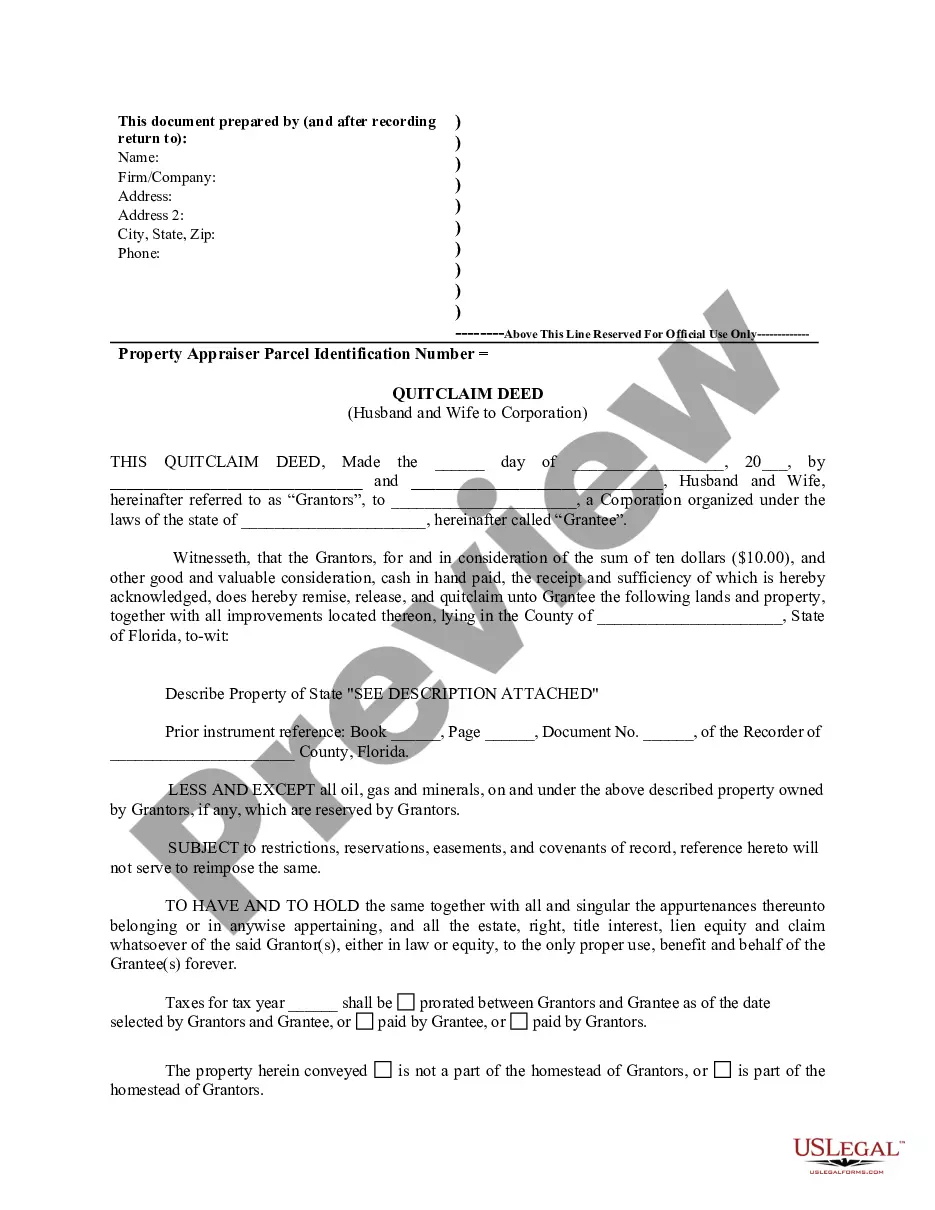

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Palm Bay Florida Quitclaim Deed from Husband and Wife to a Corporation is a legal document used to transfer ownership of real estate property from a married couple to a corporation, using a quitclaim deed method. This type of deed is commonly used when a husband and wife who jointly own property wish to transfer it to a corporation they own or are establishing. In Palm Bay, Florida, there are different types of Quitclaim Deeds from Husband and Wife to a Corporation that can be used, depending on the specific circumstances. Here are some variations: 1. Husband and Wife Quitclaim Deed to Corporation: This is a straightforward transfer where both spouses transfer their individual ownership rights simultaneously to the corporation. It ensures that the corporation becomes the sole owner of the property. 2. Joint Tenancy with Right of Survivorship Deed to Corporation: In some cases, the husband and wife might hold the property in joint tenancy with a right of survivorship. With this type of deed, if one spouse passes away, the property automatically transfers to the surviving spouse. If both spouses pass away, the property goes to the corporation as indicated in the deed. 3. Tenancy by the Entire ties Quitclaim Deed to Corporation: In Florida, married couples can hold property as tenants by the entire ties, which provides certain legal protections and benefits. If the couple wishes to transfer the property to their corporation, they can execute a Tenancy by the Entire ties Quitclaim Deed to transfer their shared ownership to the corporation. 4. Community Property Quitclaim Deed to Corporation: For married couples who acquired property during marriage in a community property state, such as California or Texas, executing a Community Property Quitclaim Deed might be applicable. This deed allows both spouses to transfer their community property rights to the corporation. When preparing a Palm Bay Florida Quitclaim Deed from Husband and Wife to Corporation, it is imperative to include accurate information such as the complete legal names of the husband, wife, and the exact corporate name. Additionally, the property's legal description, address, and tax identification number must be included. Lastly, the deed needs to be signed by both spouses and notarized in the presence of witnesses to ensure its validity. Consulting a qualified attorney or real estate professional experienced in Palm Bay, Florida, is recommended to ensure the proper execution and recording of the deed, as well as to provide individualized advice based on specific circumstances.A Palm Bay Florida Quitclaim Deed from Husband and Wife to a Corporation is a legal document used to transfer ownership of real estate property from a married couple to a corporation, using a quitclaim deed method. This type of deed is commonly used when a husband and wife who jointly own property wish to transfer it to a corporation they own or are establishing. In Palm Bay, Florida, there are different types of Quitclaim Deeds from Husband and Wife to a Corporation that can be used, depending on the specific circumstances. Here are some variations: 1. Husband and Wife Quitclaim Deed to Corporation: This is a straightforward transfer where both spouses transfer their individual ownership rights simultaneously to the corporation. It ensures that the corporation becomes the sole owner of the property. 2. Joint Tenancy with Right of Survivorship Deed to Corporation: In some cases, the husband and wife might hold the property in joint tenancy with a right of survivorship. With this type of deed, if one spouse passes away, the property automatically transfers to the surviving spouse. If both spouses pass away, the property goes to the corporation as indicated in the deed. 3. Tenancy by the Entire ties Quitclaim Deed to Corporation: In Florida, married couples can hold property as tenants by the entire ties, which provides certain legal protections and benefits. If the couple wishes to transfer the property to their corporation, they can execute a Tenancy by the Entire ties Quitclaim Deed to transfer their shared ownership to the corporation. 4. Community Property Quitclaim Deed to Corporation: For married couples who acquired property during marriage in a community property state, such as California or Texas, executing a Community Property Quitclaim Deed might be applicable. This deed allows both spouses to transfer their community property rights to the corporation. When preparing a Palm Bay Florida Quitclaim Deed from Husband and Wife to Corporation, it is imperative to include accurate information such as the complete legal names of the husband, wife, and the exact corporate name. Additionally, the property's legal description, address, and tax identification number must be included. Lastly, the deed needs to be signed by both spouses and notarized in the presence of witnesses to ensure its validity. Consulting a qualified attorney or real estate professional experienced in Palm Bay, Florida, is recommended to ensure the proper execution and recording of the deed, as well as to provide individualized advice based on specific circumstances.