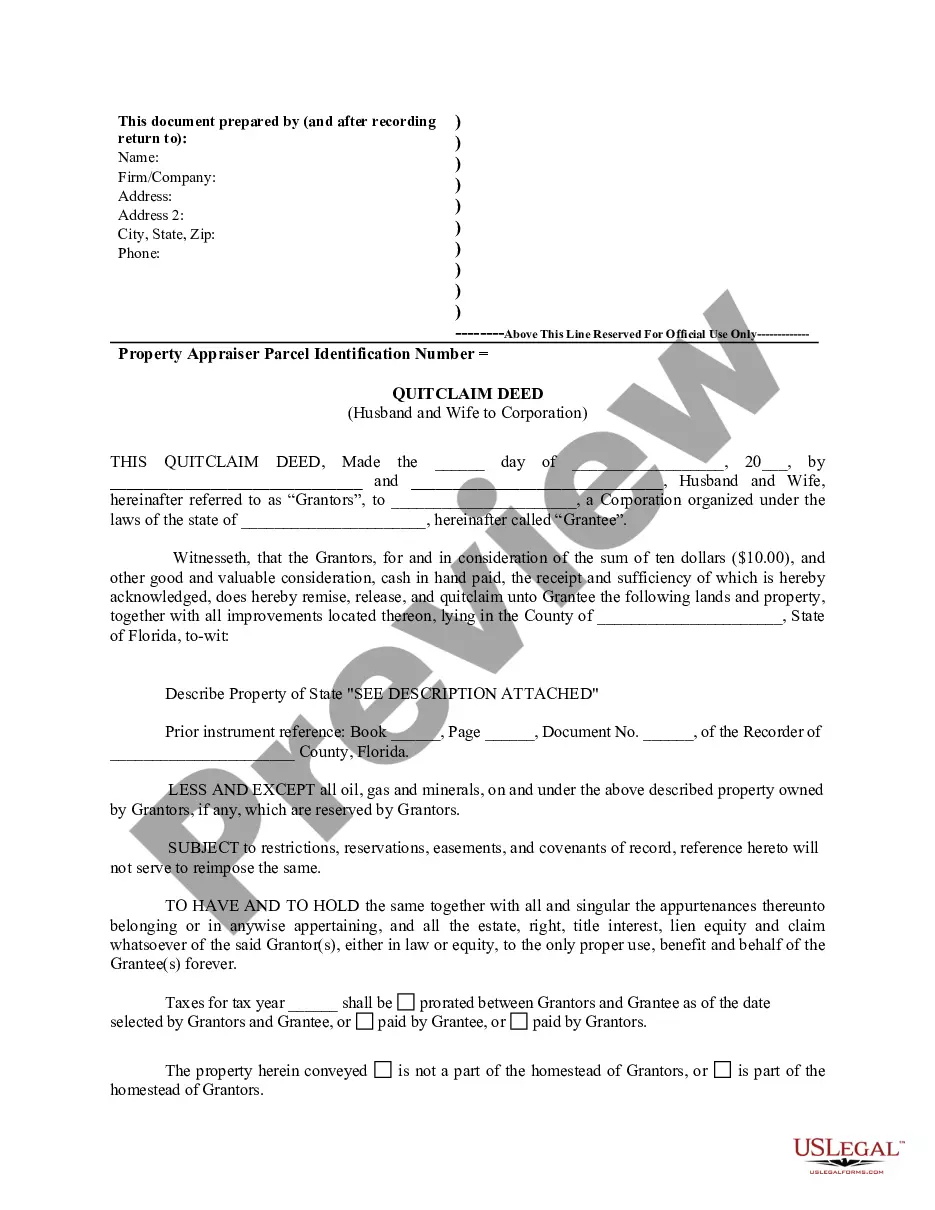

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A West Palm Beach Florida Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers ownership of real estate property from a couple (husband and wife) to a corporation. This type of deed is commonly used when the property is jointly owned by the couple, and they wish to transfer ownership to their corporation. In West Palm Beach, Florida, there are different types of Quitclaim Deeds from Husband and Wife to Corporation, which may include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used when transferring property ownership. It transfers the couple's rights and interests in the property to the corporation without any warranties or guarantees. 2. Special Warranty Quitclaim Deed: This type of quitclaim deed provides a limited warranty by the granters (husband and wife). It ensures that they have not incurred any encumbrances or claims on the property during their ownership, except those specifically mentioned in the deed. 3. Enhanced Life Estate Quitclaim Deed: Also known as a "Lady Bird Deed," this deed allows the granters (husband and wife) to retain control and rights over the property during their lifetime. Upon their death, the property automatically transfers to the corporation, avoiding the need for probate. 4. Corporation or Business Entity Quitclaim Deed: This quitclaim deed is used when the property is currently owned by the couple, and they want to transfer it directly into the ownership of their existing corporation or business entity. When preparing a West Palm Beach Florida Quitclaim Deed from Husband and Wife to Corporation, certain essential details should be included: 1. Identification: The full legal names and addresses of both the husband and wife, as well as the corporation, must be clearly stated. 2. Property Description: The deed should provide a detailed and accurate description of the property being transferred, including its legal description, address, and any applicable parcel numbers. 3. Consideration: This section confirms whether any monetary consideration is involved in the transfer. In most cases, transfers between spouses and corporations are done for no monetary value. 4. Legal Language: The language used in the deed should clearly state the intention to transfer title ownership from the husband and wife to the corporation, using specific legal terminology. 5. Signatures and Notarization: Both the husband and wife must sign the deed and have their signatures notarized. The corporation's representative should also sign and have their signature notarized. It is important to consult with a qualified real estate attorney or legal professional when creating and executing a Quitclaim Deed from Husband and Wife to Corporation in West Palm Beach, Florida, to ensure compliance with state laws and requirements.A West Palm Beach Florida Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers ownership of real estate property from a couple (husband and wife) to a corporation. This type of deed is commonly used when the property is jointly owned by the couple, and they wish to transfer ownership to their corporation. In West Palm Beach, Florida, there are different types of Quitclaim Deeds from Husband and Wife to Corporation, which may include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used when transferring property ownership. It transfers the couple's rights and interests in the property to the corporation without any warranties or guarantees. 2. Special Warranty Quitclaim Deed: This type of quitclaim deed provides a limited warranty by the granters (husband and wife). It ensures that they have not incurred any encumbrances or claims on the property during their ownership, except those specifically mentioned in the deed. 3. Enhanced Life Estate Quitclaim Deed: Also known as a "Lady Bird Deed," this deed allows the granters (husband and wife) to retain control and rights over the property during their lifetime. Upon their death, the property automatically transfers to the corporation, avoiding the need for probate. 4. Corporation or Business Entity Quitclaim Deed: This quitclaim deed is used when the property is currently owned by the couple, and they want to transfer it directly into the ownership of their existing corporation or business entity. When preparing a West Palm Beach Florida Quitclaim Deed from Husband and Wife to Corporation, certain essential details should be included: 1. Identification: The full legal names and addresses of both the husband and wife, as well as the corporation, must be clearly stated. 2. Property Description: The deed should provide a detailed and accurate description of the property being transferred, including its legal description, address, and any applicable parcel numbers. 3. Consideration: This section confirms whether any monetary consideration is involved in the transfer. In most cases, transfers between spouses and corporations are done for no monetary value. 4. Legal Language: The language used in the deed should clearly state the intention to transfer title ownership from the husband and wife to the corporation, using specific legal terminology. 5. Signatures and Notarization: Both the husband and wife must sign the deed and have their signatures notarized. The corporation's representative should also sign and have their signature notarized. It is important to consult with a qualified real estate attorney or legal professional when creating and executing a Quitclaim Deed from Husband and Wife to Corporation in West Palm Beach, Florida, to ensure compliance with state laws and requirements.