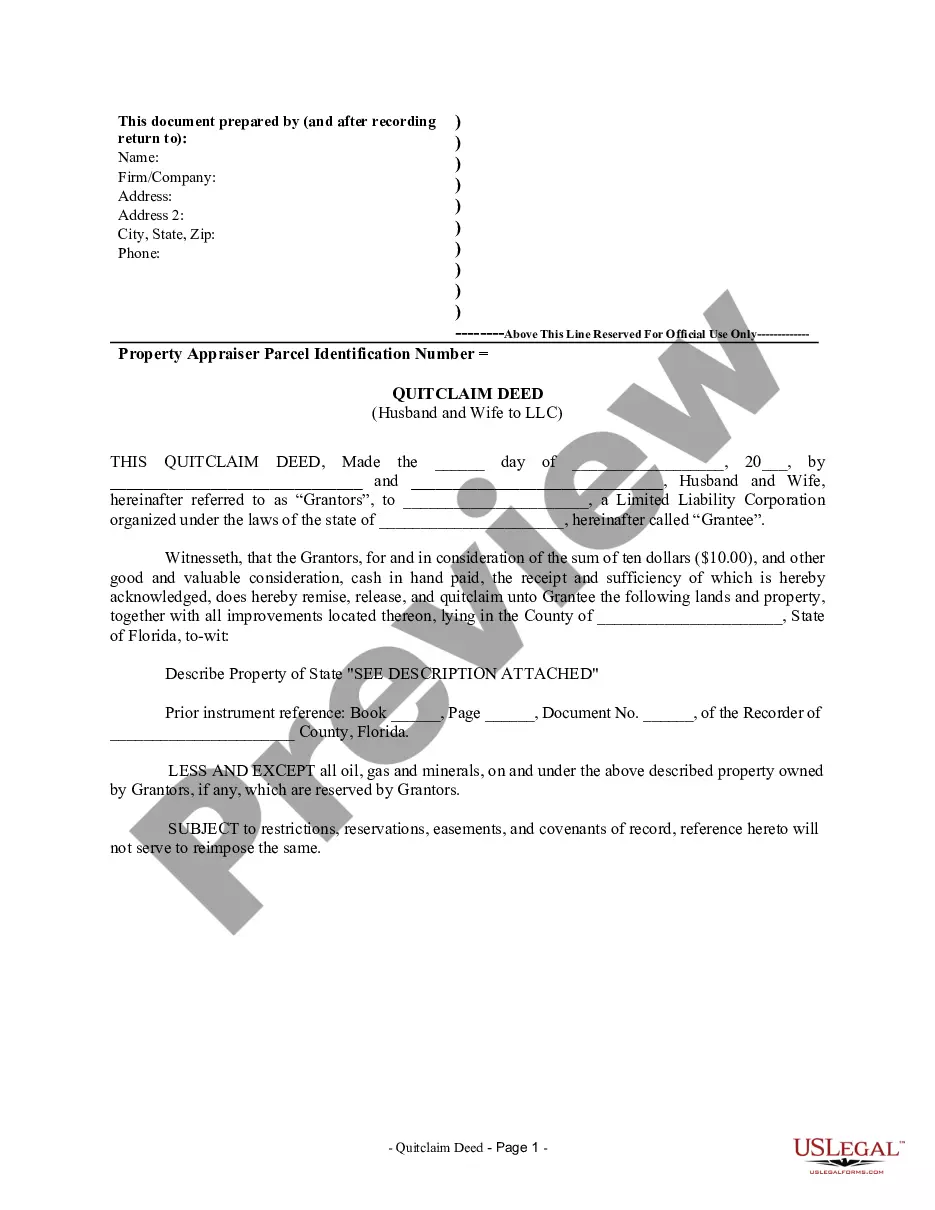

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

In Cape Coral, Florida, a Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer ownership of a property to a Limited Liability Company (LLC) using the quitclaim method. This deed type ensures a seamless and efficient transfer of the property's title and all the associated rights and liabilities to the LLC. The Cape Coral Quitclaim Deed from Husband and Wife to LLC is often used in situations where a married couple wishes to protect their personal assets or establish a separate legal entity for property ownership and management purposes. It provides a straightforward way for the couple to transfer ownership without having to involve a third party or incur additional expenses. By preparing and executing this deed, the husband and wife are effectively conveying their interest in the property to the LLC, making the LLC the new owner. It is important to note that a quitclaim deed only transfers the ownership interest held by the couple at the time of the transfer and does not guarantee clear title or address any outstanding liens or encumbrances on the property. Therefore, it is advised to conduct a thorough title search and seek legal advice before executing the deed. Different variations of the Cape Coral Quitclaim Deed from Husband and Wife to LLC may include specific provisions tailored to the unique circumstances of the property transfer. These provisions may include rights of survivorship, covenants, conditions, and restrictions, or any other specific agreements between the married couple and the LLC. It is essential to draft the deed accurately to ensure all parties' rights and obligations are explicitly stated and legally binding. Transferring property through a Quitclaim Deed from Husband and Wife to LLC in Cape Coral, Florida, offers numerous benefits, such as protecting personal assets, simplifying property management, and providing liability protection for the married couple. However, it is crucial to consult with a qualified attorney or real estate professional to ensure compliance with local laws and regulations, as well as to address any potential tax implications or other legal considerations. Overall, the Cape Coral Florida Quitclaim Deed from Husband and Wife to LLC provides a versatile and efficient way for married couples to transfer property ownership to an LLC, offering increased flexibility, asset protection, and potential tax advantages.In Cape Coral, Florida, a Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer ownership of a property to a Limited Liability Company (LLC) using the quitclaim method. This deed type ensures a seamless and efficient transfer of the property's title and all the associated rights and liabilities to the LLC. The Cape Coral Quitclaim Deed from Husband and Wife to LLC is often used in situations where a married couple wishes to protect their personal assets or establish a separate legal entity for property ownership and management purposes. It provides a straightforward way for the couple to transfer ownership without having to involve a third party or incur additional expenses. By preparing and executing this deed, the husband and wife are effectively conveying their interest in the property to the LLC, making the LLC the new owner. It is important to note that a quitclaim deed only transfers the ownership interest held by the couple at the time of the transfer and does not guarantee clear title or address any outstanding liens or encumbrances on the property. Therefore, it is advised to conduct a thorough title search and seek legal advice before executing the deed. Different variations of the Cape Coral Quitclaim Deed from Husband and Wife to LLC may include specific provisions tailored to the unique circumstances of the property transfer. These provisions may include rights of survivorship, covenants, conditions, and restrictions, or any other specific agreements between the married couple and the LLC. It is essential to draft the deed accurately to ensure all parties' rights and obligations are explicitly stated and legally binding. Transferring property through a Quitclaim Deed from Husband and Wife to LLC in Cape Coral, Florida, offers numerous benefits, such as protecting personal assets, simplifying property management, and providing liability protection for the married couple. However, it is crucial to consult with a qualified attorney or real estate professional to ensure compliance with local laws and regulations, as well as to address any potential tax implications or other legal considerations. Overall, the Cape Coral Florida Quitclaim Deed from Husband and Wife to LLC provides a versatile and efficient way for married couples to transfer property ownership to an LLC, offering increased flexibility, asset protection, and potential tax advantages.