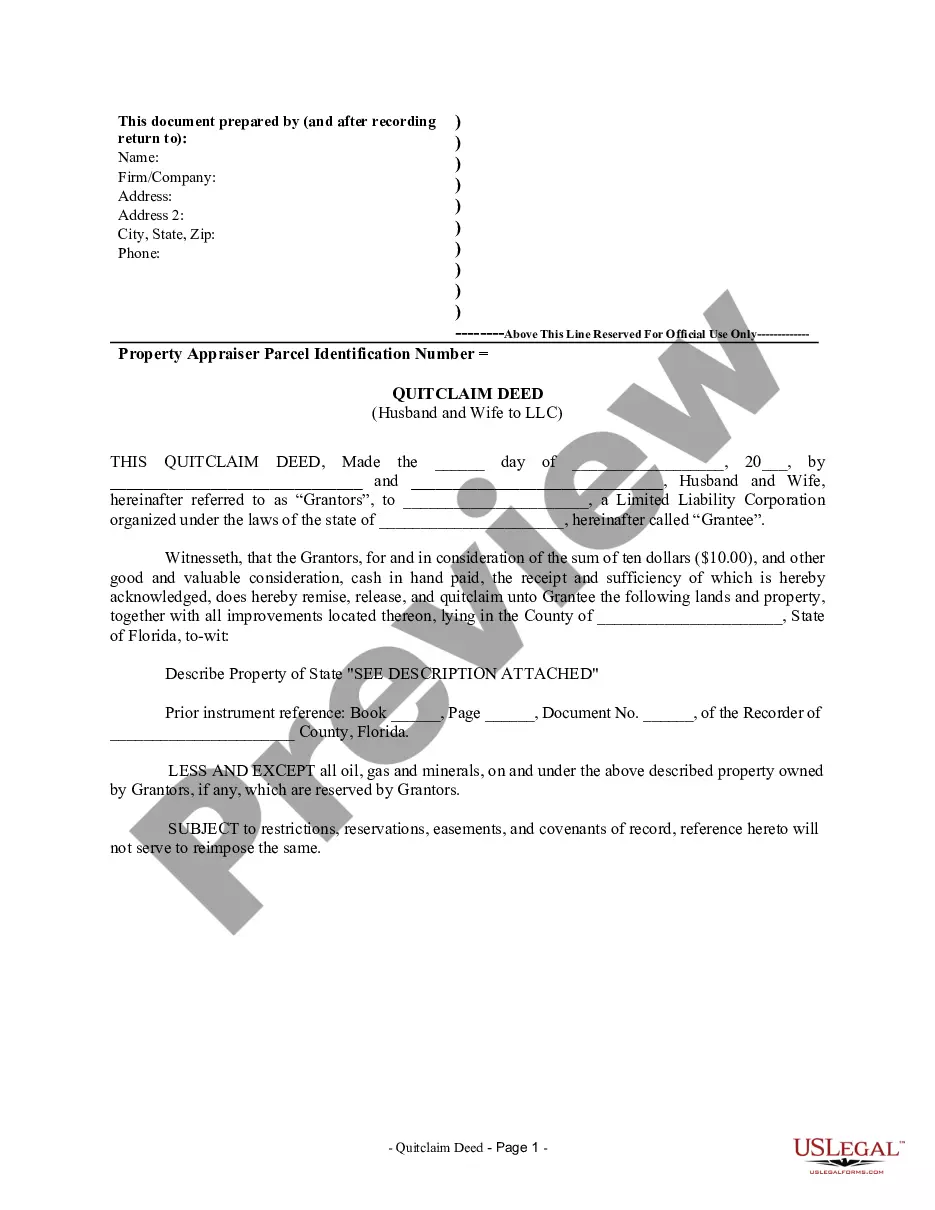

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A quitclaim deed is a legal document used to transfer property ownership between parties, providing a clear indication of the intent to relinquish any interests or rights associated with the property. In the context of Miami Gardens, Florida, a Quitclaim Deed from Husband and Wife to LLC is a specific type of quitclaim deed that involves the transfer of property ownership from a married couple to a limited liability company (LLC) based in Miami Gardens. This type of quitclaim deed is commonly used when a married couple wishes to transfer the ownership of property they jointly own to an LLC, which can offer various benefits such as asset protection, tax advantages, and easier management. The Miami Gardens Florida Quitclaim Deed from Husband and Wife to LLC ensures a smooth transfer of property while minimizing potential legal complications. By executing this deed, the couple effectively transfers all their rights, interests, and claims in the property to the LLC, making the LLC the new owner and responsible party for the property. It is important to note that there may be variations or subcategories of the Miami Gardens Florida Quitclaim Deed from Husband and Wife to LLC, depending on specific circumstances and legal requirements. These variations may include: 1. Individual Husband and Wife to Single-Member LLC Quitclaim Deed: In this scenario, a married couple transfers ownership to an LLC with a single member, typically one of the spouses. This type of deed is commonly used for estate planning or to facilitate property management within a family structure. 2. Joint Husband and Wife to Multi-Member LLC Quitclaim Deed: This type of deed involves the transfer of property ownership from a married couple to an LLC with multiple members. It may be utilized for business purposes, real estate investments, or asset protection strategies. 3. Husband and Wife as Members of LLC Quitclaim Deed: Sometimes, rather than transferring ownership to an existing LLC, a married couple establishes a new LLC and becomes its members. The property is then transferred to this newly formed LLC using a quitclaim deed, thus consolidating ownership within the LLC structure. By executing a Miami Gardens Florida Quitclaim Deed from Husband and Wife to LLC, individuals can streamline property transfers, protect assets, and leverage the benefits offered by an LLC structure. It is advisable to consult with a qualified attorney or real estate professional to ensure compliance with local laws and regulations, as well as the specific needs and goals of the parties involved.A quitclaim deed is a legal document used to transfer property ownership between parties, providing a clear indication of the intent to relinquish any interests or rights associated with the property. In the context of Miami Gardens, Florida, a Quitclaim Deed from Husband and Wife to LLC is a specific type of quitclaim deed that involves the transfer of property ownership from a married couple to a limited liability company (LLC) based in Miami Gardens. This type of quitclaim deed is commonly used when a married couple wishes to transfer the ownership of property they jointly own to an LLC, which can offer various benefits such as asset protection, tax advantages, and easier management. The Miami Gardens Florida Quitclaim Deed from Husband and Wife to LLC ensures a smooth transfer of property while minimizing potential legal complications. By executing this deed, the couple effectively transfers all their rights, interests, and claims in the property to the LLC, making the LLC the new owner and responsible party for the property. It is important to note that there may be variations or subcategories of the Miami Gardens Florida Quitclaim Deed from Husband and Wife to LLC, depending on specific circumstances and legal requirements. These variations may include: 1. Individual Husband and Wife to Single-Member LLC Quitclaim Deed: In this scenario, a married couple transfers ownership to an LLC with a single member, typically one of the spouses. This type of deed is commonly used for estate planning or to facilitate property management within a family structure. 2. Joint Husband and Wife to Multi-Member LLC Quitclaim Deed: This type of deed involves the transfer of property ownership from a married couple to an LLC with multiple members. It may be utilized for business purposes, real estate investments, or asset protection strategies. 3. Husband and Wife as Members of LLC Quitclaim Deed: Sometimes, rather than transferring ownership to an existing LLC, a married couple establishes a new LLC and becomes its members. The property is then transferred to this newly formed LLC using a quitclaim deed, thus consolidating ownership within the LLC structure. By executing a Miami Gardens Florida Quitclaim Deed from Husband and Wife to LLC, individuals can streamline property transfers, protect assets, and leverage the benefits offered by an LLC structure. It is advisable to consult with a qualified attorney or real estate professional to ensure compliance with local laws and regulations, as well as the specific needs and goals of the parties involved.