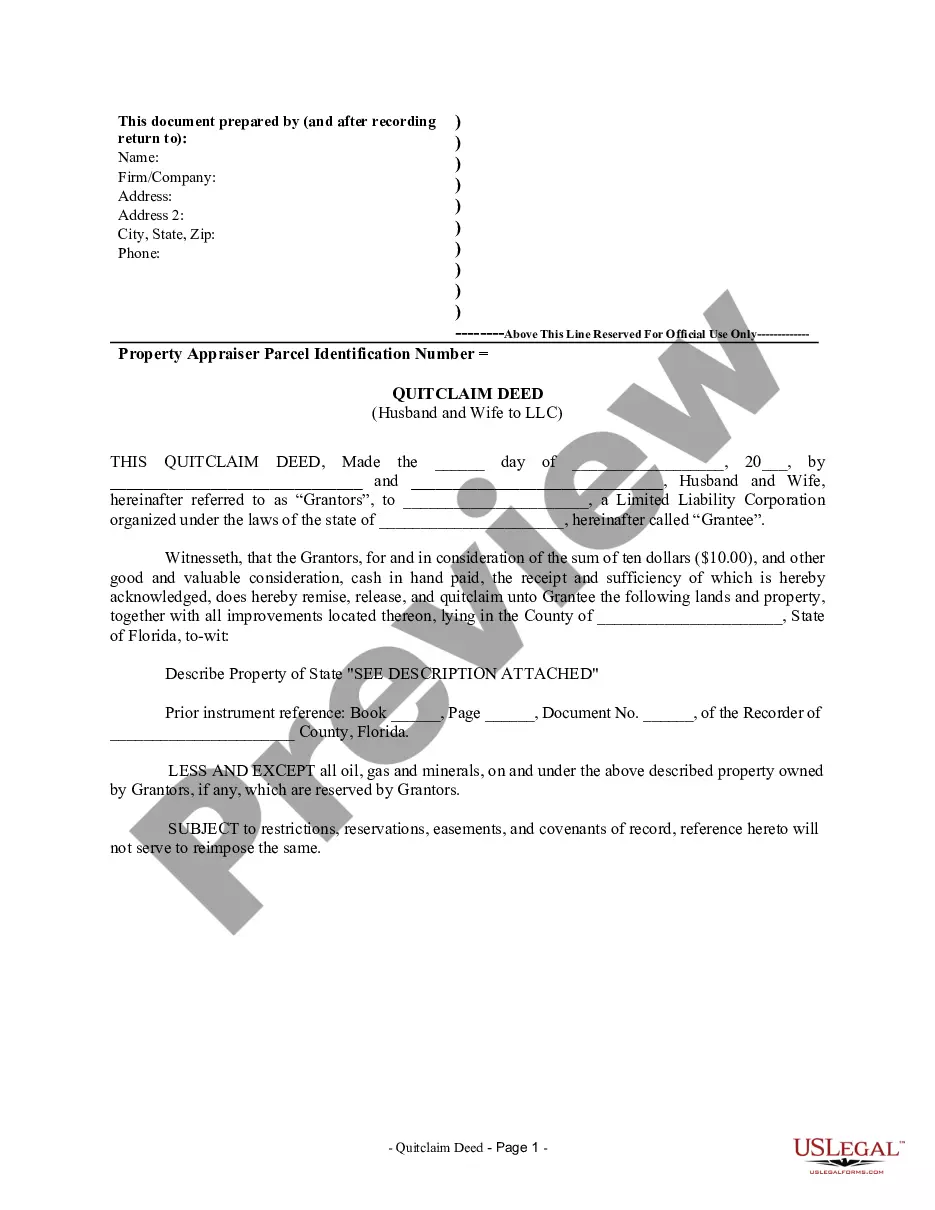

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A properly executed Quitclaim Deed is key when transferring real estate ownership from a husband and wife to an LLC in Lakeland, Florida. This legal document ensures a smooth and transparent transfer, safeguarding the rights and interests of all parties involved. Whether you're a real estate investor or a married couple looking to transfer property into an LLC, understanding the different types of Quitclaim Deeds in Lakeland, Florida is essential. Lakeland, Florida Quitclaim Deeds from Husband and Wife to LLC can fall into two main categories: Individual Transfer Quitclaim Deed and Marital Transfer Quitclaim Deed. 1. Individual Transfer Quitclaim Deed: This type of quitclaim deed is used when the property owners, both husband and wife, wish to transfer their interest to an LLC as separate individuals. In this case, each spouse will execute their own individual quitclaim deed to the LLC, relinquishing their respective ownership rights. This deed type ensures that ownership is properly transferred without commingling the interests of the couple. 2. Marital Transfer Quitclaim Deed: As the name suggests, this type of quitclaim deed is used when a husband and wife collectively transfer their jointly owned property to an LLC. By executing a joint quitclaim deed, both spouses simultaneously convey their shared interest in the property to the LLC. This deed type simplifies the transfer process and ensures that both parties fully release their rights to the LLC. Executing a Lakeland, Florida Quitclaim Deed from Husband and Wife to LLC involves several crucial steps. Firstly, the deed should clearly state that it is a quitclaim deed, specifying the names of the husband and wife transferring the property as granters, and the LLC as the grantee. The legal description of the property, including the parcel number and address, must be accurately stated in the deed. Additionally, it is imperative to include a statement confirming the consideration for the transfer, which can be as simple as "for valuable consideration." This consideration signifies that the transfer is not a gift but rather a legally binding transaction. Both spouses must sign the deed in the presence of a notary public, acknowledging their voluntary acceptance of the transfer. By employing the correct type of Quitclaim Deed and meticulously adhering to the legal requirements, the transfer of ownership from a husband and wife to an LLC in Lakeland, Florida can be accomplished smoothly and with legal certainty. Seeking professional advice from a real estate attorney or title company is strongly recommended throughout this process to ensure compliance with all applicable laws and regulations.A properly executed Quitclaim Deed is key when transferring real estate ownership from a husband and wife to an LLC in Lakeland, Florida. This legal document ensures a smooth and transparent transfer, safeguarding the rights and interests of all parties involved. Whether you're a real estate investor or a married couple looking to transfer property into an LLC, understanding the different types of Quitclaim Deeds in Lakeland, Florida is essential. Lakeland, Florida Quitclaim Deeds from Husband and Wife to LLC can fall into two main categories: Individual Transfer Quitclaim Deed and Marital Transfer Quitclaim Deed. 1. Individual Transfer Quitclaim Deed: This type of quitclaim deed is used when the property owners, both husband and wife, wish to transfer their interest to an LLC as separate individuals. In this case, each spouse will execute their own individual quitclaim deed to the LLC, relinquishing their respective ownership rights. This deed type ensures that ownership is properly transferred without commingling the interests of the couple. 2. Marital Transfer Quitclaim Deed: As the name suggests, this type of quitclaim deed is used when a husband and wife collectively transfer their jointly owned property to an LLC. By executing a joint quitclaim deed, both spouses simultaneously convey their shared interest in the property to the LLC. This deed type simplifies the transfer process and ensures that both parties fully release their rights to the LLC. Executing a Lakeland, Florida Quitclaim Deed from Husband and Wife to LLC involves several crucial steps. Firstly, the deed should clearly state that it is a quitclaim deed, specifying the names of the husband and wife transferring the property as granters, and the LLC as the grantee. The legal description of the property, including the parcel number and address, must be accurately stated in the deed. Additionally, it is imperative to include a statement confirming the consideration for the transfer, which can be as simple as "for valuable consideration." This consideration signifies that the transfer is not a gift but rather a legally binding transaction. Both spouses must sign the deed in the presence of a notary public, acknowledging their voluntary acceptance of the transfer. By employing the correct type of Quitclaim Deed and meticulously adhering to the legal requirements, the transfer of ownership from a husband and wife to an LLC in Lakeland, Florida can be accomplished smoothly and with legal certainty. Seeking professional advice from a real estate attorney or title company is strongly recommended throughout this process to ensure compliance with all applicable laws and regulations.