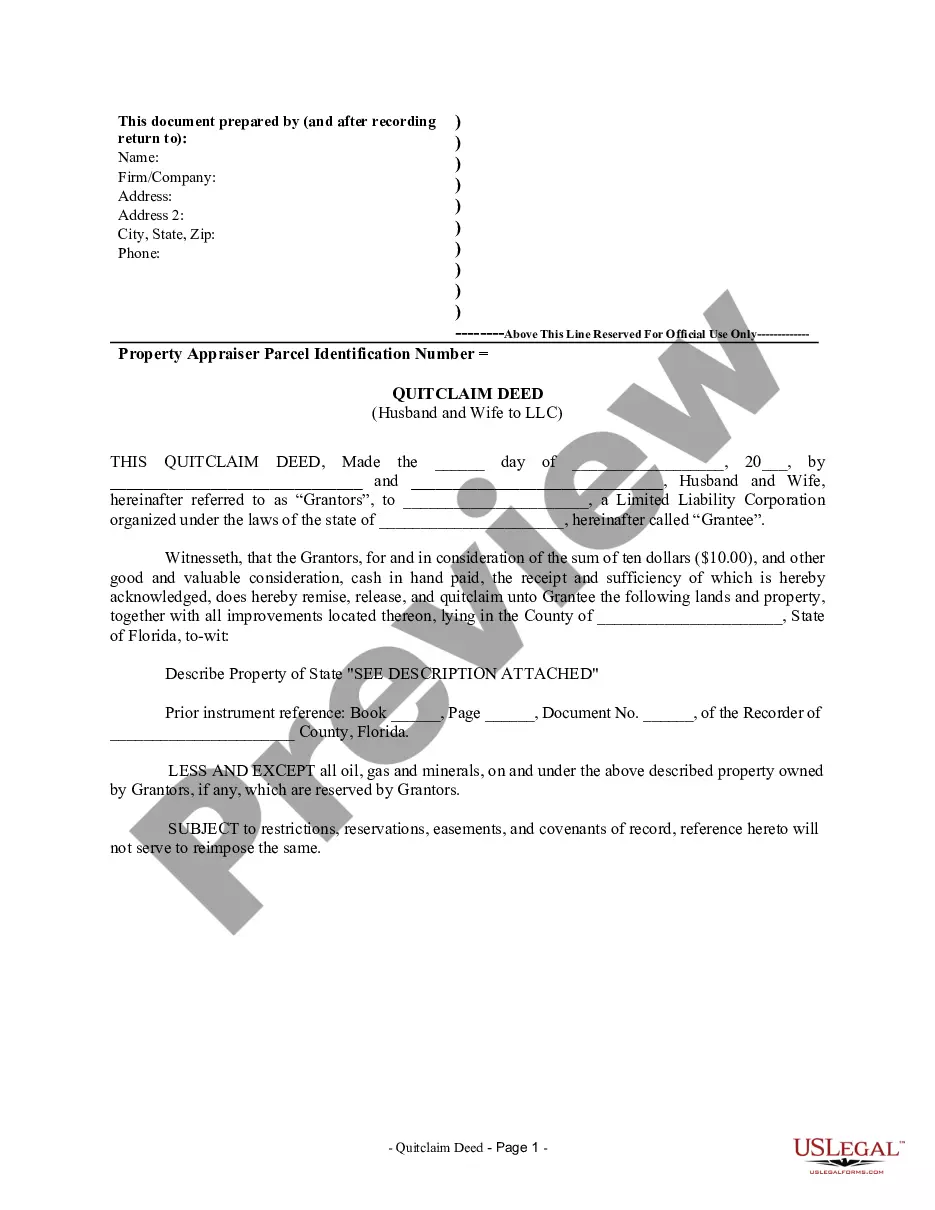

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Palm Beach Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of real estate ownership from a married couple to a limited liability company (LLC) in Palm Beach County, Florida. This type of deed is commonly used when the husband and wife want to transfer their shared property into an LLC for various reasons, such as asset protection or estate planning. The Palm Beach Florida Quitclaim Deed allows the couple (granters) to transfer their ownership rights and interest in a property to the newly formed LLC (grantee) without making any warranties or guarantees about the title. In other words, the couple is essentially releasing their claims to the property without guaranteeing the absence of any liens or encumbrances. This quitclaim deed offers flexibility in ownership structure and asset management for the couple. By transferring the property to an LLC, they can enjoy the limited liability protection provided by the entity, meaning that their personal assets may be shielded from potential lawsuits or creditors relating to the property. Additionally, it allows for easier management and division of ownership shares within the LLC. There might be variations of Palm Beach Florida Quitclaim Deed from Husband and Wife to LLC based on specific circumstances or purposes, including: 1. Single-Member LLC Quitclaim Deed: If the LLC is solely owned by one spouse, this variant is used to transfer the property from both spouses to the LLC owned by the one spouse. 2. Multi-Member LLC Quitclaim Deed: In cases where the LLC is jointly owned by the husband and wife, this type of quitclaim deed is employed to transfer the property into the LLC. 3. Vesting Name Change Deed: This variant is used if the husband and wife wish to change the name in which the property is currently vested, such as when they want to transfer ownership to an existing LLC. 4. Revocable Trust to LLC Quitclaim Deed: In situations where the property is held in a revocable trust, this type of quitclaim deed is implemented to transfer the property from the trust to an LLC owned by the husband and wife. Executing a Palm Beach Florida Quitclaim Deed from Husband and Wife to LLC requires careful attention to legal requirements and potential tax implications. It is advisable to consult with a qualified real estate attorney or legal professional to ensure compliance and a smooth transfer of property.A Palm Beach Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of real estate ownership from a married couple to a limited liability company (LLC) in Palm Beach County, Florida. This type of deed is commonly used when the husband and wife want to transfer their shared property into an LLC for various reasons, such as asset protection or estate planning. The Palm Beach Florida Quitclaim Deed allows the couple (granters) to transfer their ownership rights and interest in a property to the newly formed LLC (grantee) without making any warranties or guarantees about the title. In other words, the couple is essentially releasing their claims to the property without guaranteeing the absence of any liens or encumbrances. This quitclaim deed offers flexibility in ownership structure and asset management for the couple. By transferring the property to an LLC, they can enjoy the limited liability protection provided by the entity, meaning that their personal assets may be shielded from potential lawsuits or creditors relating to the property. Additionally, it allows for easier management and division of ownership shares within the LLC. There might be variations of Palm Beach Florida Quitclaim Deed from Husband and Wife to LLC based on specific circumstances or purposes, including: 1. Single-Member LLC Quitclaim Deed: If the LLC is solely owned by one spouse, this variant is used to transfer the property from both spouses to the LLC owned by the one spouse. 2. Multi-Member LLC Quitclaim Deed: In cases where the LLC is jointly owned by the husband and wife, this type of quitclaim deed is employed to transfer the property into the LLC. 3. Vesting Name Change Deed: This variant is used if the husband and wife wish to change the name in which the property is currently vested, such as when they want to transfer ownership to an existing LLC. 4. Revocable Trust to LLC Quitclaim Deed: In situations where the property is held in a revocable trust, this type of quitclaim deed is implemented to transfer the property from the trust to an LLC owned by the husband and wife. Executing a Palm Beach Florida Quitclaim Deed from Husband and Wife to LLC requires careful attention to legal requirements and potential tax implications. It is advisable to consult with a qualified real estate attorney or legal professional to ensure compliance and a smooth transfer of property.