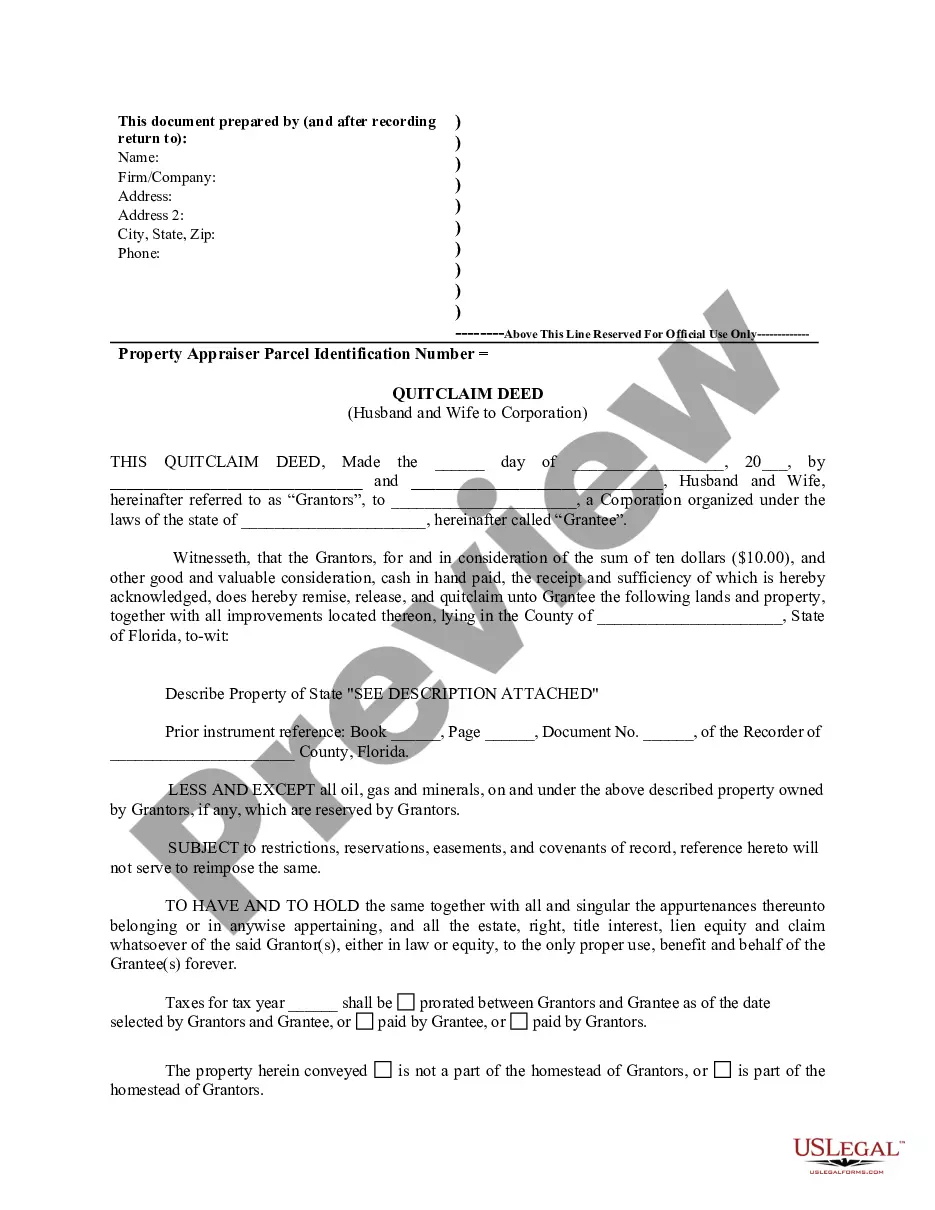

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Coral Springs Florida Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers ownership of real estate property from the spouses to a corporation through a quitclaim deed. This type of deed is commonly used when a husband and wife, as joint owners of a property, want to transfer their interest to a corporation they own or establish. In Coral Springs, Florida, there are two main types of Quitclaim Deeds from Husband and Wife to Corporation: 1. Individual-to-Corporation Quitclaim Deed: This type of deed is used when the husband and wife own the property as individuals, and they transfer their ownership rights jointly to a corporation solely owned by them. The purpose of such a transfer can be for asset protection, estate planning, or to facilitate business operations. 2. Jointly-owned-to-Corporation Quitclaim Deed: This variant of the quitclaim deed is employed when the husband and wife jointly own the property and want to transfer their shared interest to a corporation. This may occur when the spouses want to change the property's ownership structure, distribute shares among partners, or transfer the property to a newly formed corporation. The Coral Springs Florida Quitclaim Deed from Husband and Wife to Corporation typically includes the following information: 1. Identification: The deed will state the names and addresses of the husband and wife, along with their marital status. 2. Property Description: A detailed legal description of the property being transferred, including its address, lot number, and any relevant survey information. 3. Consideration: The amount of money or other consideration, if any, exchanged between the spouses and the corporation for the transfer of the property. 4. Granting Clause: A clear and concise statement indicating that the husband and wife, as granters, "quitclaim" their interest in the property to the corporation, as the grantee. 5. Signatures: The husband, wife, and corporate representatives must sign the deed in the presence of a notary public to make it legally binding. 6. Recording Information: The deed should include a statement indicating the desired county recorder's office for recording purposes. It's essential to note that while Quitclaim Deeds from Husband and Wife to Corporation are commonly used in Coral Springs, Florida, seeking legal advice is crucial before executing such a transfer. This ensures compliance with specific state laws and regulations and guarantees the proper legal execution of the deed. Keywords: Coral Springs Florida, Quitclaim Deed, Husband and Wife, Corporation, Individual-to-Corporation Transfer, Jointly-owned-to-Corporation Transfer, Real Estate, Property Ownership, Legal Document, Asset Protection, Estate Planning, Business Operations, Ownership Structure, Recording Information.A Coral Springs Florida Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers ownership of real estate property from the spouses to a corporation through a quitclaim deed. This type of deed is commonly used when a husband and wife, as joint owners of a property, want to transfer their interest to a corporation they own or establish. In Coral Springs, Florida, there are two main types of Quitclaim Deeds from Husband and Wife to Corporation: 1. Individual-to-Corporation Quitclaim Deed: This type of deed is used when the husband and wife own the property as individuals, and they transfer their ownership rights jointly to a corporation solely owned by them. The purpose of such a transfer can be for asset protection, estate planning, or to facilitate business operations. 2. Jointly-owned-to-Corporation Quitclaim Deed: This variant of the quitclaim deed is employed when the husband and wife jointly own the property and want to transfer their shared interest to a corporation. This may occur when the spouses want to change the property's ownership structure, distribute shares among partners, or transfer the property to a newly formed corporation. The Coral Springs Florida Quitclaim Deed from Husband and Wife to Corporation typically includes the following information: 1. Identification: The deed will state the names and addresses of the husband and wife, along with their marital status. 2. Property Description: A detailed legal description of the property being transferred, including its address, lot number, and any relevant survey information. 3. Consideration: The amount of money or other consideration, if any, exchanged between the spouses and the corporation for the transfer of the property. 4. Granting Clause: A clear and concise statement indicating that the husband and wife, as granters, "quitclaim" their interest in the property to the corporation, as the grantee. 5. Signatures: The husband, wife, and corporate representatives must sign the deed in the presence of a notary public to make it legally binding. 6. Recording Information: The deed should include a statement indicating the desired county recorder's office for recording purposes. It's essential to note that while Quitclaim Deeds from Husband and Wife to Corporation are commonly used in Coral Springs, Florida, seeking legal advice is crucial before executing such a transfer. This ensures compliance with specific state laws and regulations and guarantees the proper legal execution of the deed. Keywords: Coral Springs Florida, Quitclaim Deed, Husband and Wife, Corporation, Individual-to-Corporation Transfer, Jointly-owned-to-Corporation Transfer, Real Estate, Property Ownership, Legal Document, Asset Protection, Estate Planning, Business Operations, Ownership Structure, Recording Information.