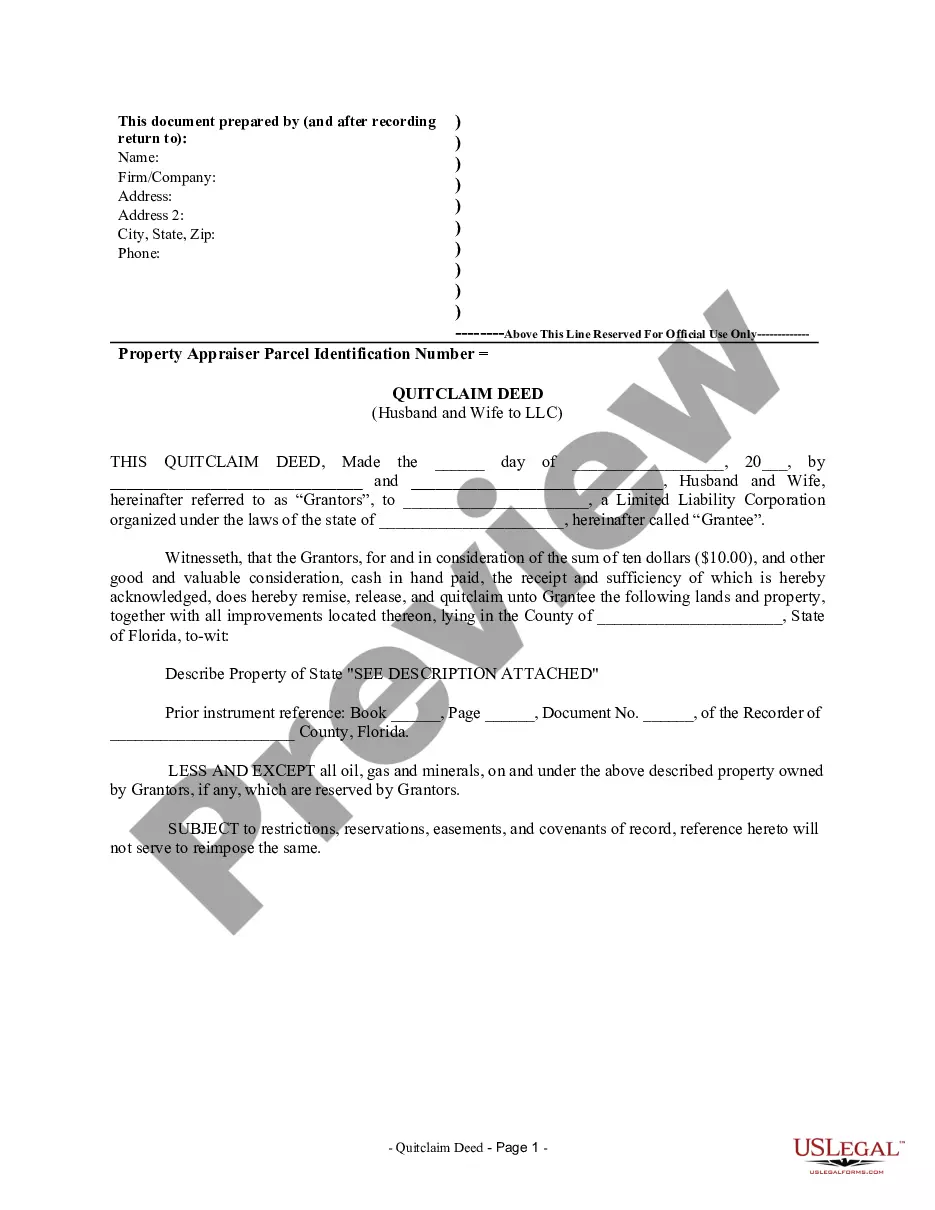

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Orange Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to their limited liability company (LLC) in Orange County, Florida. This type of deed is commonly used when spouses want to transfer their jointly owned property into their LLC, thereby protecting their personal assets and streamlining their business or investment ventures. The Orange Florida Quitclaim Deed from Husband and Wife to LLC serves as evidence of the transfer of ownership and also ensures that the LLC has legal rights over the property, including the ability to make decisions, conduct transactions, and manage the property on behalf of the company. There are two main types of Orange Florida Quitclaim Deed from Husband and Wife to LLC: 1. Traditional Orange Florida Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when both spouses, as joint owners, want to transfer the property to their LLC. By executing this deed, the couple relinquishes their individual ownership rights and instead holds the property as members or owners of the LLC. 2. Orange Florida Quitclaim Deed from Husband and Wife to LLC with Rights of Survivorship: This type of deed is used when spouses want to transfer the property to their LLC, while still maintaining survivorship rights. In the event of the death of one spouse, the ownership rights automatically pass to the surviving spouse as a joint owner of the LLC. Executing an Orange Florida Quitclaim Deed from Husband and Wife to LLC requires certain steps, such as drafting the deed, signing it before a notary public, and filing it with the Orange County Clerk of Court's office. It's important to consult with an attorney or a real estate professional familiar with Florida real estate laws to ensure all legal requirements are met and to understand the implications of this type of property transfer. In summary, an Orange Florida Quitclaim Deed from Husband and Wife to LLC allows married couples to transfer their jointly owned property to their LLC, providing asset protection and facilitating the management of the property as a business or investment asset. Different types of Orange Florida Quitclaim Deeds include the traditional deed, which transfers ownership outright to the LLC, and the deed with rights of survivorship, where surviving spouse retains ownership rights in case of one spouse's death.Orange Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to their limited liability company (LLC) in Orange County, Florida. This type of deed is commonly used when spouses want to transfer their jointly owned property into their LLC, thereby protecting their personal assets and streamlining their business or investment ventures. The Orange Florida Quitclaim Deed from Husband and Wife to LLC serves as evidence of the transfer of ownership and also ensures that the LLC has legal rights over the property, including the ability to make decisions, conduct transactions, and manage the property on behalf of the company. There are two main types of Orange Florida Quitclaim Deed from Husband and Wife to LLC: 1. Traditional Orange Florida Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when both spouses, as joint owners, want to transfer the property to their LLC. By executing this deed, the couple relinquishes their individual ownership rights and instead holds the property as members or owners of the LLC. 2. Orange Florida Quitclaim Deed from Husband and Wife to LLC with Rights of Survivorship: This type of deed is used when spouses want to transfer the property to their LLC, while still maintaining survivorship rights. In the event of the death of one spouse, the ownership rights automatically pass to the surviving spouse as a joint owner of the LLC. Executing an Orange Florida Quitclaim Deed from Husband and Wife to LLC requires certain steps, such as drafting the deed, signing it before a notary public, and filing it with the Orange County Clerk of Court's office. It's important to consult with an attorney or a real estate professional familiar with Florida real estate laws to ensure all legal requirements are met and to understand the implications of this type of property transfer. In summary, an Orange Florida Quitclaim Deed from Husband and Wife to LLC allows married couples to transfer their jointly owned property to their LLC, providing asset protection and facilitating the management of the property as a business or investment asset. Different types of Orange Florida Quitclaim Deeds include the traditional deed, which transfers ownership outright to the LLC, and the deed with rights of survivorship, where surviving spouse retains ownership rights in case of one spouse's death.