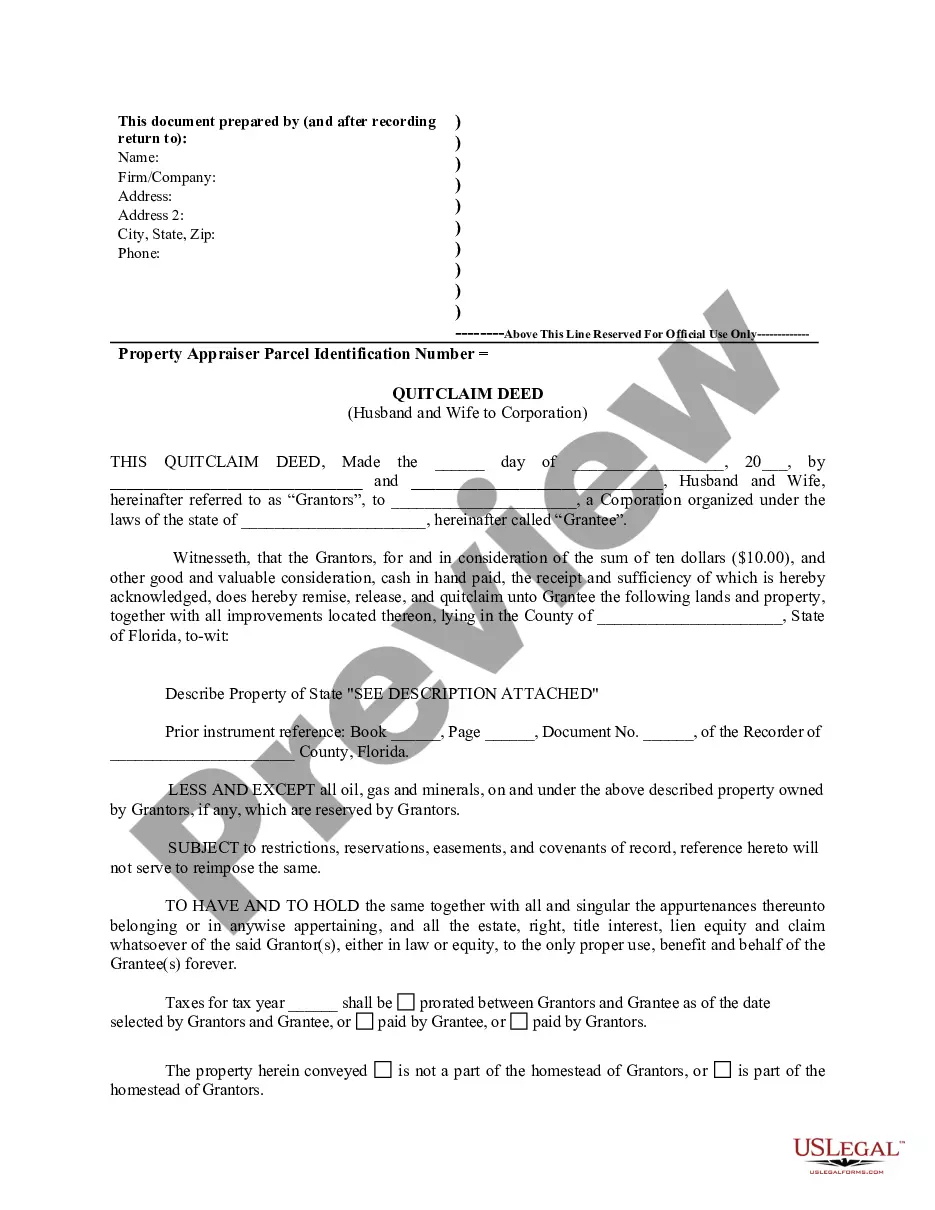

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Palm Beach Florida Quitclaim Deed from Husband and Wife to a Corporation, also known as a quitclaim deed with joint tenancy, is a legal document that allows a married couple to transfer ownership of a property to a corporation, thereby changing the property's ownership structure. This type of deed is commonly used in real estate transactions and can have various variations, including a Special Warranty Deed from Husband and Wife to Corporation or a General Warranty Deed from Husband and Wife to Corporation. In Palm Beach, Florida, the quitclaim deed from Husband and Wife to a Corporation ensures a clear transfer of ownership rights, making it essential for both parties involved. This legally binding document relinquishes the ownership interest of the husband and wife, known as the granters, and transfers it to the corporation, referred to as the grantee. It is important to note that a quitclaim deed does not guarantee that the property is free of any liens or encumbrances, unlike a warranty deed, which provides additional protections. When executing a Palm Beach Florida Quitclaim Deed from Husband and Wife to a Corporation, several key elements should be included. The document must clearly state the names of the granters, who are the husband and wife, along with their marital status. The granters should disclose their intention to convey the property's ownership rights to the named corporation as the grantee. The property's complete and accurate legal description, including the address, should also be provided. Additionally, the quitclaim deed should contain the consideration, or value, provided by the corporation in exchange for the property. This value can be monetary or non-monetary and should be mentioned to ensure a valid transfer. Both the husband and wife must sign the deed in the presence of a notary public, who will authenticate their signatures and ensure the document's legality. The Palm Beach Florida Quitclaim Deed from Husband and Wife to a Corporation offers several benefits to both parties involved. For the husband and wife, it allows them to transfer their ownership interest without the need for an actual sale, simplifying the process. Moreover, it ensures that the corporation becomes the sole owner, taking on any future responsibility or liability associated with the property. For the corporation, acquiring a property through a quitclaim deed presents an opportunity for investment or expansion of its real estate portfolio. It provides the corporation with a legally recognized ownership interest, allowing them to exercise various rights and responsibilities associated with property ownership. In conclusion, a Palm Beach Florida Quitclaim Deed from Husband and Wife to a Corporation is a legal document that facilitates the transfer of ownership rights from a married couple to a corporation. It is crucial to have this deed properly executed and filed with the appropriate authorities to ensure a legitimate and transparent transfer of property ownership.A Palm Beach Florida Quitclaim Deed from Husband and Wife to a Corporation, also known as a quitclaim deed with joint tenancy, is a legal document that allows a married couple to transfer ownership of a property to a corporation, thereby changing the property's ownership structure. This type of deed is commonly used in real estate transactions and can have various variations, including a Special Warranty Deed from Husband and Wife to Corporation or a General Warranty Deed from Husband and Wife to Corporation. In Palm Beach, Florida, the quitclaim deed from Husband and Wife to a Corporation ensures a clear transfer of ownership rights, making it essential for both parties involved. This legally binding document relinquishes the ownership interest of the husband and wife, known as the granters, and transfers it to the corporation, referred to as the grantee. It is important to note that a quitclaim deed does not guarantee that the property is free of any liens or encumbrances, unlike a warranty deed, which provides additional protections. When executing a Palm Beach Florida Quitclaim Deed from Husband and Wife to a Corporation, several key elements should be included. The document must clearly state the names of the granters, who are the husband and wife, along with their marital status. The granters should disclose their intention to convey the property's ownership rights to the named corporation as the grantee. The property's complete and accurate legal description, including the address, should also be provided. Additionally, the quitclaim deed should contain the consideration, or value, provided by the corporation in exchange for the property. This value can be monetary or non-monetary and should be mentioned to ensure a valid transfer. Both the husband and wife must sign the deed in the presence of a notary public, who will authenticate their signatures and ensure the document's legality. The Palm Beach Florida Quitclaim Deed from Husband and Wife to a Corporation offers several benefits to both parties involved. For the husband and wife, it allows them to transfer their ownership interest without the need for an actual sale, simplifying the process. Moreover, it ensures that the corporation becomes the sole owner, taking on any future responsibility or liability associated with the property. For the corporation, acquiring a property through a quitclaim deed presents an opportunity for investment or expansion of its real estate portfolio. It provides the corporation with a legally recognized ownership interest, allowing them to exercise various rights and responsibilities associated with property ownership. In conclusion, a Palm Beach Florida Quitclaim Deed from Husband and Wife to a Corporation is a legal document that facilitates the transfer of ownership rights from a married couple to a corporation. It is crucial to have this deed properly executed and filed with the appropriate authorities to ensure a legitimate and transparent transfer of property ownership.