This form is a Quitclaim Deed where the Grantors are two Individuals and the Grantee is an Individual. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Jacksonville Florida Quitclaim Deed - Timeshare from Two Individuals to One Individual

Description

How to fill out Florida Quitclaim Deed - Timeshare From Two Individuals To One Individual?

Regardless of your social or professional position, completing legal documents is a regrettable requirement in the modern world.

Frequently, it’s nearly unattainable for an individual lacking any legal background to generate this kind of documentation independently, primarily because of the intricate language and legal nuances involved.

This is where US Legal Forms can come to the rescue.

Ensure the form you have selected is appropriate for your region, as the rules of one state or county may not apply to another.

If the chosen document does not fulfill your requirements, you can restart the process and search for the correct document.

- Our service offers an extensive library with more than 85,000 ready-to-use state-specific documents applicable to nearly any legal matter.

- US Legal Forms is also an outstanding asset for affiliates or legal advisors aiming to save time using our DIY papers.

- Whether you seek the Jacksonville Florida Quitclaim Deed - Timeshare from Two Individuals to One Individual or any other document suitable for your state or county, with US Legal Forms, everything is easily accessible.

- Here’s how to obtain the Jacksonville Florida Quitclaim Deed - Timeshare from Two Individuals to One Individual in a matter of minutes using our dependable service.

- If you are already a subscriber, you may proceed to Log In to your account to acquire the right form.

- However, if you are unfamiliar with our platform, ensure you follow these actions prior to acquiring the Jacksonville Florida Quitclaim Deed - Timeshare from Two Individuals to One Individual.

Form popularity

FAQ

The tax rate for documents that transfer an interest in real property is $. 70 per $100 (or portion thereof) of the total consideration paid, or to be paid, for the transfer. An exception is Miami-Dade County, where the rate is $. 60 per $100 (or portion thereof) when the property is a single-family residence.

Filing a Deed in Florida The comptroller's office charges a small fee for the deed's filing in the form of a documentary stamp tax, levied at 70 cents per $100 of the sale or transfer amount. There will also be a $10 fee for the first page of the document and $8.50 for each additional page.

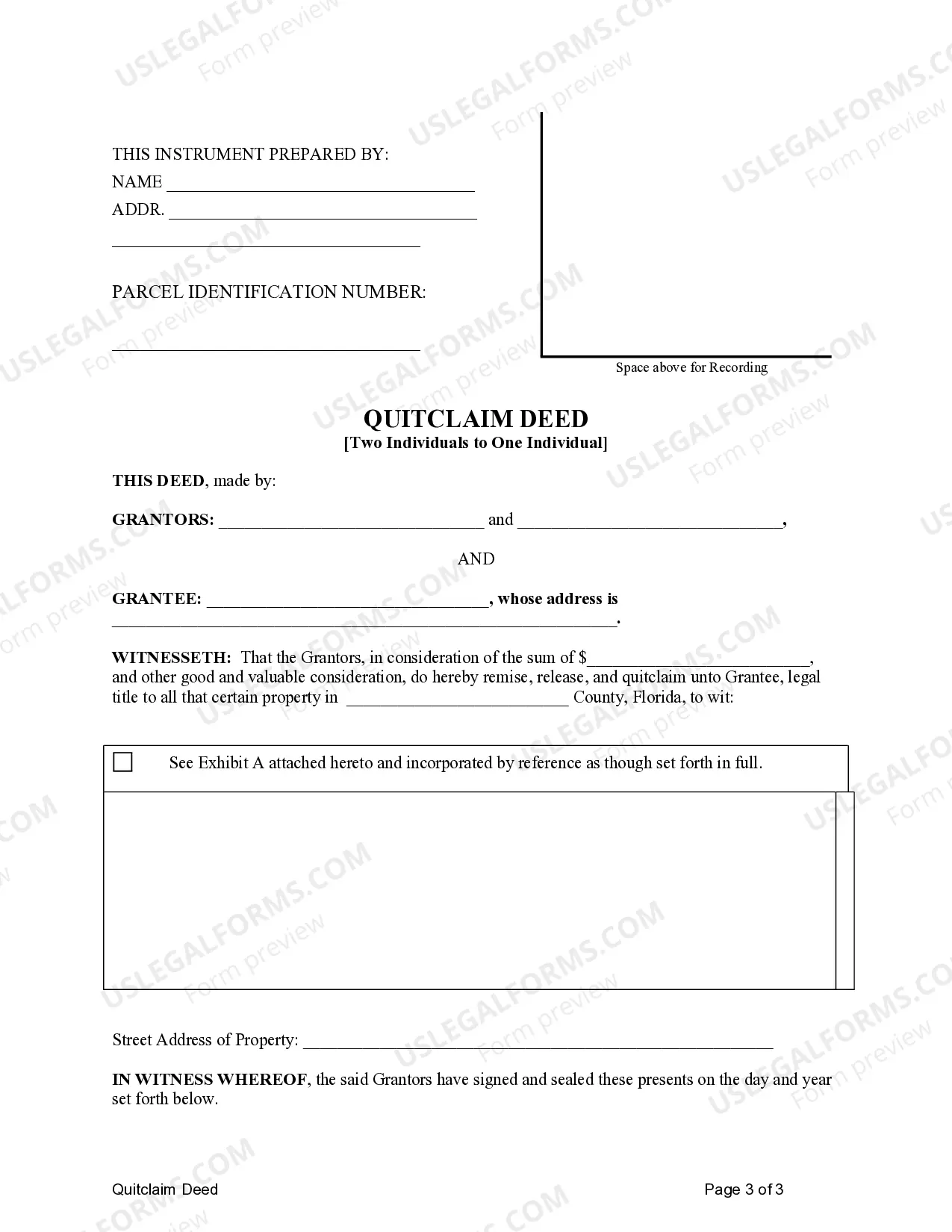

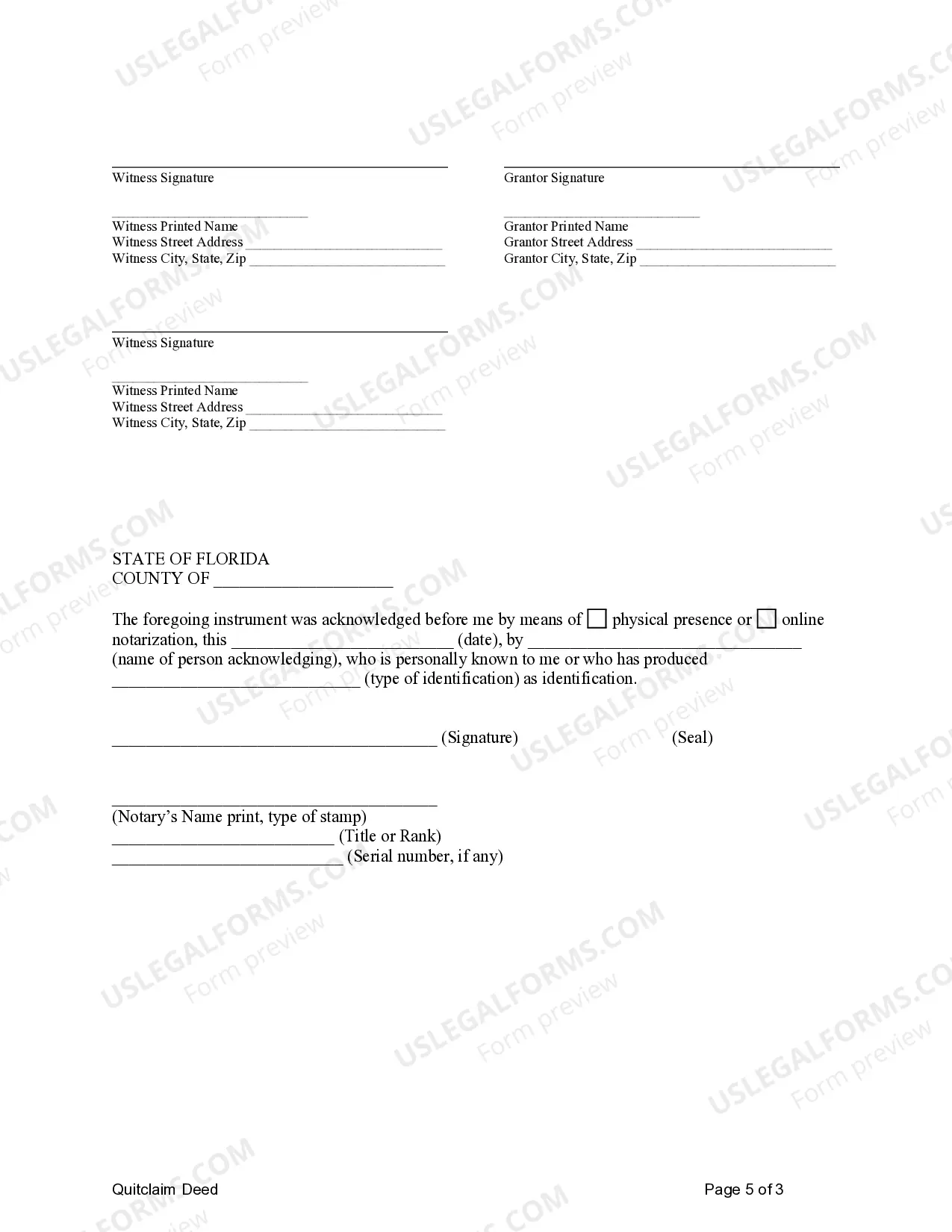

In Florida, timeshares are treated as real property. Real property ownership transfers are by deed. A deed is a paper, signed by the current owner to transfer the current owner's interest to a new owner. Florida requires the current owner's signature to be both acknowledged by a notary and witnessed by two individuals.

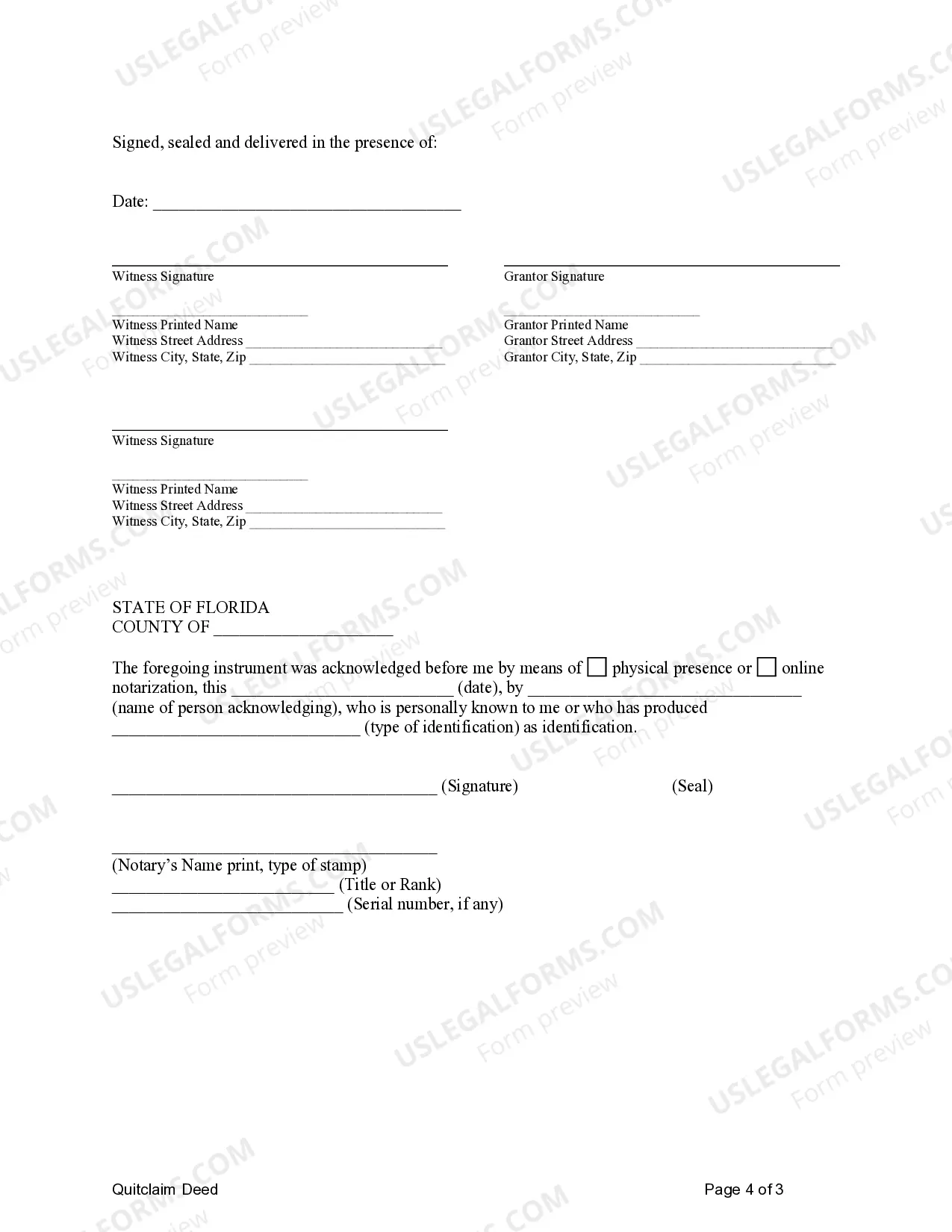

A person can file a quitclaim deed by (1) entering the relevant information on a quitclaim deed form, (2) signing the deed with two witnesses and a notary, and (3) recording the deed at the county comptroller's office. In Florida, quitclaim deeds must have the name and address of both the grantor and the grantee.

A new deed must be filed with the local clerk of court's office in order to change the name on a Florida deed, no matter the circumstances leading to the change. Marriages and divorces are some of the most common reasons to alter a deed in Florida. A death in the family may also necessitate a name change to a deed.

A person filing a deed for transfer of Florida real estate ownership must do so through the county comptroller's office where the property is located. There is a small fee for filing and a document stamp tax, which is an excise tax on legal documents delivered, executed or recorded in the state.

Filing With the Clerk A quit claim deed should be filed with the Clerk of Court in the county where the property is located. This will involve taking the deed to the Clerk's office and paying the required filing fee (typically about $10.00 for a one-page quit claim deed).

Cost of a Quitclaim Deed in Florida If you have any concerns about making the quitclaim deed legally correct, you could hire an attorney to write the deed. With an attorney, a quitclaim deed costs between $250 to $350 in most cases.

Despite the amounts involved, it is possible to transfer ownership of your property without money changing hands. This process can either be called a deed of gift or transfer of gift, both definitions mean the same thing. Executing a deed of gift can be a complex undertaking, but it isn't impossible.