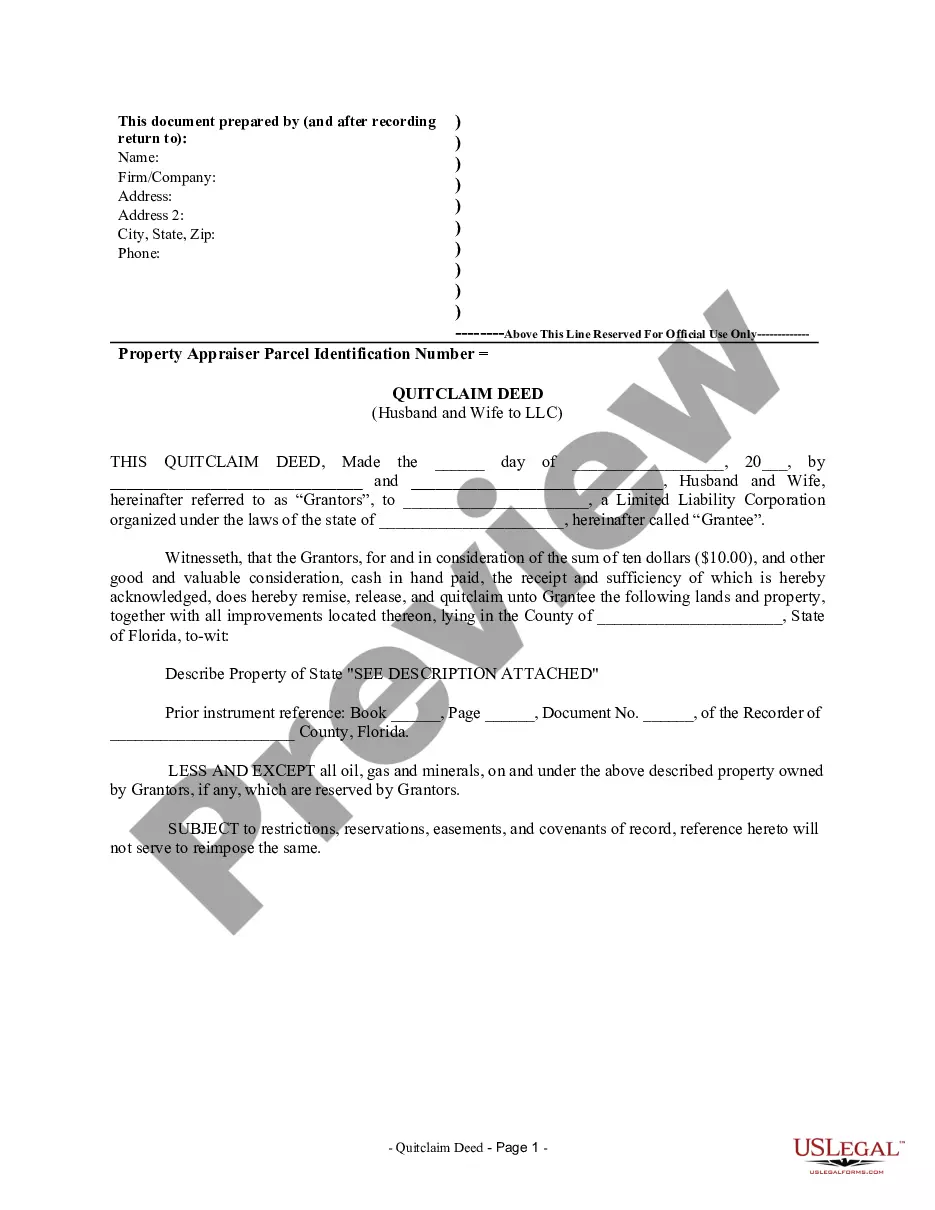

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Hollywood Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of ownership of real estate property from a married couple to their limited liability company (LLC) in Hollywood, Florida. This deed serves as evidence of the transfer and ensures that the property is now owned by the LLC. One type of Hollywood Florida Quitclaim Deed from Husband and Wife to LLC is the "General Quitclaim Deed." This is the most common form used when both spouses agree to transfer their ownership rights to the LLC without any warranties or guarantees. It simply states that the couple is relinquishing their interest in the property to the LLC, without specifying any terms or conditions. Another type is the "Limited Liability Quitclaim Deed." In this case, the LLC assumes ownership of the property and the liability associated with it. This may be a preferred option for married couples seeking additional protection from potential lawsuits or debts related to the property. The limited liability clause ensures that the couple's personal assets remain separate and protected. Additionally, there is the "Divorce-Related Quitclaim Deed." In situations where a divorce is involved, a specialized quitclaim deed may be used to transfer the property from the husband and wife to the LLC. This deed acknowledges the dissolution of the marriage and the specific division of property as agreed upon in the divorce settlement. It ensures a smooth transition of ownership without legal complications. When preparing a Hollywood Florida Quitclaim Deed from Husband and Wife to LLC, it is crucial to include key information such as: 1. Names and contact information: Provide the full legal names and addresses of both spouses and the LLC. 2. Property description: Detail the property's physical address, legal description, lot numbers, and any other specifications required for accurate identification. 3. Consideration: Specify any monetary consideration exchanged during the transfer, if applicable. 4. Legal language: Include standard legal language and references to relevant state laws that govern the transfer of property. 5. Signatures and notarization: All parties involved, including the husband, wife, and LLC representative, must sign the deed in the presence of a notary public to authenticate the transfer. By using a Hollywood Florida Quitclaim Deed from Husband and Wife to LLC, married couples can effectively transfer ownership of real estate property to their LLC while ensuring legal compliance and protecting personal assets. It is essential to consult with a qualified real estate attorney to ensure accuracy and adherence to local laws and regulations throughout the process.A Hollywood Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of ownership of real estate property from a married couple to their limited liability company (LLC) in Hollywood, Florida. This deed serves as evidence of the transfer and ensures that the property is now owned by the LLC. One type of Hollywood Florida Quitclaim Deed from Husband and Wife to LLC is the "General Quitclaim Deed." This is the most common form used when both spouses agree to transfer their ownership rights to the LLC without any warranties or guarantees. It simply states that the couple is relinquishing their interest in the property to the LLC, without specifying any terms or conditions. Another type is the "Limited Liability Quitclaim Deed." In this case, the LLC assumes ownership of the property and the liability associated with it. This may be a preferred option for married couples seeking additional protection from potential lawsuits or debts related to the property. The limited liability clause ensures that the couple's personal assets remain separate and protected. Additionally, there is the "Divorce-Related Quitclaim Deed." In situations where a divorce is involved, a specialized quitclaim deed may be used to transfer the property from the husband and wife to the LLC. This deed acknowledges the dissolution of the marriage and the specific division of property as agreed upon in the divorce settlement. It ensures a smooth transition of ownership without legal complications. When preparing a Hollywood Florida Quitclaim Deed from Husband and Wife to LLC, it is crucial to include key information such as: 1. Names and contact information: Provide the full legal names and addresses of both spouses and the LLC. 2. Property description: Detail the property's physical address, legal description, lot numbers, and any other specifications required for accurate identification. 3. Consideration: Specify any monetary consideration exchanged during the transfer, if applicable. 4. Legal language: Include standard legal language and references to relevant state laws that govern the transfer of property. 5. Signatures and notarization: All parties involved, including the husband, wife, and LLC representative, must sign the deed in the presence of a notary public to authenticate the transfer. By using a Hollywood Florida Quitclaim Deed from Husband and Wife to LLC, married couples can effectively transfer ownership of real estate property to their LLC while ensuring legal compliance and protecting personal assets. It is essential to consult with a qualified real estate attorney to ensure accuracy and adherence to local laws and regulations throughout the process.