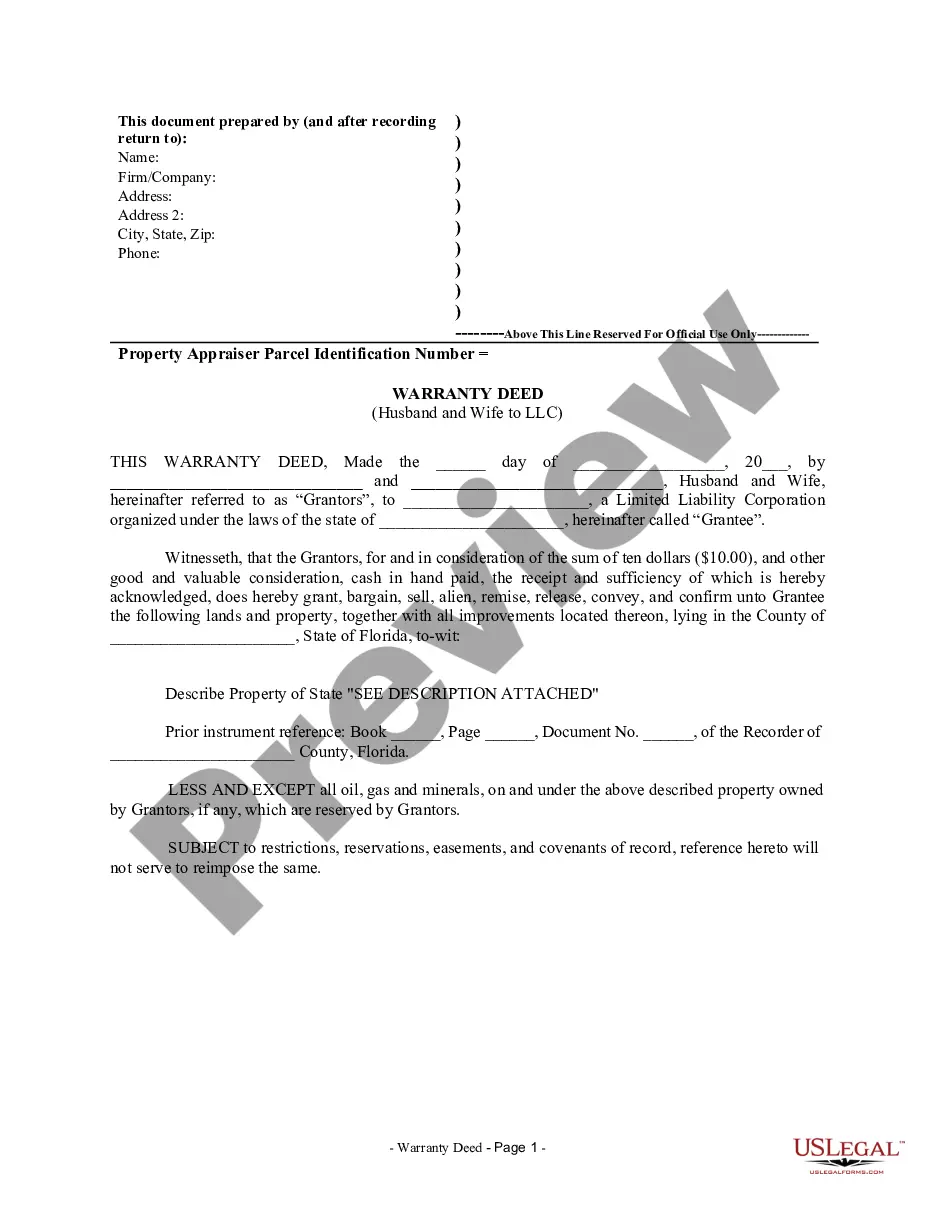

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

Miami-Dade Florida Warranty Deed from Husband and Wife to LLC: A Comprehensive Guide Keywords: Miami-Dade, Florida, warranty deed, husband and wife, LLC. Introduction: In Miami-Dade County, Florida, when a property is being transferred from a husband and wife to a limited liability company (LLC), a specific type of deed is required to be called a Miami-Dade Florida Warranty Deed from Husband and Wife to LLC. This legal document provides a clear title to the property and ensures that the LLC becomes the rightful owner. Types of Miami-Dade Florida Warranty Deed from Husband and Wife to LLC: 1. General Warranty Deed: A general warranty deed provides the highest level of protection to the buyer (LLC) by guaranteeing that the property is free from any undisclosed claims or defects, both during the ownership of the husband and wife and before their ownership. This deed offers the most comprehensive coverage against any potential future claims. 2. Special Warranty Deed: A special warranty deed, also known as "limited warranty deed," guarantees that the husband and wife only warrant the property against any claims or defects arising during their ownership. This implies that they do not take responsibility for any issues that existed prior to their ownership. Generally, this type of deed is used when the husband and wife have not been in possession of the property for an extended period or have limited knowledge of its history. 3. Quitclaim Deed: A quitclaim deed, although less commonly used when transferring property to an LLC, allows the husband and wife to transfer any interest they may have in the property to the LLC. However, this deed provides no warranties or guarantees concerning the status of the title. It simply transfers any rights or claims the husband and wife have to the LLC without any guarantee of ownership or freedom from defects. Key aspects of Miami-Dade Florida Warranty Deed from Husband and Wife to LLC: 1. Property description: The warranty deed should include a comprehensive description of the property being transferred, including the legal description, lot number, block number, and any other relevant information that uniquely identifies the property in Miami-Dade County. 2. Granter and grantee information: The deed must clearly and accurately identify the husband and wife (as the granters) and the LLC (as the grantee). Their full legal names, mailing addresses, and contact information should be provided. 3. Consideration: The consideration refers to the value or payment exchanged for the transfer of the property. The deed should state the agreed-upon consideration between the husband and wife and the LLC, which can be monetary or non-monetary (e.g., assuming the outstanding mortgage). 4. Covenants and warranties: Depending on the type of deed chosen, the document must contain appropriate covenants and warranties that legally protect the LLC against any potential claims or defects. The extent of these covenants and warranties will vary based on the type of deed selected. Conclusion: A Miami-Dade Florida Warranty Deed from Husband and Wife to LLC establishes a legally binding transfer of property ownership from a married couple to a limited liability company in Miami-Dade County, Florida. Selecting the appropriate type of warranty deed, such as a general warranty deed, special warranty deed, or quitclaim deed, is crucial to ensure the desired level of protection for the LLC. Seeking legal advice and assistance during this process is highly recommended ensuring a smooth transfer of ownership and minimize any potential risks or complications.Miami-Dade Florida Warranty Deed from Husband and Wife to LLC: A Comprehensive Guide Keywords: Miami-Dade, Florida, warranty deed, husband and wife, LLC. Introduction: In Miami-Dade County, Florida, when a property is being transferred from a husband and wife to a limited liability company (LLC), a specific type of deed is required to be called a Miami-Dade Florida Warranty Deed from Husband and Wife to LLC. This legal document provides a clear title to the property and ensures that the LLC becomes the rightful owner. Types of Miami-Dade Florida Warranty Deed from Husband and Wife to LLC: 1. General Warranty Deed: A general warranty deed provides the highest level of protection to the buyer (LLC) by guaranteeing that the property is free from any undisclosed claims or defects, both during the ownership of the husband and wife and before their ownership. This deed offers the most comprehensive coverage against any potential future claims. 2. Special Warranty Deed: A special warranty deed, also known as "limited warranty deed," guarantees that the husband and wife only warrant the property against any claims or defects arising during their ownership. This implies that they do not take responsibility for any issues that existed prior to their ownership. Generally, this type of deed is used when the husband and wife have not been in possession of the property for an extended period or have limited knowledge of its history. 3. Quitclaim Deed: A quitclaim deed, although less commonly used when transferring property to an LLC, allows the husband and wife to transfer any interest they may have in the property to the LLC. However, this deed provides no warranties or guarantees concerning the status of the title. It simply transfers any rights or claims the husband and wife have to the LLC without any guarantee of ownership or freedom from defects. Key aspects of Miami-Dade Florida Warranty Deed from Husband and Wife to LLC: 1. Property description: The warranty deed should include a comprehensive description of the property being transferred, including the legal description, lot number, block number, and any other relevant information that uniquely identifies the property in Miami-Dade County. 2. Granter and grantee information: The deed must clearly and accurately identify the husband and wife (as the granters) and the LLC (as the grantee). Their full legal names, mailing addresses, and contact information should be provided. 3. Consideration: The consideration refers to the value or payment exchanged for the transfer of the property. The deed should state the agreed-upon consideration between the husband and wife and the LLC, which can be monetary or non-monetary (e.g., assuming the outstanding mortgage). 4. Covenants and warranties: Depending on the type of deed chosen, the document must contain appropriate covenants and warranties that legally protect the LLC against any potential claims or defects. The extent of these covenants and warranties will vary based on the type of deed selected. Conclusion: A Miami-Dade Florida Warranty Deed from Husband and Wife to LLC establishes a legally binding transfer of property ownership from a married couple to a limited liability company in Miami-Dade County, Florida. Selecting the appropriate type of warranty deed, such as a general warranty deed, special warranty deed, or quitclaim deed, is crucial to ensure the desired level of protection for the LLC. Seeking legal advice and assistance during this process is highly recommended ensuring a smooth transfer of ownership and minimize any potential risks or complications.