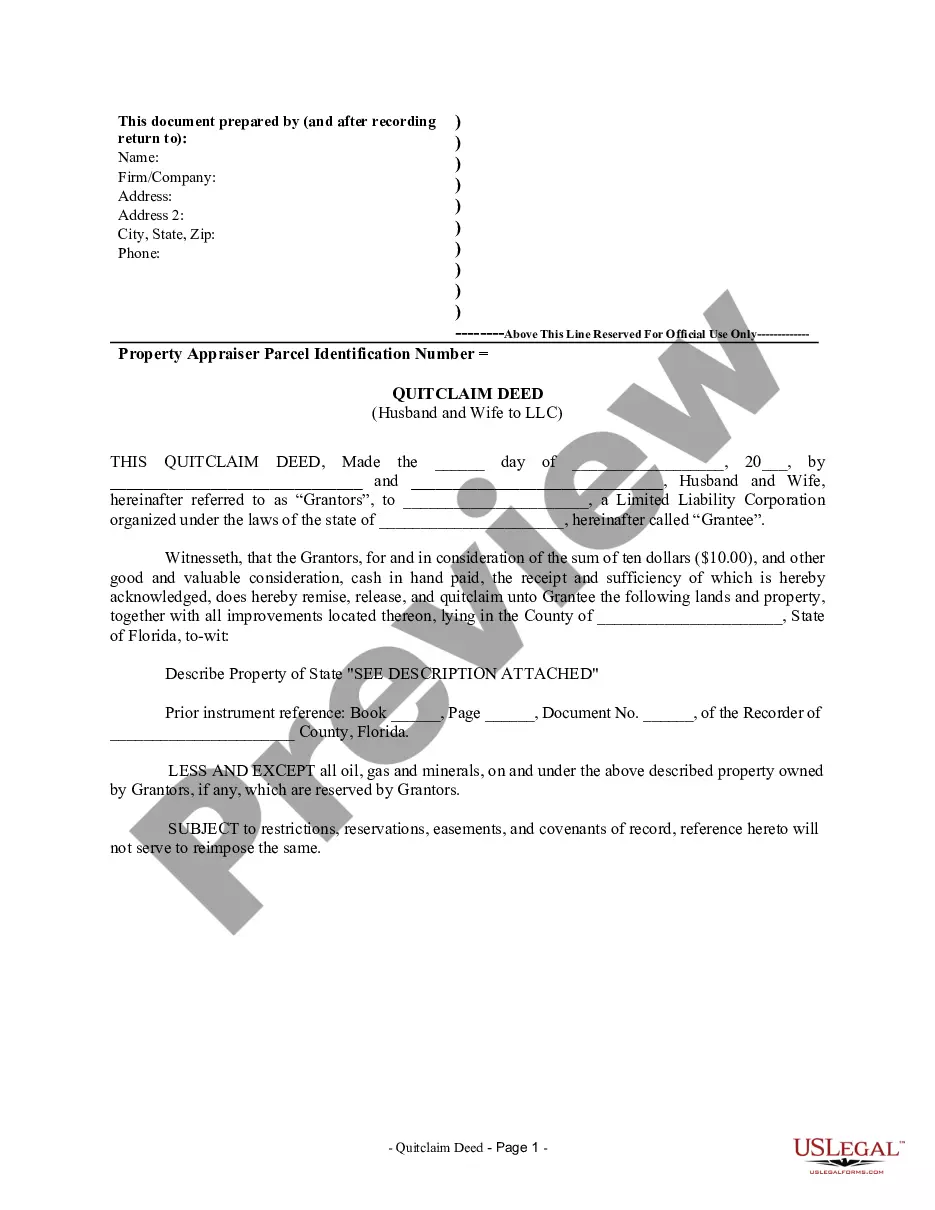

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A quitclaim deed is a legal document used to transfer ownership of a property from one party to another. In the context of Hillsborough, Florida, a particular type of quitclaim deed is the "Quitclaim Deed from Husband and Wife to LLC." This type of deed is often utilized when a married couple wants to transfer their shared ownership interest in a property to their limited liability company (LLC) in Hillsborough County, Florida. By executing the Hillsborough Florida Quitclaim Deed from Husband and Wife to LLC, the couple is essentially conveying their joint ownership rights in a property to their LLC entity. This process allows the LLC to assume full ownership and control over the property, offering various benefits such as liability protection and potential tax advantages. This particular type of quitclaim deed ensures a smooth transition of ownership between the married couple and their LLC. It provides legal clarity and protects all parties involved, ensuring that the property is now solely owned by the LLC and not subject to potential claims or disputes by individuals or creditors. There might be different variations of the Hillsborough Florida Quitclaim Deed from Husband and Wife to LLC, including: 1. Individual-to-LLC Quitclaim Deed: This document may be used when only one spouse intends to transfer their ownership interest in the property to the LLC, while the other spouse remains as an individual owner. 2. Equal Interest Quitclaim Deed: In situations where both spouses have an equal ownership interest in the property, this type of deed is used to transfer the complete ownership rights to the LLC, effectively making the LLC an equal co-owner. 3. Unequal Interest Quitclaim Deed: In some cases, the spouses may have different ownership interests in the property, and the quitclaim deed can be customized to reflect their respective ownership percentages in the LLC. It's important to consult with a qualified real estate attorney or legal professional familiar with Hillsborough County's regulations and requirements for quitclaim deeds to ensure compliance and accuracy during the transfer process.A quitclaim deed is a legal document used to transfer ownership of a property from one party to another. In the context of Hillsborough, Florida, a particular type of quitclaim deed is the "Quitclaim Deed from Husband and Wife to LLC." This type of deed is often utilized when a married couple wants to transfer their shared ownership interest in a property to their limited liability company (LLC) in Hillsborough County, Florida. By executing the Hillsborough Florida Quitclaim Deed from Husband and Wife to LLC, the couple is essentially conveying their joint ownership rights in a property to their LLC entity. This process allows the LLC to assume full ownership and control over the property, offering various benefits such as liability protection and potential tax advantages. This particular type of quitclaim deed ensures a smooth transition of ownership between the married couple and their LLC. It provides legal clarity and protects all parties involved, ensuring that the property is now solely owned by the LLC and not subject to potential claims or disputes by individuals or creditors. There might be different variations of the Hillsborough Florida Quitclaim Deed from Husband and Wife to LLC, including: 1. Individual-to-LLC Quitclaim Deed: This document may be used when only one spouse intends to transfer their ownership interest in the property to the LLC, while the other spouse remains as an individual owner. 2. Equal Interest Quitclaim Deed: In situations where both spouses have an equal ownership interest in the property, this type of deed is used to transfer the complete ownership rights to the LLC, effectively making the LLC an equal co-owner. 3. Unequal Interest Quitclaim Deed: In some cases, the spouses may have different ownership interests in the property, and the quitclaim deed can be customized to reflect their respective ownership percentages in the LLC. It's important to consult with a qualified real estate attorney or legal professional familiar with Hillsborough County's regulations and requirements for quitclaim deeds to ensure compliance and accuracy during the transfer process.