owner alongside the limited partnership rather than replacing it entirely. 4. Dissolution Pembroke Pines Florida Quitclaim Deed from Limited Partnership to Limited Liability Company: Sometimes, a limited partnership may dissolve, leading to the transfer of its property ownership to a limited liability company through a quitclaim deed. This type of deed terminates the partnership and transfers the property exclusively to the limited liability company. It is crucial to consult with legal professionals or real estate experts to ensure the proper execution and filing of these quitclaim deeds. The specific requirements and regulations surrounding these transfers may vary based on the jurisdiction and the unique circumstances of the transfer. In conclusion, a Pembroke Pines Florida Quitclaim Deed from Limited Partnership to Limited Liability Company is a legal document used to transfer property ownership from a limited partnership to a limited liability company. Different variations of this deed may exist depending on the specific circumstances, such as partial transfers, appending the deed, or dissolving the partnership. It is advisable to seek expert guidance to navigate the legal complexities of these transactions.