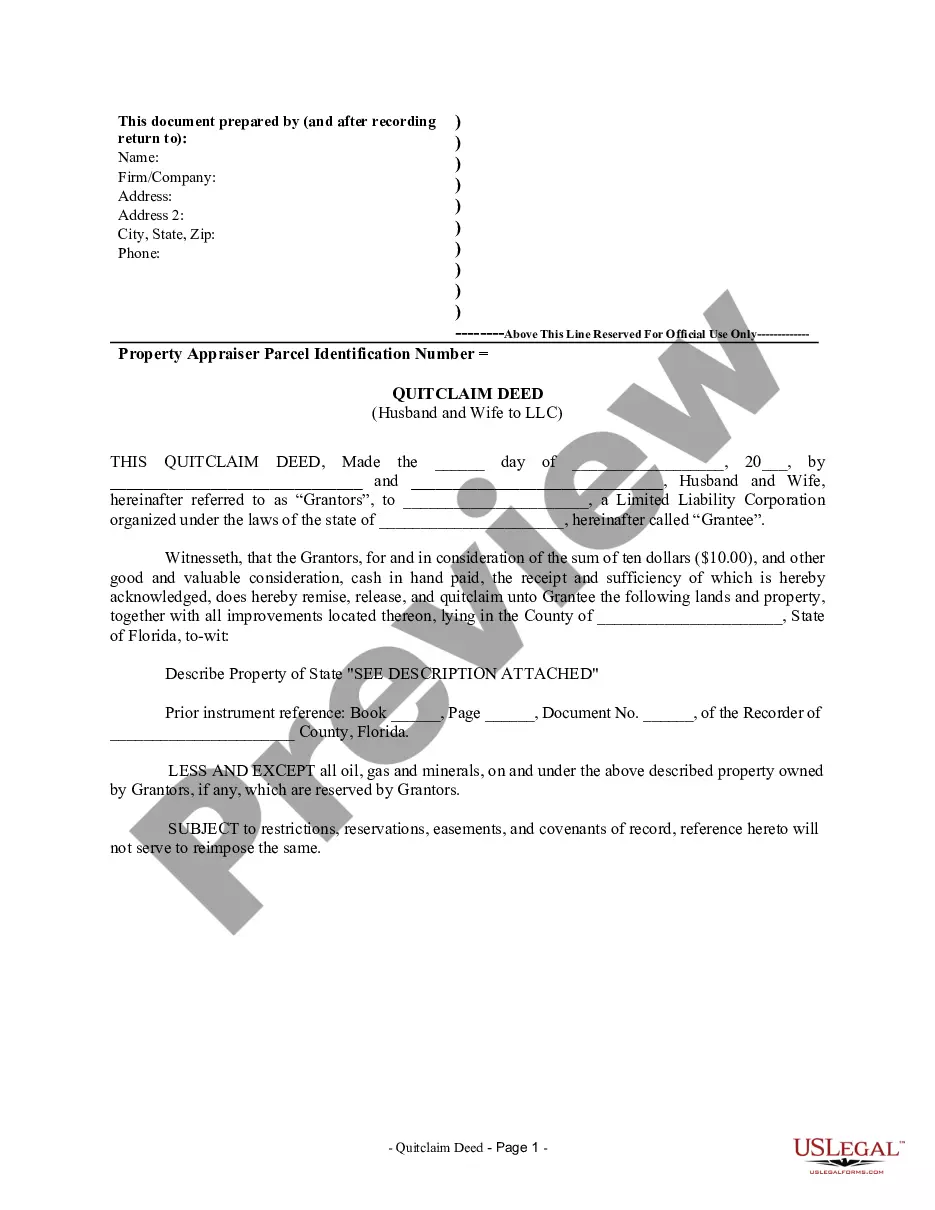

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Coral Springs Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that conveys the ownership interests of a property from a married couple to a limited liability company (LLC). This type of deed is commonly used when a husband and wife want to transfer property ownership to their business entity. In this situation, the husband and wife (granters) act as sellers, relinquishing their ownership rights, while the LLC (grantee) acts as the buyer, acquiring the property. The quitclaim deed is a legal instrument that enables the transfer of ownership without providing any guarantees or warranties about the property's title or condition. This specific type of quitclaim deed is frequently utilized by couples who wish to protect personal assets or establish liability protections for their property. Transferring the property to an LLC can shield the couple's personal assets from potential creditor claims and lawsuits, creating a separation between their personal and business affairs. Coral Springs, located in southeastern Florida, is known for its vibrant neighborhoods and family-friendly living. The city offers an array of recreational opportunities, excellent schools, and a strong sense of community. Different types of Coral Springs Florida Quitclaim Deeds from Husband and Wife to LLC may include variations based on specific circumstances or requirements. Some key variations may include: 1. Individual to Multi-Member LLC: This type of quitclaim deed is used when a property is transferred from a married couple as individuals to an LLC with multiple members. It allows multiple individuals to share ownership and management responsibilities of the property through the LLC structure. 2. Individual to Single-Member LLC: This variant is utilized when a property is conveyed from a husband and wife to an LLC with only one member. It provides the benefits of liability protection and flexible management structure through the LLC while maintaining a single owner. 3. Joint Tenancy to LLC: Joint tenancy is a form of property ownership where two or more individuals have equal rights and interests in the property. This type of quitclaim deed is used when a husband and wife, as joint tenants, transfer their ownership rights to an LLC. 4. Tenancy in Common to LLC: Tenancy in common is another form of co-ownership where each owner has a distinct, undivided interest in the property. If a husband and wife, as tenants in common, want to transfer their ownership rights to an LLC, they would use this type of quitclaim deed. By utilizing a Coral Springs Florida Quitclaim Deed from Husband and Wife to LLC, couples can protect their property, establish liability protections, and streamline the management of their assets. It is essential to consult with a qualified real estate attorney or legal professional to ensure the deed is drafted and executed correctly to meet their specific needs and comply with applicable laws and regulations.A Coral Springs Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that conveys the ownership interests of a property from a married couple to a limited liability company (LLC). This type of deed is commonly used when a husband and wife want to transfer property ownership to their business entity. In this situation, the husband and wife (granters) act as sellers, relinquishing their ownership rights, while the LLC (grantee) acts as the buyer, acquiring the property. The quitclaim deed is a legal instrument that enables the transfer of ownership without providing any guarantees or warranties about the property's title or condition. This specific type of quitclaim deed is frequently utilized by couples who wish to protect personal assets or establish liability protections for their property. Transferring the property to an LLC can shield the couple's personal assets from potential creditor claims and lawsuits, creating a separation between their personal and business affairs. Coral Springs, located in southeastern Florida, is known for its vibrant neighborhoods and family-friendly living. The city offers an array of recreational opportunities, excellent schools, and a strong sense of community. Different types of Coral Springs Florida Quitclaim Deeds from Husband and Wife to LLC may include variations based on specific circumstances or requirements. Some key variations may include: 1. Individual to Multi-Member LLC: This type of quitclaim deed is used when a property is transferred from a married couple as individuals to an LLC with multiple members. It allows multiple individuals to share ownership and management responsibilities of the property through the LLC structure. 2. Individual to Single-Member LLC: This variant is utilized when a property is conveyed from a husband and wife to an LLC with only one member. It provides the benefits of liability protection and flexible management structure through the LLC while maintaining a single owner. 3. Joint Tenancy to LLC: Joint tenancy is a form of property ownership where two or more individuals have equal rights and interests in the property. This type of quitclaim deed is used when a husband and wife, as joint tenants, transfer their ownership rights to an LLC. 4. Tenancy in Common to LLC: Tenancy in common is another form of co-ownership where each owner has a distinct, undivided interest in the property. If a husband and wife, as tenants in common, want to transfer their ownership rights to an LLC, they would use this type of quitclaim deed. By utilizing a Coral Springs Florida Quitclaim Deed from Husband and Wife to LLC, couples can protect their property, establish liability protections, and streamline the management of their assets. It is essential to consult with a qualified real estate attorney or legal professional to ensure the deed is drafted and executed correctly to meet their specific needs and comply with applicable laws and regulations.