Title: Cape Coral Florida Installment Purchase and Security Agreement Without Limited Warranties — Horse Equine Forms: A Comprehensive Overview Introduction: In Cape Coral, Florida, horse enthusiasts can benefit from the convenience and assurance offered by the Installment Purchase and Security Agreement Without Limited Warranties — Horse Equine Forms. These legal documents govern the terms and conditions of horse sales, ensuring an organized and transparent transaction process. This article will provide a detailed description of these forms, highlighting their significance, key elements, and potential variations available. 1. Purpose and Importance: The Cape Coral Florida Installment Purchase and Security Agreement Without Limited Warranties — Horse Equine Forms act as legally binding contracts that protect both the buyer and seller during a horse sale. They outline essential terms, obligations, and liabilities of each party, establishing a clear understanding of the transaction. 2. Key Elements: a. Identification: The forms typically include detailed information about the horse being sold, including breed, age, markings, and registration details. b. Purchase Price and Payment Terms: The agreement specifies the total purchase price, down payment (if applicable), and any installment terms for the buyer's convenience. c. Security Agreement: A security interest may be included, outlining the collateral (i.e., the horse) offered by the buyer as security until the full payment is made. d. Limited Warranties: These forms generally exclude warranties, indicating that the horse's condition and suitability are the responsibility of the buyer upon purchase completion. e. Risk and Insurance: The agreement often addresses issues relating to the risk of loss, insurance coverage, and who bears responsibility in case of injury, damage, or death of the horse during the purchase process. f. Default and Remedies: Terms for default, repossession, and potential remedies in case of non-payment or breach of the agreement are clearly defined, ensuring fair protection for both parties. 3. Types of Cape Coral Florida Installment Purchase and Security Agreement Without Limited Warranties — Horse Equine Forms: a. Standard Installment Purchase and Security Agreement: This is the most common type of agreement used for horse sales, covering general terms and conditions. b. Customized Agreements: Depending on the circumstances of the sale, custom agreements may be created, addressing specific buyer or seller requirements or additional clauses. c. Installment Sales Agreement with Leaseback: In certain cases, a seller may allow the buyer to lease the horse during the installment payment period, ensuring continued use until ownership is transferred. d. Horse Trade-In Agreements: If a buyer wishes to exchange an existing horse as part of the purchase, specific forms may be used to facilitate the trade-in process. Conclusion: The Cape Coral Florida Installment Purchase and Security Agreement Without Limited Warranties — Horse Equine Forms are crucial legal instruments that protect both buyers and sellers during horse sales. By providing comprehensive terms, obligations, and remedies, these agreements ensure a fair and transparent transaction process. Horse owners in Cape Coral can rest assured knowing that these forms exist to safeguard their rights and interests.

Cape Coral Florida Installment Purchase and Security Agreement Without Limited Warranties - Horse Equine Forms

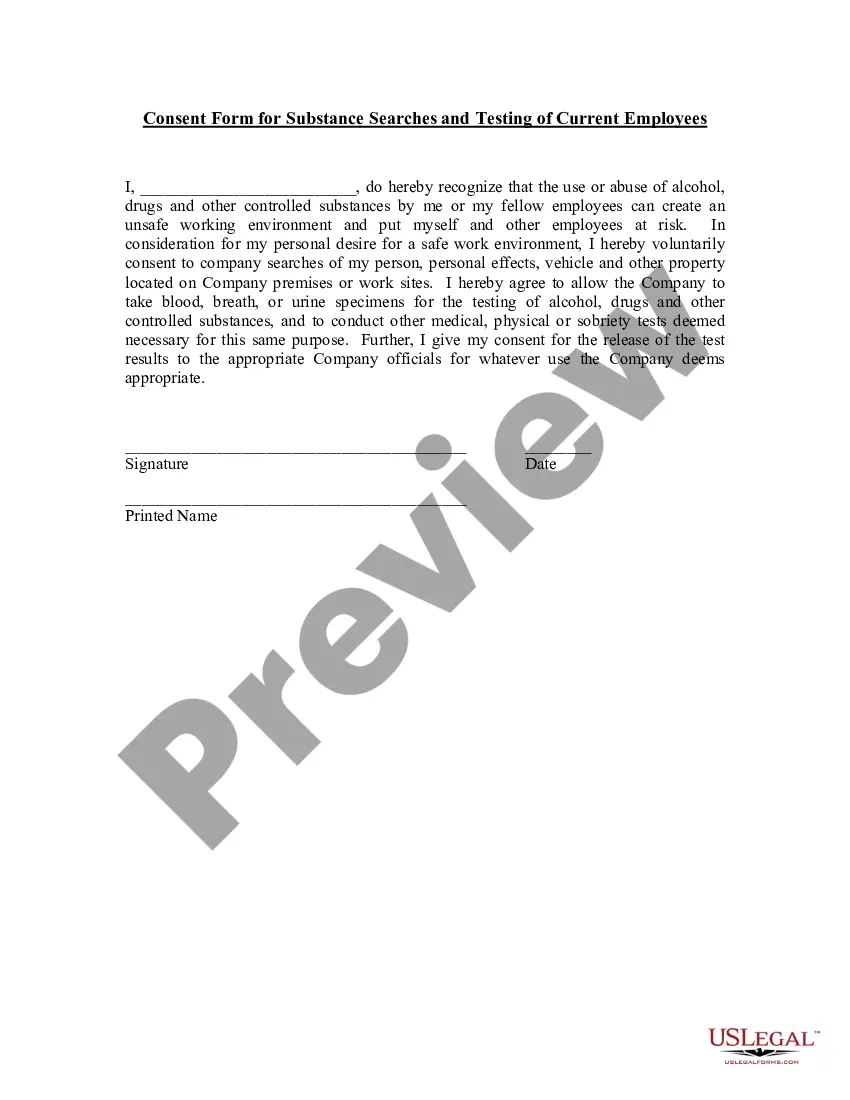

Description

How to fill out Cape Coral Florida Installment Purchase And Security Agreement Without Limited Warranties - Horse Equine Forms?

Do you need a reliable and inexpensive legal forms supplier to get the Cape Coral Florida Installment Purchase and Security Agreement Without Limited Warranties - Horse Equine Forms? US Legal Forms is your go-to option.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of specific state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Cape Coral Florida Installment Purchase and Security Agreement Without Limited Warranties - Horse Equine Forms conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is good for.

- Restart the search in case the form isn’t suitable for your specific situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Cape Coral Florida Installment Purchase and Security Agreement Without Limited Warranties - Horse Equine Forms in any provided format. You can return to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online for good.