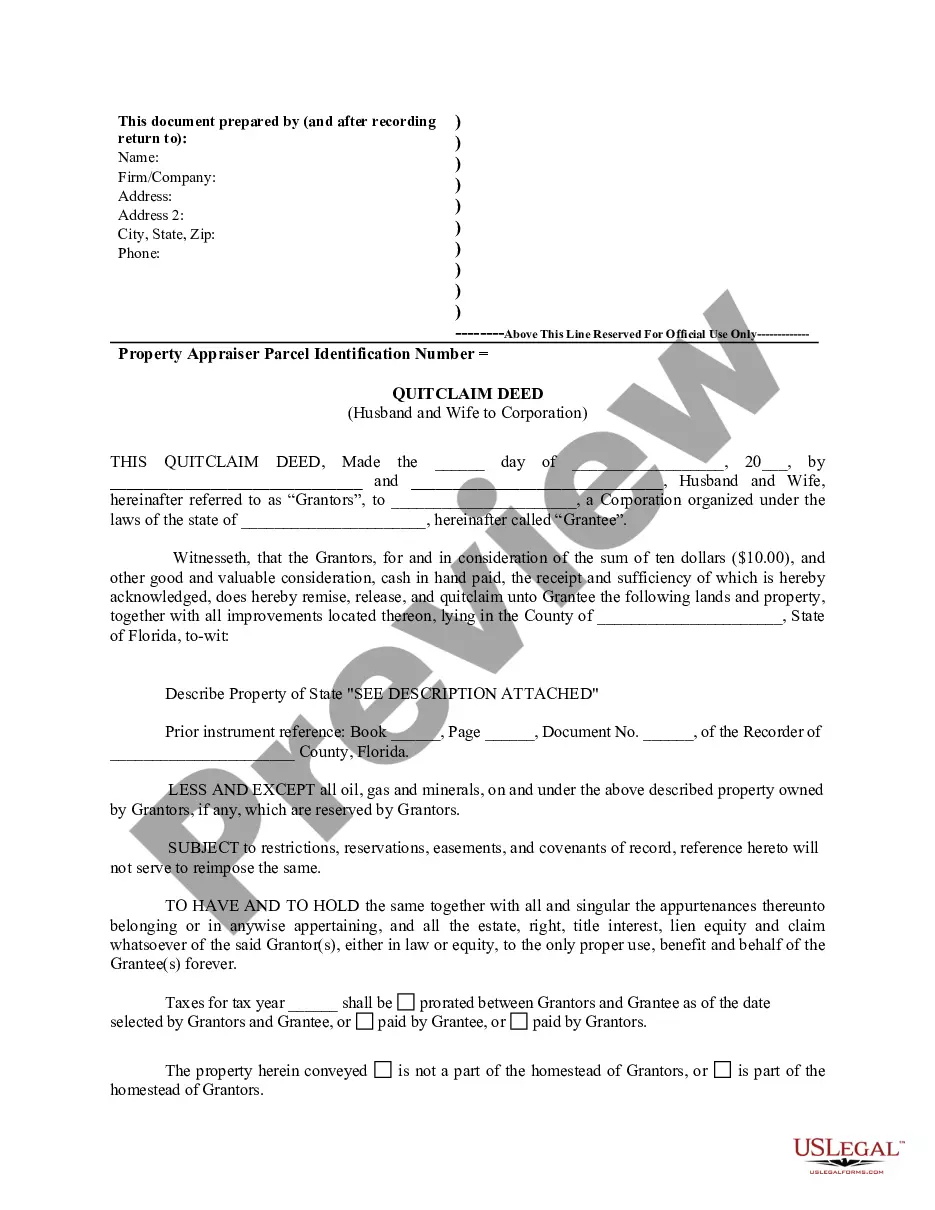

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Pembroke Pines Florida Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers ownership of a property from a married couple to a corporation, using a quitclaim deed. This type of deed allows the couple to transfer their interest in the property to the corporation without making any warranties or guarantees about the property's title. The Pembroke Pines Florida Quitclaim Deed from Husband and Wife to Corporation is typically used when a married couple wants to transfer ownership of their property to a corporation that they own or are affiliated with. This can be done for various reasons, such as asset protection, tax purposes, or to facilitate business operations. When executing this type of quitclaim deed, it is crucial to ensure compliance with the specific legal requirements in Pembroke Pines, Florida. It is advisable to consult with an attorney to draft the deed correctly and ensure a smooth transfer of ownership. Different types of Pembroke Pines Florida Quitclaim Deed from Husband and Wife to Corporation may include: 1. Standard Quitclaim Deed: This type of deed transfers the property ownership from the husband and wife to the corporation. It is the most common form of quitclaim deed used in Pembroke Pines, Florida. 2. Joint Tenancy with Right of Survivorship Quitclaim Deed: If the husband and wife hold the property as joint tenants with right of survivorship, they can transfer their ownership interest to the corporation using this type of quitclaim deed. This ensures that the surviving spouse retains ownership upon the death of the other spouse. 3. Tenancy by the Entirety Quitclaim Deed: If the husband and wife hold the property as tenants by the entirety, they can execute this type of quitclaim deed to transfer their shared ownership interest to the corporation. Tenancy by the entirety provides certain legal protections and inheritance rights for married couples. Executing a Pembroke Pines Florida Quitclaim Deed from Husband and Wife to Corporation requires careful consideration and adherence to legal requirements. It is essential to consult with an experienced attorney to ensure compliance with state laws and to protect all parties involved in the property transfer.A Pembroke Pines Florida Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers ownership of a property from a married couple to a corporation, using a quitclaim deed. This type of deed allows the couple to transfer their interest in the property to the corporation without making any warranties or guarantees about the property's title. The Pembroke Pines Florida Quitclaim Deed from Husband and Wife to Corporation is typically used when a married couple wants to transfer ownership of their property to a corporation that they own or are affiliated with. This can be done for various reasons, such as asset protection, tax purposes, or to facilitate business operations. When executing this type of quitclaim deed, it is crucial to ensure compliance with the specific legal requirements in Pembroke Pines, Florida. It is advisable to consult with an attorney to draft the deed correctly and ensure a smooth transfer of ownership. Different types of Pembroke Pines Florida Quitclaim Deed from Husband and Wife to Corporation may include: 1. Standard Quitclaim Deed: This type of deed transfers the property ownership from the husband and wife to the corporation. It is the most common form of quitclaim deed used in Pembroke Pines, Florida. 2. Joint Tenancy with Right of Survivorship Quitclaim Deed: If the husband and wife hold the property as joint tenants with right of survivorship, they can transfer their ownership interest to the corporation using this type of quitclaim deed. This ensures that the surviving spouse retains ownership upon the death of the other spouse. 3. Tenancy by the Entirety Quitclaim Deed: If the husband and wife hold the property as tenants by the entirety, they can execute this type of quitclaim deed to transfer their shared ownership interest to the corporation. Tenancy by the entirety provides certain legal protections and inheritance rights for married couples. Executing a Pembroke Pines Florida Quitclaim Deed from Husband and Wife to Corporation requires careful consideration and adherence to legal requirements. It is essential to consult with an experienced attorney to ensure compliance with state laws and to protect all parties involved in the property transfer.