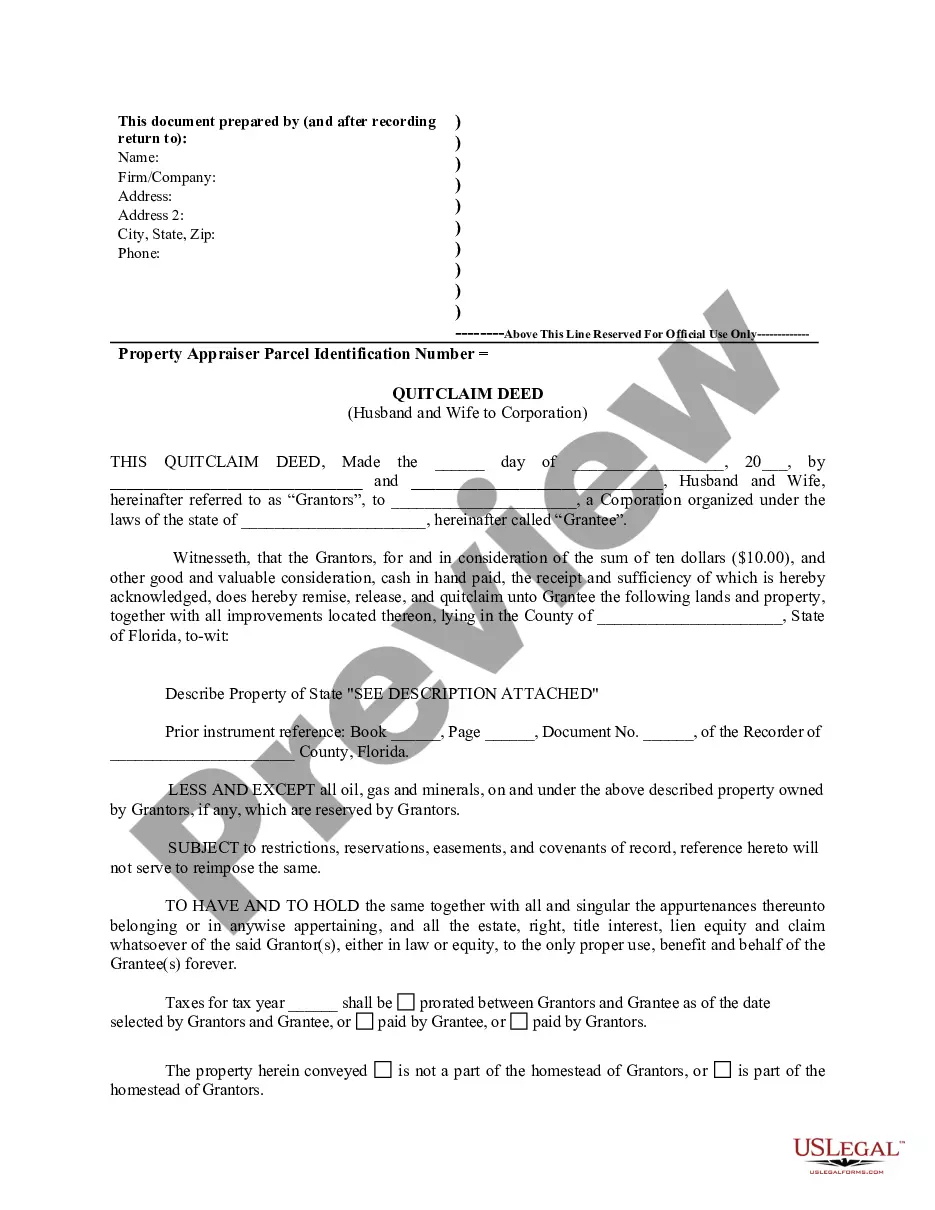

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation is a specific legal document that transfers ownership of a property from a married couple to a corporation through the use of a quitclaim deed. This type of deed grants ownership rights without any warranties or guarantees, only the release of the transferring parties' interest in the property. This means that the corporation will obtain the property in its current condition, with no guarantees regarding any potential liens, judgments, or claims against it. When it comes to different types of Cape Coral Florida Quitclaim Deeds from Husband and Wife to Corporation, there are several variations that may arise based on specific circumstances or requirements. Some of these variations include: 1. Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation with Full Disclosure: In this scenario, the married couple provides information about the property, including any known encumbrances or defects. This additional disclosure ensures that the corporation has full knowledge of the property's condition before accepting ownership. 2. Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation with Limited Warranty: This particular type of quitclaim deed offers the corporation a limited warranty regarding the quality of the title. In this case, the transferring parties guarantee that they have not encumbered the property themselves and that there are no undisclosed defects or claims. 3. Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation for Tax Purposes: This type of quitclaim deed might be used for tax planning or estate planning purposes. It involves the transfer of property ownership from a married couple to their corporation to gain tax benefits or to facilitate estate distribution. 4. Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation with Covenant of Further Assurance: This particular variation of the deed includes an added clause requiring the transferring parties to assist the corporation in obtaining any missing documents or curing any defects related to the title if they arise in the future. In conclusion, a Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation is a legal tool designed to transfer property ownership from a married couple to a corporation. The deed type may vary based on the level of disclosure, warranty, tax planning, or additional assurances involved in the transfer.A Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation is a specific legal document that transfers ownership of a property from a married couple to a corporation through the use of a quitclaim deed. This type of deed grants ownership rights without any warranties or guarantees, only the release of the transferring parties' interest in the property. This means that the corporation will obtain the property in its current condition, with no guarantees regarding any potential liens, judgments, or claims against it. When it comes to different types of Cape Coral Florida Quitclaim Deeds from Husband and Wife to Corporation, there are several variations that may arise based on specific circumstances or requirements. Some of these variations include: 1. Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation with Full Disclosure: In this scenario, the married couple provides information about the property, including any known encumbrances or defects. This additional disclosure ensures that the corporation has full knowledge of the property's condition before accepting ownership. 2. Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation with Limited Warranty: This particular type of quitclaim deed offers the corporation a limited warranty regarding the quality of the title. In this case, the transferring parties guarantee that they have not encumbered the property themselves and that there are no undisclosed defects or claims. 3. Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation for Tax Purposes: This type of quitclaim deed might be used for tax planning or estate planning purposes. It involves the transfer of property ownership from a married couple to their corporation to gain tax benefits or to facilitate estate distribution. 4. Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation with Covenant of Further Assurance: This particular variation of the deed includes an added clause requiring the transferring parties to assist the corporation in obtaining any missing documents or curing any defects related to the title if they arise in the future. In conclusion, a Cape Coral Florida Quitclaim Deed from Husband and Wife to Corporation is a legal tool designed to transfer property ownership from a married couple to a corporation. The deed type may vary based on the level of disclosure, warranty, tax planning, or additional assurances involved in the transfer.