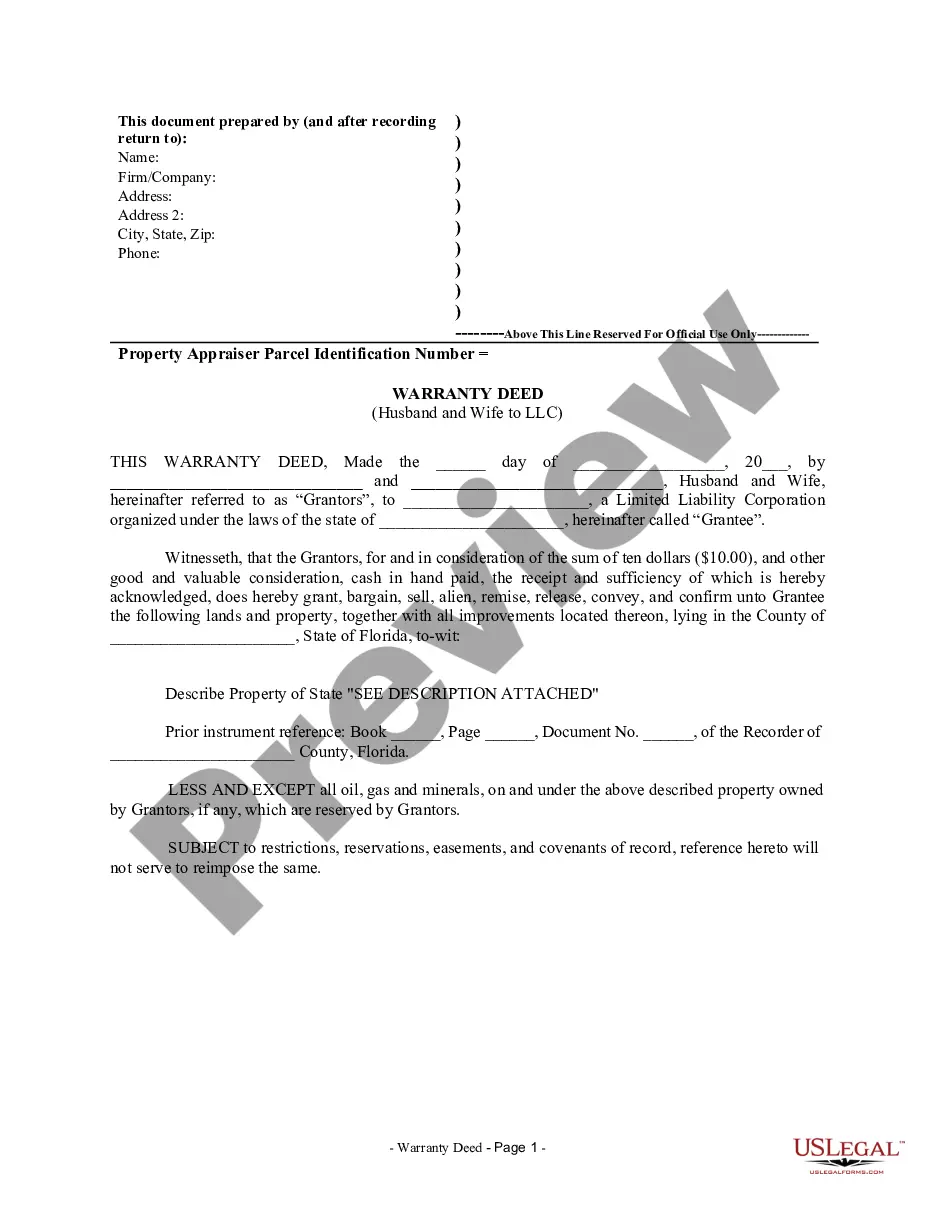

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

A Hillsborough Florida Warranty Deed from Husband and Wife to LLC is a legal document that transfers ownership of real property from a married couple to a limited liability company (LLC) while guaranteeing that the property is free from any undisclosed claims or liens. This type of deed is commonly used when a husband and wife wish to transfer their jointly owned property into an LLC to protect their personal assets or for business purposes. The Hillsborough County jurisdiction is specific to the state of Florida. The process of creating a Hillsborough Florida Warranty Deed involves several steps. First, the husband and wife, as granters, must draft the deed, ensuring accuracy and compliance with state laws. The deed should include the names of the granters and the LLC, a legal description of the property being transferred, and clear language expressing their intent to transfer the property with a warranty. The warranty guarantees that the granters have a legally valid title to the property and that it is free from any undisclosed encumbrances. The granters must also sign the deed before a notary public, finalizing its authenticity. Keywords: Hillsborough Florida, warranty deed, husband and wife, LLC, real property, ownership transfer, undisclosed claims, liens, joint ownership, limited liability company, protect personal assets, business purposes, Granters, accurate drafting, compliance, state laws, grantee, legal description, transfer intent, warranty, encumbrances, notary public, authenticity. Different types of Hillsborough Florida Warranty Deeds from Husband and Wife to LLC may include variations such as: 1. General Warranty Deed: This is the most common type of deed used in Florida. It offers the highest level of protection to the grantee, as it guarantees the granters' ownership and the property's title against any defects or claims, even those that arise before the granters' ownership. 2. Special Warranty Deed: With this type of deed, the granters warrant the property against any encumbrances or claims that arise only during their period of ownership. It provides less extensive protection compared to a general warranty deed. 3. Bargain and Sale Deed: This type of deed is often used when the granters do not wish to provide any warranty or guarantee of title. It implies that the granters have ownership of the property, but it does not guarantee against any claims or encumbrances. 4. Quitclaim Deed: A quitclaim deed is commonly used when transferring property between family members or in situations where there is no monetary exchange. It offers the least protection to the grantee, as it only transfers the granters' interest in the property, without any warranty or guarantee of title. When considering a Hillsborough Florida Warranty Deed from a husband and wife to an LLC, it is advised to seek professional legal advice to ensure compliance with state laws and to select the most appropriate type of deed based on individual circumstances.