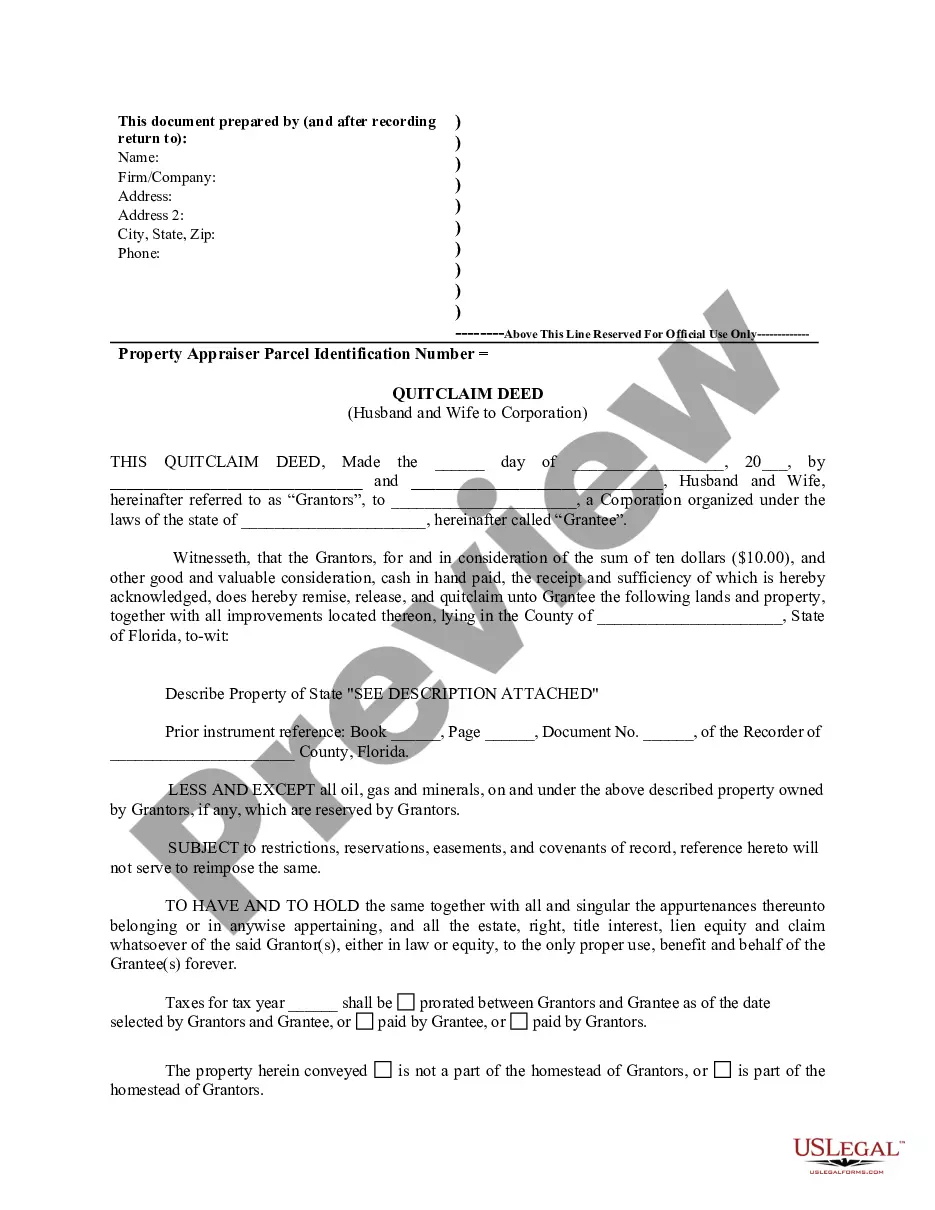

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Fort Lauderdale Florida Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of a property from a married couple to a corporation. This type of deed is often used when the couple wants to transfer the property ownership to a corporate entity they own or are affiliated with, typically for business or liability protection purposes. In Fort Lauderdale, Florida, there are different variations of Quitclaim Deeds from Husband and Wife to Corporation that cater to various scenarios and legal requirements. Some of these types include: 1. Individual to Corporation Quitclaim Deed: This is the most common type of quitclaim deed where both spouses jointly transfer their ownership rights in a property to their corporation. 2. Tenancy in Common to Corporation Quitclaim Deed: This type of deed is used when the couple owns the property as tenants in common, meaning they have equal ownership rights. In this case, they can transfer their respective shares in the property to the corporation. 3. Joint Tenancy with Right of Survivorship to Corporation Quitclaim Deed: If the property is owned by the couple as joint tenants with the right of survivorship, they can transfer their interest to the corporation while still maintaining the survivorship right. 4. Life Estate to Corporation Quitclaim Deed: In some cases, the couple may have a life estate interest in the property, which grants them the right to live on the property until their death. They can transfer this life estate to the corporation through a quitclaim deed, allowing the corporation to take ownership after their passing. It is essential to consult with a qualified real estate attorney in Fort Lauderdale, Florida, to ensure the correct type of quitclaim deed is used based on the specific circumstances. This will help to ensure the legality and accuracy of the deed transfer, as well as protect the rights and interests of both the couple and the corporation involved.A Fort Lauderdale Florida Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of a property from a married couple to a corporation. This type of deed is often used when the couple wants to transfer the property ownership to a corporate entity they own or are affiliated with, typically for business or liability protection purposes. In Fort Lauderdale, Florida, there are different variations of Quitclaim Deeds from Husband and Wife to Corporation that cater to various scenarios and legal requirements. Some of these types include: 1. Individual to Corporation Quitclaim Deed: This is the most common type of quitclaim deed where both spouses jointly transfer their ownership rights in a property to their corporation. 2. Tenancy in Common to Corporation Quitclaim Deed: This type of deed is used when the couple owns the property as tenants in common, meaning they have equal ownership rights. In this case, they can transfer their respective shares in the property to the corporation. 3. Joint Tenancy with Right of Survivorship to Corporation Quitclaim Deed: If the property is owned by the couple as joint tenants with the right of survivorship, they can transfer their interest to the corporation while still maintaining the survivorship right. 4. Life Estate to Corporation Quitclaim Deed: In some cases, the couple may have a life estate interest in the property, which grants them the right to live on the property until their death. They can transfer this life estate to the corporation through a quitclaim deed, allowing the corporation to take ownership after their passing. It is essential to consult with a qualified real estate attorney in Fort Lauderdale, Florida, to ensure the correct type of quitclaim deed is used based on the specific circumstances. This will help to ensure the legality and accuracy of the deed transfer, as well as protect the rights and interests of both the couple and the corporation involved.