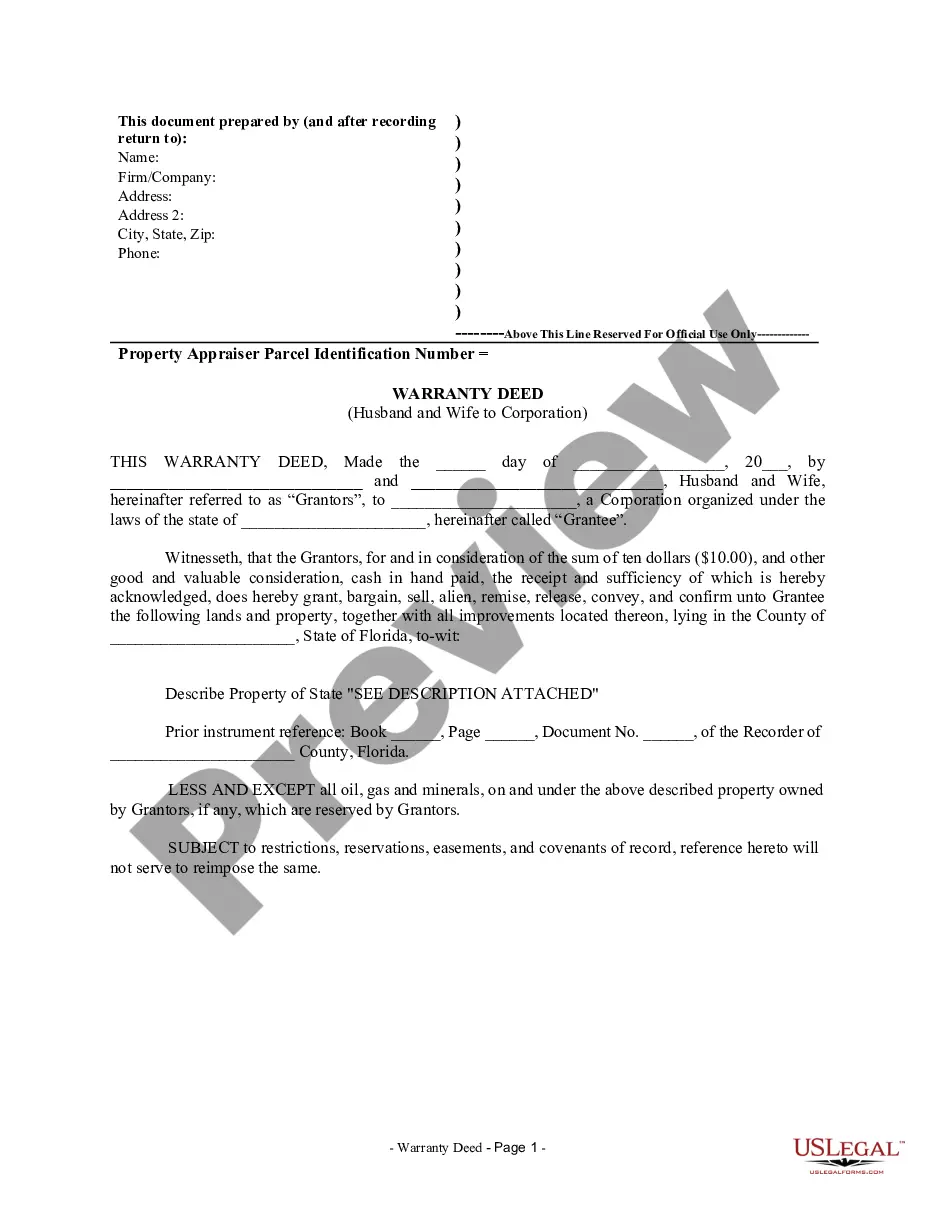

This Warranty Deed from Husband and Wife to Corporation form is a Warranty Deed where the grantors are husband and wife and the grantee is a corporation. Grantors warrant and convey the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Hialeah Florida Warranty Deed from Husband and Wife to Corporation is a legal document that transfers ownership of a property from a married couple to a corporation while ensuring that the property has a clear title and is free from any encumbrances or claims. This transaction is commonly referred to as a "conveyance" of real estate and is typically used for business purposes, such as transferring property to a corporation for investment or asset protection reasons. In this type of warranty deed, the husband and wife (referred to as granters) transfer all of their interests, rights, and claims in the property to the corporation (referred to as the grantee). The deed guarantees that the granters hold clear title to the property, meaning there are no undisclosed liens, claims, or disputes that could affect the corporation's ownership rights. The Hialeah Florida Warranty Deed from Husband and Wife to Corporation can be further classified based on various factors. Some common types include: 1. General Warranty Deed: This type of deed offers the highest level of protection to the grantee, as the granters assure the corporation that they have clear title to the property and will defend it against any future claims. 2. Special Warranty Deed: Unlike a general warranty deed, a special warranty deed only guarantees the grantee against any claims or encumbrances that arose during the husband and wife's ownership period. It does not protect against any previous claims or encumbrances that may have existed before their ownership. 3. Limited Warranty Deed: In a limited warranty deed, the granters provide a limited warranty of title, typically only guaranteeing against claims that arose during their period of ownership but not providing any assurances for previous claims or encumbrances. 4. Quitclaim Deed: This type of deed is typically used when the husband and wife want to transfer their interests in the property without making any warranties or guarantees about the title. A quitclaim deed transfers whatever interests the granters have in the property to the corporation without assurances of clear title. It is important to carefully consider the type of warranty deed to be used in this type of transaction based on the level of protection desired by the corporation acquiring the property. Seeking legal advice from a real estate attorney or professional is highly recommended ensuring a smooth transfer of ownership and to comply with the specific legal requirements in Hialeah, Florida.A Hialeah Florida Warranty Deed from Husband and Wife to Corporation is a legal document that transfers ownership of a property from a married couple to a corporation while ensuring that the property has a clear title and is free from any encumbrances or claims. This transaction is commonly referred to as a "conveyance" of real estate and is typically used for business purposes, such as transferring property to a corporation for investment or asset protection reasons. In this type of warranty deed, the husband and wife (referred to as granters) transfer all of their interests, rights, and claims in the property to the corporation (referred to as the grantee). The deed guarantees that the granters hold clear title to the property, meaning there are no undisclosed liens, claims, or disputes that could affect the corporation's ownership rights. The Hialeah Florida Warranty Deed from Husband and Wife to Corporation can be further classified based on various factors. Some common types include: 1. General Warranty Deed: This type of deed offers the highest level of protection to the grantee, as the granters assure the corporation that they have clear title to the property and will defend it against any future claims. 2. Special Warranty Deed: Unlike a general warranty deed, a special warranty deed only guarantees the grantee against any claims or encumbrances that arose during the husband and wife's ownership period. It does not protect against any previous claims or encumbrances that may have existed before their ownership. 3. Limited Warranty Deed: In a limited warranty deed, the granters provide a limited warranty of title, typically only guaranteeing against claims that arose during their period of ownership but not providing any assurances for previous claims or encumbrances. 4. Quitclaim Deed: This type of deed is typically used when the husband and wife want to transfer their interests in the property without making any warranties or guarantees about the title. A quitclaim deed transfers whatever interests the granters have in the property to the corporation without assurances of clear title. It is important to carefully consider the type of warranty deed to be used in this type of transaction based on the level of protection desired by the corporation acquiring the property. Seeking legal advice from a real estate attorney or professional is highly recommended ensuring a smooth transfer of ownership and to comply with the specific legal requirements in Hialeah, Florida.