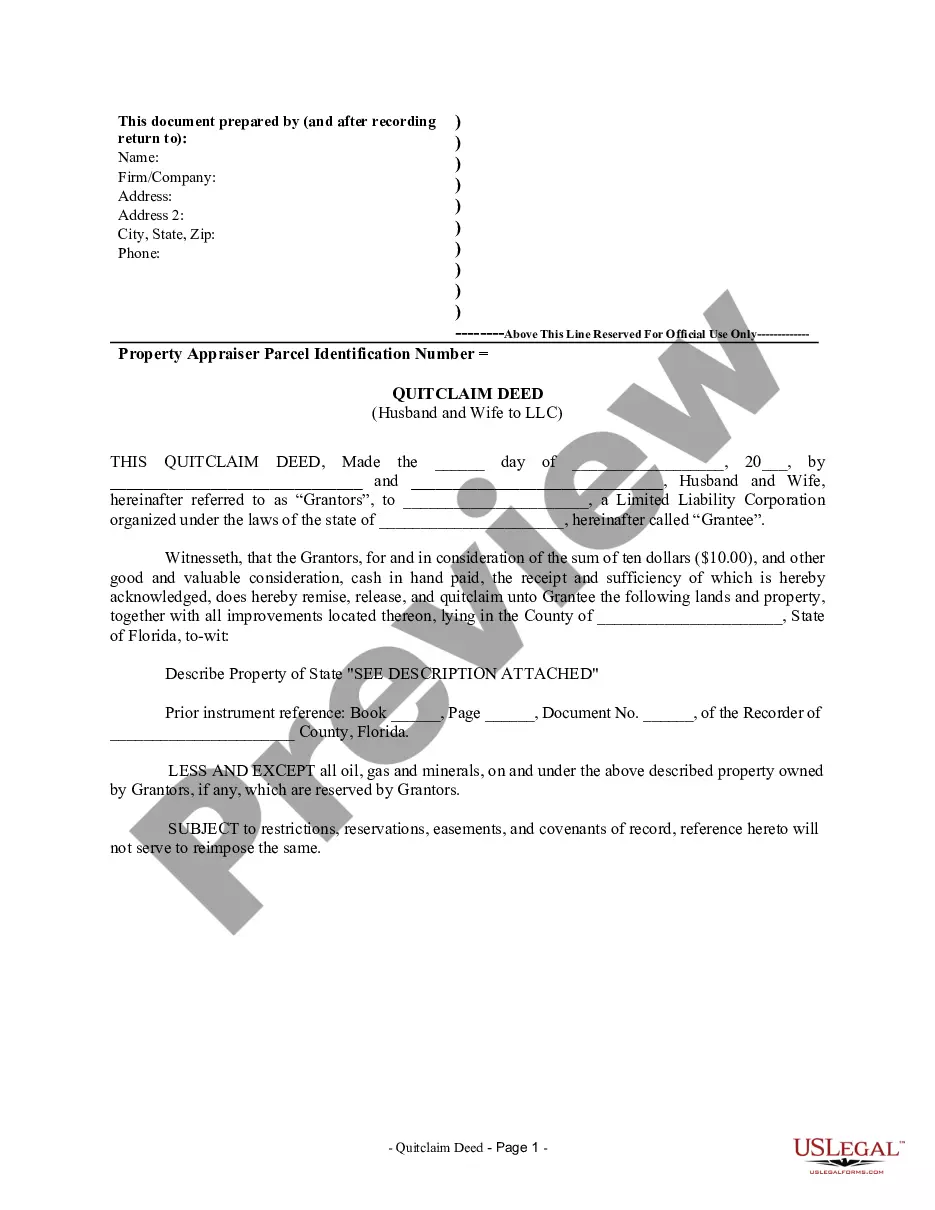

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A West Palm Beach Florida Quitclaim Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of property ownership from a married couple to a limited liability company (LLC). This type of deed is commonly used when a husband and wife want to transfer property they jointly own to an LLC they own or plan to establish, thereby protecting their personal assets while maintaining control of their property. The West Palm Beach Florida Quitclaim Deed from Husband and Wife to LLC involves the conveyance of property rights and interests without any warranties or guarantees, only transferring whatever ownership rights the granters possess. This specific type of deed is commonly used in Florida due to its simplicity and efficiency in property transfers. Different types of West Palm Beach Florida Quitclaim Deed from Husband and Wife to LLC include: 1. Individual Quitclaim Deed: This is a quitclaim deed executed by a married couple as individuals, transferring their joint property to an LLC they jointly own or plan to establish. 2. Tenants by the Entire ties Quitclaim Deed: This type of quitclaim deed is specifically used when a property is owned by a husband and wife as tenants by the entire ties, a form of joint property ownership recognized in some states. This deed allows them to transfer their entire ties property into an LLC, providing liability protection and potential tax benefits. 3. Community Property Quitclaim Deed: In the event that the husband and wife own the property as community property, recognized in some states such as Florida, this specific quitclaim deed is required. By executing this deed, they can transfer their community property to an LLC, segregating it from their personal assets. 4. Trust Quitclaim Deed: If the husband and wife hold the property in a trust, this type of quitclaim deed is necessary to transfer ownership from the trust to an LLC. This may be beneficial for asset protection or estate planning purposes. In summary, a West Palm Beach Florida Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to an LLC, offering liability protection and potential tax advantages. Different variations include individuals, tenants by the entire ties, community property, and trust quitclaim deeds. It is important to consult with a qualified attorney or real estate professional when preparing and executing these deeds to ensure compliance with local laws and regulations.