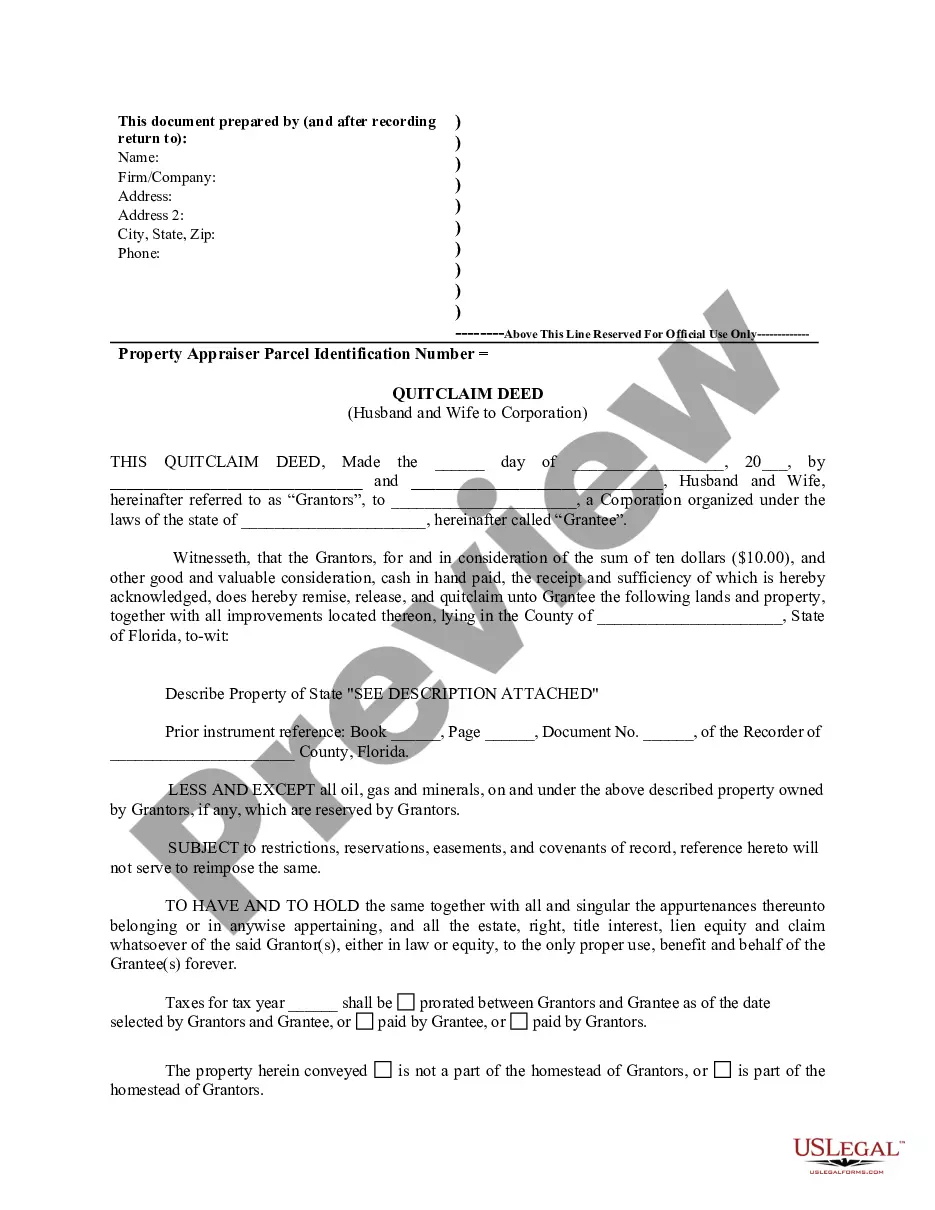

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Port St. Lucie, Florida quitclaim deed from husband and wife to a corporation is a legal document that transfers the ownership of a property from a married couple to a corporation. This type of deed is commonly used when a husband and wife wish to transfer the property they own jointly to a corporation, often for business or estate planning purposes. Here are some important details to consider: 1. Purpose: The primary purpose of executing a quitclaim deed is to convey the property's ownership rights from the husband and wife to a corporation. This legal transaction ensures that the property is now solely owned by the corporation. 2. Transfer Process: The transfer of ownership is initiated by the husband and wife, who act as the granters, whereas the corporation is the grantee. The transfer occurs by completion and filing of the quitclaim deed with the St. Lucie County Clerk's office. 3. Property Details: The quitclaim deed should accurately identify the property being transferred. This includes the complete legal description, which typically includes details such as lot number, block number, subdivision name, and any other applicable information that uniquely identifies the property. 4. Consideration: A Port St. Lucie quitclaim deed usually requires a consideration clause, which states the value exchanged between the husband and wife as granters and the corporation as the grantee. Typically, this states that the consideration is "for the sum of $1 and other valuable consideration." 5. Signatures and Notarization: Both the husband and wife, as the granters, must sign the quitclaim deed in the presence of a notary public. The notary public will then acknowledge their signatures, certifying that they signed willingly and voluntarily. Types of Port St. Lucie, Florida Quitclaim Deed from Husband and Wife to Corporation: 1. General Quitclaim Deed: This is the most common type, wherein the husband and wife transfer the full ownership rights of the property to the corporation without any specific conditions or restrictions. 2. Special Quitclaim Deed: In some cases, the husband and wife may wish to impose certain restrictions or conditions on the use of the property. This type of deed allows for the transfer of ownership to the corporation while specifying these conditions. 3. Enhanced Life Estate Quitclaim Deed: Occasionally, the husband and wife may want to transfer ownership to the corporation but retain a life estate, which grants them the right to live in the property until their passing. Upon their death, the property would be fully owned by the corporation. Executing a Port St. Lucie, Florida quitclaim deed from husband and wife to a corporation requires careful review and understanding of all legal implications. It is recommended to consult with a qualified real estate attorney to ensure compliance with all relevant laws and to protect the interests of all parties involved.A Port St. Lucie, Florida quitclaim deed from husband and wife to a corporation is a legal document that transfers the ownership of a property from a married couple to a corporation. This type of deed is commonly used when a husband and wife wish to transfer the property they own jointly to a corporation, often for business or estate planning purposes. Here are some important details to consider: 1. Purpose: The primary purpose of executing a quitclaim deed is to convey the property's ownership rights from the husband and wife to a corporation. This legal transaction ensures that the property is now solely owned by the corporation. 2. Transfer Process: The transfer of ownership is initiated by the husband and wife, who act as the granters, whereas the corporation is the grantee. The transfer occurs by completion and filing of the quitclaim deed with the St. Lucie County Clerk's office. 3. Property Details: The quitclaim deed should accurately identify the property being transferred. This includes the complete legal description, which typically includes details such as lot number, block number, subdivision name, and any other applicable information that uniquely identifies the property. 4. Consideration: A Port St. Lucie quitclaim deed usually requires a consideration clause, which states the value exchanged between the husband and wife as granters and the corporation as the grantee. Typically, this states that the consideration is "for the sum of $1 and other valuable consideration." 5. Signatures and Notarization: Both the husband and wife, as the granters, must sign the quitclaim deed in the presence of a notary public. The notary public will then acknowledge their signatures, certifying that they signed willingly and voluntarily. Types of Port St. Lucie, Florida Quitclaim Deed from Husband and Wife to Corporation: 1. General Quitclaim Deed: This is the most common type, wherein the husband and wife transfer the full ownership rights of the property to the corporation without any specific conditions or restrictions. 2. Special Quitclaim Deed: In some cases, the husband and wife may wish to impose certain restrictions or conditions on the use of the property. This type of deed allows for the transfer of ownership to the corporation while specifying these conditions. 3. Enhanced Life Estate Quitclaim Deed: Occasionally, the husband and wife may want to transfer ownership to the corporation but retain a life estate, which grants them the right to live in the property until their passing. Upon their death, the property would be fully owned by the corporation. Executing a Port St. Lucie, Florida quitclaim deed from husband and wife to a corporation requires careful review and understanding of all legal implications. It is recommended to consult with a qualified real estate attorney to ensure compliance with all relevant laws and to protect the interests of all parties involved.