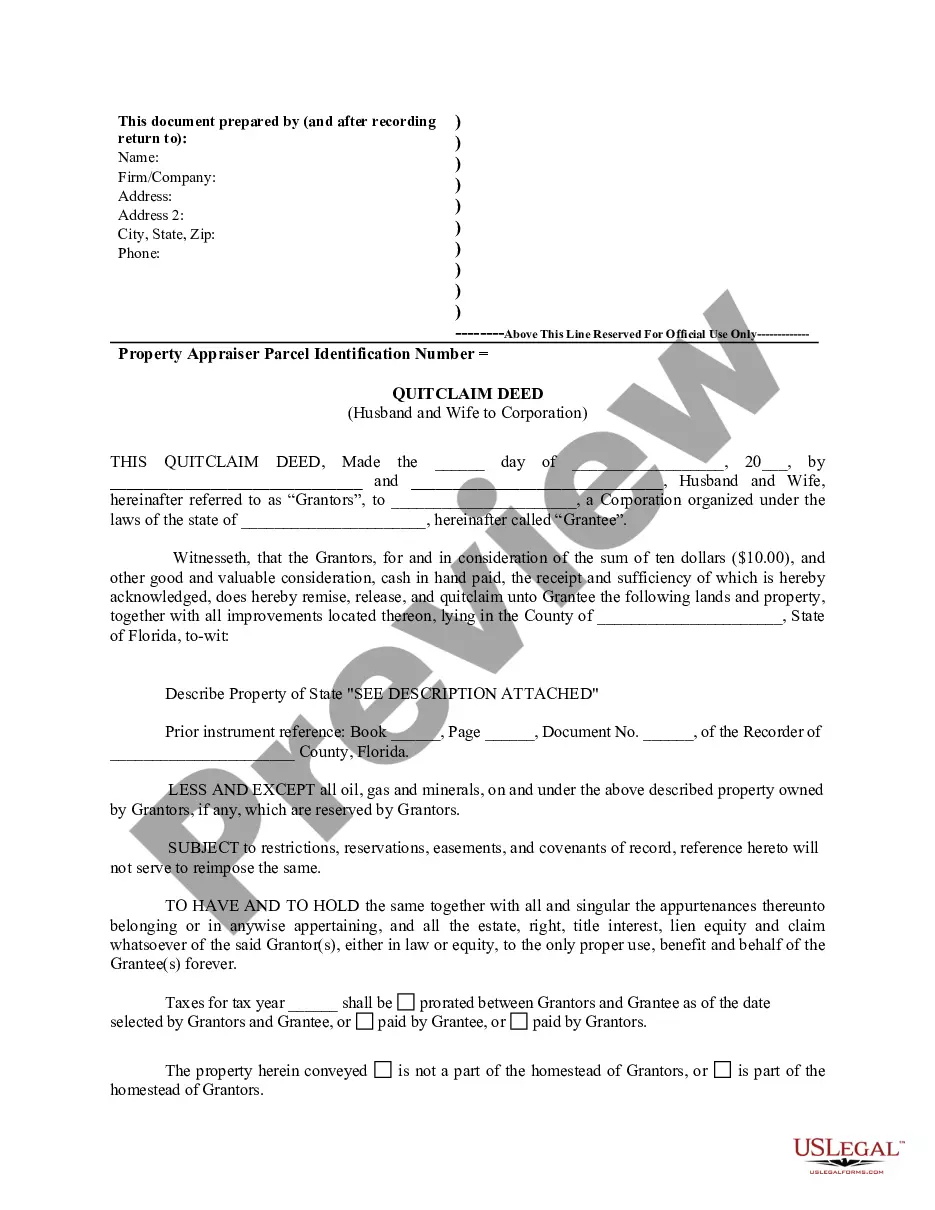

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Lakeland Florida Quitclaim Deed from Husband and Wife to Corporation is a legal document that allows a married couple to transfer their ownership rights and interests in a property to a corporation through a quitclaim deed. This type of transfer is often done for various reasons, such as asset protection, estate planning, or business purposes. In this type of deed, the husband and wife, known as granters, relinquish their ownership rights, title, and interest in the property to the corporation, known as the grantee. The corporation then becomes the new owner of the property, assuming all rights and responsibilities associated with it. There are different variations or types of Lakeland Florida Quitclaim Deed from Husband and Wife to Corporation that can be used for specific circumstances. Some of these variations include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed where the husband and wife transfer their ownership rights to the corporation without any warranties or guarantees regarding the property's title or condition. It is typically used when there is a preexisting relationship between the granters and the grantee. 2. Special Warranty Quitclaim Deed: This type of deed provides limited warranties or guarantees by the husband and wife stating that they have not done anything to harm the title of the property during their ownership. It offers some level of protection to the grantee in case of undisclosed liens or encumbrances. 3. Enhanced Life Estate Quitclaim Deed: Also known as a Lady Bird Deed, this variation of quitclaim deed allows the husband and wife to transfer the property to the corporation while retaining a life estate, which means they can live on the property until their death. This type of deed provides certain advantages for estate planning purposes, as it avoids probate and allows for seamless transfer of ownership after the granter's death. It is crucial to seek the guidance of an experienced attorney when preparing a Lakeland Florida Quitclaim Deed from Husband and Wife to Corporation, as the specific requirements and legal implications may vary depending on the circumstances and jurisdiction. Hiring a knowledgeable professional ensures the deed complies with all applicable laws and protects the interests of all parties involved.A Lakeland Florida Quitclaim Deed from Husband and Wife to Corporation is a legal document that allows a married couple to transfer their ownership rights and interests in a property to a corporation through a quitclaim deed. This type of transfer is often done for various reasons, such as asset protection, estate planning, or business purposes. In this type of deed, the husband and wife, known as granters, relinquish their ownership rights, title, and interest in the property to the corporation, known as the grantee. The corporation then becomes the new owner of the property, assuming all rights and responsibilities associated with it. There are different variations or types of Lakeland Florida Quitclaim Deed from Husband and Wife to Corporation that can be used for specific circumstances. Some of these variations include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed where the husband and wife transfer their ownership rights to the corporation without any warranties or guarantees regarding the property's title or condition. It is typically used when there is a preexisting relationship between the granters and the grantee. 2. Special Warranty Quitclaim Deed: This type of deed provides limited warranties or guarantees by the husband and wife stating that they have not done anything to harm the title of the property during their ownership. It offers some level of protection to the grantee in case of undisclosed liens or encumbrances. 3. Enhanced Life Estate Quitclaim Deed: Also known as a Lady Bird Deed, this variation of quitclaim deed allows the husband and wife to transfer the property to the corporation while retaining a life estate, which means they can live on the property until their death. This type of deed provides certain advantages for estate planning purposes, as it avoids probate and allows for seamless transfer of ownership after the granter's death. It is crucial to seek the guidance of an experienced attorney when preparing a Lakeland Florida Quitclaim Deed from Husband and Wife to Corporation, as the specific requirements and legal implications may vary depending on the circumstances and jurisdiction. Hiring a knowledgeable professional ensures the deed complies with all applicable laws and protects the interests of all parties involved.